Here's my Top 10 links from around the Internet at 2 pm today.

As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #7 from Matt Taibbi on US student loan debt. My other must read is the Geonet website. Seddon quake just went through at 6.9, Geonet says. Felt it big time in Wellington.

1. Banker argues against bank regulator - I'm a big fan of Stephen Toplis, who is BNZ's Head of Research. He regularly writes some of the best economic analysis around and in an accessible fashion. I always read his notes.

So I was surprised he has taken quite a flick at the Reserve Bank's push for 'speed limits' on high LVR lending in this note titled: The RBNZ's Big Experiement.

David Hargreaves has written it up here as well.

I'm all for questioning the Reserve Bank's performance, but the tone of the note suggests Toplis would rather the bank put up the OCR than mess around with all this 'experimental' stuff with macro-prudential policy. He even says the Reserve Bank is in 'panic mode'.

I think that's a bit rough. The bank, if anything, has moved too slowly. It missed the boat last year when the ANZ and ASB were at each other's throats cutting fixed mortgage rates and ramping up high LVR lending in Auckland. ANZ ramped up in Auckland to fight off an attack it knew would come when it integrated National. ASB fought back hard in its core market. The end result was a 20% rise in house prices. If anything, the central bank hasn't moved fast enough.

I also just don't agree with Toplis' assertion that it's all about Auckland's supply problem. That problem, if it really has been there, has been around for years. The fact rents are so flat in Auckland (unlike in Christchurch) should make people think twice before reflexively blaming supply. The only thing that changed to pump up house prices by 20% in the last year was a good old fashioned lowering of credit standards and a cut in the price of credit through cuts to actual fixed mortgage rates.

That is a demand problem. The best way to deal with it is to reduce the credit stimulus. The first option would be a rate hike, but with inflation below the target band the only option the Reserve Bank has is to force the banks to reduce the leverage.

Toplis argues the bank has been muddying the waters between prudential policy and monetary policy. I just don't think that's the case. Anyone who has read the Reserve Bank speeches and papers will know the bank is clearly describing this as a way to protect the banking system. If foreign investors aren't sure, they need to read the speeches. Yes the speed limits may have some side effects on the economy, but that's all they are. The loosening of bank lending practices through late 2012 and early 2013 had side effects too. Bankers didn't mind the muddying of the prudential and monetary policy waters then...

At its heart the dispute between the Reserve Bank and the banks is about leverage. The banks want more of it, both for themsleves and their customers. That makes banks and their customers more vulnerable to a correction, but more profitable in the short term while prices are rising. The Reserve Bank's role, rightly, is to protect the banking system and it should fight hard to do that, particularly given we have no government guarantee and are relying on the figleaf of Open Bank Resolution to protect taxpayers. To often around the world over the last 6 years, banks have successfully fought regulators' attempts to put that leverage back in the box.

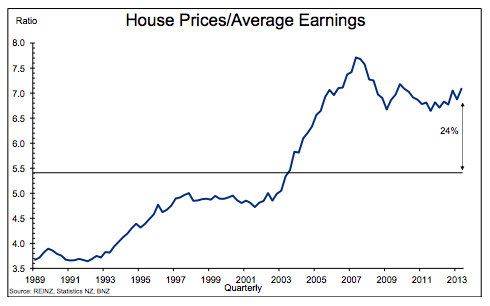

That means central banks should pull hard on the reins when the horses would prefer to gallop on. Toplis' own chart showing how over-valued New Zealand's house prices are should strengthen the RBNZ's resolve. Bankers believe they are bulletproof. Until they are not. Also, monetary policy needs mates. The government is helping with its fiscal policy, but not so much with its first home buyer subsidies in tandem with KiwiSaver withdrawals, which really started to kick in last year. Surprise surprise, another demand stimulus.

Here's Toplis:

We’re not strong advocates of the macro-prudential process generally, and the proposed LVR changes specifically, but that’s by-the-by as the changes are upon us whatever we think. What matters now is that the Reserve Bank provides absolute clarity as to what it is doing and why it is doing it.

It will tell you that it already is but the number of questions we are getting from both offshore and onshore is testament to the fact that its current communications strategy is less than optimal. Moreover, with all the hype over LVRs and the current intense concentration on regulatory matters at the Bank, it is equally imperative that the importance of monetary policy and orthodox responses to economic cycles does not play second fiddle.

2. One swallow does not a swallow make - Reuters' economics correspondent in London, Alan Wheatley, an old squash partner of mine, writes well about how Europe's apparent slight rebound in economic activity is not an indicator of much better things to come.

The recovery is vulnerable to external shocks and too weak yet to make a difference to two of the major issues hanging over the euro zone: record unemployment and the sustainability of the area's public and private debt.

Quarterly growth of 0.7 percent in Germany and 0.5 percent in France, the bloc's two biggest economies, was faster on an annualized basis than in the United States, whose economy expanded 1.7 percent in the second quarter using that calculation.

Context counts, however. Inflation-adjusted U.S. output is about 5 percent higher than it was in the first quarter of 2008. Households have acted swiftly to pay down debt and the housing market is enjoying a brisk upswing. Growth has responded, even if the recovery has been weak by historical standards.

The euro zone, by contrast, is still in catch-up mode. Gross domestic product remains 3 percent below the peak reached five years ago and, on current trends, is unlikely to regain that high water mark until the middle of 2015 at the earliest, according to Jefferies, an investment bank, in London.

3. Deflationary pressures - Reuters reports Ford has launched a price war in Europe and sees it going on for a while. This is one of the reasons I reckon inflation is completely dead. Industrial capacity in Europe and Asia is bearing down on prices of all sorts of things.

Confidential research seen by Reuters indicated that discounts by mass-market brands jumped 17 percent in May from a year earlier across Europe's five biggest markets.

