Here's my Top 10 links from around the Internet at 8 pm today in association with NZ Mint.

As always, we welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #7 on the future of work and incomes in a hyper-connected world.

1. What happened to Xi Jingping? - This is the biggest story on the planet right now and it's not something you'll see on the front pages or at the beginning of bulletins in New Zealand.

The man widely expected to be China's next leader has gone mysteriously missing and has cancelled meeting after meeting in recent days.

The speculation inside China is intense and shows the once-in-a-decade leadership transition is not going nearly as smoothly as many thought and hoped. We've already had the Bo Xilai scandal.

So where is he?

One report says he has had a heart attack.

Another says he has had a car accident.

The most sensational report from Boxun said he was injured in an assassination attempt. There is no way of verifying this and reports from the New York Times and Wall St Journal are very cautious. But something has happened the Communist leadership don't want to fess up about. Reuters later reported sources saying he is suffering from a back injury after a swim.

Here's Boxun:

A so-called internal Beijing source claims that vice president Xi, the man widely tipped to be China's next leader, was involved in a mysterious car accident last Tuesday night in Beijing when his vehicle was sandwiched by two off-road Jeeps. The 59-year-old was said to have passed out during the collision and was rushed to Beijing's 301 Military Hospital with light injuries.

An hour later, the source says, He Guoqiang, the secretary of the Commission for Discipline Inspection, was involved in a separate road accident when a truck traveling at high speed struck his car from behind, causing it to flip. He was also taking to 301 Military Hospital and is said to be in a critical condition.

The source adds that Communist Party leaders then held an emergency meeting where it was suspected that foul play may have been involved. According to evidence collected by the party, the culprit is a military officer and a supporter of former Chongqing party secretary Bo Xilai, the source alleged.

2. The problem with very low interest rates - David Cay Johnston puts his finger on why the Fed's ZIRP (Zero Interest Rate Policy) will ultimately fail: it is wiping out already weakened defined benefit pension schemes.

In July the 100 largest company pension plans had their worst recorded month and now owe $533 billion (r.reuters.com/syf22t) more than they have assets to pay, the Milliman benefits consultancy says. Other consultancies have issued similarly dire reports.

The core problem has been too little money put into pension plans. Putting in too little money, as noted economist Martin Feldstein pointed out more than three decades ago, inflates stock prices by obscuring corporate liabilities for future pension obligations. This distorts current investment decisions and creates future risks for investors and workers when these pension obligations come due.

Pension funds come from workers, who set aside what would otherwise be current cash wages to provide for their old age. Not putting that money into the pension plan is a subtle, but widespread form of wage theft. Companies argue that they make funding estimates based on what the law allows, which is true. But then it is usually what the law allows, not venality, that is the scandal.

Compounding the thievery are 12 years of abysmal stock market returns. From its 2000 peak, the total market, with dividends reinvested, is down a fourth in real terms, prices of Vanguard’s total stock index fund show.

3. The other point of view - Many in financial markets point to Japan's very high debt/GDP ratios and say it's on the verge of going bust.

But, amazingly, interest rates are virtually zero and have been for years. Also, it's currency is remarkably popular despite all this debt.

Why?

Here's Ellen Brown on HuffPo saying the idea that Japan is broke is a myth. She points out the Japanese government borrows from its own people at 1% and lends it to America at 1.6%. Sweet.

Japan's debt-to-GDP ratio is nearly 230 percent, the worst of any major country in the world. Yet Japan remains the world's largest creditor country, with net foreign assets of $3.19 trillion. In 2010, its GDP per capita was more than that of France, Germany, the UK and Italy. And while China's economy is now larger than Japan's because of its burgeoning population (1.3 billion versus 128 million), China's $5,414 GDP per capita is only 12 percent of Japan's $45,920.

How to explain these anomalies? Fully 95 percent of Japan's national debt is held domestically by the Japanese themselves.

4. The emperor has no clothes but he still rules - Michael D Yates from the Monthly Review writes a review of three books on neo-classical economists that points out they are naked after the global financial crisis exposed their practices as ideas rather than science.

Modern Political Economics gives us the most sophisticated account of the surreal character of neoclassical economics. This book is not for beginners; a prior understanding of economics is required to get through it. And patience, as it is more than five hundred pages long. However, its deconstruction and demolition of neoclassical economics is devastating. Yanis Varoufakis, Joseph Halevi, and Nicholas J. Theocaratis show us in superb detail how economists have constructed a model of the capitalist economy that assumes it is exactly analogous to a flawlessly operating machine system (they use the movie The Matrix to good effect as an example).

