Inland Revenue’s draft long-term insights briefing currently out for consultation has generated quite a bit of debate. The paper discusses the future shape of the system and how to fund the rising cost of superannuation and related health costs.

Sir Roger Douglas has now entered the chat as he, together with Professor Robert MacCulloch of Auckland University, have released a paper titled How to change the welfare state from a taxation to a savings-based model. In some typically bold thinking from Sir Roger, the proposal is to dramatically change the tax system, and instead of trying to raise additional tax to meet these costs, take a completely different approach.

A tax cut or something else?

Sir Roger and Professor MacCulloch suggestion is for the first $60,000 of income to be tax free. Based on current tax rates, that's at least a $10,000 tax cut for everyone with income of at least $60,000. Instead, those taxes would be directed into mandatory savings accounts for health, pensions and other risk cover. These would then be supplemented by employer contributions (effectively a social security tax, although not specifically described as such) with the trade-off for these contributions being a cut to the corporate income tax rate.

They've released a short paper outlining their proposal (there's also a more detailed paper that Sir Roger and Professor McCullouch produced in 2020). The paper starts with an analysis of the forthcoming rise in health and superannuation costs and the need to take a long-term view on addressing this issue. Sir Roger and Professor McCullouch take the view that the conventional approach, raising taxes to meet these costs isn't going to cut it. Something more dramatic is needed.

Taking the axe to corporate welfare

In addition to the proposed mandatory savings accounts, Sir Roger and Professor McCullouch propose cuts to what they call corporate welfare and grants to high earners. The cuts include the removal of screen production grants, ending accelerated depreciation allowances for industries such as forestry, fishing and bloodstock, withdrawing winter energy payments to wealthy households and KiwiSaver subsidies to higher earners. They also propose ending the “favourable tax treatment to owners of rental housing” but this isn’t defined. I’d be very intrigued to know more about what exactly they're driving at there. All up Sir Roger and Professor MacCulloch suggest these could save over $12 billion annually.

Yeah, but…

This is a quite radical proposal which would be quite a shock to the system, and I'd be very interested to see what other economists think of it. One hurdle I see is with the proposals aimed at introducing competition into the provision of health services. This is a perennial problem for our economy. We are just 5.2 million people and 2,000 kilometres away from the nearest neighbour. Competition in that context is always going to be difficult but it’s an issue we need to address, not just in this context but across the economy as a whole, because I think it's a major problem for our economy.

Overall, you can never say that Sir Roger Douglas would die wondering. As a RNZ report noted it’s a bold plan and I recommend reading the summary paper. Bear in mind some of what it proposes in terms of removing subsidies such as the Government’s KiwiSaver contribution for high-income employees are now actually happening.

What about increasing GST?

On a more conventional approach Inland Revenue’s briefing paper includes a discussion about the implications of raising GST from 15% to 18%. Last Thursday I spoke with Wallace Chapman of RNZ’s The Panel about this proposal.

The Inland Revenue briefing paper notes the suggested GST increase could raise $5.5 billion of tax annually. This is because, as I explained to Wallace and his panellists, GST is an enormously efficient tax. It does meet the classic broad based low-rate approach. You broaden the basis as widely as possible so you can have as low rate as possible. Furthermore, because we have no exemptions, our GST is enormously efficient. So really if you were thinking of increasing taxes. your first point of call would be to raise GST.

