Here's my Top 10 items from around the Internet over the last week or so. As always, we welcome your additions in the comments below or via email to bernard.hickey@interest.co.nz.

See all previous Top 10s here.

My must read is #3 from John Garnaut on what's going on inside China's leadership right now. It is epic and it is driving so much of the capital flight from China into safe havens at the moment.

1. The rush of capital from China into Australian residential property - Here's a useful Bloomberg piece with detail from a specialist mortgage broker expecting a two thirds increase in Chinese buying of Australian homes.

Ausin Group finances the purchase (often off the plan) of Australian apartments by investors still in China.

It expects to lend A$500 million this year to such buyers.

This surge into Australia is certainly increasing the supply of new homes into the market.

The article also reinforces that yield doesn't matter much. It's all about protecting asset values from political and financial risk (ie not seeing prices fall...)

More on the political risk of leaving your money in China below.

Ausin sources projects from local developers, including Stockland (SGP) and Mirvac Group (MGR), marketing them in China where it has 11 offices and 280 staff, Zaja said. The average price of the properties Chinese buy in Australia is A$630,000, according to the company.

Ausin has a client who buys about 10 properties through the company every year, and now owns about 40, Zaja said. The client has been able to negotiate a better rate and a higher loan amount, he said.

The company, which also offers immigration services to Chinese wanting to move to Australia, is setting up a fund targeting those from the mainland applying for a Significant Investor Visa, he said. The visa allows foreigners investing at least A$5 million in Australia to qualify for residency. Chinese nationals accounted for 91 percent of applications and 86 percent of grantees as of the end of June, according to the office of the assistant minister for immigration and border protection.

Australia is the No. 1 destination for Chinese seeking to emigrate after Canada, which in February implemented restrictions on foreign investment and immigration, CLSA’s Johnston wrote. “Some 45 percent of the 70 million people in the top income bracket in China express intentions to emigrate,” Johnston said.

2. A zero sum game - Here's Reserve Bank of India Governor (and former IMF Chief Economist) Raghuram Rajan telling it like it is in this WSJ piece. He's warning of a 1930s-style beggar-thy-neighbour set of monetary policies.

We hardly ever hear our own Reserve Bank (or Government) talk about this very real issue for the New Zealand economy. Everyone else is printing money and cutting interest rates to devalue their currencies and boost demand, which means our 'crazily' high OCR of 3.5% looks mighty attractive.

Competitive monetary policy easing has now taken the place of competitive currency devaluations as the favored tool for playing a zero-sum game that is bound to end in disaster. Now, as then, “demand shifting” has taken the place of “demand creation,” the Indian policymaker said.

As was the case in the 1930s, the lack of coordination between policymakers is producing spillovers that may be difficult to control, and the world’s financial system may soon face fresh turbulence at a time when central banks have yet to repair the damage that the 2008 financial crisis caused to developed economies.

“We are taking a greater chance of having another crash at a time when the world is less capable of bearing the cost,” said Mr. Rajan in an interview with the Central Banking Journal.

Mr. Rajan said economists still disregard the central role of financial systems in the economy and believe they can predict upcoming disruptions. “They still do not pay enough attention–en passant–to the financial sector,” Mr. Rajan said. “Financial sector crises are not as predictable. The risks build up until, wham, it hits you.”

3. 'You die. I live' - Australian journalist John Garnaut is one of the best foreign correspondents in China. He's written a fascinating piece for the New York Times on Xi Jingping's big anti-corruption drive. It's worth reading to understand the nerves that drives capital out of China into safe havens such as New Zealand.

The four Chinese characters that heralded President Xi Jinping’s war against corruption in a speech by a political ally in December 2011 can easily lose impact in translation. “Life-and-death struggle,” while idiomatic in English, is too passive. “Do-or-die” lacks the necessary intent.

“The crude, word-for-word translation better captures the essence,” said Charles Qin, a professional translator. “You die, I live.”

