Here's my edition of Top 10 links from around the Internet at 10:00 am today. We now have a Monday-Wednesday-Friday schedule for Top 10.

Bernard will be back with his version this Wednesday. We will have another guest posting on Friday.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

See all previous Top 10s here.

1. Personal virtue, social vice

Perhaps this one is a little geeky to start with today, but it is from Paul Krugman - who is talking up Larry Summers, someone he is clearly in awe of. (It helps that he agrees with Summers.)

The two of them think the record shows that long term, we need either negative interest rates, or continuous big deficit spending by governments (or even wasteful spending by big corporations!).

The problem is demographics. In a natural state, slow growing populations of consumers don't justify or support faster growing incomes and wealth. They can be supported by bubbles, but not in a normal state.

That is the core underlying problem according to the Summers/Krugman analysis. Your view?

Of course, the underlying problem in all of this is simply that real interest rates are too high. But, you say, they’re negative – zero nominal rates minus at least some expected inflation. To which the answer is, so? If the market wants a strongly negative real interest rate, we’ll have persistent problems until we find a way to deliver such a rate.

One way to get there would be to reconstruct our whole monetary system – say, eliminate paper money and pay negative interest rates on deposits. Another way would be to take advantage of the next boom – whether it’s a bubble or driven by expansionary fiscal policy – to push inflation substantially higher, and keep it there. Or maybe, possibly, we could go the Krugman 1998/Abe 2013 route of pushing up inflation through the sheer power of self-fulfilling expectations.

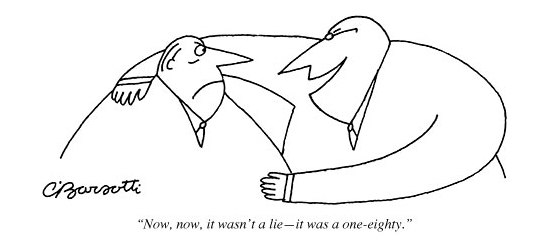

Any such suggestions are, of course, met with outrage. How dare anyone suggest that virtuous individuals, people who are prudent and save for the future, face expropriation? How can you suggest steadily eroding their savings either through inflation or through negative interest rates? It’s tyranny!

But in a liquidity trap saving may be a personal virtue, but it’s a social vice. And in an economy facing secular stagnation, this isn’t just a temporary state of affairs, it’s the norm. Assuring people that they can get a positive rate of return on safe assets means promising them something the market doesn’t want to deliver – it’s like farm price supports, except for rentiers.

Oh, and one last point. If we’re going to have persistently negative real interest rates along with at least somewhat positive overall economic growth, the panic over public debt looks even more foolish than people like me have been saying: servicing the debt in the sense of stabilizing the ratio of debt to GDP has no cost, in fact negative cost.

2. A WFMD?

Warren Buffet said derivatives were 'weapons of financial mass destruction'. Derivatives are fiendishly 'clever' financial products dreamed up by smart computer geeks that few others understand. Now some people claim that is what Bitcoin is - a speculative wealth generator for the few at the expense of the many.

And it is what Phillip Inman says - 'bright graduates who create electronic currencies may be as dangerous as unregulated traders before the financial crisis'.

Regulators say they are worried about the growth of shadow banking as much in China as in the US and Europe (China has its fair share of restless, clever graduates). They should be equally worried about Bitcoin.

Regulation is annoying and banks can charge too much for processing transactions, but that is not a justification for a shadow currency with the potential, should it be allowed to proliferate, to wobble and crash.

The Bitcoin early adopters and the people who are currently using computer programs to "mine" Bitcoins want a new currency so they can make trading profits from doing nothing other than trading. There is no higher motive. In the early days of its operation individuals can go bust – so who cares? They took the risk of a collapse in the currency's value (so far it has only gone from $1 to $1,000 in its five-year life). But once institutions are trading with other people's money – pension money – then it becomes serious when losses occur. Before you know it there will be a clamour for regulation and the regulators will impose charges to cover their costs, place restrictions on trading and possible apply a tax. And the reaction from the Bitcoiners? Start another currency.

We often talk about the brightest graduates turning their backs on manufacturing and engineering in favour of banking. They still do but there is not enough banking to go round for the star-studded students of today and tomorrow. Left to their own devices, and without being channeled into more productive activities, of course they will print new money if, in our ignorance, we all say it is OK.

3. Roubini warns again

The RBNZ has put in LVR controls, but Nouriel Roubini thinks this sort of action won't work - for reasons readers here will be well versed in.

