Here's my Top 10 links from around the Internet at 1 pm today.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #9 on Chinese debt. Read it and quiver.

1. A deregulation story? - Pattrick Smellie writes well at Stuff about the history of the deregulation of New Zealand's food safety regimes over the years.

This was one of the points raised in Xinhua's '100% festering sore' editorial.

It compared Fonterra's failings to leaky buildings. It could have just as easily compared it to Pike River.

Pattrick rightly points to the ceding of soverignty in 1999 that sent Food Standards NZ over the Tasman.

This almost happened too in banking in 2005. Luckily a strong fightback by the Reserve Bank stopped that. If only New Zealand had kept its own food safety bureaucrats, this might have been avoided.

Most of the scientific and political clout at Food Standards Australia New Zealand now resides on the other side of the Tasman. Yet safe food is one of our most valuable exports, its purity inextricably linked to the country's tourist reputation as a clean country.

At the same time, New Zealand began moving from explicit regulation to company-specified risk management programmes. These have to be registered with the Ministry for Primary Industries, be available for public inspection, and should also be accompanied by a register of compliance, ideally available online. But if this intended transparency is supposed to be a meaningful line of defence, don't hold your breath. By using search engines, it's possible to find the risk management programmes (RMPs) part of the ministry website.

It would once have been part of the standalone New Zealand Food Safety Authority's website, but that independent body was subsumed into the ministry years ago.

2. Don't hold your breath - One argument in favour of today's NZ$30 million taxpayer subsidy for Rio Tinto to keep Tiwai Pt open until 2017 is that it buys time for a cyclical rebound in the price of aluminium.

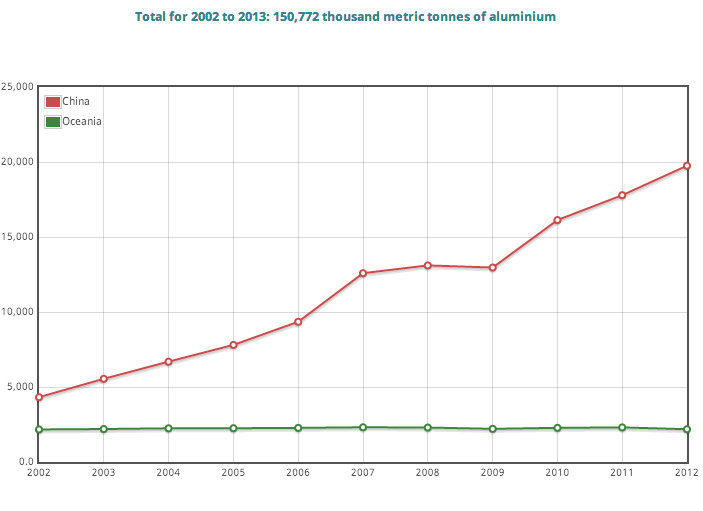

But what if the slump is structural? Chinese output, much of it heavily state subsidised, has quadrupled in the last decade to 20 million tonnes per annum. Tiwai Pt is producing around 0.3 million tonnes per year.

Reuters reports here China plans to increase output by 50%, including an extra 3 million tonnes (10 times Tiwai Pt's output) in this year alone.

The aluminium price is, as the Monty Python sketch goes, a dead parrot. It is deceased. It is not resting or stunned. It is an ex-parrot. The chart below shows Chinese output and Oceania output, which includes New Zealand and Australia (which also by the way heavily subsidises production).

Here's the latest from Reuters.

Beijing has tried unsuccessfully to limit aluminium capacity and last month further tightened regulations for new and existing smelters. Analysts and smelter sources said the regulations would not cut production this year, but would limit expansion in the longer term.

China has more than 27 million tonnes of annual capacity currently. Some 10 million tonnes of capacity was being built, according to a report on the Ministry of Industry and Information Technology website. Analysts expect China to add more than 3 million tonnes of new aluminium smelting capacity this year and the bulk would come from the northwestern remote region of Xinjiang.

