Here's my Top 10 items from around the Internet over the last week or so at 10 am. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read today is #1 on the political response to the Second Machine Age.

1. Where's our Bismarck or Roosevelt or Seddon? - Michael Ignatieff has written a compelling piece in the the FT about the political response to the Second Machine Age.

He puts what's happening now into the context of what happened after the first machine age, when politicians such as Bismarck in Germany (pensions), Gladstone in Britain (universal primary education) and Dick Seddon in New Zealand (pensions) moved to rectify some of the income imbalances created by the epic shifts in technology, work and wages.

Ignatieff is asking some deep questions and I sense he's hitting a raw nerve globally that is still forming.

We face decades of political and economic tensions ahead as a greater share of incomes created by the move of services into the cloud and the 'rise of the robot' transform the way we work and earn. There will be a few very large natural winners, and plenty of uncertainty and retraining and collateral damage along the way for the rest.

The last time around universal suffrage and the rise of the Welfare State ensured a safety net was built in the developed world to offset a massive rise in inequality. Some of that safety net has been unpicked in some places, although not largely in New Zealand.

Here's Ignatieff with this must-read:

If, in the words of Google chairman Eric Schmidt, there is a “race between people and computers” even he suspects people may not win, democrats everywhere should be worried. In the same vein, Lawrence Summers, former Treasury secretary, recently noted that new technology could be liberating but that the government needed to soften its negative effects and make sure the benefits were distributed fairly. The problem, he went on, was that “we don’t yet have the Gladstone, the Teddy Roosevelt or the Bismarck of the technology era”.

These Victorian giants have much to teach us. They were at the helm when their societies were transformed by the telegraph, the electric light, the telephone and the combustion engine. Each tried to soften the blow of change, and to equalise the benefits of prosperity for working people. With William Gladstone it was universal primary education and the vote for Britain’s working men. With Otto von Bismarck it was legislation that insured German workers against ill-health and old age. For Roosevelt it was the entire progressive agenda, from antitrust legislation and regulation of freight rates to the conservation of America’s public lands.

All three leaders also held power when public investment began to flow into science and technology. On their watch, governments began to create the infrastructure of a modern knowledge economy. These patricians came from families threatened by the industrial revolution, yet they embraced change instead of fighting it. They held on to power convincing their electorates to be unafraid of the future, even as change was revolutionising their lives.

2. Cutting off your hand to stay alive - This analysis by Rafael Halpin at FT.com of the reforms needed within China to rebalance itself and make its growth more sustainable is a crackingly good look at the key areas.

He refers to a Chinese legend about a warrior who has to cut off his hand to save his life after a snake bite.

Halpin reckons those supplying commodities for infrastructure investment (ie Australia) will do worse than those providing goods and services for a growing and more consumptive middle class (ie New Zealand). Yay. We win. Australia loses. ;)

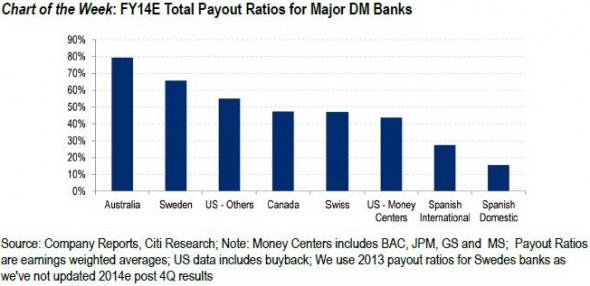

3. Oh to be an Australian bank shareholder - This FTAlphaville chart tells the story of why Australian banks are so valuable and how good they are at keeping shareholders happy.

They are the best dividend payers on the planet.

