July At Wharf Gate (AWG) prices for export logs remained largely unchanged from June prices. Although the CFR price for logs in China increased by approximately 3 USD per JASm³, this was offset by a weakening of the USD against the NZD. Consequently, July AWG prices rose by only 1 NZD per JASm³—a movement that was largely symbolic rather than financially material. At this stage, there is little indication of any significant change in AWG pricing for September.

Log demand in China has declined to around 50,000 m³ per day, a level typical during the peak of the Chinese summer when construction activity slows due to extreme heat. Softwood log inventories remain stable, with a modest month-on-month increase of approximately 4%.

Demand from India has also softened as the country enters its monsoon season, further dampening market activity. Fortunately, reduced harvest volumes from New Zealand coincide with this lower demand, helping to maintain relative market balance.

In the domestic market, New Zealand sawmills continue to face pressure from rising operational costs. Carter Holt Harvey (CHH) has announced an upcoming price increase for structural sawn timber, effective from October.

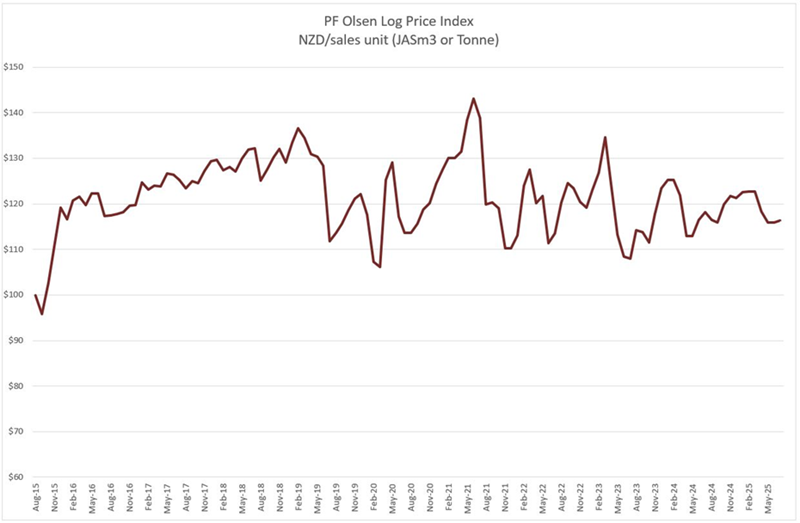

The PF Olsen Log Price Index remains steady at $116. This is currently $2 below the two-year average and $4 below the four-year average.

Domestic Log Market

Carter Holt Harvey (CHH) has recently announced plans to implement a 5-7% increase in prices across its structural sawn timber range, effective from October 1. There is industry pushback, suggesting the added cost may derail ongoing projects causing a possible slow-down in home builds should costs not be able to be absorbed or mitigated. This price increase announced by CHH seems more of a ‘catch-up’ adjustment than a broader market upswing in sawn timber prices. Input cost increases in energy, freight and labour have not previously been passed on, as sellers compete in a difficult market.

Moody’s has revised its global outlook for the forest products sector from stable to negative, citing the combined impact of rising tariffs and weakening demand. This shift presents challenges for New Zealand’s export-reliant forestry sector, particularly in the pulp, panel, and sawn timber markets. Tariff increases in key markets have disrupted trade flows and added cost and complexity across the supply chain. New Zealand exporters are facing tighter margins as raw material and freight costs climb, while some buyers reassess sourcing strategies amid geopolitical and economic uncertainty. Softening global demand is adding further pressure, with elevated interest rates and a slowdown in residential construction impacting log, timber, and panel product consumption. Moody’s forecasts a 2–4% drop in sales income across the global industry over the next 12–18 months, with discretionary and cyclical segments likely to be hit hardest.

Export Log Markets

China

CFR prices for A-grade logs are currently in the range of USD 113–117 per JASm³ for July vessel arrivals. Log demand in China has softened to around 50,000 m³ per day, driven by extremely high temperatures and adverse weather events. As a result, softwood log inventories have edged up slightly and now sit at approximately 2.7 million m³. Log supply from New Zealand continues to track below average due to ongoing wet weather and storm activity across the country.

Recent storms in the Tasman region have caused windthrow damage to approximately 4,000 hectares of standing trees. Harvesting levels will undoubtedly increase, as forest owners and managers want to salvage logs before they deteriorate. However, there won't be as significant an increase in volume like the surge following Cyclone Gabrielle in the Central North Island (CNI). The CNI response involved more ground-based harvesting, allowing for faster extraction and dispatch via multiple ports—Tauranga, Napier, and Taranaki. In contrast, most of the Tasman area is steep terrain requiring cable-hauler operations, which are slower and more complex. Furthermore, Tasman logs will be exported solely through the single-berth port at Nelson, limiting throughput. Salvage harvesting in the region will rely more on reallocating existing infrastructure rather than adding a lot of new capacity.

Softwood log imports from Europe fell sharply in the first half of 2025, down 59% compared to the same period in 2024—a reduction of 1.14 million m³. Log prices in Europe remain strong, even as some buyers face margin pressure from softer product demand and persistently high raw material costs.

In broader economic news, the Caixin China General Manufacturing PMI unexpectedly rose to 50.4 in June. Output grew at the fastest pace since November 2024, supported by improved domestic orders and promotional efforts. However, export demand remains subdued, and overall business sentiment is still below the long-term average.

