Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must-watch today is #10 from John Oliver on inequality in the United States. Entertaining and informative from someone with out outsiders' view from inside America. Numbers 8 and 9 are also eye-opening on the issue of money laundering, China's banks and Australia.

1. Really? - Ambrose Evans Pritchard at the Telegraph reckons US Federal Reserve Chair Janet Yellen has begun to pivot towards being a hawk that puts up interest rates.

He thinks this will trigger a blistering US dollar rally. His reading is quite different from the rest of the market, who just saw more dovishness from the little lady when she spoke this week.

Here's hoping.

New Zealand exporters could do with some relief.

It's been so long since people predicted a 'blistering US dollar rally' that we've all given up hope. I remember Bill English assuring me and others in December last year that a stronger US dollar (and weaker NZ dollar) was just around the corner.

Since then dairy prices and log prices have fallen more than 30% and the New Zealand dollar has just strengthened. Even now, after yesterday's shock 8.9% fall in dairy prices and yet another weaker than expected inflation figure, the currency is still barely below its post-float highs.

Anyhoo, here's the alternative and hopeful view (yet again):

Since Fed chief Janet Yellen targets jobs above all else, this was bound to force capitulation by the Fed before long. It happened this week in her testimony to Congress. "If the labour market continues to improve more quickly than anticipated, then increases in the federal funds rate likely would occur sooner and be more rapid than currently envisioned," she said.

This is a policy shift. Mrs Yellen has admitted that the Fed misjudged the pace of jobs recovery. The staff did not expect unemployment to fall this low until late next year. The inflexion point has come 15 months early.

Mrs Yellen is not as dovish as believed, in any case. Her lodestar is the "non-accelerating inflation rate of unemployment" (NAIRU), the point at which tight labour markets start to drive a wage-price spiral. She thinks this is near 5.4pc.

When the rate is above NAIRU, she is a dove: when below, she is a hawk. She was one of the first to call for pre-emptive rate rises in 1996 to choke inflation, dissenting from the Greenspan Fed. Nobody thought of her as dovish then.

2. 'We live in a dollarised world' - Ambrose does make the good point however that whatever the US Federal Reserve does (and it still hasn't said whether it will sell back all those bonds it bought) it will have a massive effect on the rest of the world.

Here's why:

We still live in a dollarised world. Charles de Gaulle railed against the "exhorbitant privellege" of US dollar hegemony in the 1960s, but remarkably little has changed since. The BIS says global cross-border lending by banks alone has risen from $4 trillion to $10 trillion over the past decade, and $7 trillion of this is denominated in dollars. This does not include the dollar bond markets.

What Fed now does arguably has more amplified effects than at any time since the end of gold and the collapse of the fixed-exchange Bretton Woods regime in 1971. This is the paradox of 21st century globalisation.

Much of the dollar business is conducted through European and UK banks, leaving them acutely vulnerable to a dollar squeeze. Such episodes can be ferocious. It was a dollar liquidity shock that turned the Lehman affair into a global banking crisis, instantly engulfing Europe in October 2008.

Emerging markets went into a tailspin last year at the first suggestion of Fed bond tapering. There was a sudden stop in capital flows. The "Fragile Five" (India, Indonesia, South Africa, Brazil and Turkey) were punished for current account deficits. The Fed backed down. The storm passed.

3. Healthy debate - FOMC voting member and Richmond Fed President Jeffrey Lacker and Rennee Holtom have written a useful Fed Richmond paper questioning whether the Fed should do emergency lending. He's not a fan and doesn't pull any punches. The bolding is mine.

Here's why:

Experience suggests that the Fed’s activities should be limited. Experience suggests that the Fed’s activities should be limited to more closely align with this original vision. When the central bank utilizes “lender of last resort” powers to allocate credit to targeted firms and markets, it encourages excessive risk-taking and contributes to financial instability.