A regressive tax

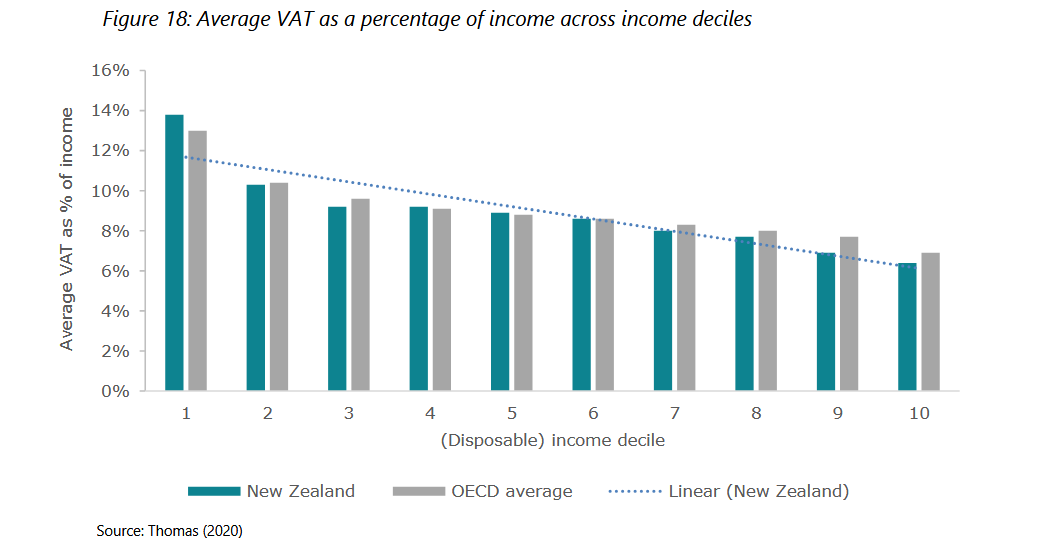

The problem is though, as Inland Revenue pointed out and as Holly Bennett, one of Wallace’s guests immediately jumped on, GST is a regressive tax. There's quite an interesting analysis of this in the Inland Revenue briefing paper. The paper notes that GST or VAT (value added tax) is regressive relative to income.

According to the organisation of Economic Cooperation and Development (the OECD), the average GST to income ratio declines from 10.4% in Decile 2 to 6.9% in Decile 10. We follow a similar profile with our GST to income ratio declining from 10.3% in Decile 2 to 6.4% in Decile 10.

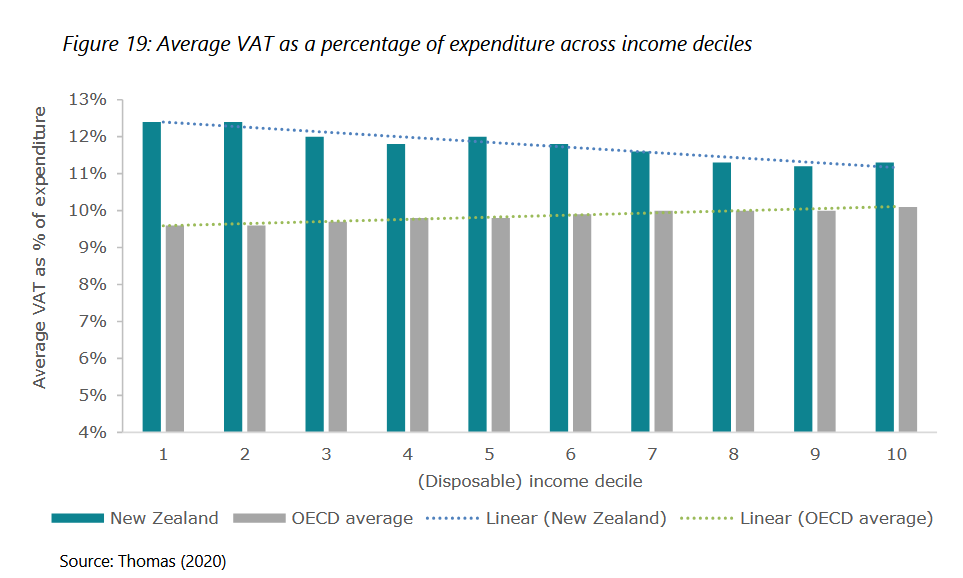

The Inland Revenue paper also considers the effect of GST relative to expenditure. In this instance GST or VAT is slightly progressive for most OECD countries because of the exemption of tax of necessities such as food and some sanitary products and various other Items which make up a very large proportion of the consumption basket of lower income households. However, our GST because we don't have any such exemptions is mildly regressive.

Increasing poverty?

As Holly Bennett was quick to also point out, an effect of GST increases is to increase the poverty headcount. According to Inland Revenue, based on the 2015/2016 Household Expenditure Survey GST “increased the imposition of GST in New Zealand increased the poverty headcount by 4.7%, the poverty gap by 1.7%, and the squared poverty gap by 0.8.” What's worse is that the effect of those increases is higher than the OECD averages of 3.1%, 0.7%, and 0.3% respectively, again, because we have no exemptions.

The GST dilemma

So, raising GST results in the dilemma that it would raise a lot of revenue very quickly but hit lower income families harder. The suggestion in Inland Revenue’s paper is that there should be a compensation increase in welfare benefits for low-income families. They suggest that would probably cost maybe $440 million a year in total.

Readers and listeners may recall that last year a guest was Andrew Paynter, one of the Tax Policy Charitable Trusts co-winners. We discussed his proposal of raising GST to 17.5 % and introducing a GST refund tax credit for low- and middle-income earners.