De Waard said much of the problem stemmed from unused manufacturing capacity, with plants able to produce in excess of 4 million vehicles beyond what was required to meet European demand.

"We come from an industry of 18 million and even at that level there was overcapacity. And while there has been activity by us and our competitors to adjust capacity, that capacity will take a while before it's actually gone, it's really the end of next year that the first plants really close," said de Waard.

4. It's not about Lebron James - Some argue the growth of inequality and the mega-pay of the 1% is linked to the growth of highly paid sports stars, musicians and movie stars.

This chart from Slate's Matthew Yglesias suggests that's not the driver.

A great paper by Jon Bakija, Adam Cole, and Bradley Heim last spring (PDF) looked in detail at the occupations of the top 1 percent and the top 0.1 percent and showed that while there has been a rise in superstardom it happened in the 1980s. More recently, superstars have been on the decline.

5. How overvalued? - US stocks are over-valued, but not by as much as they were in 1929 or 2000, according to Robert Shiller's Cyclically Adjusted Price to Earnings multiple, FTAlphaville reports.

At 23.8, the Shiller CAPE suggests that stocks are clearly overvalued. But it does not suggest that they are a screaming sell or in a bubble, as it plainly did in 1929 or 2000, or that there is as much reason for concern as there was in 2007.

Prof Shiller himself suggests that CAPE at this level is consistent with average real returns over the next decade of about 3 per cent – which is historically underwhelming, but would be grabbed with both hands by bond investors facing real returns not far above zero.

6. A really green building - Quartz reports on a green building in Japan that dedicates 20% of its floor space to growing vegetables. Click through for even more amazing pictures.

7. The scandal of US student loan debt - Here's Matt Taibbi in Rolling Stone with another cracker.

The dirty secret of American higher education is that student-loan interest rates are almost irrelevant. It's not the cost of the loan that's the problem, it's the principal – the appallingly high tuition costs that have been soaring at two to three times the rate of inflation, an irrational upward trajectory eerily reminiscent of skyrocketing housing prices in the years before 2008.

How is this happening? It's complicated. But throw off the mystery and what you'll uncover is a shameful and oppressive outrage that for years now has been systematically perpetrated against a generation of young adults. For this story, I interviewed people who developed crippling mental and physical conditions, who considered suicide, who had to give up hope of having children, who were forced to leave the country, or who even entered a life of crime because of their student debts.

They all take responsibility for their own mistakes. They know they didn't arrive at gorgeous campuses for four golden years of boozing, balling and bong hits by way of anybody's cattle car. But they're angry, too, and they should be. Because the underlying cause of all that later-life distress and heartache – the reason they carry such crushing, life-alteringly huge college debt – is that our university-tuition system really is exploitative and unfair, designed primarily to benefit two major actors.

First in line are the colleges and universities, and the contractors who build their extravagant athletic complexes, hotel-like dormitories and God knows what other campus embellishments. For these little regional economic empires, the federal student-loan system is essentially a massive and ongoing government subsidy, once funded mostly by emotionally vulnerable parents, but now increasingly paid for in the form of federally backed loans to a political constituency – low- and middle-income students – that has virtually no lobby in Washington.

9. Totally John Oliver on Jeff Bezos buying The Washington Post.

And here's Part II with the excellent John Hodgman...

10. Totally Clarke and Dawe on the Australian election campaign...

8 Comments

Off-topic, but hope you're stable on your feet down in the capital, Bernard!

I'm a little bit wobbly, but a lot of people say that's a regular thing...

Plenty of aftershocks.

More detail here...

http://www.interest.co.nz/news/65915/wellington-hit-again-earthquake-me…

cheers

What is the CPI after all Zanyzane, a recording of PAST inflation - which of course is what the RBNZ's job is, to control past inflation - youre right, monetary policy can't affect that. And HE needs to revisit econ101 ?

#8 is old news: Glenn Reynolds (Instapundit) has a book out about it and it fits broadly into the notion that ya cannae implant the Attributes which lead to good life outcomes (deferral of gratification, getting and staying partnered, yada yada), by subsidising the Markers (houses, edumication). Matt T is late to this party but of course an entertaining read.

Chin up Wellingtonians, quakes ain't much fun but it sounds like damage is mild

As your lawyer I recommend a large Long Island Ice Tea

I know, why not blame the poor. It is much easier than thinking. The first home buyers see house prices going up by their annual income every year - that is why they jump in,

3. Deflationary pressures - Reuters reports Ford has launched a price war in Europe and sees it going on for a while. This is one of the reasons I reckon inflation is completely dead. Industrial capacity in Europe and Asia is bearing down on prices of all sorts of things.

Please do use the word inflation in a sentence until you have listened to Randel Wray - maybe he can help you understand what inflation is. It will not try to because I have also been swamped with masses of misinformation about what inflation is and is not. An alternative to Wray would be a famous S'crooge McDuck' Comic written by Carl Barks when Scrooges Giant money pit exploded and scattered all of his money out to everyone

http://en.wikipedia.org/wiki/A_Financial_Fable

What it is not is measure of the rate of increase in the price of cars. Inflation is about money- and money as a store of value. Inflation is a measure using other things like cars to determine what is happening to money as a store of value- that is why it is really important (or should be) to the RB. The actual price of a car has been steadily dropping while the quality and features have been rising. So cars alone are not a very good measure of inflation. nor indeed of money as a store of value- cars in themselves are not a very good dstore of value.

Before anyone bothers to point out that money is not a very good store of value- i agree- but the degree to which it not a good store of value can be roughly calculated.

Land in NZ is a much better way of determining the change in the store of value of money and by that measure money an't what it used to be.

Plan B you have put that so well - Thanx

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.