He wants [much] higher rates to hold back the froth

In most economies, these macro-prudential policies are modest, owing to policymakers’ political constraints: households, real-estate developers, and elected officials protest loudly when the central bank or the regulatory authority in charge of financial stability tries to take away the punch bowl of liquidity. They complain bitterly about regulators’ “interference” with the free market, property rights, and the sacrosanct ideal of home ownership. Thus, the political economy of housing finance limits regulators’ ability to do the right thing.

To be clear, macro-prudential restrictions are certainly called for; but they have been inadequate to control housing bubbles. With short- and long-term interest rates so low, mortgage-credit restrictions seem to have a limited effect on the incentives to borrow to purchase a home. Moreover, the higher the gap between official interest rates and the higher rates on mortgage lending as a result of macro-prudential restrictions, the more room there is for regulatory arbitrage.

For example, if loan-to-value ratios are reduced and down payments on home purchases are higher, households may have an incentive to borrow from friends and family – or from banks in the form of personal unsecured loans – to finance a down payment. After all, though home-price inflation has slowed modestly in some countries, home prices in general are still rising in economies where macro-prudential restrictions on mortgage lending are being used. So long as official policy rates – and thus long-term mortgage rates – remain low, such restrictions are not as binding as they otherwise would be.

What we are witnessing in many countries looks like a slow-motion replay of the last housing-market train wreck. And, like last time, the bigger the bubbles become, the nastier the collision with reality will be.

4. Trying to avoid falling prices

Iraq vs Iran has never worked out in the past. Now that 'peace' is breaking out in the Gulf, OPEC is wondering what will happen if Iran's oil production picks up just as the new fast-growing Iraqi output blooms. Another Mid-east flash point brewing? More from the WSJ:

"If Iran increases its production, OPEC may have to look at who should cut, and most likely that would be the Gulf," an OPEC official said.

Gulf OPEC officials, however, are split on who should rein in output, according to people familiar with the debate. Saudi Arabia, Kuwait and the United Arab Emirates, who together account for more than half of the cartel's output, are possible candidates.

Some say they should do it themselves next year in an effort to support prices, while others say Iraq should be asked to rein in its output, those involved in the debate say.

"The closer Iraq gets to a four million barrels [a day] mark, the more it is important for us to find a way to put a limit on their output," said one Gulf delegate.

Iraq has shown little willingness to back down.

"I don't think we can take orders from anybody [related to] the future of Iraq—especially Saudi Arabia and Iran," Adnan Al Janabi, chairman of the Iraqi parliament's oil and gas committee, said at an energy conference in Istanbul in November.

Earlier this year, surging production by the U.S. divided cartel members over what to do in response to all the new supply from outside OPEC's ranks.

5. Not believing their own spin

How come big tech companies don't let their employees work from home? It seems ironic that the companies that make the devices and systems that make it possible won't have a bar of it themselves. This is what David Amerland of Forbes figures the reasons are:

Marissa Mayer’s oft-cited letter to Yahoo employees stated:

"We need to be one Yahoo!, and that starts with physically being together. Speed and quality are often sacrificed when we work from home."

(Emphasis mine.) She wasn’t referring so much to the quality of work done as to the qualities that employees bring to a company when they get together around the water cooler and talk shop.

She probably learned this while at Google. It’s a sentiment echoed by Google’s CFO, Patrick Pichette. In an interview with Australian journalist Ben Grubb, he explained Google’s counterintuitive anti-teleworking stance:

"There is something magical about sharing meals. There is something magical about spending the time together, about noodling on ideas, about asking, “What do you think of this?"

Magical or not, the fact remains that teleworking generally doesn’t work well, because corporations still haven’t solved the issues of remote learning, knowledge sharing, or firing up ideas. If that “magic” is to happen, you still need office face-time.

6. 'I know what I like' to become 'We know what you like'

I love Skype, and most families probably do these days. Others like 'selfies' on Instagram, Facebook or Twitter. There are hundreds of ways your face is being recorded - not to mention from the security cameras everywhere, including in your favourite ATM.

It turns out your emotions can be read from them in an increasingly sophisticated way. Just the thing for marketing campaigns to target you more individually, it seems. Anne Eisenberg at the NY Times has an update:

Face-reading technology may one day be paired with programs that have complementary ways of recognizing emotion, such as software that analyzes people’s voices, said Paul Saffo, a technology forecaster. If computers reach the point where they can combine facial coding, voice sensing, gesture tracking and gaze tracking, he said, a less stilted way of interacting with machines will ensue.