Mr. Xi was raised in a you-die-I-live world where leaders who failed to destroy potential rivals were constantly at risk of losing far more than their jobs. Stalin used bullets to keep such threats at bay. Mao preferred public humiliation and torture behind closed doors.

Even Deng Xiaoping, the exalted economic reformer, used long sessions of harrowing criticism to destroy the officials he was discarding, before locking them in their houses or leaving them in living purgatory at their desks. Effective leaders also found that rolling purges were useful tools for instilling ideological discipline and keeping cadres on their toes.

4. Show us the oil and gas - Ambrose Evans Pritchard writes at The Telegraph that oil and gas explorers are now borrowing and selling assets to make up for the fact they haven't found enough new oil and gas after big, long exploration spree.

The US Energy Information Administration (EIA) said a review of 127 companies across the globe found that they had increased net debt by $106bn in the year to March, in order to cover the surging costs of machinery and exploration, while still paying generous dividends at the same time. They also sold off a net $73bn of assets.

This is a major departure from historical trends. Such a shortfall typically happens only in or just after recessions. For it to occur five years into an economic expansion points to a deep structural malaise.

The EIA said revenues from oil and gas sales have reached a plateau since 2011, stagnating at $568bn over the last year as oil hovers near $100 a barrel. Yet costs have continued to rise relentlessly. Companies have exhausted the low-hanging fruit and are being forced to explore fields in ever more difficult regions.

The major companies are struggling to find viable reserves, forcing them take on ever more leverage to explore in marginal basins, often gambling that much higher prices in the future will come to the rescue. Global output of conventional oil peaked in 2005 despite huge investment.

5. Why oil prices will probably stay high - Here's more from Ambrose's piece indicating oil companies will struggle to find the money to invest to find more oil unless those prices stay very high or even rise. Ultimately, shareholders will not allow the current situation to go on for too long.

I wouldn't be an oil company shareholder for anything. Except, we all are, sort of. NZ Super Fund's third biggest international equity holding is Exxon Mobil at NZ$81 million as at the end of May. It's biggest New Zealand holding is Z Energy at NZ$321 million.

Here's the bad news from Ambrose:

The global oil and gas nexus is clearly over-extended and could face a severe crunch if oil prices slip towards $80. A growing number of experts say it would be wiser to shrink the industry to a profitable core, returning revenues from existing ventures to shareholders and putting some companies into partial “run-off” rather than risking fresh money on projects that may prove to be ruinous white elephants.

The International Energy Agency in Paris says global investment in fossil fuel supply rose from $400bn to $900bn during the boom from 2000 and 2008, doubling in real terms. It has since levelled off, reaching $950bn last year. The returns have been meagre. Not a single large oil project has come on stream at a break-even cost below $80 a barrel for almost three years.

A study by Carbon Tracker said companies are committing $1.1 trillion over the next decade to projects requiring prices above $95 to make money. Some of the Arctic and deepwater projects have a break-even cost near $120. “The oil majors like Shell are having to replace cheap legacy reserves with new barrels from much more difficult places,” said Mark Lewis from Kepler Cheuvreux.

The new worry is that many companies will be left with “stranded assets” as climate accords kick in. The IEA says companies have booked assets that can never be burned if there is a deal limit to C02 levels to 450 (PPM), a serious political risk for the industry. Estimates vary but Mr Lewis said this could reach $19 trillion for the oil nexus, and $28 trillion for all forms of fossil fuel.

6. The theory of McPeace - True globalisation really depended on the end of the Cold War and a continued state of non-cold war between America and China.

The Russia-Ukraine mess is changing a lot of people's thinking on globalisation, the Washington Post's Anne Applebaum opines.

At the height of this optimism, the “McDonald’s theory of international relations” was a thing one heard about quite frequently. The idea was that no country with a McDonald’s restaurant would ever go to war with another country with a McDonald’s restaurant, because in order to have a McDonald’s restaurant you had to be thoroughly integrated into the global economy, and if you were integrated into the global economy you would never attack another one of its members.

