By Christopher Walsh*

Going abroad or spending on foreign websites? Who you bank with and how you pay makes a big difference in how much you spend.

Every overseas transaction incurs a “Currency conversion charge” – you pay this on any transactions you do in a foreign currency, such as spending when you are overseas or buying goods or services online from an overseas eCommerce shop.

In New Zealand, you’ll pay between 0% and a whopping 4.5% (depending on who you bank with and how you pay) when it comes to foreign currency purchases. We found that two popular payment methods, PayPal and the PrezzyCard, charge you a lot more than standard cards.

Our guide to lower overseas credit card fees

This step-by-step guide covers what your card currently charges you to use it on any foreign purchase, the cards and payment methods to avoid and finally a few tips to make big savings. Highlights include:

- The Best Debit And Credit Card For Overseas Purchases

- Credit Card and Debit card Overseas Fees by Bank

- Worst Card to use for Foreign Currency Purchases

- Worst Payment Methods for Foreign Currency Purchases

- Avoid PayPal's Poor Value Exchange Rates With One Simple Click

The best debit or credit card for overseas purchases

| WINNER | RUNNER UP | |||

|

Flight Centre Mastercard FlexiGroup's specialist travel product offers a 0% conversion fee. The standard QMastercard offers a 1.40% fee. |

Kiwibank Credit Cards Kiwibank offers the second cheapest conversion fee, at 1.85%, for all of its credit cards. |

Credit card and debit card overseas fees

Overseas currency conversions charges - New Zealand banks (debit cards and credit cards)

|

Value

|

Kiwibank

Credit Card |

ASB Debit &

& Credit Cards |

BNZ Debit &

& Credit Cards |

ANZ, TSB, Westpac

Credit & Debit Cards |

Kiwibank

Debit Cards |

Co-operative Bank

Debit & Credit Cards |

|

Currency Conversion Fee

|

1.85%

|

2.10%

|

2.25%

|

2.50%

|

2.50%

|

2.60%

|

|

US$150 Purchase Fee (in NZD)

|

$4.02

|

$4.56

|

$4.89

|

$5.43

|

$5.43

|

$5.65

|

|

US$2,500 Purchase Fee (in NZD)

|

$67.03

|

$76.10

|

$81.52

|

$90.58

|

$81.52

|

$94.20

|

|

|

Flight Centre

Mastercard |

QMastercard

|

SBS Bank

(Debit Card only) |

PrezzyCard

(Debit Card Only) |

PayPal

(paid with PayPal balance or a Debit/Credit card) |

|

Currency Conversion Fee

|

0%

|

1.40%

|

2.80%

|

3.50%

|

4.50%

|

|

US$150 Purchase Fee (in NZD)

|

$0

|

$3.05

|

$6.09

|

$7.61

|

$9.78

|

|

US$2,500 Purchase Fee (in NZD)

|

$0

|

$50.73

|

$101.45

|

$126.81

|

$163.04

|

SBS BANK (Debit card)

Transaction fee: 2.8% fee (debit card purchases)

SBS’s Debit Card’s overseas currency fees are 33% higher than the ANZ’s debit card equivalent and 10% higher than every other bank.

PREZZYCARD

Transaction fee: 3.5%

The PrezzyCard has been discussed in our PrezzyCard guide and given its function as a debit card, we found the 3.5% fee to be the highest fee of any card and close to twice the standard 1.85% fee for credit cards charged by its parent, Kiwibank.

Transaction fee: up to 4.5%

There is a common misconception that PayPal offers Kiwis a low-cost overseas payment service. In reality, it charges the highest fees of any bank or payment provider. In short, use Paypal for an overseas purchase and you can pay close to three times what the Kiwibank credit card costs to process the same transaction.

However, PayPal isn’t transparent with its overseas fees. The total purchase value is not itemised with conversion and transaction fees like some banks do. Instead, you'll get one number - the total price in NZD. In January 2018 we attempted to make three purchases in three currencies; AU$200, US$200 and £200. Each purchase suggested we convert at the PayPal rates of:

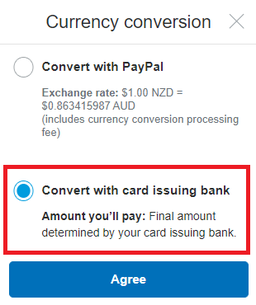

- $1.00 NZD = $0.863415987 AUD vs $1.00 NZD = $0.903787 AUD (Standard rate) - calculating a 4.5% difference

- $1.00 NZD = $0.664478304 USD vs $1.00 NZD = $0. 0.690856USD (Standard rate) - calculating a 4.0% difference

- $1.00 NZD = £0.505143878 GBP vs $1.00 NZD = £0.527961 GBP (Standard rate) - calculating a 4.5% difference

The good news is you can still use PayPal AND avoid their foreign exchange fees - see our tip below.