Neoclassical economists assume that society is made up of independent, self-interested, and all-knowing human beings, who come together in marketplaces over which they exert no control, and all at once arrive at agreements in such a way that every market clears. That is, a price is established at which the supply of every single commodity equals the demand for it.

5. China's revolution risk - Ambrose Evans Pritchard from The Telegraph always writes a ripping yarn. This time he's worrying about China's political stability. See #1 above.

The Bo Xilai affair has lifted the lid on a hornet's nest. I had not realised quite how serious the situation has become until listening to China expert Cheng Li here at the Ambrosetti forum of the world policy elites on Lake Como. (My hardship assignment each year.) Nor had anybody else in the room at Villa d'Este. There were audible gasps.

The rifts within the upper echelons of Chinese Communist Party are worse than they were during the build-up to Tiananmen Square, he said, and risks spiralling into "revolution". Dr Cheng — a Shanghai native — is research director of the Brookings Institution in Washington and a director of the National Committee on US-China Relations. He argues that China's economic hard-landing is intertwined with a leadership crisis as the ten-year power approaches this autumn. The two are feeding on each other. "You cannot forecast the Chinese economy unless you have a sophisticated view of the political landscape and the current succession crisis," he said.

Is this the start of the seasonal rally that will carry the iron ore price all the way back to the price

trapdoorfloor of $120 a tonne? Or is it just a dead cat bounce? Obviously we think it’s probably the latter.

7. The future of work in a globalised age - Professor Lynda Gratton writes at BBC about how extraordinary connectivity is transforming workplaces around the world.

It seems to me that this will impact all of us in three ways - the hollowing out of work, the globalisation of virtual work, and the rise of the 'transnational'. As a result of connectivity and globalisation millions of jobs across the world are disappearing. This hollowing out of work is seeing the disappearance of middle-wage, middle-skilled jobs such as managers, secretaries, or assembly line workers.

These jobs are at risk because they can either be outsourced to a region with lower wages, or they can be replaced by technology. So what is left is the jobs at each end of the skill and wage spectrum.

At one end there are high-skill, high-wage jobs - like investment bankers, lawyers, engineers, or IT specialists - which need complex knowledge and expertise and cannot (yet) be substituted by technology. You can expect these jobs to be paid increasingly well. At the other end are the low-skilled, low-wage jobs like hairdressers, waiters, bank tellers and shop assistants.

8. China's stimulus is a unicorn - FTAlphaville reports UBS' Wang Tao is sceptical about China's widely touted 'new' 1 trillion yuan of stimulus projects.

That is what we call a bit of make-believe. Sure, the weak August data seem to have prompted more policy actions by various government agencies and we expect better implementation and coordination as well. But a closer look at the newly announced approvals shows that these projects have been approved in the past 2-3 months, some as early as April and May, and most of these projects are part of the local governments’ 12th Five Year Plans.

In other words, many readers believed that the government suddenly rolled out a RMB 1 trillion stimulus package in the past week ahead of the weak August data, but the truth is that the NDRC just suddenly PUBLISHED the project approvals of the past few months, perhaps to demonstrate that the government’s policy support in the form of infrastructure investment has already been underway.

