Here's my Top 10 links from around the Internet at 1 pm today in association with NZ Mint.

As always, we welcome your additions in the comments below or via email tobernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #9 from Jon Morgan on the One Plan hysteria. Well worth a read.

1. How it can be done - The OECD has published a journal chapter looking at how to reduce income inequality and grow economies at the same time.

They think it can be done.

It needs to be done because at the moment large chunks of wealth and income are surging up the spectrum into the zone of the 1%, and even higher.

That leaves middle to lower income groups with less real income to spend on consumption. With the debt taps of the last 20 years now turned off, the crushing weight of this demand shortage is dragging on economic growth.

Meanwhile the 1% see growth slowing and are understandably reluctant to invest in new hiring and capacity. Thus begins a type of Catch 22 downward spiral in investment, employment, consumer incomes, consumer spending, investment, employment....etc.

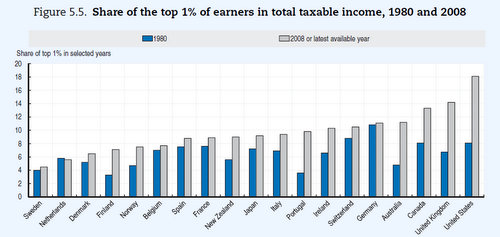

The chart below shows a massive rise in inequality in New Zealand between 1980 and 2008. Australia, the UK, the US and Portugal also have seen massive increases. Germany, France, Switzerland, Denmark, the Netherlands and Sweden did not increase inequality much.

Here's the OECD's suggestions:

One key finding is that education and anti-discrimination policies, well-designed labour market institutions and large and/or progressive tax and transfer systems can all reduce income inequality. On this basis, the chapter identifies several policy reforms that could yield a double dividend in terms of boosting GDP per capita and reducing income inequality, and also flags other policy areas where reforms would entail a trade-off between both objectives.

Education policies matter. Policies that increase graduation rates from upper secondary and tertiary education and that also promote equal access to education help reduce inequality. Well-designed labour market policies and institutions can reduce inequality. A relatively high minimum wage narrows the distribution of labour income, but if set too high it may reduce employment, which dampens its inequality-reducing effect.

2. Watch out for the 'lead bosses' - This Reuters article about the scale of the environmental challenges in china is well worth a read. It focuses on the city of Tianying, which as a dirty great big lead smelter in the centre of town.

"I heard the central government is going to protect the environment more, but it won't happen here," said Zhang Weimin, a 58-year-old resident who lives a mile from the smelter. "I don't trust the local government or the public security bureau or the lead factory bosses."

Fear of the local authorities is palpable. Many residents were reluctant even to be seen near Reuters correspondents during a recent visit, saying they would be punished by the "lead bosses" as well as the police.

3. Corporate bond liquidity to dry up? - FT.com reports on how changes in bank regulations will make it tougher for the big banks to act as market makers for corporate bonds, particularly for European high yield corporate debt. I wonder if Graeme Hart is watching this trend... He has US$18.3 billion of such bonds on issue...

“There is a growing concern now that if we get outflows from corporate bond funds in anything like the size of recent inflows, then the markets will have limited capacity to absorb them,” says Chris Huggins a portfolio manager at GLG Partners.

Before the crisis, primary dealers in Europe and in the US held large inventories of corporate bonds and so were able to act as market makers, encouraging a liquid market for secondary trading. But in the wake of the financial crisis, with tougher capital standards under Basel III making it more expensive to hold corporate debt and the pending Volcker rule making it harder for US banks to trade on their own accounts, this practice has fallen sharply.

In May, a number of large US asset managers called nine of Wall Street’s top banks to an emergency meeting in Boston to address the liquidity drought, with warnings that volatility could have a severe impact on the real economy if bond prices fell quickly and companies found it hard to borrow. “The decline of capital in the market making system adds to the risk of volatility in the system,” says Paul Watters, corporate bonds analyst at S&P. “And in a more fragile bond market such as European high yield, it reinforces the tendency for the market to seize up periodically,” he adds.