For some, this type of technology raises an Orwellian specter. And Affectiva is aware that its face-reading software could stir privacy concerns.

So far, the company’s algorithms have been used mainly to monitor people’s expressions as a way to test ads, movie trailers and television shows in advance. (It is much cheaper to use a program to analyze faces than to hire people who have been trained in face-reading.)

Affectiva’s clients include Unilever, Mars and Coca-Cola. The advertising research agency Millward Brown says it has used Affectiva’s technology to test about 3,000 ads for clients.

7. A normal year, weather-wise

Recent rains have recovered soil moisture levels. Looks like we are in for a cracker full dairy season. How's it at your place?

8. Those pesky chickens

Here's a problem everyone foresaw, but no-one has done anything about. It just too explosive. Part of the deal to 'clean up' banks with too much international corporate debt and derivatives, was to print money and have these banks borrow it to repay the problem loans, and then 'invest' in much safer sovereign bonds as part of their capital structure resilience.

But now the chickens are coming home. The concentration of risk in dodgy domestic government debt is out of control in many countries. The latest stress tests are highlighting the vulnerability in Europe. The ECB is in a big bind as its about to take over eurozone bank regulation. New Year fireworks? More from Spiegel:

European banks ... have purchased enormous quantities of government bonds from their own country. In Italy, Spain and elsewhere the lending institutions have become the leading financiers of their own states. This may please their respective governments, but it also entails risks. If, at a certain point, a state can no longer service its debts, the banks could suffer huge losses. Consequently, many economists -- above all Bundesbank President Weidmann -- are urging the introduction of new regulations to break the so-called feedback loop between governments and private banks.

ECB monetary policy plays a role in all of this, too. For years, it has been supplying euro-zone banks with cheap liquidity in a bid to boost the economy. But Italian banks are not using those funds to grant loans to Italian companies. Instead, they have increased their holdings of sovereign bonds since late 2011 from €240 billion to €415 billion.

"We are observing an evasive reaction that we have caused ourselves through monetary policy interventions," argues Weidmann. Indeed, he thinks it is necessary "that we treat sovereign bonds the way we treat corporate bonds." According to normal banking practice, financial institutions are only allowed to grant companies loans up to a certain limit. In Weidmann's opinion, a similar credit limit should also be introduced for states -- specifically, the bonds issued by each individual country.

Experts like Daniel Gros, the director of the Center for European Policy Studies in Brussels, take a similar view. "The most consistent instrument for dealing with sovereign bonds would be the use of credit limits," says Gros, who is also a member of the advisory committee of the European Systematic Risk Board. Gros notes that it may be advisable to set aside capital to cover the sovereign debt, depending on the level of risk. "We should not orient ourselves according to ratings here, but simply according to the level of sovereign debt in relation to the gross domestic product."

9. 'We're very sorry, but ...'

When they can't make money, Rio Tinto has shown it will shut down its aluminium plants. It has just done so at Gove, in the Northern Territories. Wonder how Tiwai Point is currently faring ... Maybe the deal 'we' did has bought us some valuable time?

Rio Tinto chief executive Sam Walsh said "This is a very sad day for everyone associated with Gove. It has been an extremely difficult decision and we recognise it will have a significant impact on our employees, the local community and the Northern Territory. There is no doubt it is a challenging path ahead. We are working in partnership with the Northern Territory and Australian Governments, the broader community and Traditional Owners to identify initiatives to create new opportunities for the people of Nhulunbuy. We have a firm belief in the potential of the bauxite operation, a quality asset with a long-term future.

The Australian and Northern Territory Governments on both sides of politics have worked tirelessly with Rio Tinto over recent months endeavouring to secure a long-term future for the refinery. All practical scenarios were considered in an attempt to make this work however, it has not been possible to find a sustainable solution. There is nothing more the Northern Territory Government could have done to help secure a long-term future for the refinery.

"I would like to acknowledge the significant business improvements our Gove employees have achieved in the face of extremely challenging market conditions over an extended period of time,'' Mr Walsh said.

