China

Sawmillers report rising local demand. Eyes on China for post-holiday signals. Tough in India until the new FTA comes into effect

31st Jan 26, 9:37am

Sawmillers report rising local demand. Eyes on China for post-holiday signals. Tough in India until the new FTA comes into effect

Jiao Wang asks if US tariffs have failed to bite given China’s trade surplus hit a record US$1.2 trillion

20th Jan 26, 2:03pm

Jiao Wang asks if US tariffs have failed to bite given China’s trade surplus hit a record US$1.2 trillion

China’s new condom tax will prove no effective barrier to country’s declining fertility rate, Dudley L. Poston Jr says

19th Jan 26, 2:53pm

4

China’s new condom tax will prove no effective barrier to country’s declining fertility rate, Dudley L. Poston Jr says

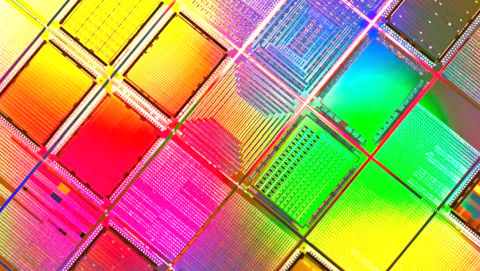

Australia is betting on a new ‘strategic reserve’ to loosen China’s grip on critical minerals, Susan M Park says

16th Jan 26, 9:52am

2

Australia is betting on a new ‘strategic reserve’ to loosen China’s grip on critical minerals, Susan M Park says

David Mahon sees China growing in confidence it will lead an Asia-centric renewal, even with India included

14th Jan 26, 9:01am

1

David Mahon sees China growing in confidence it will lead an Asia-centric renewal, even with India included

Despite easing overall demand, New Zealand logs get higher China market share. Also poised for gains in India. Demand from local sawmillers is expected to gradually improve

22nd Dec 25, 9:11am

Despite easing overall demand, New Zealand logs get higher China market share. Also poised for gains in India. Demand from local sawmillers is expected to gradually improve

November log prices were little-changed, but China is anticipating more NZ supply keeping a lid on prices there. India prospects depend on FTA progress. Seasonal domestic prices are usually firm from here

29th Nov 25, 1:20pm

November log prices were little-changed, but China is anticipating more NZ supply keeping a lid on prices there. India prospects depend on FTA progress. Seasonal domestic prices are usually firm from here

Is Nvidia chief Jensen Huang right and China will win the AI race? Two experts present arguments for and against

11th Nov 25, 12:46pm

1

Is Nvidia chief Jensen Huang right and China will win the AI race? Two experts present arguments for and against

What will Trump’s deal with Xi mean for the US economy and relations with China?

31st Oct 25, 1:08pm

What will Trump’s deal with Xi mean for the US economy and relations with China?

Following the Chinese and Indian holiday seasons when demand usually rises, this year demand for logs has remained flat. Domestic demand flat too, and sawn timber to the US attracting tariffs

31st Oct 25, 10:51am

Following the Chinese and Indian holiday seasons when demand usually rises, this year demand for logs has remained flat. Domestic demand flat too, and sawn timber to the US attracting tariffs

Xi-Trump summit: Trade, Taiwan and Russia still top agenda for China and US presidents, 6 years after their last meeting

29th Oct 25, 2:52pm

Xi-Trump summit: Trade, Taiwan and Russia still top agenda for China and US presidents, 6 years after their last meeting

Kate Hua-Ke Chi looks at why countries struggle to quit fossil fuels, despite higher costs and 30 years of climate talks and treaties

20th Oct 25, 10:07am

15

Kate Hua-Ke Chi looks at why countries struggle to quit fossil fuels, despite higher costs and 30 years of climate talks and treaties

David Mahon says China is emerging stronger politically and economically but must learn from the mistakes and naked hubris of the American, Soviet and British empires

14th Oct 25, 9:30am

5

David Mahon says China is emerging stronger politically and economically but must learn from the mistakes and naked hubris of the American, Soviet and British empires

Forest owners eye a boost from NZ Government spending plans. China log demand making small gains, India demand for NZ logs helped by rising euro but seasonally soft

2nd Oct 25, 2:18pm

1

Forest owners eye a boost from NZ Government spending plans. China log demand making small gains, India demand for NZ logs helped by rising euro but seasonally soft

Goodbye petrostates, hello ‘electrostates’: how the clean energy shift is reshaping the world order

25th Sep 25, 12:28pm

29

Goodbye petrostates, hello ‘electrostates’: how the clean energy shift is reshaping the world order