Here's my Top 10 links from around the Internet at 10 am today in association with NZ Mint.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #6 from Jeremy Grantham. It's a surprisingly hopeful view that falling birth rates and improving solar technology could solve the world's energy shortages.

1. 'Don't believe a word of it' - So says Wolfgang Munchau from the FT in this piece on suggestions austerity may be about to end in Southern Europe.

He says the recent Italian comments railing against austerity are just window dressing, as is the French crowing about more time to get back to surplus.

The Germans won't allow any real expansion in budget deficits.

The Germans themselves are tightening.

No wonder the entire euro-zone is in recession.

Munchau doesn't think the madness will end until the euro breaks up.

If the eurozone were serious about a U-turn on austerity, the only effective way to accomplish this would be for the creditor countries to expand their fiscal positions during the recession. The opposite is happening.

Germany, a country with a lot more fiscal space than Italy, undertook a fiscal adjustment of almost similar scale. Between 2010 and 2012 the accumulated net improvement of the structural balance was 2.5 per cent of GDP. Italy and Germany are both projected to record structural balance, more or less, this year and in 2014.

There is no way that Germany in particular will accept a fiscal stimulus for the sake of the southern European countries. This is because Germany restrained itself by passing a balanced budget law that requires the government to run near-zero structural deficits indefinitely.

If you want austerity to end, you need to start by repealing the fiscal pact and amending some of the secondary legislation governing fiscal policy co-ordination. I do not think this is going to happen. My conclusion is that austerity is here to stay, but will simply be presented with warmer words.

And it will last for as long as the euro exists.

------------------------------------------------------------------------------------------------------------------------------------------

Keep it safe. Keep it in a New Zealand Mint safety deposit box. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

2. Victory is declared - Ambrose Evans Pritchard writes at The Telegraph about the latest call from a German leader for the Germans to ease up on the austerity or risk a dangerous backlash from Southern Europe.

Pritchard quotes an apparent victory speech from a Frenchman.

Quite a rare thing. A victory speech from a Frenchman...especially over Germans...

Mr Lafontaine said on the parliamentary website of Germany's Left Party that Chancellor Angela Merkel will "awake from her self-righteous slumber" once the countries in trouble unite to force a change in crisis policy at Germany's expense.

His prediction appeared confirmed as French finance minister Pierre Moscovici yesterday proclaimed the end of austerity and a triumph of French policy, risking further damage to the tattered relations between Paris and Berlin.

"Austerity is finished. This is a decisive turn in the history of the EU project since the euro," he told French TV. "We're seeing the end of austerity dogma. It's a victory of the French point of view."

------------------------------------------------------------------------------------------------------------------------------------------

New Zealand Mint. Experts in gold & silver bullion, commemorative coins and jewellery. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

3. The Bernanke Put - Michael Mackenzie from the FT writes about the stunning rallies in dividend-yield stocks and corporate bonds as the US Federal Reserve cranks out the fresh money to buy bonds.

All this money sloshing around, but so little of it is going into expanding production, jobs and wages.

The market’s lack of a decent correction is a source of frustration and yet another example of how QE is distorting the behaviour of asset prices. It’s most apparent in the corporate bond market, where many companies are issuing debt at absurdly cheap levels and using the proceeds to buy back stock or pay dividends that cater to investors and their current preference for yield.

The harsh reality for investors is that they would be better served by companies ploughing their piles of cash into productive uses that ultimately boost the broad economy. Growth via stimulative tax and fiscal measures, and not extended rounds of QE, is required to restore confidence and reduce the distortions seen across asset classes.

“Without progress on fiscal and structural policies, central banks have no choice but to do more, with diminishing returns and increasing risks,” says Marco Annunziata, at General Electric. “Debating austerity and begging for more QE is a waste of time.”

As long as QE keeps rolling, the risk is that the economy can’t gain escape velocity and corporate executives focus on financial engineering that only intensifies the current mania for bonds and dividends.

------------------------------------------------------------------------------------------------------------------------------------------

Available now. Our brand new 1 oz Taku gold bullion coin. Details here »

------------------------------------------------------------------------------------------------------------------------------------------

4. How to get money out of China - David linked yesterday to an excellent piece showing just how quickly China's money supply is growing.

The next question is how to get the money out of China once it has been printed.

Here's The Times with a good piece on the giant laundering machine that is Macau.

The “Macau Laundry Service”, a set of illicit mechanisms thought to funnel more than £130 billion worth of yuan out of China every year, could be the Achilles heel of officials targeted in President Xi Jinping’s war on corruption.

