Here's my Top 10 links from around the Internet. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #1 on the potential for the ECB to start printing money too.

1. 'We haven't even started printing yet' - Just in case you think the era of endless money printing and 0% interest rates forever is over, the Chief Economist of the European Central Bank said overnight that the ECB could cut rates further and it had yet to start printing money.

Currently America, Japan and Britain are printing money like there's no tomorrow.

It explains (at least partly) why the New Zealand dollar is so stubbornly strong and over-valued. It also explains why property bubbles are blowing up all over the world, including in New Zealand.

And the ECB, which governs a currency zone almost as large as America's, is now suggesting it may start printing too.

When will this all end? It seems never.

We shouldn't be surprised to see some of this printed money squirt out the sides and trickle down towards our own long white cloud of inflated property prices.

We also shouldn't be surprised if the Reserve Bank's high LVR speed limit fails to control this bubble, thanks to capital and people inflows.

Here's Peter Praet's interview with the WSJ.

The European Central Bank could adopt negative interest rates or purchase assets from banks if needed to lift inflation closer to its target, a top ECB official said, rebutting concerns that the central bank is running out of tools or is unwilling to use them.

"If our mandate is at risk we are going to take all the measures that we think we should take to fulfill that mandate. That's a very clear signal," ECB executive board member Peter Praet said in an interview Tuesday with The Wall Street Journal.

Mr. Praet didn't rule out what some analysts see as the strongest, and most controversial, option: purchases of assets from banks to reduce borrowing costs in the private sector. "The balance-sheet capacity of the central bank can also be used," said Mr. Praet, whose views carry added weight as he also heads the ECB's powerful economics division. "This includes outright purchases that any central bank can do."

2. Why house and prices are expensive in China - Luckily for us, most land in and around New Zealand cities is not sold by the local government. That is the case in China and it's frustrating the hell out of the central government there, which is grappling with an asset bubble.

Reuters has the background here:

Homes in cities such as Beijing are more expensive by some measures than Britain or Japan, a dismal outcome for a central government campaign aimed at making homes more affordable to Chinese. House prices in September rose nationwide at their fastest pace in three years.

"The starting point of local governments is to keep land prices relatively high," said Zou Xiaoyun, deputy chief engineer at China Land Surveying and Planning Institute, a research unit affiliated to the land ministry. "Governments are not willing to see home prices fall."

Selling land is a major source of income for local governments but other factors drive up prices as well. These include natural demand from a rising population, and speculation fuelled by ready cash, given relatively few alternatives for investment.

3. 'A socialist market economy' - Here's the Xinhua report from the Third Plenum announcement of major economic reforms. You gotta love the Chinese determination to create a 'socialist market economy', which most would see as an oxymoron. The weekend's reform news was the biggest political and economic news for New Zealand in the last year or so, now that China is our largest trading partner.

Here's the sort of words (or at least the English translation) that were used. It looks big, if Xi Jingping can pull another Deng Xiaopeng-style reform leap. Xi certainly has the authority now and more than any previous leader since Deng.

Build a unified and open market system with orderly competition

Allow the market to play a decisive role in resources allocation

Establish fair, open and transparent market rules

The session also proposes to build a unified and open market system with orderly competition, and allow the market to play a decisive role in resources allocation. China needs to accelerate forming a mordern market system in which enterprises operate independently, and compete fairly. The focus should be given to clearing market barriers and improving the efficiency and fairness of resources allocation.

4. Yikes - Japan's growth is slowing, despite a monstrous amount of money printing.

5. Time to prick the bubble? - The Telegraph's Jeremy Warner thinks it might be time to prick Britain's property bubble, which is being blown up by 0% interest rates, money printing and Government 'help to buy'.

One local thought on this. Expat Kiwis previously stranded in British homes that were under water may soon be able to sell up and bring their pounds down here to buy even more over-priced property. And remember, the Welcome Home Loans are exempt from the high LVR policy. Just what we need.

6. China's property bubble - China, through its crawling peg, is connected to the money printing in America and it's own banking systems (conventional and shadow) have pumped US$14 trillion of credit into its economy in the last 5 years. Now it is also trying desperately to control a housing bubble.

Is there a theme developing here?

Here's Reuters' version of all the tweaks and limits imposed (without success) to control its bubble.