It also embroils the central bank in distributional politics and jeopardizes the independence that is critical to the central bank’s ability to ensure price stability. The lesson to be learned from the expansive use of the Fed’s emergency-lending powers in recent decades is that it threatens both financial stability and the Fed’s primary mission of ensuring monetary stability

4. Our Futures - New Zealand's Royal Society has studied the Census results produced a major review of the rapidly changing New Zealand population, and the implications of this for the economy, social cohesion, education, and health.

This stood out and feeds in to the 'zombie town' meme unleashed by Shamubeel Eaqub this week:

- New Zealand is regionally diverse and interconnected, with Auckland accounting for over half the population growth between 2006 and 2013. Internal migration has decelerated between regions.

- The implication for New Zealand is a pattern of greater relative growth for Auckland, a few centres with slower growth, and population decline in much of rural New Zealand, with implications for maintaining service levels for an ageing and possibly dwindling population.

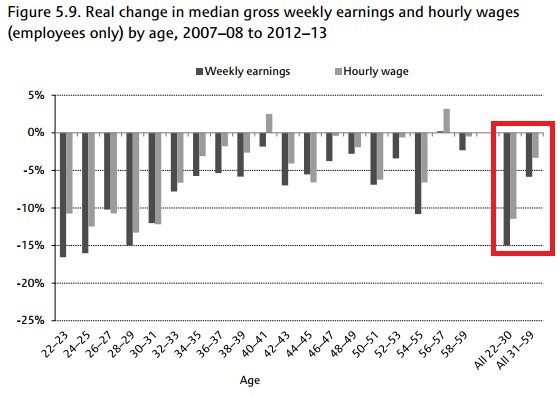

5. The recession that hit the young hardest - This FTAlphaville piece looks out the fallout on the various generations' incomes from the Great Recession in the UK.

The young didn't do well:

In their annual survey on living standards in Britain, the Institute for Fiscal Studies and the Joseph Rowntree Foundation suggest that the fastest growing type of inequality over the past five years has been between the young and the old, rather than between the rich and the poor or London and the rest of the country. (There is of course overlap here, and the IFS says the rich-poor divide will soon widen.) This rupture promises to affect the future of Britain’s economy for generations to come.

Twenty-somethings’ toils have been well documented but the report provides fascinating new details about what happened to young people in the labour market.

As the chart below shows, the employment rate for 31-59 year-olds stood up well over the past five years. Contrast that with the rates for 20-somethings, even after one removes those in full-time education, as IFS-JRF do here. The decline began before the onset of the recession but accelerated around 2009.

6. China's 7.5% growth - Statistics out yesterday seemed to show China's growth slowdown stabilising at 7.5%. Scratch the surface though and it's not so promising. It's mostly about the banks and others there turning on the credit tap.

I've included a few charts below showing how much credit has expanded in China, how other indicators of GDP (truck sales and electricity generation) are not so positive, and how much the rest of the world (including us) now rely on China. You only have to look at this week's GlobalDairyTrade results to see that.

7. America as oligarchy rather than democracy - BBC points here to a Princeton study of who wields power in the United States and who does not. The bolding is mine. Remember: this is a Princeton study.

Multivariate analysis indicates that economic elites and organised groups representing business interests have substantial independent impacts on US government policy, while average citizens and mass-based interest groups have little or no independent influence.

When a majority of citizens disagrees with economic elites and/or with organised interests, they generally lose. Moreover, because of the strong status quo bias built into the US political system, even when fairly large majorities of Americans favour policy change, they generally do not get it.

Americans do enjoy many features central to democratic governance, such as regular elections, freedom of speech and association and a widespread (if still contested) franchise. But we believe that if policymaking is dominated by powerful business organisations and a small number of affluent Americans, then America's claims to being a democratic society are seriously threatened.

8. Keep an eye on this - The big news in China's financial system in the last week has been an extraordinary investigation by China's state-run CCTV into a yuan remittance scheme run by state-owned Bank of China that helps wealthy Chinese citizens shift money into other countries in a way that circumvents China's capital controls. It was called "You Huitong" or "You uncapped."

