By Brendon Harre*

Many New Zealanders are surprised that affordable housing for all is an internationally agreed upon human right and their perceived right to speculate and make tax-free capital gains on real estate investment is not.

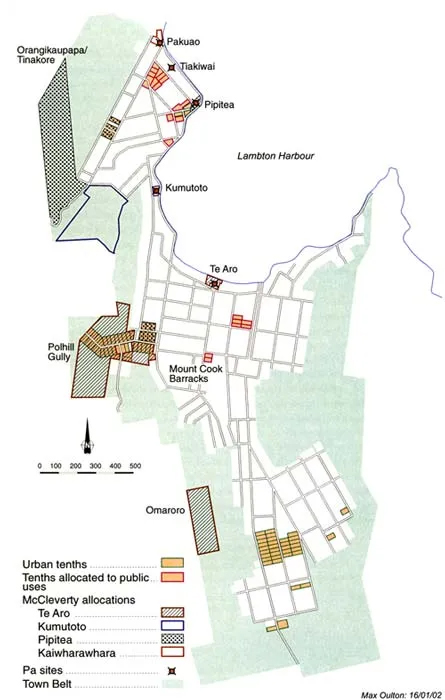

As part of the purchase of Wellington by the New Zealand Company, one tenth of the land titles was to be set aside for Māori. Most of these reserves were never honoured. Source

In most aspects of society New Zealand acts in good faith but the way it has run its land-use policies has such a long history of deceit and speculation that win-lose outcomes have become the default setting.

New Zealand’s mis-management of land-use is so imbedded that honourable win-win solutions are not understood, and New Zealanders are unfamiliar with better ways to manage land-use. This lack of understanding prevents New Zealand from replicating land-use success stories from overseas (such as, Singapore, Japan, Germany, Vienna’s land bank for public good, etc.).

Not understanding the tools for changing land-use has prevented New Zealand cities from reducing their climate change emissions (my hometown of Christchurch is a particularly bad example) and it may prevent New Zealand from adapting to a more dangerous warming world.

Solutions that could have addressed the inequality aspect of the housing crisis have only been partially delivered upon. Meaning New Zealand risks slipping into a classist society based on inherited property wealth.

Currently, New Zealand over invests in property speculation that has win-lose effects to different societal groups. The win-win option of switching capital flow investment to other commercial opportunities has not been chosen and New Zealand’s productivity performance continues to drift behind others.

The North Island’s recent flooding from Cyclone Gabrielle highlights that extreme storm events are becoming more common as the world gets warmer. New Zealand needs better spatial planning and infrastructure provision to manage increasingly volatile water catchments. New Zealand will need to reconfigure its built environments as it retreats from at-risk areas. Central government, local government and the property development community will need to work together better — there will need to be a collective response. What form should this take? What are the underlying principles? Hopefully this article illustrates some of the issues.

It is obvious that the recovery from Cyclone Gabrielle, managed retreat, and greater land-use resiliency infrastructure investment will be expensive. The Reserve Bank Governor has injected some realism into the government-spending-versus-inflation political nexus by explaining that if increased spending is needed then it should come from increased taxation or from spending cuts elsewhere — the government should not borrow to spend. The reason for this advice is because fiscal policy needs to assist monetary policy to bring down inflation. This means the Cyclone recovery will be different from earlier disasters, like the Covid pandemic and the Christchurch and Kaikoura earthquakes which used debt as a recovery tool.

Who should pay? Collectively land owners have benefited from past infrastructure provision and they will benefit from future spending. Land owners should contribute so that prosperity is evenly shared. Yet this will not automatically happen. It will take a cultural shift that even large disasters in the past have not budged.

As long as New Zealand believes that increases in the value of scarce natural resources — like land — belong to the individual title holder and this gain should be free from taxation or any return to the common good then New Zealand will continue to mis-manage land-use. If landholders continue to successfully defend a culture where costs are socialised whilst benefits are capitalised then shared prosperity is not possible (or shared pain if the time of consequences is really bad).

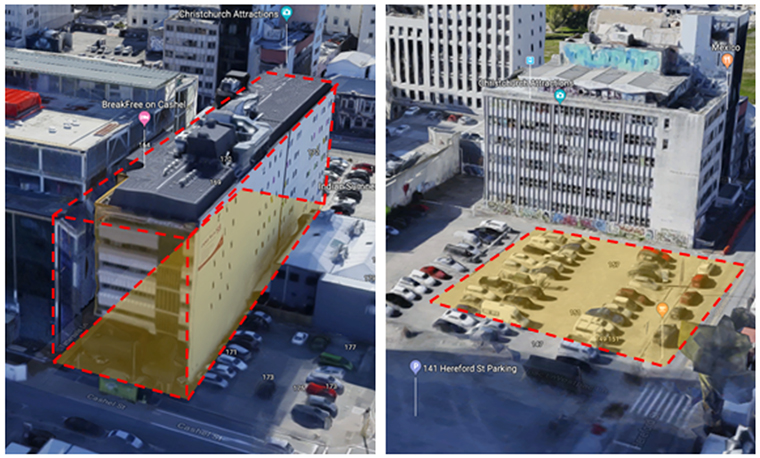

Eastward view from the centre of New Zealand’s second largest city. Twelve years after Christchurch’s city centre was destroyed by earthquakes — why has large swathes of it not been rebuilt? What is wrong with New Zealand’s land-use incentives?

