The June At Wharf Gate (AWG) prices for export logs around New Zealand ports remained the same as May prices.

The CFR price for A grade logs in China has increased slightly to 113-115 USD per JASm3 for July vessel arrivals, and the market expects further small CFR price increases. Shipping cost increases and currency movements are likely to negate any AWG benefit from small price increases in China.

Log demand has remained relatively constant within the 50-60k m3 per day range, despite the start of the Chinese summer when construction activity usually slows down. More recent log supply from New Zealand has dropped by about 10% causing log inventory levels to reduce in China.

Domestically, winter continues to cast a damp shadow over the construction sector, with minimal activity or optimism on the horizon. Despite this, log pricing has remained consistent.

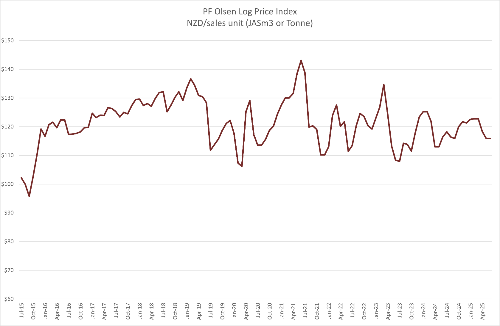

The PF Olsen Log Price Index remains at $116. The Index is currently $2 below the two-year average, and $5 below the five-year average.

Domestic Log Market

The domestic log market continues to face tough conditions, compounded by the seasonal winter slowdown and an oversupply of structural sawn timber. Building activity remains subdued in both the residential and commercial sectors, as higher interest rates and tighter credit conditions constrain demand.

Sawmills are operating cautiously, maintaining lower log intakes to match reduced throughput. While there has been no major movement in domestic log prices, any upside for the third quarter appears unlikely. Most mills are signalling flat pricing through July and into early spring.

Structural log grades remain in steady supply, though volumes of pruned logs are more variable depending on regional harvesting programs. The pulp market remains weak, with prices under pressure due to low demand from paper and packaging manufacturers.

Export Log Markets

China

CFR prices for A-grade logs are around USD 113–115 per JASm3 for July log vessel arrivals. Although demand is low by historical standards, it remains consistent at 50,000–60,000 m3 per day. Seasonal factors—including high heat and rainfall—are likely to further suppress construction activity in the coming months, potentially easing demand slightly.

Between January and April 2025, New Zealand exported 5.89m m3 of logs to China, down just 4% year-on-year. China’s inventory levels continue to drop, aided by a larger more recent 10% reduction in New Zealand supply, particularly from the South Island. In this same four-month period, China imported a total of 570k m3 of logs from Japan. While this is a year-on-year increase of 26%, Japan still only accounts for a relatively small portion of China’s total log imports, representing just 7% of the 7.97m m3 imported during the same four-month period. Japan has a strategy to increase the harvesting of its plantation forests to 20% over the next decade, due to 40% of the population being affected by pollen allergies supposedly largely caused by ageing cedar and cypress plantations. This volume has mainly replaced the volume that was coming in from the United States.

The Caixin China General Manufacturing PMI unexpectedly dropped to 49.5 in May from 50.4 in April. This was the first contraction in eight months and despite strong negative market sentiment last month the forecast was to increase to 50.6. This represents the steepest decline since September 2022, as output shrank for the first time in 19 months and at the fastest pace since November 2022, while new orders contracted at the sharpest rate since 2022. Foreign sales fell to their lowest level since July 2023, amid ongoing uncertainty in the global trade environment. Ironically market sentiment improved with hopes of market conditions improving.

While the domestic log market price for A grade logs is about 750 RMB the futures market price is 806 RMB. This should signal the market expects log prices to rise but they seem to be two separate markets.

India

The strengthening Euro is dampening the Indian demand for imported kiln dried sawn timber from Europe. This reduction in kiln dried lumber imports from Europe should increase the demand for pine sawn timber.

India’s log market overall has softened following an early start to the monsoon season, which typically restricts demand and disrupts supply chains. Kandla port is expecting reduced log arrivals in July, down to around five vessels.

The price of pine green sawn timber In Gandhidham is 491 INR per CFT from South American logs and 521 INR per CFT from New Zealand logs.

Seasonal sentiments may increase log volumes into Kandla in September, anticipating post Diwali demand in October/November.

Tuticorin may take increased volumes of New Zealand pine logs in smaller bulk vessels during 2025.

Free Trade Agreement talks between India and New Zealand may conclude in three to four months, Piyush Goyal, the Indian Commerce Minister, said on 19 June. The Indian log and timber market is eagerly awaiting the outcome of these talks.

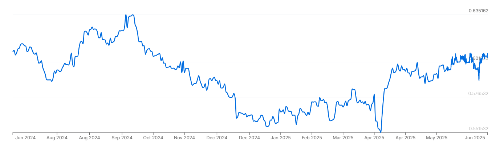

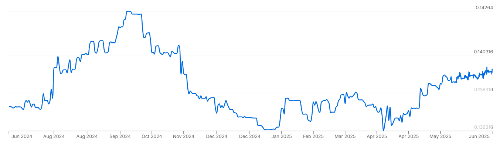

Exchange rates

The NZD has strengthened by about 1.80% against the USD through June, and this has about a 2 NZD negative impact on AWG prices. The CNY has increased against the USD by about 0.48% through June.

NZD:USD

CNY:USD

Currency graphs source: XE

Shipping costs

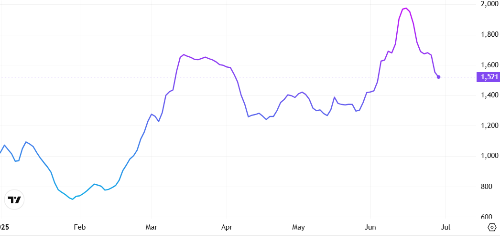

Shipping rates remain a key pressure point. The average shipping cost to China for a log vessel loading at two North Island ports is now USD 30 per JASm3.

The Baltic Dry Index (BDI), a proxy for global bulk shipping costs, has dropped to its lowest level since February, with weakness across all vessel categories including Panamax, Supramax, and Handysize—the latter being most relevant to New Zealand’s log trade.

Baltic Dry Index (BDI)

Source: TradingEconomics.com

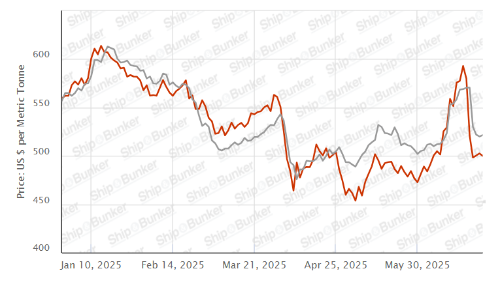

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - June 2025

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – June 2025

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Jun-25 | May-25 | Apr-25 | Mar-25 | Feb-25 | Dec-24 | Jun-25 | May-25 | Apr-25 | Mar-25 | Feb-25 | Dec-24 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 180 | 180 | 190 | 200 | 200 | 190 |

| Structural (S30) | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | ||||||

| Structural (S20) | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | ||||||

| Export A | 116 | 116 | 120 | 129 | 129 | 126 | ||||||

| Export K | 107 | 107 | 111 | 120 | 120 | 117 | ||||||

| Export KI | 97 | 97 | 101 | 110 | 110 | 107 | ||||||

| Export KIS | 88 | 88 | 92 | 101 | 101 | 98 | ||||||

| Pulp | 48 | 48 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.