Almost immediately, Bank of China shut the scheme down. ICBC also shut down its scheme, Business Insider reported.

This is one for our own Reserve Bank to watch. It has just registered a second China state-owned bank, CCB, in New Zealand, having registered ICBC late last year. Again: the bolding is mine.

Here's BusinessSpectator with the story:

CCTV’s serious allegations about the Bank of China -- that it was helping its clients to ‘launder money’ -- has sparked heated debate in the country about massive capital outflows from China, including illicit money that belongs to corrupt officials and businesspeople. Research and advocacy group Global Financial Integrity estimates that between 2000 and 2011, China lost $US3.8 trillion in illicit capital outflows.

Last week China Central Television (CCTV) aired what it called an undercover investigation program that uncovered a little known service called “You Hui Tong”, which allows wealthy Chinese individuals to take part in investment emigration programs in other countries to move cash offshore in amounts that exceed the annual cap of $US50,000.

9. You Huitong and Australia's Significant Investor Visa (SIV) Programme - BusinessSpectator points out the involvement of Australia in the CCTV report on the alleged money laundering.

The SIV scheme (A$5 million in Australian bonds required) looks a lot like the "Investor Plus" scheme that was used by Kim Dotcom to get into New Zealand.

Here's Business Spectator with the damning quotes:

China’s state broadcaster CCTV has launched an extraordinary attack on one of the country’s most powerful government controlled financial institutions – the Bank of China, accusing it of money laundering in Australia, via the country’s Significant Investor Visa Program.

“We don’t care where your money is from or how you earn it, we can help you get it out of the country,” a Bank of China employee told CCTV. “We don’t care how black your money is or how dirty it is, we will find ways to launder it and shift it overseas for you,” according to a detailed CCTV investigative report.

Australia is a centrepiece of the investigation due to the country’s Significant Investor Visa program, which offers an accelerated pathway for wealthy investors to gain permanent residency by investing $5 million in Australian bonds, funds or a small business. Chinese nationals account for nine out of 10 applicants since the program was introduced under the former Labor government.

And then this:

The CCTV report accuses the Bank of China of money laundering via a scheme called ‘You Huitong’, translated as You Uncapped, which allows wealthy Chinese to circumvent Beijing’s strict currency controls. “You Huitong is a shadowy business,” CCTV says. “It is unbelievable that such a big bank is violating the law to fill its own pockets.”

Business Spectator understands that some private bankers from Australia’s big four banks have been aware of the ‘You Huitong’ service for a year.

An investigation by Fairfax Media last November reported allegations that a prominent Chinese businessman used his private jet to ferry suitcases of cash and deposited them at a local Bank of China branch in Melbourne.

Anyone using 'You Uncapped' in New Zealand?

Is the Reserve Bank confident that ICBC NZ and CCB NZ are not using this scheme?

10. Totally John Oliver with a useful and fun 14 minutes on inequality in America.

34 Comments

#5 is a recognition that credentialism on tick is not a sustainable policy setting. It simultaneously:

- increases debt to the young

- delays family formation with various undesirable domino effects (e.g. the greatly increased risks of birth after the late 20's)

- takes students out of the workforce for a 3-5 year block, with significant opportunity costs (lost earnings...)

- provides a lifestyle (low hours, assured income) which is far removed from actual workers' experience thus making later work seem much less satisfying

- removes opportunities for capital formation (except for the economically literate few who leverage zero-interest loans into commercial and property opportunities)

- at the end of the course, sprays out credentials that mean little to nothing to employers, especially if a 'soft' (non-STEM) course has been selected.

It will come to be seen by historians as a major policy blunder and a tragic waste of young lives.

As I understand it (but haven't checked the figures myself) young people with degrees are less badly off compared to preceeding age cohorts than young people without degrees. So it is more a case that people can take on debt in order to tread water, or sink early without the credential. Neither way offers an actual pathway of life getting better for young people.

