Here's my Top 10 links from around the Internet at 10:00 am today in association with NZ Mint.

Bernard is on his summer break and will be back on January 22, 2013, from Wellington.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

See all previous Top 10s here.

1. China data dodgy?

More and more analysts are having doubts about Chinese export data. A mathematical tool devised by an American physicist in the 1930s underscores doubts about the quality and reliability of Chinese economic data, according to research by an ANZ economist.

The results are based on “Benford’s Law,” which holds that in any series of numbers, certain patterns will be found only if the statistics are naturally generated.

The rule, created by former General Electric engineer Frank Benford, suggests patterns for the first and second digits in a numeric series and can be used to detect phony data, said Li-Gang Liu, ANZ’s chief economist for Greater China.

Benford’s work has already been adapted to show Greece should have been suspected of manipulating its data before the European debt crisis and that now-jailed financier Bernard Madoff was overstating investment returns.

The ANZ economists studied China’s annual nominal gross domestic product data from 1952 to 2011 to measure how frequently numbers from one to nine appeared as the first digit. While the 24 occurrences of "one" is higher than the 18 suggested by the rule, the economists said the statistics largely abide by what Benford’s Law allows. The same is true of industrial production data.

2. Abe wants inflation at 2%

Japanese Prime Minister Shinzo Abe is looking for a "bold policy leader" as the next Bank of Japan governor as he aims to end deflation in Japan and drive a recovery from recession. More from Reuters, via the NY Times:

Prime Minister Shinzo Abe said the Bank of Japan (BOJ) must set a 2 percent inflation target and make it a medium-term, not long-term, goal to show markets it was determined to pursue bold monetary easing to end nearly two decades of deflation.

The government is negotiating with the BOJ to issue a joint statement this month to make the central bank accountable for achieving 2 percent inflation, double its current price goal.

"The BOJ basically says it sees 1 percent inflation as a loose goal. That doesn't show it's responsible to achieve it and doesn't show its strong determination," Abe said told public broadcaster NHK on Sunday.

"The statement must say clearly that 2 percent is the target. That would lead to fundamental changes" in the way it guides policy, he said.

3. The middle income trap

The rise of emerging markets is prompting economists to ask how long their growth spurts can last. The answer is until per-capita income reaches $10,000 to $11,000 and, once growth resumes, about $15,000 to $16,000 as measured in 2005 dollars, according to three economists including Barry Eichengreen of the University of California, Berkeley.

The economists found countries tend to experience slowdowns at two different income levels.

Middle-income countries may find themselves slowing down at lower income levels than implied by our earlier estimates. Slowdowns are most likely in emerging markets with high old-age dependency ratios, strong investment rates and undervalued currencies that lower incentives to move up the technology ladder. These patterns will presumably remind readers of current conditions and recent policies in China,” it said. China’s per capita GDP was $7,129 in 2010.

Still, China has slightly higher average years of secondary schooling than the median and a greater share of high-tech goods to exports, suggesting less risk of a slowdown. Countries accumulating high quality human capital and moving into the production of higher tech exports stand a better chance of avoiding the middle income trap.

4. Today's raw market data ...

A quick holiday update:

| as at 11:10am | Today 9:00 am |

Friday | Four weeks ago |

One year ago |

| NZ$1 = US$ | 0.8363 | 0.8447 | 0.8463 | 0.7935 |

| NZ$1 = AU$ | 0.7941 | 0.7975 | 0.8025 | 0.7697 |

| TWI | 75.03 | 75.71 | 75.46 | 71.14 |

| Gold, US$/oz | 1,658 | 1,675 | 1,696 | 1,641 |

| Dow | 13,493 | 13,486 | 13,149 | 12,467 |

| Copper, US$/tonne | 8,071 | 8,117 | 8,001 | 7,966 |

| Volatility Index | 13.36 |

13.49 |

16.34 | 22.20 |

5. A Buffett guarantee

Batty Liu recaps her Bloomberg interview with Berkshire Hathaway CEO Warren Buffett in which he guaranteed that banks will no longer be trouble for the United States.

The banks will not get this country in trouble, I guarantee it.

The capital ratios are huge, the excesses on the asset side have been largely cleared out ...

6. Helicopter money

Central banks may need to allow a dilution of their independence during periods of economic stress.

That’s according to a paper titled "Helicopter Money: Or How I Stopped Worrying and Love Fiscal-Monetary Cooperation," by Paul McCulley, a former managing director at PIMCO and Zoltan Pozsar from the Federal Reserve Bank of New York.

When companies and households are cutting back, monetary policy will flop if it’s aimed at boosting private demand for credit. The solution is to embrace fiscal stimulus and have the central bank communicate that such measures should be encouraged until the deleveraging finishes.