4. Singapore and emotion - I lived in Singapore for a couple of years in the mid 2000s and can attest to the accuracy of this survey reported by Businessweek showing Singaporeans are the least emotional in the world. They are rich, but not necessarily happy. The Danes (see the chart above) are the happiest and, interestingly, most equal in terms of income and wealth.

U.S. pollster Gallup conducts surveys in over 140 countries to compare how people feel about their lives. Singapore ranks as the most emotionless society in the world, behind Georgia, Lithuania, and Russia. Singaporeans are unlikely to report feelings of anger, physical pain, or other negative emotions. They’re not laughing a lot, either. “If you measure Singapore by the traditional indicators, they look like one of the best-run countries in the world,” says Jon Clifton, a Gallup partner in Washington. “But if you look at everything that makes life worth living, they’re not doing so well.”

The country’s leaders want to promote a more freewheeling society. In a speech last August, Prime Minister Lee Hsien Loong told Singapore’s Tiger Moms and Dads, “Please let your children have their childhood! No homework is not a bad thing.” Progress is slow. William Wan is general secretary of the Singapore Kindness Movement, a government-funded organization that has been working since 1997 to help Singaporeans be nicer to one another. Singaporeans still “take ourselves a bit too seriously,” says Wan, who wishes people would loosen up a bit. “We don’t clap very loudly,” he says. “I’ve been to concerts where people don’t even applaud as much as they should.”

5. Using Social Media to substitute for Original Thought - Another Onion Talks satire on Ted Talks. Another needle in the smug bubble.

6. So much money for so little actual work - The Hewlett Packard takeover of Autonomy is turning into a debacle. HP alleges Autonomy faked its figures so badly that it had to write off 80% of the US$12 bln purchase price.

Now the fingers of blame are being pointed at Autonomy's auditors (Deloitte) and Deloitte's auditors (KPMG), and the investment bankers who sold HP Autonomy. These include Frank Quattrone, the former CSFB tech banker eventually acquitted of obstructing justice.

Here's Reuters on the blame game:

When Hewlett Packard acquired Autonomy last year for $11.1 billion, some 15 different financial, legal and accounting firms were involved in the transaction -- and none raised a flag about what HP said Tuesday was a major accounting fraud.

HP Chief Executive Meg Whitman, who was a director at the company at the time of the deal, said the board had relied on accounting firm Deloitte for vetting Autonomy's financials and that KPMG was subsequently hired to audit Deloitte. HP had many other advisers as well: boutique investment bank Perella Weinberg Partners to serve as its lead adviser, along with Barclays. The company's legal advisers included Gibson, Dunn & Crutcher; Freshfields Bruckhaus Deringer; Drinker Biddle & Reath; and Skadden, Arps, Slate, Meagher & Flom, which advised the board.

On Autonomy's side of the table were Frank Quattrone's Qatalyst Partners, which specializes in tech deals, as well as UBS, Goldman Sachs, Citigroup, JPMorgan Chase and Bank of America. Slaughter & May and Morgan Lewis served as Autonomy's legal advisers on the deal.

And here's the most fun part:

Multiple sources with knowledge of the HP-Autonomy transaction added that the big-name banks on Autonomy's side were brought in days before the final agreement was struck. These sources said the banks were brought on as favors for their long relationships with the companies, in a little-scrutinized Wall Street practice of crediting -- and paying -- investment banks that actually have little do with the deal.

7. Argentina default? - FT.com reports a US court ruling in favour of hedge fund holdouts from an old debt restructuring could force Argentina to default and make sovereign debt restructurings much more difficult in future.

Argentina is not happy and the fallout could be big.

There’s the biggest question of all: how on earth are countries ever meant to be able to restructure their debts, if orders like this allow holdout creditors to get paid in full?

The obvious thing for Argentina to do is to simply default on all its foreign obligations. It could then launch another exchange offer, saying that anybody holding the exchange bonds could swap them into domestic Argentine bonds with exactly the same terms; at that point, Argentina would happily make up any arrears.

Such a move would certainly trigger Argentina’s credit default swaps; in doing so, it would deliver a tidy sum to Elliott Associates, which is rumored to hold a large quantity of Argentine CDS. But at least Elliott wouldn’t get paid directly by Argentina, and Cristina could stay true to her promises.