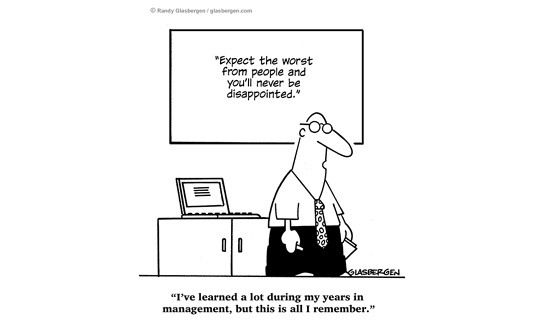

10. Today's quote

"What we want from a monetary system isn't to make people holding money rich; we want it to facilitate transactions and make the economy as a whole rich. And that's not at all what is happening in Bitcoin." - Paul Krugman

8 Comments

Re 1. "saving may be a personal virtue, but it’s a social vice" finally, I've repeatedly stated this and especially with the increasing wealth disparity, if you become extremely wealthy and have the personal virtue of 'saving' (which is easy) then you destructively levelerage off this middle class ethic

The problem is chronic overcapacity due to a global society that seeks to needlessly provide everyone with 8 or more hous of employment when the productivity of industry doesn't need so much labour to support the pubic's demand for it produce and its productivity is predicted only to escalate as business invest in industrial and logistics robots, automation, and streamline their business processe with ICT.

Spot on Neven. Savers expect returns (not just returns but high returns) for doing.... nothing.

The only way interest can be paid on savings is if that money is being lent out to someone working to pay the interest. So your essentially expecting someone else to do the work for you.

http://www.nzherald.co.nz/politics/news/article.cfm?c_id=280&objectid=1…

Cargo-cult mystique of funding through private sector deals blurs burden of risk for public.

Article abolutely nails the PPP nonsense

@ Rio Tinto & Aluminium story . Of course with the negative sentiment towards John Key in some quarters , there will ne no recognition of Key's foresight in the Tiwai allowance agreement to keep the smelter going .

The alternatives were closure of the facility , a spike in unemployment , a fall in GDP, reduced power consumption , more people on the benefit , and a drift by those people to the bigger centres of Auckland and Chch with no houses available , looking for work that does not exist .

The critics also dont understand the marginal utility effect , because where electricity is sold at cost it is still generating cash , and its better than electicity not being sold at all, and bringing in no cash at all .

The problem is that if the Tiwai smelter is closed , the power generators fixed costs remain , so those fixed costs eventually either erode profits or lead to tarriff increases for everyone else

In essence , the income stream from Tiwai ,( even if the power is sold at cost,) is a contributor to fixed costs.

PPP for beginners.

Ah ..but the Mayors will not get the perks, if onee does not raise a smile on ones voters future attributes, so one has to source that 12 billion from somewhere, else.

And what is 12 billion amongst friends, especially if you can get an early payment up front as part of the jobbie, before a lifetime of early retirement, down on the farm, that would be half the value, should they be divorced from reality.

As would most farmers, if land were not a landbank.

PPP or no.

I can over sea debt as best as the next man.

In fact importing debt is ever so easy.

In fact I am sure 12 billion, will never be enough to satisfy an Awklander, nor a Christchurch, nay even a Wellingtonian mayor or civic leader of note.

That is why Mayors of all our major cities are crying out loud, aided and abetted by every MP to get jobs for the boys and stadiums and Casinos built at long last.

But sleeping on the job, where I come from is a big no no. So is gambolling.

Not at any price, no matter how well paid, us kiwis are, today.

So have a well earned rest all you workers, cos the Season of Goodwill is upon us.

And Charity begins at home, just not YOURS.

Another true story, to finally get the point across.

As a matter of interest to all our readers, did anyone notice that in the UK, Charities were hit up for contributions to hold the London Olympics, but they cannot be repaid, cos there is not enough money left in the kitty.

Now that is a true example of a PPP, for you. So maybe charity, should not begin at home.

Especially of Olympic proportions.

Eh Len. (Think big, ask for a Charity donation)

"Neither a borrower, nor a lender be", especailly when they are playing "games", with your charity donations.

But more especially, your rates, your taxes, as well.

It appears national soil moisture is below average, particularly in northen Waikato and Northland, but we're in for a cracker of a season. Hope so, but as they say one swallow doesn't make a summer.

At this stage there is plenty of grass in central NI, but soil moisture is vulnerable given a week of hot dry weather.

#4 So the oil supply is actually controlled by the cartel to ensure oil price is high so the sheiks can sustain their opulent lifestyles. There is no peak oil. It's just scaremongering and it's a surprise that the greenies are buying into this, forcing so many governments to impose carbon tax and cause so much hardship everywhere.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.