Construction of the world’s largest hydroelectric dam on China’s Yarlung Zangbo River has generated excitement, but it's unlikely to materially increase demand for New Zealand logs. While such mega-projects do require some timber for scaffolding, formwork, and temporary structures, the total volume is relatively small and often sourced domestically due to the project’s remote location in Tibet. Imported softwood like radiata pine may play a minor role, but any impact on New Zealand log exports would be negligible compared to broader market drivers like housing and infrastructure activity in more accessible regions of China.

India

India’s log market is experiencing the seasonal slow- down in log and sawn timber demand due to the monsoon season. Kandla port is expecting only four log arrivals in August. Expected A grade CFR sale price is 130 USD per JASm3 as exporters look to cover higher shipping costs.

Due to the higher log price, the price of pine green sawn timber In Gandhidham is expected to increase by about 20 INR per CFT to 511 INR per CFT from South American logs and 541 INR per CFT from New Zealand logs. This price increase to cover higher costs certainly won’t stimulate more demand.

Tuticorin log buyers are transitioning from receiving logs in container shipments to logs in break bulk vessels.

India and New Zealand resumed talks on a proposed free trade agreement on July 14, aiming to boost trade and investment flows. A key sticking point is the imbalance in tariff structures - New Zealand’s average import duty (tariff) is just 2.3%, while India’s sits at 12%. For New Zealand’s forestry sector, India’s 5% import tariff on softwood logs is a major barrier. Total import taxes can feel higher once Integrated Goods and Service Tax (IGST) and handling charges are included, sometimes causing confusion about the "real" tariff impact. Reducing this could significantly improve access to one of the world’s most promising markets for log exports. Negotiations concluded on July 25.

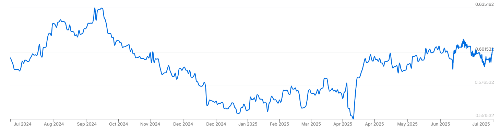

Exchange rates

The current NZD position against the USD means the exchange rate is unlikely to negatively impact August AWG prices, as it did in July. The CNY has strengthened against the USD by about 0.3% over the last month.

NZD:USD

CNY:USD

Currency graphs source: XE

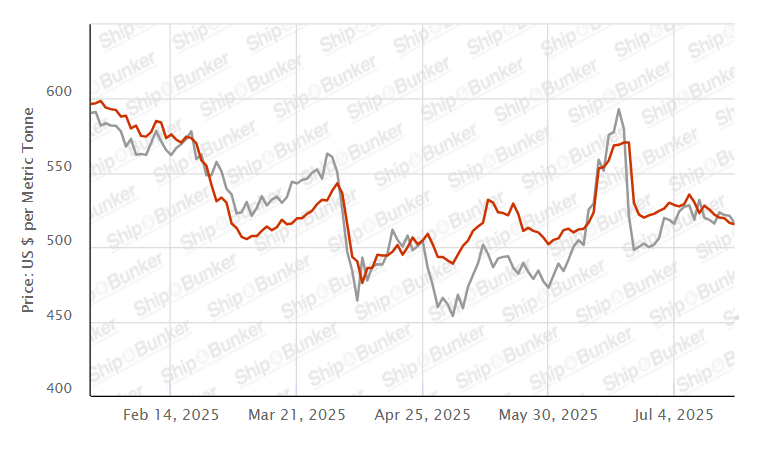

Shipping costs

Shipping rates have remained relatively stable over the past month, with some minor increases in spot prices. The average cost to ship logs to China loaded from two North Island ports is currently around USD 30 per JASm³.

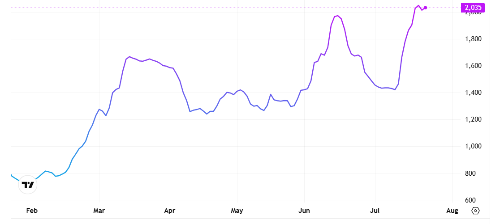

The Baltic Dry Index (BDI), a widely used indicator of global bulk shipping costs, has risen to its highest level since July 2024. However, pricing trends have varied across different vessel classes.

The BDI is a composite index derived from three sub-indices representing different vessel sizes: Capesize (40%), Panamax (30%), and Supramax (30%). It reflects the average daily USD hire rates across 20 major ocean freight routes. While most New Zealand log exports are transported via Handysize vessels (not directly included in the BDI), this segment remains closely influenced by broader trends in the index.

Baltic Dry Index (BDI)

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - July 2025

The PF Olsen Log Price Index remains at $116. The Index is currently $2 below the two-year average, and $4 below the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – July 2025

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Jul-25 | Jun-25 | May-25 | Apr-25 | Mar-25 | Feb-25 | Jul-25 | Jun-25 | May-25 | Apr-25 | Mar-25 | Feb-25 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 180 | 180 | 180 | 190 | 200 | 200 |

| Structural (S30) | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | ||||||

| Structural (S20) | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | ||||||

| Export A | 117 | 116 | 116 | 120 | 129 | 129 | ||||||

| Export K | 108 | 107 | 107 | 111 | 120 | 120 | ||||||

| Export KI | 98 | 97 | 97 | 101 | 110 | 110 | ||||||

| Export KIS | 89 | 88 | 88 | 92 | 101 | 101 | ||||||

| Pulp | 46 | 48 | 48 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.