By Michael Coote (email)

Saving people from themselves has evolved into one of the major growth industries of the 20th and 21st centuries. Disguised as altruism, this industry only needs its moral camouflage peeled back in order to reveal the grossest self-interest as the primary motivation of its advocates.

Saving people from themselves has evolved into one of the major growth industries of the 20th and 21st centuries. Disguised as altruism, this industry only needs its moral camouflage peeled back in order to reveal the grossest self-interest as the primary motivation of its advocates.

Outside of its lunatic fringe, who can’t help themselves let alone anybody else, we typically find greedy careerists ever anxious to intervene for profit in other people’s affairs.

Refreshing it is then to find that one of the world’s biggest bond fund managers – California-based PIMCO – has embraced a whole new way of thinking that cuts the Gordian knot and squares the circle in normalising mental illness to benign and lucrative ends, no intervention from the salvation industry required.

This novel mental climate may be described as sane madness or mad sanity, and, democratically, you can DIY.

In signing off the latest PIMCO Secular Outlook: Navigating the Multi-Speed World , CEO Mohamed El-Erian writes:

“The world will remain an unusually fluid place. By looking forward and retaining our culture of ‘constructive paranoia,’ we will strive to ensure that your [bond] portfolios benefit from change, rather than fall victim to it.”

Yes, constructive paranoia is the desirable mental condition to adopt in these challenging times.

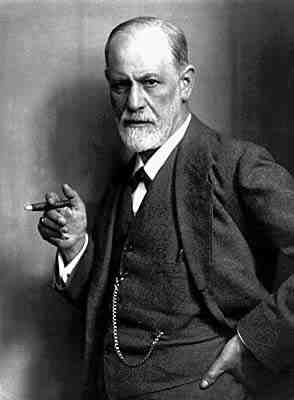

Paranoia is a contentious term in modern psychiatry, but is classically associated with a disease of the imagination expressed as morbid delusions arising from fears and anxieties, especially those caused by irrational beliefs that one is the victim of threats, persecutions and conspiracies.

Be suspicious when investing your money

Clinically paranoid persons can be extremely dangerous when feeling compelled to lash out at those they fantasize to be enemies, particularly when they have the kind of political power achieved by such famous modern examples as Hitler, Stalin and Chairman Mao.

The central dictum of the latest vogue for paranoiacs can be summed up as, “Be extremely suspicious when investing your money.”

Pimco’s constructive paranoia redeems the classical form of mental suffering principally by arguing that fears and anxieties over what is happening in investment markets are not delusional but rationally based on actual conspiracies by governments.

Indeed, the logic runs, we are being threatened and persecuted by what conspiratorial government authorities are doing to create the impression that they have the aftermath of the global financial crisis and the Great Recession under control.

Several government conspiracies have been fingered by Pimco as worth getting seriously constructively paranoid about.

One concerns the US Federal Reserve’s willingness to keep overnight interest rates at zero indefinitely and “print money” through quantitative easing, or gross expansion of the money supply.

The Fed’s latest round of quantitative easing – the US$600 billion scheme dubbed “QE2” – has had the effect the Fed was aiming at in driving prices for risky assets like shares and commodities through the roof.

Yield search

The US economy may be struggling to get going again, but don’t worry, be happy, because the stockmarket keeps going up thanks to super cheap, superabundant greenbacks being applied to the “search for yield” in buying up risky assets that pay much better, at least temporarily.

This type of psychological manipulation of markets is nicknamed the “401K effect” after the positive impact it has on the mood of US workers, whose 401K retirement savings accounts are the American equivalent of our KiwiSaver.

Of course, the search for yield can’t go on forever – we have seen booms and busts driven by it before – and this time around will be no different.

The Fed will stop “printing money” through QE2 at the end of June, and at some later stage will have little option but to hike interest rates as inflation expectations take off in the US economy.

The end of QE2 should start to unmask how overextended prices in the risky asset markets have become, although not necessarily curtail the present bull market.

But for now – on a constructive paranoia reading that mixes metaphors madly in the liberating spirit of the new mental attitude - make hay while the sun shines, surf the rising risky asset wave, be ready to cash in quick as lightning, and stuff the money in a mattress when the fat lady sings, because otherwise you could fall hapless victim to the Fed’s nefarious conspiracy.

1 Comments

I think what he's saying, Iain, is the crooks (the worldwide reserve/shadow banking sector, i.e. the status quo) are crooks - it's not a conspiracy, rather it's a reality. They are forcing us to live/survive/compete in a ponzi scheme and they being the first into the ponzi will play a winner take all end game.

So, "... for now – make hay while the sun shines, surf the rising risky asset wave, be ready to cash in quick as lightning, and stuff the money in a mattress when the fat lady [the status quo] sings [allows the ponzi to tumble and takes all the ill gotten gains]".

.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.