Note: The above calculation was prepared in January 2018. While currency exchange rates vary, we believe the PayPal margin does not.

Avoid PayPal's poor value exchange rates with one simple click

If you choose to pay by PayPal, you can avoid these fees and be charged your bank rates by clicking on “convert with card issuing bank”.

This means that PayPal will charge your bank the foreign currency amount and your bank will charge you its fee (1.85% to 2.8%) of the amount to translate it into NZD, avoiding the 4-4.5% charged by PayPal.

The only difference you'll see is a foreign currency charge in your card statement and the fees your bank charges.

Our view:

- There is a HUGE difference between what banks charge for something as simple as making an overseas purchase.

- The Flight Centre Mastercard is a standout product, which also offers $1 of Flight Centre vouchers for every $100 spent.

- Among the banks, ANZ, TSB and Wesptac charge 35% higher fees on international transactions than Kiwibank’s credit cards (i.e. 2.5% vs 1.85% on the purchase value).

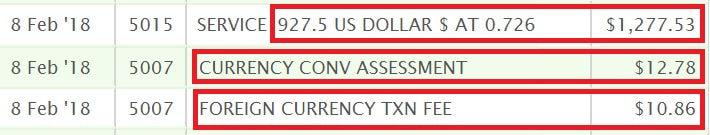

- Some banks make it clear what the fees are on your statement, while others don't. For example, Kiwibank shows the total in the foreign currency, the exchange rate used, the "Currency Conversion Assessment" fee and the "Foreign Currency Transaction Fee" all as separate items (see the example below). In comparison, the BNZ shows one number - the total price you pay for the transaction. The "Foreign Currency Transaction" and the "Foreign Currency Service Fee" are aggregated in the New Zealand dollar amount, with the rate of exchange shown on your statement for each purchase involving a foreign currency transaction.

- PayPal and the Prezzycard’s conversion fees are 143% and 89% higher respectively than the lowest available.

Example of foreign exchange charges on a Kiwibank credit card statement, indicating the FX rate, the conversion fee and the transaction fee.

Our advice:

- If you make a lot of international purchases or travel overseas a lot, consider getting a Flight Centre Mastercard, although to justify the annual $50 card fee you would need to spend at least NZ$2,700 on overseas purchases every year to make it more economical than a zero annual fee Kiwibank credit card. The Flight Centre Mastercard also runs in a very similar way to the QMastercard - read our review of this product here.

- Be aware that the 1.85% Kiwibank fee is only for credit cards - you'll pay 2.50% for using a Kiwibank debit card on foreign purchases.

- If you use PayPal, you can save big by avoiding PayPal’s own foreign exchange rates and clicking “convert with card issuing bank”. This dodges the 4.00-4.50% fee and brings the fees down to what your bank charges.

How much money are we talking about?

- The percentages we’re talking about add up.

- Buying something for US$600? You’ll be around $20 better off with a Flight Centre Mastercard than a Westpac or ANZ credit card for example.

- These amounts may not sound like much, but the differences always add up over time.

Christopher Walsh is the senior researcher at MoneyHub, where this article first appeared. It is re-posted here with permission.

6 Comments

Another option if you travel to Australia regularly is to open up a bank account there (f2f with passport or online) and then use an eftpos card (e.g. Bendigo has zero fees for a transactional account). Then use it as storage for leftover cash, and intermittent deposits.

Best to take a mix of options for wider travel - Cash, credit card, & the newer options such as this article.

Interesting, a purchase of foreign currency at a FE dealer is considered a purchase so you could use your 6 month interest-free option on transactions over $250 on gemvisa card etc.

The other consideration is ensuring a clear audit trail for business reimbursement as cash or cash cards can be a problem backing up receipts.

What's even worse is if a foreign currency credit card transaction is reversed, most banks charge the same conversion fee on the amount credited back to your account! So you get stung twice even though the purchase wasn't completed. It's daylight robbery!

Fees as a % of the purchase amount is always a bit dodgy. It doesn't cost the bank any more to process a $1000 purchase than a $100 one, but you'll pay 10 times as much.

There's also an element of double dipping as the banks make even more out of the spread between what they pay for the foreign currency and the conversion rate you get charged. This is especially true if you make purchases on weekends when the trading desks are not manned, the margins are even wider.

But hey they're not a charity and they're providing a service

What about the difference between the actual exchange rate and the exchange rate that gets used. This hidden fee comes in addition to the currency conversion fee. The TransferWise debit card would have won hands down in this comparison. Exact exchange rate + NZD->USD conversion fee is 0.4%.

Except that TransferWise debit card isn't available in NZ yet.

ouch, just a matter of time I suppose before they offer in in NZ

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.