In Christchurch 80% of the buildings in the city centre were destroyed twelve years ago by a series of earthquakes. The rebuild has been slow, as can be seen in the above picture. A significant reason for this slowness is taxation on buildings is high and taxation on speculative land banking is low. Stupidly land bankers are protected and builders are penalised.

The above pictures are about the same size parcels of land within a few hundred metres of each other in central Christchurch. The one on the left has an annual property tax bill of over $150,000 while the one on the right pays less than $15,000. Taxing land owners who build at 10 times the rate of non-builders when a city needs to be rebuilt is stupid.

It shouldn’t be hard from examples like the above to understand why investors in New Zealand focus on land speculation and hoarding real estate rather than investing in more productive opportunities. New Zealand cannot afford to let this nonsense continue yet cultural change is hard, especially when it has had many generations to establish itself.

The bad faith institutional behaviour started in early settlement times as far back as the late 1830s with ‘native tenth reserves’ which if they had been honoured in good faith would have established a win-win precedent. But this did not happen — repeatedly prosperity was not shared and the culture of speculating on real estate dominated.

The Nelson Tenths: counting the cost of a 180-year old broken deal

The seeds of this bitter harvest were sown in 1839, when the private New Zealand Company breached its own standards in a sale agreement between the company and tangata whenua Māori in Whakatū.

The company was operating with the understanding, established by the company itself, that Māori were the owners of the land; that the company would not survey or purchase land Māori were actively using for living, cultivating, harvesting or burials; and that one tenth of all land bought from Māori land-owners would be reserved to benefit Māori.

This tenth was a crucial part of the deal, as the concept the company proposed was that the growing prosperity of the settlers’ land would also enrich mana whenua, and that enrichment constituted part of the payment for the land.

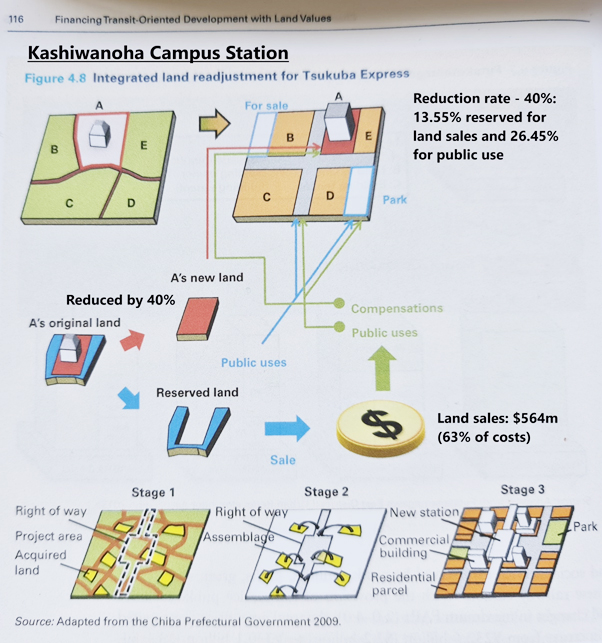

The proposed tenths rule is very similar to the Japanese voluntary land reallocation practice — which I have previously written about in the context of how Japan has reconfigured land-use around new railway lines and used land sales to help fund the infrastructure provided. This infrastructure funding tool works because local landowners essentially trade some of their land in return for better infrastructure and amenities which services the land they keep. This raises the value of their landholdings above what they previously owned. Whilst supplying an increase in well located land to the market. It is a way that incumbents and newcomers can align their interests to achieve a ‘win-win’ outcome. The basic premise of this proposal is prosperity is shared. But that didn’t happen in New Zealand as can be seen in the wealth statistics of Māori versus New Zealand Europeans.

In 2015, Stats NZ found that the median Pākehā had $114,000 in wealth — compared to $12,000 for the median Pasifika, $23,000 for the median Māori and $32,000 for the median Asian.

Since 2015 — including under the Jacinda government — the wealth gap between New Zealand Europeans and Māori has widened further. For example, by 2018 the wealth gap between the median Pākehā and Māori had grown by almost 17 percent to $109,000. Given the explosion of house and land prices because of the monetary and fiscal response to the covid pandemic the wealth gap will have widened even further.

The early Pākehā settlers when they purchased land rarely gave legal title to Māori for the agreed upon ‘tenth’ reserves. They reneged on the land sale agreements to in-effect steal land. An underlying reason for this deceitful behaviour is land speculation was a dominant cultural practice — there was a kind of Ponzi scheme of early settlers gaining title to land by any means possible so they could profit from the next wave of settlers. False advertising to attract immigrants was endemic — the New Zealand Company claiming Wellington had plenty of flat land, navigable rivers and a tropical climate where bananas grow for example.