7. More (Consumer Price Index) inflation please - The Economist wants to see more inflation. Think about that sentence for a bit. The Economist wants more inflation. It's a stunning thought after decades of inflation fighting.

All the “sound money” fanatics who issued dire warnings about rampant inflation when central bankers began their unconventional measures might usefully reconsider whether Western policymakers did too little, not too much. Be afraid of inflation, by all means; but life can be even scarier when it sinks.

Countries that have signed such investment agreements have paid a high price. Several have been subject to enormous suits – and enormous payouts. There have even been demands that countries honor contracts signed by previous non-democratic and corrupt governments, even when the International Monetary Fund and other multilateral organizations have recommended that the contract be abrogated.

Even when developing-country governments win the suits (which have proliferated greatly in the last 15 years), the litigation costs are huge. The (intended) effect is to chill governments’ legitimate efforts to protect and advance citizens’ interests by imposing regulations, taxation, and other responsibilities on corporations.

10. Totally Clarke and Dawe on contemporary Australian culture.

45 Comments

Still no mention of the outrageous plan to flog-off Air NZ shares before the Referendum, citing rules as an excuse.

We had a referendum on this in 2011, it was the General Election.

Don't recall asset sales were the single and only issue, as in a Referendum. Not to mention the anti-personality vote against the other candidates (or their non-asset sale policies). Nor the distorted pre-election polls that discouraged anti-Nat votes and allowed them to just squeek in vs. the poll-pridicted landslide for them. And getting 47% of the vote is hardly a "mandate", as constantly claimed. Repeat a lie often enough....

Meteria Turei and Kevin Hague tweeted yesterday urging voters to vote no in the referendum to send a message to John Key that he's arrogant and his government shows contempt to its citizens.

Which means the referendum isn't about one issue to the Greens, it's about showing no confidence in John Key. Which is exactly the opposite of what you said.

The only lie here is your cake - which you are attempting to have and eat.

Thats a bit of a strecth, but never mind after getting the necessary votes we get a referendum.

So if the Govn loses what should they do?

Carry on with asset sales?

If so, Id seriously wonder on their chanced of re-election.

regards

"If recent history is anything to go by, the 2014 general election result has already been decided, since 1998 the party leading the opinion polls in July of the year preceding the election has gone on to win the highest proportion of the party vote, enabling them to form a government.

Despite the current centre-left Labour/Greens bloc looking competitive, history tells us National should have the 2014 election in the bag, again.

Although David Cunliffe emerged from the Labour leadership 'primary' with all guns blazing, recent political history also suggests he will find it hard to make a sustained impact within the next 12 months. The MMP era is littered with major party leaders who have rolled their predecessors with the hope of doing better within two to three years of the next election, only to fall by the way.

John Key was the exception as leader of the Opposition for just under two years before he became Prime Minister; before that Helen Clark was leader of the Opposition for six years, and before that Jim Bolger was leader of the Opposition for 4.5 years. No one has yet gone on to lead a government within 12 months of assuming party leadership."

What then do you think having won a general election enables a Government to do?

Provided it doesnt care about being re-elected a hell of a lot. Our system doesnt have an upper house so really the party in Govn provided they have 61 (or so) MPS can vote in just about any legislation they want.

regards

And the following Parliament can repeal that legislation. That's how the system works! If it didn't work that way, then it wouldn't be a Sovereign Parliament.

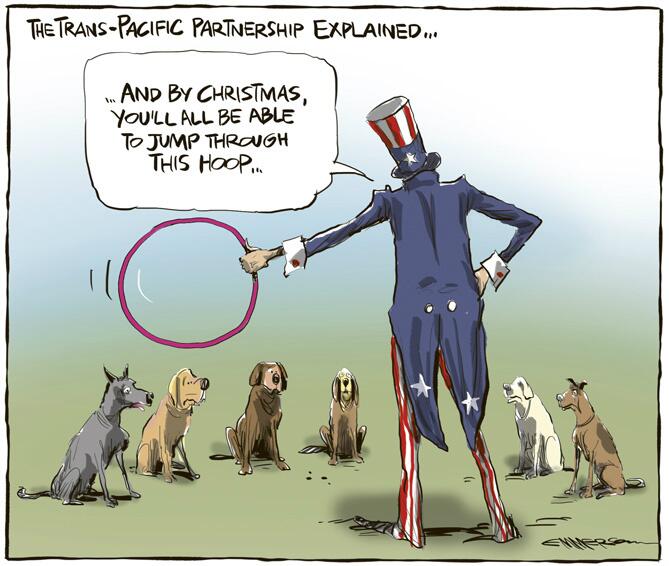

Yes indeed. Though Im not so sure how easy it is with Treaties, eg the TPP we might get stitched up with....

regards

Bernard, we do not own land, we have limited usage and ownership rights. These are dependent on us paying the rent to the local government (called rates in Double Speak) and getting local government approval if we want to make changes. Not so different from renting in some regards.