A report published last autumn by US-based Global Financial Integrity suggested that some $3.79 trillion (£2.49 trillion) may have secretly left China over the past decade. Organised crime experts believe that, if Macau’s official gaming revenues last year were $38 billion (£25 billion), as much as six times that sum may have been generated in illegal side-betting.

There are many routes by which money can leave China illicitly: Macau offers ones that are colourful, but often considered lower-risk for an official flush with ill-gotten cash. One of the favourite methods involves using a “junket” operator – the allegedly triad-linked organisations that arrange for groups of mainland visitors to come to Macau, extend them credit to beat capital controls and, if needed, assist in moving huge sums of money offshore.

5. The madness in Japan - The FT reports Japanese stocks have rallied 40% since it became clear Prime Minister Abe would unleash a doubling of Japan's money supply.

Even property stocks have jumped, despite many office blocks being empty. Japanese real estate stocks are now trading at 42 times earnings.

Across the city’s central wards, some 8.6 per cent of office space was lying vacant at the end of March, according to property agency Miki Shoji - not far off the 30-year high of 9.4 per cent last June, and a world away from the trough of 2.5 per cent six years ago.

Yet on a price to book basis, sector valuations have already returned to their 2007 peak. The Topix real estate index currently trades at a price to earnings ratio of 42 times, compared to 24 times for the broader market.

“The new BoJ policies are setting conditions for a property bubble. It may not happen, but the probability has certainly risen,” says Akihiko Murai, J-Reit analyst at Fidelity. “We can ride the wave, but it’s extremely difficult to time the market. From a longer term perspective I am a little bit nervous.”

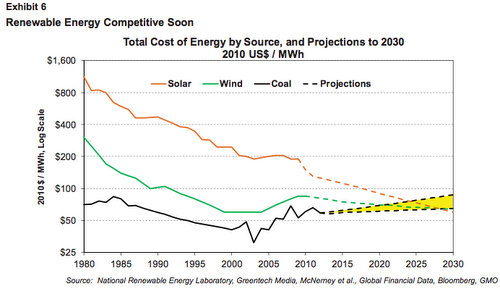

6. The race of our lives - GMO's Jeremy Grantham worries a lot about resource shortages, but he reckons declining fertility rates and improving sources of alternative energy might just save modern civilisation in the nick of time.

For once, all of the innovations, corporate start-ups, and risk taking – the best part of the capitalist system – work to decrease our use of depleting hydrocarbons and therefore to increase our chance of stabilizing our civilization before the cliff edge is reached. Exhibit 6 shows in orange the truly remarkable decline in the cost of electricity from photovoltaic cells.

The only thing to compare it to is the Moore’s Law decline in the price of semiconductors. That would indeed be a happy comparison, for perceived physical limits to semiconductor progress have been overcome time and time again. If the physical limits on photovoltaic efficiency, and hence its price, are similarly maneuvered in future decades, then the price of photovoltaic energy would guarantee us cheap and plentiful energy forever.

7. Trapdoors at the exit - Nouriel Roubini writes that the US Federal Reserve's money printing isn't helping the real economy. It's just boosting leverage and increasing risk taking in financial markets.

Given slow growth, high unemployment (which has fallen only because discouraged workers are leaving the labour force), and inflation well below the Fed’s target, this is no time to start constraining liquidity. The problem is that the Fed’s liquidity injections are not creating credit for the real economy, but rather boosting leverage and risk-taking in financial markets.

The issuance of risky junk bonds under loose covenants and with excessively low interest rates is increasing; the stock market is reaching new highs, despite the growth slowdown; and money is flowing to high-yielding emerging markets. Even the periphery of the euro zone is benefiting from the wall of liquidity unleashed by the Fed, the Bank of Japan, and other major central banks.

With interest rates on government bonds in the US, Japan, the UK, Germany, and Switzerland at ridiculously low levels, investors are on a global quest for yield.

8. Catch 22 - Roubini captures nicely the delicacy and the danger of the problem the Fed faces (and the RBNZ for that matter) -- How to withdraw the stimulus without collapsing everything

Some at the Fed—chairman Ben Bernanke and vic-chair Janet Yellen—argue that policymakers can pursue both goals: the Fed will raise interest rates slowly to provide economic stability (strong income and employment growth and low inflation) while preventing financial instability (credit and asset bubbles stemming from high liquidity and low interest rates) by using macro-prudential supervision and regulation of the financial system. In other words, the Fed will use regulatory instruments to control credit growth, risk-taking, and leverage. But another Fed faction—led by governors Jeremy Stein and Daniel Tarullo—argues that macro-prudential tools are untested, and that limiting leverage in one part of the financial market simply drives liquidity elsewhere.