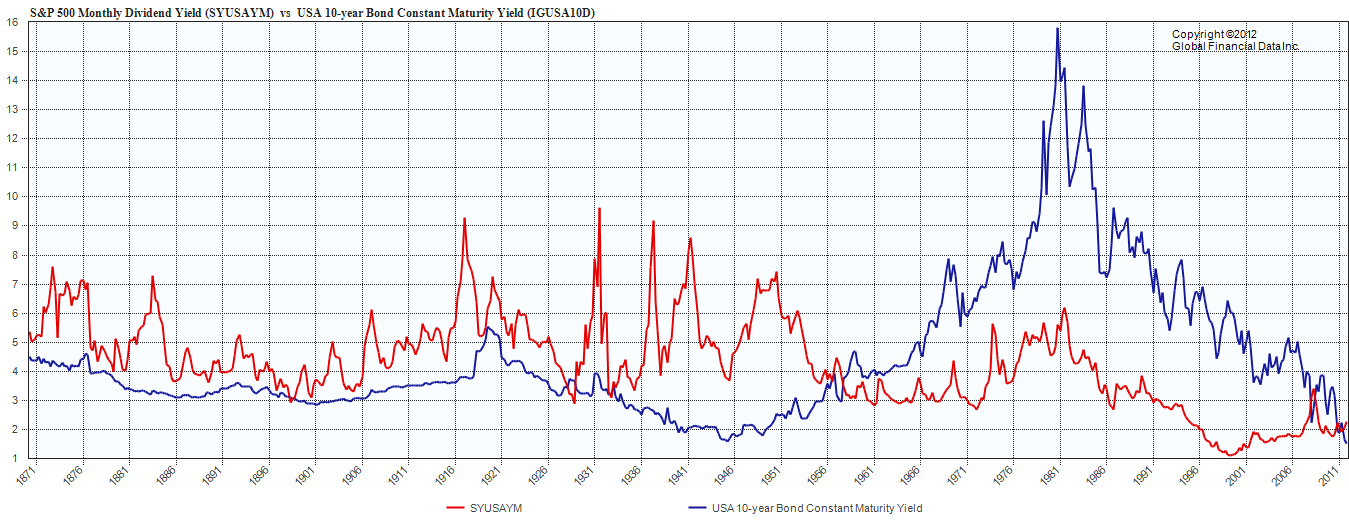

9. 'Bond yields have outperformed equity dividend yields over the long term' - That statement is heresy to most investment strategists who think stocks always outperform bonds over the long term. But this chart below cited by Barry Ritholz is a cracker, showing how bond yields have outperformed equity dividend yields for the last 56 years. Long term enough for you? Click on the chart for a readable verson. Stock bulls would no doubt point to all the share price appreciation to go with the dividends, but there are many who still say the best way to measure stock performance over time is through dividend yields.

Equities have returned more from 1871 to 1956. An amazing 85 year outperformance run! After crossing over in ~1956, the 10 Year US Bond had a spectacular 56 year run of outperformance vs Equity Dividend Yield including all of the most recent bull runs. Are Equities on the verge of another run of outperformance?

10. Totally The Daily Show on political campaigning in a Digital Age.

11 Comments

Bernard , once again you're over-the-top sensationalising a story , this time it's the supposed disappearance of future Chinese leader Xi Jingping ......

...... I saw him here in South Australia ....... he was ordering a gourmet pepperoni pizza at Eagle Boys ........ the $ 24.95 meal deal with fries & coke .....

Some things just can't be " Made-in-China "

my mate who works at Adelaide Zoo just called me to say Xi was spotted at the zoo gesticulating and blathering away in Chinese to the pandas about this and that

Well i saw him having a beer with Elvis just the other day

Bernard, i see bob jones has some kind words to say about you and John minto over at the herald today

Thanks for the heads-up Kermie , that's compulsory reading ..... Bob Jones never fails to go direct to the heart of the matter ( and to the throat of his prey ! ) ........

....." mintoitous " ! .......that's a good one ....

Gummy – people with money and an entrepreneurial spirit are talking exclusively about an elite group of Kiwis – maybe 200’000 – 300’000 – highly successful.

What about the rest of 3 million in the NZworkforce, who don’t have that privilege ? I can hardly read any article by you talking and carrying about the majority and hard working people of New Zealand. People, who are often struggling with their daily life’s.

I ask myself how entrepreneurial you are – sitting of “share- markets screen” all day long ?

As a point of interest, the number of actual full time workers in the June 2012 quarter was 1,356,400.

Re No 6 : So the Iron ore price is showing all the signs of a what happens to cats body after falling 30 floors ?

Slightly off topic , but the giant fishing trawler Abel Tasman ( currently just 400 metres from the Gummy Bear cave ) is to be banned from operating in Australian waters for two years .......

....... the Greens have spoken ! ...... and yet again , demonstrated that the tail-wags-the-dog in Australian politics ...... poor old Julia , and she still thinks she deserves to run the joint , after stabbing Kevin in the back ......

What's bemusing for the Gummster is , the boat had a quota to fish ..... so does it make any difference to the fish stocks if that quota is caught by many little boats , or several bigger ones ....... the super trawlers stay at sea much longer , making fewer trips back to base ...

........ where's the effishciency in splitting the quota amongst many , who have to tootle in & out of harbour frequently ?

[ .. just noticed that Boatman is directly above ...... should've arsked him ! .. ...... Poop .. .. .............pooooooooooooooooooop !!! ]

I'm not supposed to tell but Xi Jingping had plastic surgery and now looks like John Key.

Somebody named Xi Jingping just paid $800,000 for a two bedroom unit on Sandringham Road. What does this mean ?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.