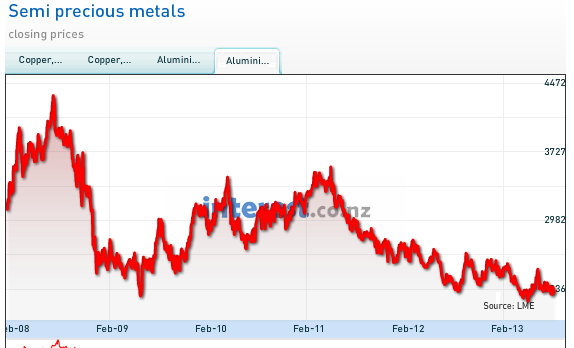

And here's the NZ$ price of aluminium since 2008. It has halved. No suprises given the chart above.

3. Out of work forever? - WSJ cites fresh research here showing long term and low skilled unemployed in the United States will really struggle to ever find work again.

Swedish economists Stefan Eriksson and Dan-Olof Rooth decided to test the theory head-on with a straightforward experiment. They applied for more than 3,500 jobs using nearly 8,500 fictitious resumes. Some of the made-up applicants had steady employment histories, some were currently employed but had been jobless at an earlier stage in their careers, and some were unemployed for various lengths of time. Then they waited to see who got called in for an interview. (The researchers quickly declined all interviews.)

In a forthcoming paper in the American Economic Review, the researchers find that short-term spells of unemployment (those of six months or less) had no effect on job-seekers’ prospects. In fact, for low-skilled jobs, being short-term unemployed may have even been a slight advantage, perhaps because the workers could start right away.

But for the long-term unemployed, it was a different story: “The callback rate decreases dramatically at nine months of unemployment,” the researchers write. For those applying for medium or low-skill jobs (those not requiring a college degree), being long-term unemployed reduced interview requests by 20%, the equivalent of shaving four years of work experience off their resumes.

4. China's roll over games - FTAlphaville looks at just how China's very indebted local governments are coping with the rolling over of their debts. It seems the shadow banks are helping them. That doesn't inspire a lot of confidence. Refer to #9 below.

One of the key questions is how the large amounts of risky debt in China will be addressed. Fitch’s Charlene Chu estimates the country’s total debt at about 200 per cent of GDP; Goldman’s estimate is 219 per cent. Both think the rate of growth has been very fast in the past five years, which is another risk indicator in itself.

Bloomberg yesterday published a round-up of what various bank analysts are thinking about China’s debt problem, which is where the economy’s shortcomings seem to be manifesting. Half of the strategists thought bad debts incurred by local government and corporations would have a “significant impact” on China’s credit and economic growth.

The question right now, however, is: how are the riskier borrowers being kept afloat, and how are banks managing their non-performing loans?

the challenge of propping up heavily-indebted borrowers is being met, for the time being, by China’s incredibly innovative shadow banking sector (which confusingly, isn’t entirely unregulated and has strong links to the formal banking sector).

Much attention has been given to the recent growth of the U.S. federal debt. This paper examines the growth of federal liabilities that are not included in the officially reported numbers. These take the form of implicit or explicit government guarantees and commitments. The five major categories surveyed include support for housing, other loan guarantees, deposit insurance, actions taken by the Federal Reserve, and government trust funds.

The total dollar value of notional off-balance-sheet commitments came to $70 trillion as of 2012, or 6 times the size of the reported on-balance-sheet debt. In other words, the budget impact associated with an aging population and other challenges could turn out to have much more significant fiscal consequences than even the mountain of on-balance-sheet debt already accumulated. .

6. Britain's zero hours economy - In Britain companies such as McDonalds, Burger King and Dominos Pizza are allowed to employ people on so-called 'zero hours' contracts, which means they're not obliged to give them any work.

The Guardian reports on a campaign to dump these contracts.

Burger King, which has 1,400 restaurants across the UK, employs its entire non-management staff on the contracts, which leave workers with no guaranteed hours of work each week. The rotas are decided a week in advance but can be subject to changes at the last minute. Staff can also be sent home early if there is not enough business.

In 1999 the company was forced to pay £106,000 in compensation to staff employed on the contracts after staff were made to clock off and stand around in stores unpaid until business picked up.

It is safe to say Marx would have cavilled with those who see zero-hour contracts as an expression of Britain's economic strength, a demonstration of flexible labour markets in action. He would have thought "reserve army of labour" a better description of conditions in which workers were expected to be permanently on call for an employer.