So this is not true:

Luckily for us, most land in and around New Zealand cities is not sold by the local government.

Yes, my point was that land ownership was a bit grey here too, obviously of a lighter shade but grey none the less. In this country land ownership is secondary to claims by the local council and to claims by the bank if there is a loan. Look at this way, who gets to eat first, the council or the "owner" or the bank? In that case, who is really the owner? Surely the one who eats first has the greater claim to ownership as commonly understood.

The second point is who gets to decide how the land is used? The council has greater rights here too.

We are a bit blind to how our own system really works, but we too have a system that cedes control of land usage to a bureaucracy and demands the payment of a land usage fee to that bureaucracy too. Is it really so different?

Some of the differences are significant:

What ownership rights we have, however limited, have protection under a system of rule of law. If this were China the national party would pick the judge and could overule their decision if they didn't like it.

In China, if you happen to be an artist with political views against the government they can beat you up, shut down your blog, bulldoze your studio, detain you in secret -- and you have no legal recourse (let alone recompense to property right).

It is an improbably long bow to string NZ next to China and say property rights are similar.

You say we have the protection of the Rule of Law. What then of the Kaipara District Council Local Bill going through Parliament right now. Retrospective legislation to right serious and admitted illegalities and ahead of a 2 year report from the Auditor General (also compromised by failings of her subsidary Audit NZ that failed to notice over $60 million of borrowings that were not compliant with the law) see www.mangawhairatepeyers.org

Mind boggling that one, both the cost getting so far out of control and the retrospective legislation. I really think the latter is way wrong, I mean how can you comply with something that isnt even written yet let alone law.

regards

May I suggest you have answered your own questions:

.. Bill going through Parliament right now ..

Totalitarian regimes have no need to admit anything, pass materially required legislation or suffer audit they did not themselves approve.

Actually if you happen to "own" rural land (which is not ownership as we understand it, as Hugh points out) the authorities can expropriate it from you 'in the public interest'. But of course the arbiter of the public interest is the authorities.

That is a significant difference I would say.

Yes Hugh but they are allowed to own their own homes, which they've been able to do since 1998. Only rural peasants aren't allowed so called property rights. Local officials rezone land from rural to urban, buy land at well below market value often as low as 2%, and sell it to property developer thereby collecting tremendous capital gains. Often those illgotten gains are smuggled overseas and invested in real estate in Western cities such as Vancouver, Miami, Melbourne, and most likely Auckland where the capital gains and illgotten wealth won't likely be subjected to to much scrutiny.

HOW ARE GROUND LEASE RENEWALS treated??? Shouldn't the concern have been about how the peasants were treated?

We have so lost our way, that the only thing that matters is money and owning stuff, too bad about the little fellow unceromoniously booted of the land to make way for the greedies, no matter what form they come in

How very Cocal-Cola of them, although they have finally buckled to pressure and signed an agreement not to bully people off their land to plant their sugar cane poison. Pepsico has not yet signed, they also control Twinings Tea and TIP TOP BAKERIES

I quite enjoyed Bruce's blog series,

http://www.stuff.co.nz/business/blogs/stirring-the-pot

in which he talks quite a bit about property rights.

Counting the cost of expensive housing....

http://www.macrobusiness.com.au/2013/11/counting-the-cost-of-expensive-…

I guess Jakarta wouldn't fit on their charts.

These new Tom Tom results confirm my article earlier in the year on New Zealand's poor transport infrastructure.

Certainly transport always rates highly as Auckland's most pressing issue- for most of us considerably more pressing frankly than affordable own your own housing.

For all that the Tom Tom study's measures seem to miss some important variables; although maybe I'm missing something.