Waymad

Good points.

But what would you say to your kids?

My daughter is at university and I can't imagine telling her to go out there and work at McDonalds instead, because unfortunately that's what happens during a recession.

(Luckily for us she has a great part time job that could turn into a good (albeit relatively low paid) full time job.)

Hard to swim against the tide.

cheers

Bernard

Employer will take someone with a good attitude and an ever better work ethic and almost certain if they can actually DO the job (which is not as common as you think; especially in IT!).

As for Uni.... Picking the "right" course helps a lot if you actually want a good job at the end that pays well..

Bernard, your daughter will be fine. She has your name, your connections, you genes and your income/wealth to keep her presentable to the market place. Pity the poor graduates who have none of this - not impossible, but puts them well back in the queu (all other things being equal - grades etc)....

It has been said that within 25 years 45% of all current jobs will no longer exist. Robots, the internet and out sourcing will do that. Both medicine and the law come to mind as professions that will not need so many people however, apparently, those jobs that require measuring, coupled with hands on thinking, will come back to fore. Perhaps the universities will then revert back to providing an education rather than a job.

I think its more like 15 years, but thats not because of technology but because of a simpler lifestyle brought about by lack of energy.

outsourcing as in globalisation? that also needs copious cheap energy to transport materials to and from cheap labour. Once energy is expensive and even scarce we will have local economies and local employment.

I dont agree with your view of Unis, I think they provide degrees with no hope of a job, still. What they will be back to in 15 odd years is teaching a far smaller % of the youngsters leaving school IMHO, maybe 1/2.

Hands on thinking, yes very much so, but that is tactical not strategic. Strategic is I agree what Unis should be for.

regards

medicine is increasing, not decreasing.

And universities are actually supposed to do research, not education. Education was a side line to get assistants and to earn money to cover the research done by the professors

Bernard, I quite understand the pull: it's all very well to make magisterial pronouncements, but applying them at a personal level is shall we say Fraught.

Glen Reynolds has re-formulated an old idea thus:

"The government decides to try to increase the middle class by subsidizing things that middle class people have: If middle-class people go to college and own homes, then surely if more people go to college and own homes, we’ll have more middle-class people.

But homeownership and college aren’t causes of middle-class status, they’re markers for possessing the kinds of traits — self-discipline, the ability to defer gratification, etc. — that let you enter, and stay, in the middle class. Subsidizing the markers doesn’t produce the traits; if anything, it undermines them."

And in a related riff about the role of Gubmints in subsidizing aforesaid markers, there's This:

"Reynolds’ Law implies that progressivism sacrifices some (actually considerable) degrees of liberty and prosperity to move us away from equality by undermining the characters and thus behavior patterns of those they promise to help. Not coincidentally, progressives accumulate power for themselves, not only by seizing it as a necessary means to their goals but by aggravating the very social problems they promise to address, thus creating an ever more powerful argument that something has to be done."

The short version: if you can see the Traits there, the kid will be OK.

A useful Tax idea from Megan McArdle via Bloomberg.

Soooo.....those dividends, CG, etc would still get paid overseas thereby avoiding local taxes......if your going to have to pay the highest personal tax rate then you are going to make sure that you receive that income in a low income tax country.

.I still think an APT tax is a better way to go........no-one has actually pointed out any pitfalls in an APT tax......best of all a country where the APT takes place gets the tax.

Not really. The problem is I suspect the rich are as elusive to tax as corporations (if not more so) already ie finding it easy to cross borders.

I think as time progresses we'll see more and more effort put into tax businesses myself because they are not (directly) voters. So Google raising advertising revenue here tax free here because the work is actually in ireland will be curtailed.

I also think we should see far more severe penalties for tax evasion and that should include jail time for the perp and their accountant.

regards.

