The credit cracks are starting to emerge for Kiwi consumers, according to credit bureau Centrix.

In its latest monthly update, the bureau's managing director Keith McLaughlin said Kiwis are feeling the pinch from high living costs, increased interest rates and the squeeze of the economic climate.

"The simultaneous increase in demand for credit and arrears points to people being under pressure to meet repayment obligations," McLaughlin said.

The overall demand for credit was up 23% year-on-year in August 2022, largely driven by an increased demand for personal loans.

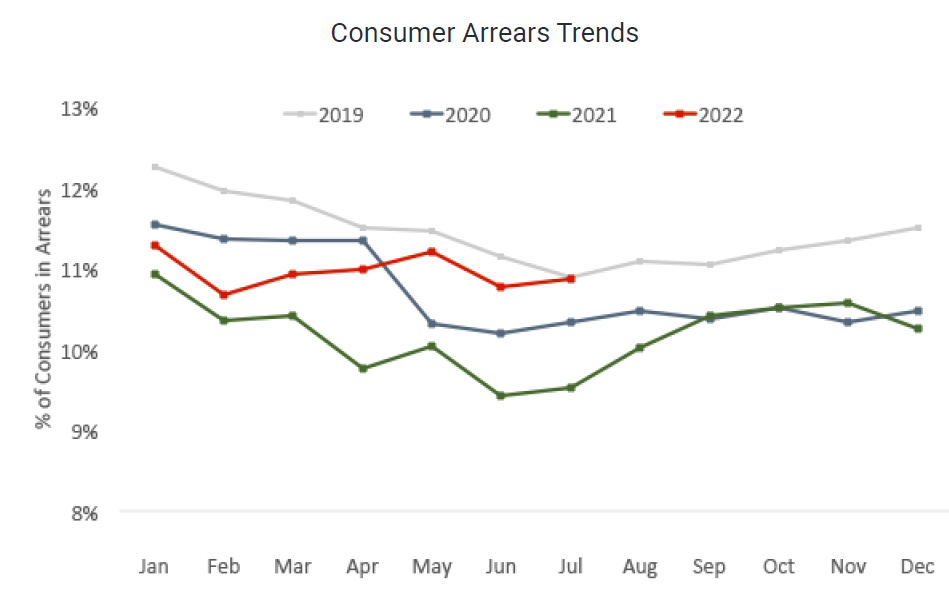

Overall arrears went up for all regions across the country, with consumer arrears increasing 13% year-on-year in July.

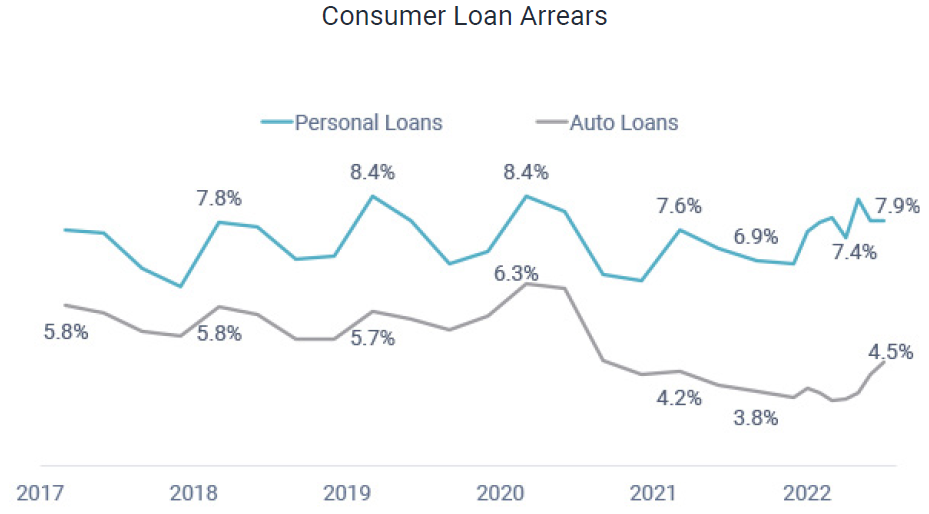

Arrears on unsecured personal loans edged up to 7.9% year-on-year.