The lesson here is that central bank independence is not a static state of being. Rather, it is dynamic and highly circumstance dependent: during times of war, deflation and private deleveraging, fiscal policy will inevitably grow to dominate monetary policy.

7. Class war abates in US

Here is a quick summary of changing US attitudes about conflict in society. Of note is that the 'old' vs 'young' contest seems to not only be waning, it is also not a major one there. It is well worth clicking through to the detailed reports.

Anyone got NZ data?

8. Will we benefit?

Beef production in the United States is expected to decrease 4.8% in 2013, the second largest year-over-year decrease in 35 years, trailing only the 6.4% drop in 2004. More from ScienceDaily:

The reason is a combination of mostly steady carcass weights and a projected 5 percent or more decrease in cattle slaughter, said Derrell Peel, Oklahoma State University Cooperative Extension livestock marketing specialist.

"Many analysts expect the 2013 numbers to be followed by a 2014 decrease of 4.5 percent or more," he said. "These two years would represent the largest percentage decrease since the late 1970s."

Choice boxed beef should move above US$200 per hundredweight in the next few weeks. Beyond that, Peel believes it will be a question of how much and how fast retailers can pass along the higher wholesale prices to consumers.

"It is not really a question of whether retail prices will go up but rather a question of how much and how fast," he said. "Beef demand remains the biggest unknown in the beef industry. Time will tell just how severe the squeeze will be on industry margins in 2013."

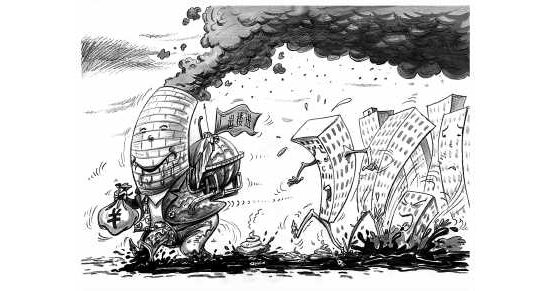

9. Pollution campaign

It might not be obvious why I have included this particular cartoon, but it is remarkable in its own way. It is from the Peoples Daily in China, and was used on their front page as part of their [very] new campaign against soil polution. Probably its a campaign against pollution generally, but the story focussed on the frightening legacy fast development has left all across China with contaminated soils and groundwater. A huge problem, and obviously the officials at the head of their government are ready to shame those industries doing the polluting. This cartoon illustrated a strong "Guest Comment" in the paper.

Polution in Beijing over the weekend has been unbelieveably bad. Someone suggested it would have been safer breathing a car exhaust directly.

10. Today's quote

"The safest way to double your money is to fold it over and put it in your pocket." Kin Hubbard

US Treasury Bonds

Select chart tabs

20 Comments

Why oh why do people ever believe anything official from the Peoples Republic of China ??? of course the market followers now deem their statistics "unrealiable". (most probably after loosing a bundle in the markets)...Give me a break.

Japan (whether Abe of Taro Aso) is desperate. I suppose after 20 years of recession (or depression) this is not unexpected. Unfotunately as all politicians, Abe thinks he is in control and that inflation can be "controlled" at 2%...good luck to him. Sometimes fools just cannot learn anything from history.

People believe anything official from the PRC Kin for the same reason they have been believing anything official from the USA....!

ooooh you cynic Wolly. Next you'll be telling us how you've noticed that the news pundits in the US are obsessed with picking holes in news coming out of PRC, and how over the past 2 years, 50% of Top 10 at 10 items are "about" PRC, and how those same US pundits never pick holes in US statistics, and how the scribes at interest.co.nz never question those US statistics, and never examine in depth or question scanty NZ data statistics.

#1. Dodgey Data. Well here I did warn you economists against taking government data (particularly from China) at face value - you are quite a gullible lot. Likewise I reported here last year that a Radio Australia report had the USA self sufficient in fossil fuels within 20 years and got roundly treated with contumely for that too: now even Mr Faith Birol, IEA Chief Economist, has it that way. This American shift away from Arab oil dependence will have enornmous effects on world geopolitics and it's likely to happen a lot sooner that 20 years.

Ergophobia

Whats even more dodgy is your opinion, IMHO and your math matches.

;]

1) Data is often collected by different organisations and guess what they all pretty much say the same thing. Interest.co.nz for instance has its own bsket of goods to look at CPI, end result pretty close to stats NZ.

2) USA wont be energy self-sufficient ever....the shale oil and gas is a shame....lets sit back and watch that unfold.