I don't think you realise how complex the tax system is in NZ or any other country for that matter. It is actually very common in NZ to have to obtain a second opinion already in regards to local tax matters. There is a significant cost to NZ business in ensuring that a business is fully compliant. International business is even more complex.

It is very easy for the average employee to make claims that the rich or business is avoiding or evading taxes......especially when employees don' have too much of a clue about business taxation.

The taxation systems used around the world are not suitable for globalisation. You can waste time discussing the status quo or you can find a new and fairer system and then everyone can move on to resolving the next issue. I imagine that our IRD would not like a new tax system such as an APT tax as there wouldn't be the need for them to be so big. So I guess they are never going to resolve any systemic problems as that is not in the staffs best interests.

Well we dont agree on fairer by a long long way.

Avoiding tax is perfectly legal, maybe a better word is minimalising tax. Evading is illegal and we can see how well the IRD is doing ($8 for a spend of $1?) in collecting such tax just for how much evasion there is.

regards

sadly the real value in tax evasion recovery is the preventative property of the action, which is by its very nature impossible to measure accuately.

Nz has a moderately good tax system, especially compared to the spaghetti that is US and UK systems!

Steven you need to seperate the issues.

People or business who are in the NZ income tax system.

People or business who come under another tax jurisdiction.

You cannot lump them all together......as the tax system doesn't work like that.

Is it fair that your boss pays all your income taxes for you?

Your boss probably has to factor the costs of the service he has provides to you into your pay, which ultimately the goods or services that your boss provides has the cost factored in.

Business that is not a price setter but a price taker doesn't have the ability to charge out for the cost of preparation and filing your taxes so the owner has to wear the cost and/or time of undertaking the activity......farmers fall into this category.

Your sense of fair seems to be about you getting everything for free and none of the hassle involved.......and then you seem to target business structures....

Most people I know in business spend a great deal of time ensuring they are tax compliant as they simply do not want any hassles down the track so dotting the "I" and crossing the "T" is undertaken as part of risk management.

The 2002 version of the Staples tax guide has 1488 pages.

I cannot tell you the number of pages in the latest edition as it is currenty not in my office but I do know that it has a lot more pages.

It is not efficient for business to be spending so much time on tax compliance issues !!!! It would be better if the time and resources could be utilised more efficently into finding new products and services, R&D etc.

Everyday people in private enterprise get out of bed to create income so the Social structures of Society can remain in tact and the costs of Socialist policies are met.

Private enterprise deserves to have an efficient system!!!!

Private enterprise wouldn't need to spend so long compling with the tax code if they hadn't spent so much effort trying to avoid paying tax, necessitating every more complicated anti-avoidance regulations.

Complying and tax planning are two different issues !!!!

Much of the new regulation comes from the Government manipulating parts of the economy in one direction or another. Which by the way is not what tax collection is actually for!

Actually yes it is, it is a way of enacting policy to indeed manipulate the economy.

regards

Again I state "that is NOT what taxes are meant to be for".

Taxes are collected for delivering the basics like law, order, justice, school education, hospitals and ensuring that the elderly and young etc do not fall through the cracks i.e. have the ability to meet their basic needs, etc.

Any other use of taxes outside of the constitutional arrangement of NZ could be considered illegal.

I don't think you have thought about the ramifications of manipulating the economy via the tax system, rules, regulations, legislation etc. Manipulating causes distortions in more ways than one.......it even distorts what people believe and what people think.......it is called indoctrination! The absence of critical thinking leads to ambiguity and contradiction.

It is a sad state of affairs when people can no longer think independently.......they need Nanny State more and more unitl they have no idea what the role of Government, what the constitutional arrangement, what their basic rights and freedoms etc are there for.

Yes they are two different issues, but very closely linked. First individuals / trusts / and companies decide to re-arrange their financial affairs to minimise their tax liabiilities. Then as this becomes widespread the law is changed to prevent such tax avoidance. Then you have to comply with the new law, and start planning new ways to avoid tax, all the while complaining about the new compliance costs!