Coincidentally or not, Andrew works for Inland Revenue, but there's a worldwide trend looking at this particular issue. For example, the International Monetary Fund released a paper last year Designing a Progressive VAT which suggested a point of sale credit for low-income families. As the Inland Revenue paper notes Canada and Thailand have point of sales/refund credits for low-income earners.

Some form of capital taxation also needed

If you were adopting a conventional approach to addressing the rising expenditure gap, then raising GST is the most likely approach. My personal view is we also need to have some form of capital taxation because as I explained to the Panel, not only do we have rising health and superannuation costs, the cost of dealing with the impact of climate change, is rapidly accelerating.

This week Forsyths Barr and the Insurance Council released data that showed that over 40 years, the average annual cost of dealing with weather related events was $203 million. However, in the latest 10 years those costs had risen to $606 million annually and the five-year average is now $952 million per annum. Currently Tasman is spending $500,000 a day repairing its roads in the wake of the recent floods.

So climate change is having a huge impact now and there are a huge number of properties - 220,000 in total - presently worth over $180 billion, which are located within coastal inundation and inland flood zones. More than a quarter of those are in the Canterbury, Tasman, Gisborne, West Coast and Nelson regions. Those last four of which have all had severe weather events in the last year.

A quid pro quo

Protection against climate events will be another growing demand, particularly since for most people their property is their principal capital asset. This is where I think some form of capital taxation/capital gains tax is perhaps appropriate because if the Government and local councils are expected to spend more to protect capital assets, the quid pro quo must be that those capital assets become taxable.

Working for Families – a correction

Moving on, last week I talked about the changes to FamilyBoost and I noted that there had been no change to the threshold for Working for Families. That was actually incorrect. A kind reader from Inland Revenue pointed out that the Working for Families threshold will increase to $44,900 with effect from 1st of April next year its first increase since July 2018. Thanks for getting in touch and apologies for my error.