Argentina might have been paying holders of its New York law bonds for years now, but it has never had access to New York markets; in that sense, by abandoning the foreign markets, it would only be abandoning markets which have served it no real purpose.

8. Christchurch vs Wellington - Christopher Moore writes at The Press about the implications of the Christchurch Council challenging the national government over the future of Christchurch's town hall.

The council has now delivered a challenge to the Government - and the Government has responded with Mr Brownlee's thinly veiled threat that the Canterbury Earthquake Recovery Authority could override the council's decision. Beneath all the references to dialogue and compromise, this could signal a replay of David versus Goliath.

In a single morning, The Town Hall became a symbol of two very different perspectives for the city's cultural future. Given that the proposed performing arts centre is one of the jewels in the Government's city rebuild blueprint, it's reasonable to ask whether the council's decision effectively threatens the project which has already caused considerable interest both here and overseas.

There is already conjecture that major overseas investors and developers, notably the Chinese, are eyeing it and the neighbouring convention centre as a lucrative joint venture with New Zealand interests.

9. Farmergeddon - Here's Jon Morgan at the DomPost with his take on the farmer-government lobbying on the One Plan decision.

An Environment Court judge has set rules a regional council must follow to keep farm pollution out of rivers. Two farmer organisations have appealed to the High Court, saying the rules will cause too much harm.

But before the appeal can be heard, the primary industries minister comments that he agrees the rules are too harsh and releases research that purports to show the financial harm to farmers will be worse than the court thinks. This has actually happened, but there has been no outcry.

I don't know, maybe I'm mistaken and the Environment Court is some sort of minor judicial body that doesn't have to be treated with respect - like the Waitangi Tribunal.

All I do know is that minister David Carter's meddling has added fuel to the hysteria boiling around the issue in the Manawatu-Whanganui region.

11 Comments

You'd better believe it! I'm just as surprised as you are that no-one is talking about this. Maybe another little 'pop' is just around the corner? Maybe....

A blast from Bridgecorp's past - http://www.stuff.co.nz/business/world/7989604/Fiji-super-fund-to-finish…

Release from Fonterra:

Fonterra Co-operative Group Limited today confirmed strong interest from farmers and staff in buying Units in the Fonterra Shareholders’ Fund but said many farmer shareholders seemed to be taking a “wait and see” approach before selling Economic Rights of Shares into the Fund.

The Co-operative said more than 2,500 people had applied to buy Units under its Friends of Fonterra Offer[1]. This is made up of:

· Nearly 900 farmer shareholders

· Nearly 200 sharemilkers

· About 70 retired farmers

· More than 1,300 staff

A further 260 Australian dairy farmer suppliers had also applied for Units in the Fund.

Each person has applied for differing amounts of Units and the number of Units each applicant will ultimately receive will be confirmed after the bookbuild process is completed and the final price is announced next week.

Fonterra Chief Executive Theo Spierings said the result showed strong support for Units among farmers and staff.

“Trading Among Farmers is all about strengthening the Co-operative and providing it with permanent capital for the future – it’s great to see these levels of support from our Fonterra family.

“We see it as a vote of confidence in the Co-operative from some of the people who know it best.

“It is another indication of the strong support we are getting from our farmers and staff for our Strategy Refresh which sets our future direction for growth.”

On the Supply side, about 260 farmer shareholders had offered to sell Economic Rights of around 5.5 million Fonterra Shares into the Fonterra Shareholders’ Fund.

“It is clear that we have seen limited interest from farmers at this time,” said Mr Spierings.

“We’re hearing from our farmer shareholders that a number of them are likely to wait and see how the Units trade before deciding to sell Economic Rights of some of their Shares into the Fund – but many are showing confidence in Fonterra by applying to buy Units.

“That’s one of the key features of the Fund – to provide flexible options for farmer shareholders. They can use it for investment purposes – or they can free up some cash by selling Economic Rights of Shares,” said Mr Spierings.

Chief Financial Officer Jonathan Mason said: “We know interest rates are low at the moment and this may mean that not all farmers are looking for alternative sources of cash.