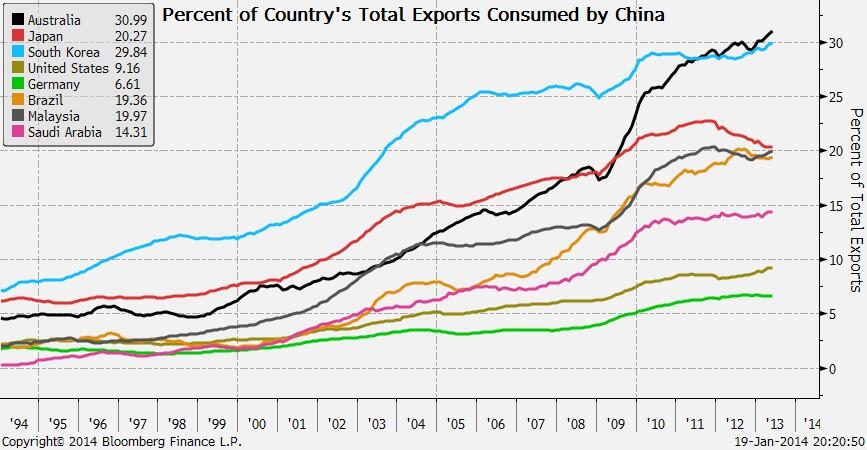

4. Exposures to China - We're right up there.

This chart, courtesy of Bloomberg Chief Economist Michael McDonough, is a helpful comparison for us in New Zealand and reinforces why we should care so much about what's happening in China.

It shows Australia and Korea having around 30% of their exports going to China. New Zealand is now over 21% and rising, which would put us third on that list.

5. China's housing market stuttering - We've been here before and every time the Chinese Government has primed the pump again with more credit, but house sales have definitely dropped from their recent peaks in December, and it's not just a Chinese New Year thing.

That's according to FT.com here.

A China Confidential survey of 300 property developer sales offices in 40 cities across the country showed a sharp decline in sales in January compared with December. Enquiries by potential buyers also slumped in January from December and the availability of financing for first-time home buyers further tightened during the month.

The China Confidential Home Sales Index (MoM) slumped to 33.7 in January from 45.7 in December. While some of the softness may have been due to slackening demand ahead of the ongoing Chinese New Year holiday, not all of the effect is seasonal. In January 2013, the index reading was 52.5 and in February – the month in which the new year fell last year – the reading was 63.2. A reading below 50 represents a contraction in activity, whereas a reading above 50 signifies expansion.

Perhaps the biggest concern, though, lies with the availability of financing. Only 17 per cent of first-time buyers were able to secure mortgages at below the benchmark interest rate, down from 19 per cent in December, the survey found. This situation represents a sea change from this time last year when around 50 per cent of first-time buyers were able to get discounted mortgages.

6. New Zealand is cheap and wages are high - This Quartz chart shows that New Zealand is among the cheapest places to buy a beer, relative to incomes and our minimum wage in particular. That might explain the carnage at the Sevens over the weekend.

It only takes half an hour working on the minimum wage to buy a beer here. I wonder what they drink in Georgia. Vodka?

7. Maybe we don't have an ageing problem - A couple of Edinburgh University professors have written this piece for Project Syndicate pointing out that the western world may not have the ageing problem it thought it had because some countries have high immigration rates and lots of women working, which is increasing the labour force participation rate. They introduce a new measure to replace the dependency ratio -- the real elderly dependency ratio.

A better measure of population aging’s impact is the real elderly dependency ratio (REDR), which divides the total number of people with a RLE of 15 years or less by the number of people actually in employment, regardless of their age. This measure accounts for the real impact of changes in mortality, by allowing the “old age” boundary to shift as advances in health prolong people’s productive lifespans.

In recent decades, as the OADR has risen in advanced countries, the REDR has declined. It has, however, stabilized, and is likely to increase gradually over the next couple of decades (see graph). In Germany and Italy, the REDR has been almost flat for two decades, owing to slower employment growth and lower birth rates than elsewhere in the developed world.

8. Just as big as Oklahoma or South Carolina - I've seen different versions of this map of the United States that matches the various sizes of state economies with those of other countries.

I've seen one which compares New Zealand to the District of Columbia (Washington) and now this one which has us in line with Oklahoma. We're also close to South Carolina, it seems.