It measures apparently how much a 30 minute commute in uncongested traffic would take in congested traffic. It doesn't seem to measure the actual average commute; nor do I find it easy to see how long the congestion periods seems to last in each city. Here we seem to have a relatively compressed peak period and I'm guessing, but an average commute of say 30-40 minutes? It seemed to me in London the average commute was an hour plus, while peak periods seemed to take two to three hours morning and evening, with real non congestion only occurring in the wee hours of the morning.

As David Chaston has noted, in the school holidays traffic flows like a dream.

Nevertheless it is a problem; and around the centre, not easily fixed with more roads, (there just isn't the space without bulldozing very expensive housing) even if there were the political or economic will. So better public transport seems a critical part of the solution. I somehow suspect Hugh that you are not advocating that approach.

Recent Potash finds in Amazon basin now equal Russian and Canadian reserves. Pesky finite resources keep popping up ruining a good Peak story.

http://www.agrolink.com.br/noticias/ClippingDetalhe.aspx?CodNoticia=188…

#2 "Governments are not willing to see home prices fall."

Sounds like here. Key has openly said he doesn't want prices to fall. Cunliffe has said the same. Wheeler too, in nominal terms, because it will cause a financial (read banking) crisis. If that's not too big to fail, what is? Supply and demand be damned. Politically it's a one way bet. No free market there!

So WTF.......you would prefer the whole banking system to fail and see people living in poverty.........nice real nice?

Not at all but don't pretend the property market is free and only governed by supply and demand. It is grossly distorted by tax advantages and a bias by the banks to lend predominantly on rural and residential land. By controlling where credit goes, the banks essentially shape the economy.

With regards to the banking system, the argument seems to be, yes too much credit/debt has been extended but it's too late now to do anything about it because that will affect property prices which support it, so we will continue to prop up the unsustainable and hope for the best.

Personally I think the unsustainable will become an Ireland type failure with socialisation of bank losses onto everyone including the majority who are mortgage free or have no property. That is a massive moral hazard. Pain for some now or collapse later?

As a libertarian free marketer can you explain why taking a punt on property should be treated differently than taking a risk in business. Why don't politicians say "we don't want to see the value of anyones business decline"

There is a balance needed in a mixed economy between public and private provision of services. The private sector would never have buit our roading/rail/port/school/health system because it is too expensive to get a return on. The private sector just cherry picks, buying or building stuff that is profitable because it doesn't have to worry about the general good, the provision of services that every civilised country needs but which can only be funded from the central government. One profitable road from Auckland to Wellington wouldn't do anyone any good. If there is a need for low cost housing and the private sector doesn't want to build them, let the government do it a la 1935

On Venezuela Mish is saying hyper inflation is a political phenomena, not a monetary one

HP and his ilk will never see a balance between the responsibility of the state and the desire of rampant corporate greed to cherry pick profitable social enterprises.

He should stick to Houston and maybe even live there. Nothing like socialising the losses of private enterprise disasters to gain HP approval.

;.))

HP and his ilk will never see a balance between the responsibility of the state and the desire of rampant corporate greed to cherry pick profitable social enterprises.

He should stick to Houston and maybe even live there. Nothing like socialising the losses of private enterprise disasters to gain HP approval.

;.))

I understand Hugh and others frustration around planning at a local government level but councils reflect their elite constituents, not the least of which are NIMBY's (many of which inhabit this site) who want to increase the value of their property. Increased land supply potentially works against this. Supply bottlenecks will in any case take years to resolve. Demand restrictions however can be applied virtually overnight starting with foreign ownership and immigration approvals. Labour and National wilfully ignore these. Even the Greens won't touch immigration.

Low cost housing can't happen in Auckland until the cost of existing property reduces to the point that it makes business sense. What private developer doesn't want to maximise his profit? What private building supply company doesn't want to maximise their profit?

And as reported on TVOne news tonight - Housing NZ returned the Government more in dividends this past year than it spent on new house builds.

So, even what we assume to be public sector services are indeed businesses which manage to provide a return to the shareholder government. Those returns have increased considerably during the term of the Nat'l government (see here p. 21 - it's called a "social dividend" lol);

Point is Hugh, government run business can indeed return a profit - that's been proven time and time again!!!!! It's normally the private sector who manages to run these businesses into the ground (e.g. AirNZ, NZ Railways .. Solid Energy being the exception, the Nat'l government managed to bankrupt that one all on it's own initiative).