Vehicle arrears rose for the fourth consecutive month, to 4.5%, the highest reported level since early 2021.

"Vehicle repayments are traditionally one of the last repayment obligations people let slip, and the ongoing growth in arrears may indicate underlying pressure for Kiwi households," McLauglin said.

"However, mortgage arrears remain low as Kiwis prioritise keeping a roof above their heads while arrears on discretionary repayments like Buy Now Pay Later accounts, credit cards and personal loans climb."

In terms of consumer arrears, Centrix said "the trend" was now catching up to pre-Covid levels. Currently 4.2% of credit active consumers are 30+ days past due and 2.4% 90+ days past due. Gisborne has the highest overall arrears (14.4%) while Northland has the highest proportion of mortgage borrowers past due (1.9%).

In terms of mortgage repayments, the proportion of home loans with missed payments remaining steady at 0.96% in July 2022.

"While there are currently more than 14,000 mortgage accounts past due, there are no major signs of mortgage stress emerging – despite the recent rate hikes and higher costs of living."

McLaughlin said following the market trend, mortgage applications were down 25% year-on-year, "which suggests people are putting real estate plans on hold in lieu of balancing their finances".

Meanwhile for those who are borrowing, new residential mortgage lending is down 40% year-on-year in July 2022.

"Despite this, first home buyers who successfully purchase property will find the average mortgage loan has fallen by $65,000 [from a peak of nearly $600,000] in the last six months – an 11% drop aligning with the cooling of the property market and falling house prices," McLaughlin said.

The Kiwi business sector continues to walk the economic tightrope of remaining open and viable while contending with supply chain issues, labour shortages and reduced consumer spending, he said.

"The retail and construction sectors in particular are challenged by defaults and lower activity, while tourism and hospitality show increased activity and lower defaults as international tourists return in greater numbers.

"For business owners and consumers alike, managing finances and repayments is paramount. It’s important for anyone struggling to speak with lenders proactively to reorganise repayment terms. An adjustment of terms is far preferable to letting debt build and potentially endangering long-term financial wellbeing."

10 Comments

Interesting article. There is financial pressure from all sides really upon families. Tax is increasing, Goods and Services are increasing, interest rates are increasing...it would be more surprising had we not seen a deterioration in credit quality perhaps?

This is the precursor to bankruptcy which I read yesterday is at an all time low.

We are surviving by low immigration and high employment.

It's all dominoes at the moment.

Not surprised, people are being hit on all fronts, it will flow on to overdrafts and credit cards to balance the monthly budget, by banks are hiking there too, result is more profits for banks siphoned to Australia.

Safe to say we are now at the top of the rollercoaster. Buckle in folks we are on our way down...

It seems encouraging eye watering levels of debt ("Interest rates won't be going up anytime soon", "Property always goes up", "Inflation is transitory") to buy hugely over priced property in order to promote the 'wealth effect' to then buy crap we don't need and live beyond our means, whilst at the same time discourage sensible, productive business and personal finance was not such a good idea after all........who would have thought?

Who would have thought? Many Int.co posters thought!

Exactly right! You did not need to be a financial Nostradamus to see this happening.

Looking at the data I dont see anything out of the ordinary yet.

"While there are currently more than 14,000 mortgage accounts past due, there are no major signs of mortgage stress emerging – despite the recent rate hikes and higher costs of living."

New Zealand 10-Year Bond Yield priced at ~4.05% has doubled three times+ from a Sep 20 low of 0.49%.

Inevitably the desire to capitalise falling discounted present values of future cash flows associated with residential property assets diminishes as term interest rates rise.

1% of home loans are in arrears? That seems like a lot.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.