Indeed, the Fed regulates only banks, so liquidity and leverage will migrate to the shadow banking system if banks are regulated more tightly. As a result, only the Fed’s interest rate instrument, Stein and Tarullo argue, can get into all of the financial system’s cracks. But if the Fed has only one effective instrument—interest rates—its two goals of economic and financial stability cannot be pursued simultaneously. Either the Fed pursues the first goal by keeping rates low for longer and normalizing them very slowly, in which case a huge credit and asset bubble would emerge in due course; or the Fed focuses on preventing financial instability and increases the policy rate much faster than weak growth and high unemployment would otherwise warrant, thereby halting an already-sluggish recovery.

The exit from the Fed’s QE and zero-interest-rate policies will be treacherous: Exiting too fast will crash the real economy, while exiting too slowly will first create a huge bubble and then crash the financial system. If the exit cannot be navigated successfully, a dovish Fed is more likely to blow bubbles.

If the bankers who blew up the financial world had been held accountable, the popular fury that fuels this bill would have dissipated by now. And if Dodd-Frank were fully in place today, instead of being bogged down in the courts and in the halls of Washington regulatory offices, there would be no political momentum behind such an effort.

Now, we will see whether the bill is simply a barbaric yawp of anger at the big banks or something with actual force. It probably won’t get passed, but its underlying premise cannot be dislodged from the Washington conversation.

10. Totally Jon Stewart on the problem with US veterans' benefit claims:

12 Comments

#8 ..

Been waiting for that realisation to dawn. Snookered. The plimsol line was supposed to rise with all the boats in the harbour rising. But it hasn't, and they havent. In fact the tide receded. So, now how do you unwind? Simple answer. Can't.

"receeded" correct, welcome to the results of austerity we deserve.

On the bright side all those 1s and 0s will simply disappear...just like thye were created.

regards

#6 Based on pretty much every long term population trend analysis, if humanity can scrape through the next 60 years or so the resource scarcity due to population growth will stop being a problem. Of course, what will then be a problem is economic models predicated on population growth (such as funding superannuation out of population growth).

Yes - Grantham doesn't quite get it, does he?

Mixes up 'cheap' with 'reduction in energy consumption', doesn't get the end to 'Moores Law', as pointed out by Malthus some time ago. (pointed out that while we were growing taller trees and couldn't ascertain how far the process went, could safely pick a height beyond which it wouldn't go).

Goes closer than most, though.

Yes, he's interesting, sometimes what he writes seems to suggest he really gets it, other times its like he's staggered off on a tangent into no hoper. I think there is a lot of wiseful thinking/praying going on...."someone will save us" be it god, or scientists. Strange really the very ppl who preach self-reliance ie the rabid right rely on magic from someone else saving them.

regards

Well Here's some Interesting news, BH.

Seems that our biggest export market has its own Plunge Protection Team....

Here's the money shot:

"it is proving hard to pop the housing boom without popping the economy itself."

Gosh, next they'll be adopting the Ones' now infamous slogan:

"Hope and Change!"

http://www.nzherald.co.nz/opinion/news/article.cfm?c_id=466&objectid=10…

It's not as though we haven't known about these problems for some time. In 2009 Professor of Economics at Stanford University Frank Wolak gave the Commerce Commission three lines of evidence to show that the four large suppliers in the New Zealand electricity market "have both the ability and incentive to exercise unilateral market power, and that this exercise of unilateral market power has resulted in substantial wealth transfers from consumers to producers during several sustained periods of time between January 1, 2001 to June 30, 2007".

Subsequent analysis by senior associate at the Institute for Governance and Policy Studies at Victoria University, Geoff Bertram, shows Wolak was right. Bertram tracks artificial asset revaluations by the generator-retailers totalling $2.4 billion over 1994-2004, which translates to an annual excess charge on electricity consumers of $312 million per year going forward. "In other words," says Bertram. "A permanent annual levy to reward the industry for successfully manipulating 'the regulator'."

http://www.comcom.govt.nz/assets/Imported-from-old-site/BusinessCompeti…

A fine article by Barton - thks Henry_Tull.

Thanks Henry, these two articles of his caught my atention too

http://www.nzherald.co.nz/opinion/news/article.cfm?c_id=466&objectid=10881834

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10824121

Telcom the gift that kept on giving...

Risk we see to mrp (given wall of $ looking for yield) is the gifting of value a la fonterra units.

With banker chaps happy to hold bar low, so friends can show a portfolio gain 6mths hence. -ref our post last week ex the guardian (Manchester) describing life and times of said/sad banker types.

The end of growth in the UK? Unusual to see this get an airing in a mainstream publication, and all the more interesting for that:

http://www.guardian.co.uk/business/2013/may/05/uk-growth-pessimists-eco…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.