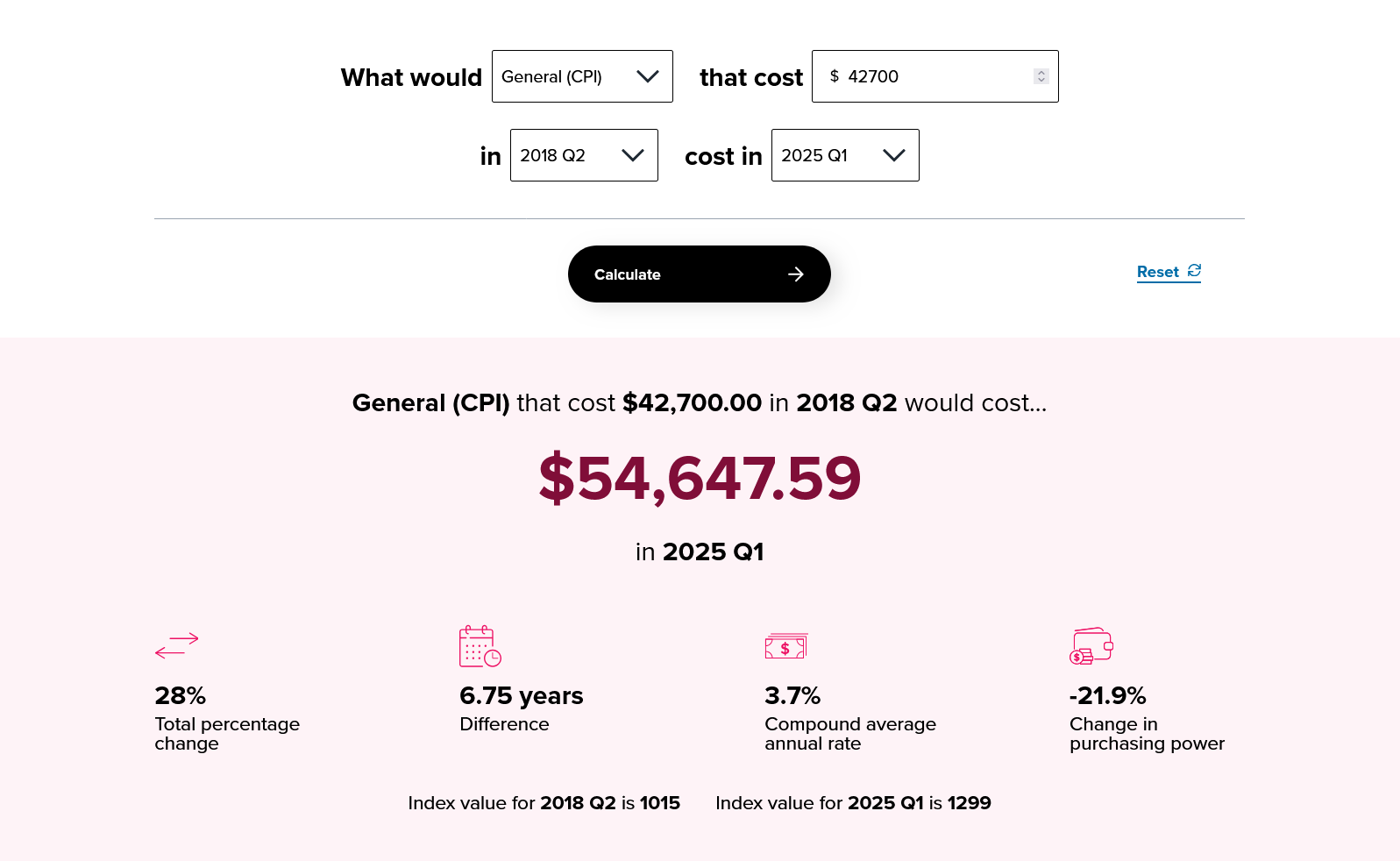

I'll just simply add that on an inflation adjusted basis, that threshold should have gone up to something like $54,650 so it's still way short of where it should be.

In any case the effect of the increase in the threshold from$42,700 to $44,900, which remember is for a family’s income, is mitigated by the increase in the abatement rate went up from 27.5 cents per $100 to 28 cents per $100.

Furthermore, the other point I made last week was about the focus of the FamilyBoost towards higher income families. That point doesn't change just because the threshold for Working for Families has been (slightly) increased.

A New Zealand first

A recurrent theme this year is how Inland Revenue has increased its focus on chasing non-compliance. The latest example is the Auckland man who has become the first person in New Zealand to be convicted and sentenced for aiding and abetting his company's possession of the electronic sales suppression tools.

Now these sales suppressions tools basically alter the Eftpos record so they're very much about suppressing income and basically trying to defraud the taxpayer. In this case Gurwinder Singh, has been sentenced to seven months home detention on tax evasion charges, including the charge of aiding and abetting this company for possessing electronic sales suppression tools for the purpose of evading the assessment and payment of tax.

All up, Singh’s tax evasion amounted to $198,500. Apparently one of the things he was also doing was although he had four employees, including himself, he was only reporting PAYE returns for two staff. So, some obvious and not so obvious tax evasion was going on here. Anyway, this is the first time the new law in relation to electronic sales suppression tools has been applied. Would-be fraudsters have been warned.

The pitfalls of schedular payments

As often mentioned, Inland Revenue turns out vast amounts of very interesting and helpful material. Once such source are its Technical Decision Summaries about issues or rulings that Inland Revenue has encountered.

One TDS released this week is a private ruling in relation to the application of the schedular payment rules.

This involved a company wanting to make use of offshore personnel to act as directors in New Zealand. The question of interest here is a reminder that if you are making payments to overseas persons, they may, even if they are contractors, be subject to non-resident withholding taxes/schedular payments.

That's why this one is useful. This ruling explained why those provisions would not apply. But typically, if they do apply then 15% withholding tax can be deducted which can come as a shock to some overseas persons. This is a useful ruling on a point which we often encounter but is one of those cases where I suspect the compliance isn't always as diligent as it could be.

And on that note, that’s all for this week, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

13 Comments

I don't get it. Isn't Douglas supposed to be a fervent, classical libertarian? Hence, when his proposal starts with a $10,000 tax cut for individuals, but then prescribes that;

... those [individual] taxes would be directed into mandatory savings accounts for health, pensions and other risk cover.

It doesn't sound very non-coercive to me - quite the opposite, it's: "here's your tax cut but WE know you won't use it wisely, so WE'LL make that decision for you".

And really all he is doing is using what should be for citizens to use as they wish as a means to address problems the government has created with it's own failed economic planning.

As PDK would remind us, savings are an IOU on energy (predominantly oil) and that energy debt wont be repayable by the time many will need it.

Tax brackets should be adjusted for inflation. People will spend more. Save money by aggressively pushing people back into the work force. The free ride for life vibe is too ingrained. You need to motivate people to work, otherwise those with a work ethic will leave. GST is already high.

Assuming there are jobs to be pushed into.