Dt Carter......that's like saying that business didn't voluntarily pay GST so the GST tax law had to be implemented to make sure they paid it.

Maybe you should think about why PAYE is the employers responsibility along with the employees Kiwisaver, child maintenance deductions, student loan repayments etc !!!

The only thing that is widespread is that Governments keep running out of money and keep inventing new ways to fund their extravagance and they know that they can make one group of society comply with their wishes............so not only does that one group of people have to do the paying they have to file all the appropriate paper work that goes with it.

If the IRD has isues with upaid taxes they shouldn't be looking at ordinary businesses....they should be looking at people on wages who undertake activities outside of their normal employment !!!! There are some dodgy public servants around and they like moonlighting !!!

Those dodgy public servants and their under-the-table jobs eh? No wonder the countries finances are a mess, oh wait... isn't the deficit cyclical and almost gone? Need to find something better to blame them for.

financial affairs are arranged to minimise losses.

tax is theft, so obviously setting things up to pay inordinate level of tax cost is detrimental to the individual/trust/company, that is not good for the people or the country. And in the cases of Trusts and Companies, organising (or failing to organise) in order to take into account excessive tax loss is _illegal_.

That's rubbish and you know it.

Often the cases can be complex. And rules have to put in places to sort it out. What is profit? What is revenue? What rate can a piece of equipment be written off... but what if it's in storage... and is still getting dated... can we write off the storage cost even if the equipment isn;t used? If we sell it because we're not using it, is the correct depreciation it's last operational date, it's age, it's scrap value? What it if was leased? What if we have 30% shares in the leasing company? What if the equipment was donated by one of our staff as their buy in portion to the leasing company? What if the staff member was non-resident? What if that staff member temporarily resided at a company persons house, can the company person claim extra portion of their home costs since the business was using there assets? What if the non-resident then moved to a friend of theirs place? Can ther company pay board? Will that be a non-resident working in NZ? where do they pay tax? If the company gives them a gift or gratuity (eg a expenses paid tour) is that illegal income? is that liable for tax? if so, in which country? Does the money paid for their accomodation then become illegal income? what about the earlier company person who was claiming costs, was that effective income? And if the donated machine breaks down, if it's returned to the non-resident in a repaired state is that income or taxable? what if the machine is disposed of? can the non-resident be recompensated for the employed based damage??

The difficult part is that all the rules have to be mostly consistent for everyone, they have to be reliable in advance so people can make good choices, and they have to comprehensive for a bunch of stuff that hasn't even happened yet.

That's why it's hard to keep up with the cascade of changes.

"Is it fair that your boss pays all your income taxes for you?" yes that is one way to do it. Or he can pay me a lot more as a self-employed person, he has chosen the former.

"Your boss probably has to factor........" Indeed a factor of 1.3 to 1.5 seems a ballpark number that includes holidays, sickness as well as the costs of compliance etc.

"getting everything for free" um no, but then your take everything to extreme view is par for the course. I see there needs to be a balance, actually you do not.

There will always be tax compliance no matter the system and country. Compared too many other countries NZ's system seems pretty reasonable and efficient. lets face it you do not like the system in teh extreme due to your extremist political views. Simple, if you dont like NZ's system go elsewhere, Chile has an enclave of like minded ppl to yourself, try there.

All systems should be efficient, resiliant and effective and in context.

An enterprise takes a raw material and converts it into a good for a profit. in effect a business is a middleman specialising in a good(s) aiming for scale to be cost efficient. There will always be costs, simple, get on with it.

The trouble is that profit ultimately isnt under-written ie its a call on the future and the assumption is that future will be bigger and can deliver, it cannot however as we are on a finite planet.

regards

You stick with your safe tax-haven called a job......let everyone else comply on your behalf! It's funny how you have so much to say about the tax system.....but you actually don't use the system.

Yep I will.