The Office for National Statistics said last week that 250,000 people were now on zero-hours contracts – a 25% increase on its previous estimates but still small in relation to the 30 million people employed in the UK. The estimate is, however, disputed by some labour market experts who point out that more than 300,000 care workers are on such contracts. What is certain is that the total is on a steep upward curve; it may be as high as one million and growing.

Bodies representing employers say zero-hours contracts should be welcomed since without them unemployment would be even higher. Better, they say, that people should be working 20 hours one week and no hours at all the next rather than be on the dole.

Seen in this light, Vince Cable – who is conducting a review of the contracts – should be thinking of further deregulation of the labour market rather than contemplating measures that might reduce this "flexibility". He could, for instance, repeal the 1874 Factory Act that banned children under 10 from working in a manufacturing plant. He could rethink the 1847 10-hour Act that said children should not work for more than 10 hours a day. He could be really bold and say that Parliament erred in 1841 when it voted in favour of the Mines Act that prevented a child under 10 from working underground in a pit. Because, let's face it, all this legislation represented regulation of the labour market that made it less "flexible".

8. Here's why zero hours contracts are so big - John McDermott writes at FT.com about the growth of zero-hours contracts.

In the nearer past, the growth of zero-hours contracts has two immediate causes, as suggested by the Resolution Foundation, a think-tank. First, in 2010, the UK implemented an EU directive granting agency workers – employees hired through a temp agency – equal status with other employees after 12 weeks of employment. This may have led employers to use zero-hours contracts as an alternative way of hiring people without offering a full suite of benefits.

Second, the downturn meant employers had to cut costs and Britain’s flexible labour market allowed them to do so without creating the mass unemployment seen in mainland Europe. The employment rate has remained resilient. However, since the financial crisis we have seen the rise of “underemployment” – where people have jobs but not for as many hours as they would like. Zero-hours contracts probably played a role in encouraging this trend.

If zero-hours contracts were just a response to the downturn, though, we would expect them to decline as the economy recovers and employers start to compete more for workers. This may happen but I suspect that they are here to stay.

This is because the contracts’ rise has a deeper cause. From what we know, most of the zero-hours contracts are in the part of the UK economy that has plagued policy makers looking at how to revive average living standards. Social care, retail, hotels and restaurants – which account for hundreds of thousands of zero-hours contracts – are generally sectors that are low skilled, not subject to international competition and where employers compete primarily on cost. Productivity is low, and so are wages. Unions are either absent or weak. For many companies, zero-hours contracts are a logical extension of the business model.

Avoiding a fate akin to Japan’s growth collapse of the 1990s hinges on Chinese officials’ ability to reduce debt and shift policy, JPMorgan Chase & Co. says. President Xi Jinping and Premier Li Keqiang, developing a reform strategy due at a Communist Party meeting later this year, may get input from a State Council-ordered audit of government borrowings and a World Bank-assisted study on urbanization.“The debt ratio is absolutely dangerous, there is no question,” said Yao Wei, China economist at Societe Generale SA in Hong Kong, ranked by Bloomberg as the most accurate forecaster of the nation’s gross domestic product. “There is a high risk that this debt issue will have significant downside pressure on Chinese growth in the next few years.”

Local-government debt may have surged by as much as 50 percent since the end of 2010. Borrowings as of June 30 ranged from 15 trillion yuan ($2.4 trillion) to 16 trillion yuan, according to estimates of four analysts.

That compares with the National Audit Office’s 10.7 trillion yuan estimate for the end of 2010. The agency said July 28 that the cabinet ordered a new nationwide review of government debt.China today and Japan in the 1980s share a buildup in broad measures of credit to almost double the economy’s size, JPMorgan analysts said in a July 19 report. China’s credit-to-GDP ratio rose to 187 percent in 2012 from 105 percent in 2000, compared with Japan’s increase to 176 percent in 1990 from 127 percent in 1980, JPMorgan said.