"Not at that price: Why long-term forecasts for cheap oil and natural gas are baseless"

"Once all the costs are figured in, Berman and Pittinger found that costs for gas wells drilled in the Fayetteville Shale, the Haynesville Shale, and the Barnett Shale were $8.31, $8.68 and $8.75, respectively. If land acquisition is excluded and only drilling, completion and other variable costs are included, the cost falls to $5.06, $5.63, and $6.80, respectively. Even these lower costs are still far above what some forecasts say will be the long-term U.S. price of natural gas. But, natural gas drillers will not drill wells indefinitely that lose money."

http://www.resilience.org/stories/2013-01-13/not-at-that-price-why-long…

3) Mr Birol's organisation was happily saying 130mbpd day was the projected output only a few years back. Since then they have scaled back that but still have egg on their face and needed a get out. The shale oil scam is that get out.

4) US shift, uh no. Even if that were the case the rest of the world needs 2mbpd more every year, so the US's 8mbpd no longer imported from OPEC will be absorbed in 8 to 10 years by the rest anyway, so at best a delay.

5) Sooner than 20 years, yes we will see and sooner than 5.

regards

Steven, are you serious...re your 1) the same incomplete and incorrect methothodies collected by difference sources proves zip. Try harder....

No if nothing else the same method points out trends, several methods add some comfort the output is about right. Certainly compared to the original thread I'd trust it way more. You on the other hand claim to have a method or methods that cannot be known, or verified as they are private yet apparantly differ from public data and just happen to suit your outlook it seems.

regards

Ok so you cant try harder, talk about taking assumptions as a given, all it proves is they applied the same approach, same methologies, go figure , it provides no comfort.

You don't need to believe me..just don't try to convince others with BS here.

http://www.zerohedge.com/news/2013-01-12/hyperinflation-action-beer-bag…

Rather a scary video about paying cash in Byelorusse - you can't help feeling sorry for the cashier.

#1, #9

I have a good idea.

Let them come here and run our Farms.

Or else we could just keep buying their products:

http://www.newstalkzb.co.nz/auckland/news/nbnat/459924390-fight-against…

More Leaky Building/Pipes etc. anyone?

"Bruce Kohn says they will go the Government for help if the problem continues to grow"

Like; how bad does it have to get? buildings falling down in an Earthquake?

Run our farms eh? Interesting. As Tony Chaston pointed out in 31 Decembers livestock report cost to produce a kilogram of milksoilds(kg/MS) at $5.90 is now par with the Fonterra payout according to DairyNZ. Couple this with a co-op shareprice which is floating at $7.42, so an extra $1.52 to produce an extra kgMS, plus the fact that most dairy farmers are heavily indebted and I think that the new Chinese farm managers would have to do a lot of fudging of statistics around the bank managers table.

interesting article:

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=108…

interesting turnaround in rental demand, fairly contrary to what some of the spurikers have been saying on this website

with yeilds diminishing, will this reduce investor demand in auck? Or will the speculative frenzy continue regardless of yield?

From memory, the article they reference about strong demand in early 2012 was written during the week or so that university was starting up. I suspect that we will see similar "Rentals under massive demand, get your's while you can" articles between 4 and 5 weeks from now

# 1 The respected and much watched Chinese economist Andy Zie on economic data

“The statistics in emerging economies are not accurate. The GDP data in China and India, for example, do not reflect their 2012 slowdown. My estimate is that the growth rate in emerging economies declined by half in 2012 from 2011.”

The Canadian Libertarian Fraser Institute rates NZ as number 1 place to do business. They also rate NZ as number 1 for education, which is an odd thing for libertarians to be rating, but they seem to be basing it on the results the sector is getting for the cost and the potential human capital produced by it.

http://crooksandliars.com/nonny-mouse/greatest-nation-earth-isnt-us

There was also a report rating NZ as one of the most free places to live.

All in all not a bad score.

regards

Dh,

Thanks for pointing that out.

Regards,

A powder keg? "Egypt: Foreign currency reserves now stand at $15 billion, enough to cover imports of oil, food, and other vital goods for another three months. On Sunday, the government reshuffled its cabinet to give the Islamists more direct control over key ministries. Currently pending is a $5 billion IMF loan that is seen a crucial to keeping the government solvent for a while longer. The loan however comes with important strings attached such as a major reduction of government subsidies for food and fuel."

arab winter maybe.

http://aspousa.org/2013/01/peak-oil-review-january-7-2013/

regards

Interesting article about the different factors behind the building yesterdays beloved downtown's compared to today.

http://www.urbanindy.com/2013/01/09/the-genius-of-traditional-buildings/

Pretty good for a brief article. There are plenty of other factors involved and one of the worst offenders is zoning laws. One of the key reasons the old areas worked is lots of little lots meant lots of little owners. Now big lots mean lots of non owners. With small owners the space between is communally owned, whereas the large Westfield type developments are completely controlled.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.