Mark J Perry is the economic cartographer responsible for this one. He put one out earlier that compared us with South Carolina. Australia is just like Texas, it seems. It's appropropriate we're snugly next to them.

9. Debt tensions building - Here's the latest from the WSJ on what's going on with interest rates and banks in China. The chart is useful.

Borrowing costs for Chinese companies are rising strongly, a shift that could herald weaker corporate profits, slower economic growth and even the first defaults by indebted corporations on the mainland.

Driven by a surge in borrowing in recent years, Chinese companies amassed an estimated $12.1 trillion of debt at the end of last year, according to Standard & Poor's. That compares with an estimated $12.9 trillion for U.S. businesses, now the world's most indebted. The ratings company estimates that debt at Chinese companies is poised to exceed the U.S. total this year or next.

"The leverage in the corporate sector is already very high and does pose a latent risk to the entire economy," said Shuang Ding, an economist at Citigroup

10. Totally mean tweets - Here's a bunch of celebrities reading out mean tweets about themselves on Jimmy Kimmel's show. Nice to see not everyone takes themselves too seriously.

7 Comments

#3, so the Aussie banksmake shareholders happy

Picture a kangaroo in a sauna, its pouch stuffed with cash. The Aussie banks are where you go for bank dividends, paying out practically all their earnings in durableswimable plastic cash.

And yet we need OBR. This could cause a few problems with some depositors saying' its unfair'. go figure.

#1. Pensions for more people and redistribution via government are not the way Bernard. it's just fighting over the scraps like stray dogs.

There is a problem with inequality, in my view that exhibits as unequal ownership. We need to enhance the basic ownership levels of our houses, businesses and retain ownership locally and in New Zealand.

We used to have a lot of New Zealand bank style institutions, including building societies etc. Now we mostly have the big four, owned elsewhere. Our ownership and control has been diminishing for decades. We are becoming tenants. McJobs is another manifestation. We need to wind all that back.

Local ownership by the citizens here is what is needed. I would think that view also applies along with your excellent article on monopolies on Sunday.

#7 The REDR is very pertinent ('interest' has done it before). It's a game changer when we talk population.

It debunks the issue that we have a demograhic problem with the 'old'. And the scare talk by some about everything from pensions to care facilities is just that.

It also reveals there is nothing demograhically impossible in planning to reduce population.

A reducing population will have huge advantages IMHO. Even economically.

These patricians came from families threatened by the industrial revolution, yet they embraced change instead of fighting it

The salient point being we do not live in an age where Patricians govern.

Actually those patricians were forced to seek acccomodation with the more moderate element of the opposition rather than face social strife and the potentential for far more radical changes to the social order. The end result was prolonging the survival of Europe's Ancien Regime, until they triggered the First World War which just about brought the Continent to its knees. I also think it unfair to lump Richard Seddon in with Bismarck the ultimate social reactionary, because Seddon in my view was a genuine idealist who wish to better the lot of this country's (European) citizens. Bismarck in contrast was a pragmatic man who sought to make some political and economic concesssions in order to forestall a repeat of 1848, the yyear of revolutions.

As to why there are no strong social democratic leaders pushing for populist political causes? Precisely because te social conditions of today don't call for it. Those economic changes you bring attention to ensure that in today's political crusaders actually work in te interst of the already waelthy and powerful. They're corporate lobbyists, officials in internation goverance, apostles of neoliberalism who preach from their pulpits in Washington thinktanks, and corporate owned news media. Their job is made easy by the fragmentation of the opposition and the atomisation and decline of the working class by the vast social and economic changes they've ushered in.

Yes, the view of history is a bit off I think. There is a spate of articles about who started the first world war in similar vein. No mention of the destructive role of the countries with centralised absolute monarchy as opposed to the less belligerent role of the more democratic constitutional monarchies. These differences are vitally important. Equally, no mention of the relative instability and belligerent tendency of the countries with executive presidencies (which is a sort of imitation absolute monarchy) as opposed to the non executive presidency countries.

Cashflows/profitability of Chinese businesses will be put to the test if interest rates continue to rise.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.