Double post.

Yep Government can run businesses well or badly just as private interests can run them well or badly. Cronyism, inefficiency and incompetence isn't the sole preserve of the civil service. Nor is hubris and grandiose empire building.

Kate and WTF.......I think it is pertinent to remember that all the Government run business's were funded at some point by the taxpayer. Cheap funding to get started over private business which always pays market rates for capital.

In regards to Housing NZ......How much of the dividend paid to the Government was returned to Housing NZ to undertake new projects? It appears that National is reinvesting much of the dividend back into housing can't say that the Clark led Government undertook a lot or any reinvestment with the dividends it took.

I have seen very little evidence of the Civil Service applying the rules that make up our constitutional documents in NZ.....they ride rough shod of anything in their way. Do you know how many pieces of legislation there is to control the civil service and bureaucrats?

In regards to Housing NZ......How much of the dividend paid to the Government was returned to Housing NZ to undertake new projects?

Accding to the report on TVOne last night - less than half has been reallocated as capital for investment in new social housing;

The report says the Government has contributed $129 million a year to HNZ for the past three years, but received dividends of $271 million each year.

http://tvnz.co.nz/national-news/social-housing-needs-overhaul-report-5709541

Ironic, eh?

Kate - So would you prefer the Government to not receive a dividend from housing NZ?

If so........then how would you get HNZ to be efficient operators?

Personally I would prefer that no-one had to be reliant on State housing.....the fact that so many people are reliant on State housing is an indicator that the last 50 years have taught us nothing.

Well, I guess it depends on what Housing NZ's purpose is. I perhaps wrongly thought it was a social service. Should a social service provide a return (i.e. a profit) to government? No, I'd have thought not as then it becomes a business, not a social service.

.. so many people are reliant on State housing

How many is so many? I'd have thought as a percentage of the overall population, those living in state housing has significantly decreased over the post-War (i.e. last 50) years? Perhaps you have a link to some stats?

Kate and WTF.......I think it is pertinent to remember that all the Government run business's were funded at some point by the taxpayer. Cheap funding to get started over private business which always pays market rates for capital.

Please explain this model of private enterprise funding and payback in respect of Transmission Gully?

Green Party transport spokeswoman said taxpayers would have to stump up $125 million a year over 25 years if the PPP model was used for Transmission Gully.

The road has been costed at $1.3 billion. But the Greens maintain that over 25 years it will cost the Government $3 billion, which includes all payments including road maintenance.

"National is locking future taxpayers into paying $125 million a year for Transmission Gully for a quarter of a century even though the traffic volumes don't justify building it," Genter said.

She agrees with Sole's comments that ''the patronage isn't there'' for Transmission Gully to pay for itself as a toll road.

''The costs are so high and the traffic volumes so low that [the] toll would have to be $15 each way to cover its cost - far higher than road users would pay.

''That just highlights what an uneconomic project this is. It makes no sense to force the taxpayer to shoulder this $3 billion burden instead. Read more

Or some of the PPP tunnel projects in Australia where the state government had to try and corral drivers into them to make them profitable.

Governments, including National here, say "look shiny new project and no debt, aren't we clever" and ignore the ongoing guaranteed annual operating expense which far outweighs what any debt repayments would have been. False economy

Well said wtf

just compare the insurance companies dominated healthcare system costs in USA with NHS in UK or scandavia or nzl Australia

Why private corporates were begging for govt handouts in the free market economy ?

Um did anyone else pick up the rising population bit in China. Rising population? There is no population rise in one child only country unless the olds are living forever. Could it be the rising population referred to is merely herding people from rural areas and concentrating them into the ghost cities to make it look like there is demand for them

FYI updated with cartoons.

cheers

Bernard

There are a few other interesting distinctions in the Chinese property market.

1. An individual can not take out a loan to purchase property.

2. Local government can not charge rates. They make their income from land sales so there are strong incentivites to keep development going.

3. Most of the debt is owed by local government and quasi-autonomonous companies. Credit was freely available but it's tightened up now.

4. Savings get penalised by poor interest rates and the stock market is perceived as corrupt. The only two places to put money is either housing or get it offshore, which can be difficult depending upon who you are.

5. Although the population is not increasing, urbanisation is. Thee people need somewhere to live. Growth is still high by first world standards.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.