This week, as Russia, a country with more than 400McDonald’s, ramps up its attack on Ukraine, a country with more than 70 McDonald’s, I think we can finally declare the McPeace theory officially null and void. Indeed, the future of McDonald’s in Russia, which once seemed so bright — remember the long lines in Moscow for Big Macs? — has itself grown dim. In July, the Russian consumer protection agency sued McDonald’s for supposedly violating health regulations.

7. So much for reform - China's economy seems to be picking up steam again after its banks loosened credit again...despite all the protestations from the leadership that they needed to let the chips fall and apply some market discipline. Not going to happen. But it's still a problem, as the last paragraph in the quote shows.

Here's Bloomberg:

China loosened monetary conditions last quarter at the fastest pace in almost two years, a Bloomberg LP gauge showed, testing the waning effectiveness of credit in supporting economic growth.

Bloomberg’s new China Monetary Conditions Index -- a weighted average of loan growth, realinterest rates and China’s real effective exchange rate -- rose 6.71 points to 82.81 in the second quarter from the previous three months. That’s the biggest jump since the July-September period of 2012, with May and June’s numbers the first back-to-back readings above 80 since January 2012.

New yuan loans in July will be a record high for that month, according to a Bloomberg News survey of analysts before data due by Aug. 15, suggesting officials are keeping the credit spigot open even as debt risks mount. While consumer inflation below the government’s goal allows room for more easing, economic data will determine how far policy makers go.

Each $1 in new credit added the equivalent of an extra 20 cents in GDP in the first half of 2014, according to data compiled by Bloomberg. That compares with 29 cents in full-year 2012 and 2013 and 83 cents in 2007, when global money markets began to freeze.

8. Shareholders vs stakeholders - Robert Reich has written an excellent piece on how America's capitalism changed from a stakeholder-driven one through the 1950s, 1960s and 1970s to a shareholder-driven one in the 1980s, 1990s and 2000s. Anyone who has watched the first Wall St movie recently will understand.

He would like to see a return to a system where boards governed in the long term interests of shareholders, workers, customers and the public alike, rather than just shareholders (and executives).

In retrospect, shareholder capitalism wasn’t all it was cracked up to be. Look at the flat or declining wages of most Americans, their growing economic insecurity, and the abandoned communities that litter the nation.

Then look at the record corporate profits, CEO pay that’s soared into the stratosphere, and Wall Street’s financial casino (along with its near meltdown in 2008 that imposed collateral damage on most Americans).

You might conclude we went a bit overboard with shareholder capitalism.

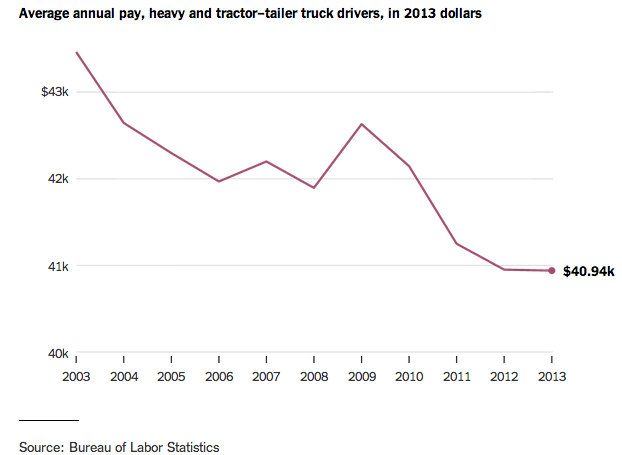

9. 'Just increase the wages' - The New York Times has done a nice piece on the shortage of truck drivers in America these days and truck drivers' wages. It's somewhat surprising that the market does not appear to be working. Driver shortages are not driving up wages. In fact, they are down in real terms over the last decade.

A similar thing is happening here, where there was a call recently for the Government to change the migration rules to allow in more drivers to deal with a shortage. Why not just put up the wages?