Where are these increased savings to be invested (if invested at all) ? Once again we appear to be placing faith in markets that have consistently failed to invest for the past 4 decades, why do we believe they will suddenly change tack?

History has shown that investment occurs at a greater rate when the long term hope(s) of the public purse are to the fore....and no need to pay an additional return to shareholders.

In 2023 Labour campaigned on removing GST from fresh fruit and vegetables, and Te Paati Māori on removing it from all food.

New Zealand Initiative chief economist Eric Crampton said the government could instead offer everyone a near $30 weekly payment - double what they would save on food if GST were removed. This, he argued, would be more efficient than tampering with GST.

https://www.rnz.co.nz/news/political/494693/cash-handouts-cheaper-than-…

Surely the same argument could apply to balancing a universal rise in GST from 15% to 18%.

Rather than introduce the complexity of indulgences for various categories of the poor that would result in discounts at checkout, offer everyone, rich and poor, young and old, a tax-free universal basic income that would offset the GST levied on ordinary living expenses.

The UBI would also encourage those who ski off-piste in the black economy to register.

Attention needs to be turned to the heavy burden that running the MSD places on the tax payer. This monolith would cease with UBI.

We are part way there with Nat Super already, just go the hole hogg, wipe out the welfare system, pay UBI and let everyone get on with earning extra if they want to.

I totally agree. But Sir Roger will never get there because you have to raise other/alternate taxes in order to get there;

https://www.interest.co.nz/public-policy/133744/what-do-you-get-when-yo…

Which is a real shame as he is an innovator and a problem solver at heart - and he (I suspect) is very disappointed at how our welfare system subsidizes just about everything these days.

Just go universal benefit - no strings attached - let people make their own life decisions. Reading a good wee book at the moment;

https://www.amazon.com/Free-Exist-Grant-Carolyn-Stock-ebook/dp/B07P9SHH…

Finland tried a half hearted UBI. Pity it wasn't tested more fully. chatgpt:-

-

From January 2017 to December 2018, Finland’s Social Insurance Institution (Kela) ran a two‑year basic income experiment, paying €560/month to 2,000 randomly‑selected unemployed people aged 25–58, with no requirement to seek or accept employment

-

The Finnish government opted not to continue or expand the trial beyond that period, despite a request from Kela to broaden it.

Pity they do not follow through and pity NZ doesn't pick it up - we HAVE to do something, current system is unsustainable.

These significant positive findings on well-being are no mystery: the basic income seems to have improved all the major components of life satisfaction (Exhibit 2). People receiving the basic income reported better health and lower levels of stress, depression, sadness, and loneliness—all major determinants of happiness—than people in the control group. Recipients of the basic income also demonstrated more confidence in their cognitive skills, assessing their ability to remember, learn, and concentrate at higher levels than the control group did. And the basic income enabled people to perceive their financial situation as more secure and manageable, even though their incomes were no higher than those of people in the control group. Finally, basic-income recipients expressed higher levels of trust in their own future, their fellow citizens, and public institutions.

So agree with you - so many problems solved (no more need for reporting to WINZ - a deadweight use of time); so many positive benefits (lower health costs; lower suicide rates; etc.) - it really is a crime that no established political party has taken this up since GM first proposed it in the Big Kahuna. And it needs to be a BIG Kahuna (the go the whole way in one transformative, well planned hit) - just like the Lange/Douglas years which reined in neoliberalism.

Neoliberalism is a dead horse now, given the massive, massive changes that AI will ring in with 1-2 years.

This National government can SEE it. No matter how much they want to talk up growth - it ain't happening and what is happening is a burgeoning unemployment queue and a totally squeezed middle class. Those things will only get worse and worse as AI comes online.

Figure 18 in particular needs caution. The main reason higher deciles deliver lower effective GST rates in this chart, as a percentage of income, is that financial services (and rent) are exempt GST. Therefore, for higher deciles one can see the logic of why roughly a third of what would otherwise look like a Decile 1 GST payment is missing - it's the proportion of disposable income going to pay the mortgage or rent. A small amount will also be savings - most of which will ultimately be spent and pay GST, just not this year.

The puzzle is the statistical difficulty apparent in decile 1. Not all of it surely is in Kainga Ora housing/rentals, paying little, and even then, it is 25% of income rent as a formula. There may be problems with income measurement. I think Decile 1 should be ignored for visualising any degree of regressiveness in GST, at least until we can see the detail of its composition. For deciles 2-10, the line is pretty flat if you draw it from 2 to 10.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.