By Amanda Morrall

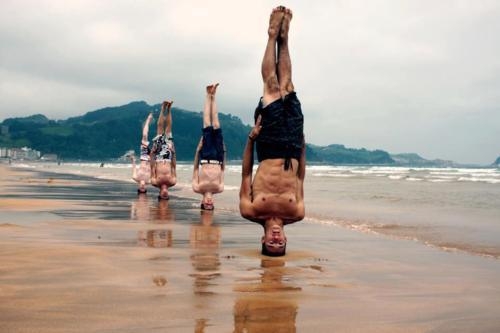

1) Playing your edge

In the yogi world, where I spend a fair bit of time hanging out, we often talk about "playing your edge.'' What does that really mean?

On the yoga mat, it means taking yourself to a point just beyond your comfort zone but within a safe limit. The fun, and scary, part is exploring and flirting with that edge. Usually what holds us back from taking ourselves to a new level is fear. Fear of falling on your arse in the company of others who probably couldn't care less. One of the many fascinating things about yoga is that in learning to overcome these fears, we build up the mental, emotional or spiritual fortitude to apply this courage or lesson to other spheres of life.

For that reason, I enjoyed this blog from retirehappyblog.ca on "Feeling the fear, and doing it anyway. "

2) Money woes in marriage

"They" say money is the No.1 marriage killer. I won't quarrel with that statement. Money can be a major source of friction for couples and yet those couples who can communicate effectively and work together as a team stand a much better chance of resolving financial conflict. This blog from worksavelive.com looks at the top three marital landmines where money is concerned and how to diffuse them.

3) Beginner's guide to haggling

The ability to haggle is a great life skill. It's not my forte however I'm certainly not scared to ask for a discount. For those shrinking violets out there here's a beginner's guide to haggling from www.givemebackmyfivebucks.com

4) Freudian slips

Perhaps one reason why a lot more people don't haggle is that we're conditioned consumer robots. One of our regular readers from Wyoming sent me this link to a documentary with some psychological insights from Freud on this matter. Thanks Andy.

5) Bye bye bonus

Working in journalism my entire career, bonuses were something of a foreign concept. Well that's not entirely true. I once worked for a tabloid newspaper chain. At Xmas time, they trotted out some cash envelopes (the amount of which were based on years of service) along with a stiff rum egg nog. It wasn't much but the token was appreciated nonetheless. That was 20 years ago. I haven't seen a bonus since. I guess it makes me that much more conditioned to accept their permanent loss. According to Mercer, those days are long gone for all but a few sectors. So too are salary hikes at pre GFC levels. Read 'em and weep.

Mercer’s New Zealand Total Remuneration Survey of 190 organisations revealed that salary increases rose 3.2% up only marginally from 3% in 2011.

Sarah Barnaby, Senior Associate in Mercer's talent business, said certain sectors and jobs are receiving above average pay rises, but the days of hefty pay package increases for all Kiwis are well and truly over.

“Employees should not expect pay rises of 5% or more - as seen before the recession, in fact 48% of organisations are giving staff less than a 3% pay rise and have no plans to change this.

To read other Take Fives by Amanda Morrall click here. You can also follow Amanda on Twitter @amandamorrall

8 Comments

People are so worried about what others thinking - but of course others aren't really looking because they're too worried about what others are thinking.

Some people just have a knack.

I have a niece who is fearless at returning stuff . One handbag she bought was replaced five times before she got her money back because they kept falling apart. She's become the family go-to person when you get into retail trouble.

And years ago I employed this young lady who could collect debt like no one I've seen again. She was happy and normal except when on the phone collecting debt. It was like a dog with a bone and she was relentless. I always wondered if she was as good with her own money or whether because it wasn't hers it made it easier.

#1 thanks for clearing that up. I always thought "playing your edge" referred to making sure you had the coolest yoga gear (lululemon - I even have the lululemon mat LOL). One of the not-so-good things about yoga is seeing badly dressed people contorting in an un-styling fashion. Nothing edgy about that.

#3 Bali and Thailand are fantastic places to develop your haggling skills, but I developed mine years earlier when at Auckland uni attending the venerable old NZ garage sale. My flatmate taught me a valuable haggling lesson which has saved me countless $ over the years - the straight to half price rule. You just offer 50% of the price. This has two outcomes - a) they actually say yes, which saves you countless minutes haggling to get to what is usually the most drastic accepted markdown (most ppl know normal retail markup is 100%, so they try it themselves), or b) they flat-out say No and you get to recognize that look, particularly in Asia, where you have gone below the no-profit line and they just turn away, but then you have turned the tables where you are now starting at the bottom and haggling up until the seller aquieces.

Of course if there is more than one place selling the same item, like all the computer shops along Tottenham Court Road, you just go from shop to shop asking what the lowest price is until you get there.

The point about timing made in the article applies to seasons as well as time of day - during Easter this year in Goa we got great prices because it was the end of the tourist season and the sellers were packing up to go back to their home states and just wanted everything gone so they didn't have to take it back with them. Cheap Cheap!

I love my Lululemon mat. No haggling there but bonus 15% discount for teachers. Wish I'd bought stocks ages ago.

Good to hear you are a style leader as well as personal finance advisor :-)

#5 Bonus

I am sure Bernard gets the hint and a substantial bonus is coming fort your way, particularly now he will be mortgage free by moving to Wellington.

Why is the media so quiet about the Ross saga unfolding!

I hear via the grape vine that he got a lot of money out of some well heeled private school old boy network.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.