10. Totally John Oliver on what's wrong with America's tax code. In short, an awful lot.

14 Comments

#1 I totally agree. Deregulation as seen in NZ from 1984 onwards has been very poorly done and has often been expensive interms of money and lives. Neoliberalism/Libertarianism/Chicago school is highly idealistic and based on some pretty long assumptions, and so should be viewed with the same amount of scepticism as socialism and religion.

On a side note, I see that Lachie fella from SthCantyFinance has been charged. I seem to remeber ready on this site at the time of it all going tits up that Lachie and a bunch of others had moved there from Westpac as a gang and were very very slippery. Does that sound familiar to anybody?

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=109…

Biennial anniversary of SCF's puff of white smoke in august 2011

Why go fast when you can go slow?

or should that be

Why go slow when you can go fast?

Your leaders, your regulators, do not want to have their faces rubbed in the ease with which they were taken advantage of

#2 - cyclical rebound in aluminium prices

Plus warehousing aluminium for gains by price maintenance by the usual suspects

You forgot to mention the two recent events involving Goldman Sachs, JP Morgan, London Metals Exchange and Glencore Xstrata - a rebound is what these guys were hoping for

http://www.reuters.com/article/2013/08/07/us-lme-warehousing-idUSBRE9760LY20130807

That court case is more about market manipulation (being able to charge "rental" to the market for shipping the aluminium between warehouses you control) than hoping for a rebound.

http://www.independent.co.uk/news/business/news/goldman-sachsin-spotlig…

Look for the price to drop more once this rort is exhausted.

#1 This might explain why the Government sounded so panicky. The Chinese wants NZ to have an independent food safety authority but NZ supposedly can't do that because they have already ceded their food safety soverignty. The NZ Govt is caught between a rock and a hard place.

The Government seemed to be very good at spreading panic.

havent you noticed that nearly everything govt does comes back and bites them - eventually

Thats right TOGS, except that it's almopst invariably citizens who get their bottoms bitten, rather than pollies and wallahs.

I don't think it's impossible that deregulation can be beneficial - I just don't recall an example where deregulation has delivered value to customers, savings or profit to the Govt, and allowed the private sector to carry the risk and fairly gather profit from properly managing that risk.

Yes that seems to be the case lately.

I also think they often spin what they do so no one suspects the real ramifications of what they are up to.

Hey Yeah, Hold Your Horses!

http://peterlbrandt.com/a-must-read-for-all-futures-market-traders-a-sp…

3. Out of work forever? - WSJ cites fresh research here showing long term and low skilled unemployed in the United States will really struggle to ever find work again.

....

But I heard a discussion on nights with Bryan Crump on immigration:

"The work that's been done impact of migrants on wages tends to suggest migrants release workers into the workforce elsewhere, it reduces the cost of some services, particularily food services, restaurant services, working in the kitchen, cleaning services, and generally raises productivity and efficiency in the economy.. and leads to higher growth rates so you get a virtuous circle. Virtually all the work that's been done points to that. In very specific areas it might reduce wages"

http://www.radionz.co.nz/national/programmes/nights/audio/2539057/migration%27s-mighty-steps.asx

so there is no excess it is soaked up.

I Christchurch when EQC get around to fixing the cosmetic cracks in the gib etc you have to move out of the house (with your furniture). People are charging $230/night for renatal accomodation knowing the insurance companies will pay. That's one reason our premiums are so high.

2. This was in tonight's Telegraph headlines

"Rio Tinto, the miner, is the latest to be stung by plunging commodity prices. Net earnings in the first half of the year have fallen 71pc to $1.7bn due to weaker iron ore and copper prices, and the company has admitted that it has given up hope of selling its Pacific Aluminium business."

It would have been better to have shared that $30m among the employees of Rio Tinto than to give it to the Company. It could have been done as Steve Keen recommends - those who have mortgages then their share goes to pay off their mortgage. Those who haven't a mortgage or who rent then their share goes straight to them.

What an excellent idea - rather than Rio disestablihsing the workforce - the workforce could disestablish themselves. You'd probably get some of the employees using the money to start up new businesses of their own. Much more sensible in the longer term for the Southland economy.

Remember the government's response to Novopay?

Compare and contrast to Queensland's response to a failed IBM payroll system.

http://www.theaustralian.com.au/australian-it/government/queensland-ban…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.