I pay tax, simple. Also its not so much the tax system as such but a system need to collect enough revenue to support the society we wish for.

regards

Your boss could pay you more as a self-employed person... are you offering that service?

Are you a dependent contractor?

Are you casual employee?

The rule of thumb is minimum revenue = 3 times the employees gross wage. That will give you what the cost of hireage is.

As an employer, not only do I have to make sure the wages are paid, correctly and on time. I have to keep track of all information and legislation pertaining to the contracts and laws in place. This is simply impossible. systems, business, enterprises etc provide consumers; sadly the consumers aren;t willing to pay for me to hire a separate professional for those services AND all professionals offering those services demand indemnification. Just like employees are indemnified. It is the owner who ends up with the responsibility, and the bill.

No I dont offer that service, but I used to, and be self-employed, yes.

PI, yes indeed, and then the bun fight can start if you dont get paid, or the customer wont pay for what you have designed and recommended. Then sues you when what he did put in didnt meet his expectations, because that's all the money he had Consumers, yes they and indeed customers are often not willing to pay enough to make it worthwhile.

NZ has a no8 bailing wire mentality, that can be a strength but also a weakness.

The tax aspect is dwarfed by the above issues frankly.

regards

And that's what happens. And contractors don't have to have to renew contracts or even take your calls. And if sued they don't always have the resources to pay up, and if they didn't do a good job the first time often not much point having them back as they can't afford the time to redo a job for free, and many can't actually improve on a poor job.

But I can also not call a contractor. NZ doesn't have the Washington/New York "Right to Work" clauses for dismissal, so I bound to an employee by the apron strings of the State.

whats bailing wire? fencing wire?

And it is a weakness. Systems need to evolve to cope with changes. they need to evolve when there are no changes in order to become fitter and better. The #8 attitude, otherwise known as "jerry rigged" gets us through a tight spot... but in NZ with it's government enforced poverty mindset, when do we ever get the cash to go a revisit that #8 work?? When do NZ businesses or individuals get the spare cash to build better systems.

With a punitive "anti-inflation" tax rate, pushing social programs that should be funded by consumers, the consumers and their supporters don't get enough cash left over to pay for the services they consume! but it's stripped off the system everywhere else so we can't afford the luxury/fat to train properly, or to reinvested in improving equipment.

Throw on the anti-housing interest rate....

why anti-housing? I've got a business investment at 1.9M, interest is 7.1 %

I have house in palmy north, 200k (2bd,1bt, garage, doublegz etc) currently owing 80k. The top rent is 250 before rates. 210 after compulsory rates. Thats 5.46% raw yield.

Makes sense to dump the house and improvements and roll forward my equity, and get 7.1% savings after tax. (instead of 5.46 less interest, before 28% tax).

so who's the silly sausage who's going to buy that at 7.1% interest?

My other place is 230/145000 or 6.9~% so wheeler wants me to dump that too.

I wonder if the new landlord will borrow at 7.1% to improve that housing stock futher?

And with 7.1% on 1.9M, I'm stretched too tight to spend to improve nice things on this business... and cutting spending and staff first is order of the day..... as 7.1%, after 28% tax is a big target for equity repayment (ie principle repayment costs me tax, but saves me interest).. guess the engineers aren't booking their holidays this year...

8. and 9. Perhaps Bernard you could ask someone in banking regarding your question above: Is the Reserve Bank confident that ICBC NZ and CCB NZ are not using this scheme?

Who says this scheme is only isolated to the Chinese owned banks?

I'm quietly bemused by the fact that some wealthy Chinese see NZ and AUS as their safe haven for laundered money.

Keep digging Bernard...I'm sure there's a good story here.

John Oliver - briliant humour... I wish we had something similar in NZ instead of the not so funny '7days' and '7 sharp'..

#5 the only figure of relevance is disposable income after tax, housing inc rates, interest, are factored in. That's your working "retained earnings" each week, to consume or invest. If it lowers your way forward is worse, if it increases you have better options.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.