“Circumstances may change in the future and that’s why we are looking to provide further opportunities for farmers to sell Economic Rights. As indicated in the Fund Prospectus, the next opportunity could be after Fonterra’s interim results for 2013 have been announced, which is likely to be in March.”

As also indicated in the Fund Prospectus, Fonterra will issue enough Shares to achieve the $500 million minimum Fund size required under the Dairy Industry Restructuring Act (DIRA) and any oversubscriptions of up to a further $25 million. The number of Shares to be issued will depend on the final price of Fund Units, which will be determined following the bookbuild process taking place next week.

Mr Mason confirmed the issue of Shares by Fonterra would, at the most, affect the Co-operative’s Earnings per Share by about one cent.[2]

Shares issued by the Co-operative will be held by the Fonterra Farmer Custodian who will hold the Economic Rights for the Fund. Fonterra does not intend to permanently retain the resulting equity.

Re #9 Carter is way outa line. Coulda been fine but now Im just tryin....

Seriously, lets move things forward, Elvis. Incremental steps, spread the cost, clean green = $. Our brand is as important as our product.

I find the comment that it was "too harsh" interesting. If that cost impsoed is a true reflection of the cost of the damage then the Pollie is saying, someone else pay. That is either us the tax payer, future generations or the ecological damage is left to accumulate. If its the latter then that unpaid portion like interest builds and will have to be paid.

In terms of "too harsh" the idea is that the costs are true and reflect the changes needed to stop them....maybe the pollie should consider the Green's getting 11% of the vote as a shot across the bows....NZers I think are showing some signs that the environment is important to them.. Meanwhile National seem hell bent on raping the one time resources for short term ain......I find that attitude strange, farmers I thought were supposed to look to the long term well being of the land because they love it.....me thinks its more like they love the $s is hands over.

regards

Vast majority of farmers do love their land I reckon. Thats why the idea that established farming methods and utopian ideals are unsustainable and damaging goes down sideways. I observe the acute defensiveness in the posturing and remonstrations of those not yet convinced.

The thought of revegetating 'good' pasture(riparian zones, erosion prone hillsides) would have turned my sheep farming Pop from the mighty Hawkes Bay blue in the face.

As an aside point the ugly truth Mike joy put breasts on is sadly based on fairly undisputible markers, eg existing native forest cover, etc.

Doable affordable chip awayable achievable solutions please anyone?

I'm interested in the process of 'capping' The revegetation of land that should clearly have not been cleared eg, east coast Cyclone Bola country. (During studies I was shown a doco on northeastern? China, total afghanistan looking subsistence farmed hills to lush goodness in 40 odd years, anyone got the link?)That being the planting out the tops of the hills - creates sponge effect of water retention and slows runoff speeds, improves permiability of soil structure, great for soils, when established natural gravity nutrient inputs to pasture downhill. Creates 'island' habitat for natives(pest control). Win win with cost and effort, I think so.

Fed, I think they said 2014 or later? and as opposites the the zillow index...where is the sustained job growth? or signs of core inflation. rising? Buying and selling houses is not an economy. The Case shiller is more widley regarded..that though also doesnt look bad...

Oil is down right now...$88 a barrel....wait and see WTI back at $100 and then look at how un-employment is doing... Oh and I would have expectd oil and petrol demand to show improvements reflecting a broader recovery...

Most commentators seem to be saying its too early to tell yet....

We can also expect frequent recoveries and relapses in a post peak oil world....this might just be another...

AEI tend to be somewhat libertarian in their outlook btw....I find that any body with a political axe to grind tends to be blinkered...or baised.

regards

Indeed, but really when you then look at the state of many of the US states they dont look too hot either.

In the EU though, Holland for instance, its housing market seems seriously out of wack.....France looks weak....all eyes on Germany....

regards

Godfrey Bloom on debt, Germany, Europe, welfarism, Gold etc

http://www.youtube.com/watch?v=8Yez8xdoH2A&feature=g-all-u

#8. the Christchurch town hall can be repaired for a certain amount. And the council wants to do that rather than have central government spend so much more on it's own scheme. And this is apparently a problem !!!! Has central government gone completely mad.

Oh. A the poor taxpayer might have a view. Maybe not - we are punchdrunk with such idiotic notions already.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.