Corporate America has become so parsimonious about paying workers outside the executive suite that meaningful wage increases may seem an unacceptable affront. In this environment, it may be easier to say “There is a shortage of skilled workers” than “We aren’t paying our workers enough,” even if, in economic terms, those come down to the same thing.

The numbers are revealing: Even as trucking companies and their trade association bemoan the driver shortage, truckers — or as the Bureau of Labor Statistics calls them, heavy and tractor-trailer truck drivers — were paid 6 percent less, on average, in 2013 than a decade earlier, adjusted for inflation. It takes a peculiar form of logic to cut pay steadily and then be shocked that fewer people want to do the job.

10. Totally Jon Stewart on the practice of corporate 'inversion', where a US company buys a foreign company to move their headquarters to a country with a lower tax rate.

14 Comments

#4 considering AEP's previous bubbling certainty there was no such event as peak oil...

regards

#5 hence why I dont put money anymore into pension funds, I expect them to default.

regards

I took command of the investment side of my non- contributory pension plan as a matter of policy to avoid gouging fee structures that were more likely to bankrupt the fund than any exongenous factor such an oil company collapse. I traded the Gilt market and paid the mandatory repositiory insurance company a flat fee of 25bps per annum on ave. asset value - I have long since transferred it to NZ under the control of a family trust.

It will be of some interest to see how the guardians of the NZ Superannuation Fund react to this development.:

US oil giant ExxonMobil and Russia’s Rosneft will continue joint exploitation of the Russian Arctic despite Western sanctions, the American company said as the two giants launched exploration drilling in the Kara Sea. Read more

EU moves steadliy down towards deflation,

http://krugman.blogs.nytimes.com/2014/08/10/meanwhile-in-europe-2/?_php…

regards

Indeed, of note,

"The price of Spanish property has fallen 44% since the eurocrisis kicked off. That’s not so much deflation as implosion. Spanish banks are burdened with as much as €40 billion of repossessed real estate. They’re under increasing pressure to sell off these ‘assets’, but the buyers are missing. The degree of desperation became apparent in late June when, despite months of heated denials, the Madrid Government finally announced a tax on bank deposits. This is a bailin whose only USP is that it is stealing customer funds before the sh*t hits the fan."

Looks like another cyprus.

and NZ is immune?

NZ depositors are so lucky, if the above is indication they not only face the OBR haircut but outright theft.

"€40 billion of repossessed real estate"

whats it really worth? 1/2 that? 1/4? ditto NZ?

Yes all is well, no worries....mateeee!

regards

And there goes Germany into Deflation, this will eventually make the EU very competitive

http://www.telegraph.co.uk/finance/economics/11030327/Now-even-German-i…

#6 Indeed. Now that America has shrugged off the mantle of 'world policing' and has made such a hash of its foreign policy over the last half-decade, it's a much less appetising picture. Because no matter what the Golfer-In-Chief might think, as Spengler argues, there's a lot of killing left to be done.

A working example?

Where did all the Somali pirates go to? Time was they were a'hi-jackin' and running amok. Why, they even made a film about it.

Well, the Russians, Iranians and the Chinese are doing the policing there now, and they don't worry too much aboot the ICC.

Actions beat rhetoric....

…the last half-decade…

I'm inclined more towards the USA stuffing up the last half-century.

Re NZ Inflation, Eurozone deflation and the Zero Sum Game piece , I get the sense our monetary policy is working quite well for us ...........for now .

We always have the fallback option of reducing interest rates to stimulate demand , and weaken the Kiwi$ if we have to , a luxury not enjoyed by many in the OECD

NZ is doing OK because the rest of the world has not imploded. When the EU or USA or Japan or China or (insert here) kicks the event of our lifetime off our RB dropping the OCR to 1% as a "substantial response" will frankly not matter IMHO.

regards

#3 actually sounds like working for a Government Department in NZ!

Yeah I wrote about civil service purging kiwistyle on Bernards daily political round up.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.