The very existence of the New Zealand Company only makes sense in that it intended to profit from land speculation. Their good intentions of sharing prosperity would not survive against their greedier speculative instincts.

When Māori became mistrustful and refused to sell their land this was one of the triggers for war against Māori and even more of their landholdings were stolen (often from non-combatants or those who fought for the Crown). In the subsequent years into the 20th century the Native Land Court focus was on divesting Māori from there remaining landholdings rather than assisting them with the prosperous development of them.

For Māori, generations of this pattern of behaviour have made them deeply mistrustful of Pākehā governing institutions. This has been partially redressed by Treaty of Waitangi settlement payments. What has not been addressed is the cultural effect this deceitful behaviour has had on New Zealand’s wider society — the unconscious and institutional biases that prevents shared prosperity land-use policies from being chosen. This is important because as the saying goes — culture trumps strategy, every time.

A win-lose pattern of deceit, speculation and mistrust was established that continues to this day. Initially between Māori and Pākehā in the 19th and 20th century but now extending to those with property wealth versus those without.

For periods of time New Zealand has had more enlightened land-use policies. The Canterbury province in effect had a public land bank which they used to fund major capital works like the Lyttelton rail tunnel. The 1890s Liberal government instituted a nationwide land value tax which raised the holding cost of land not put to its best use, which would have reduced land speculation and help speed up the transition from large wool estates to smaller yet more productive dairy and lamb farming units (NB: this nationwide land value tax was whittled away with various exceptions and finally abolished in 1990). The first Labour government in the 1930s to 1950s built state houses where the rent was a fixed proportion of the average wage. Even Michael Cullen’s creation of KiwiSaver in 2006 can be seen as an intervention to wean New Zealand off its addiction to speculative property investment.

Unfortunately, none of these interventions have been long lasting or fully transformational because vested interests fought back so that speculative property investors were able to socialise infrastructure costs onto others whilst ensuring the resulting increase in land prices and gains from land supply shortages remain tax free.

This is extremely costly to the social structure of New Zealand. There is a thought that the rise of populist extremism in New Zealand has a root cause in society poorly managing a changing world and the consequent rise in wealth inequality. For example, the fully grown man living with his parents because he cannot afford his own home who seeks an answer on social media becomes vulnerable to rabbit hole conspiracy theories (it is easy to whip up scepticism, denial, and alt reality thinking).

It is my contention that New Zealand institutionally has not learnt how to move on from its culture of deceit, speculation, and mistrust in its thinking about land-use policies. This means government initiatives like implementing a wealth tax (the efficiency and inequality benefits of switching more of the tax burden from income to land are overwhelming), KiwiBuild, the proposed co-governance reforms, three-waters reforms, Auckland Light Rail, and so on, were not thought through from first principles and consequently have become politically difficult to deliver.

New Zealand is stuck in a phase of institutional inertia with risk adverse politicians and officials. As MP Chloe Swarbrick commented about Auckland’s recent floods — “there has been a complete abdication of responsibility… I’ve definitely seen over the past few years that we have continued to build out our bureaucracies at every single level of Government to effectively be super risk-averse… The point here is that the individuals who are in the business of calculating risk warned politicians that there was flooding risk on the horizon amid the growing prominence of intense weather events — and very little was done.” I would argue that despite an expansion of governance bureaucracy that their ability to deliver genuine change has been reduced to a ‘yeah-nah’ cultural response.

How to move forward? Obviously shared prosperity is critical, and I would say that sharing includes with future generations. New Zealand needs something that the Irish economist David McWilliams calls Cathedral Thinking.

The people who built Europe’s gothic cathedrals knew that they wouldn’t be around to see them completed. They were building for people yet to be born. This is what we need to build livable cities right now.

An important aspect of Cathedral Thinking is its commitment to practical excellence. It may have taken time — but Cathedrals were delivered. They weren’t an abstract concept talked about by the professional management class in a far off capital city or an undefinable marketing term to gaslight the masses — cathedrals existed in real life (IRL) and they were the best buildings man could build at the time. Land use policy reform should deliver that same on-the-ground excellence that benefits future generations.

Shared prosperity is also more about predistribution rather than redistribution. As the bible preaches — it is better to teach someone how to fish than to give them some fish. Predistribution has the same ethos. It is about ensuring the conditions are such that more people can achieve prosperity rather than redistributing the prosperity after the fact.

If predistribution and shared prosperity are achieved then the social determinants of poor health (plus poor education and other important social indictors) will be reduced. This is a significant advantage of predistribution. It reduces the need for redistribution.

A further part of the win-win shared prosperity concept is community land value capture to fund common good infrastructure that provides a land supply that everyone can share the benefits from. There are different techniques of value capture, such as, land readjustment, public land banks, and land value tax — that all have a Georgist aspect about them.

Georgism is an important economic philosophy dating back to the self-taught US economist — Henry George. He described in his book Progress and Poverty (most published book in the 1890s other than the bible) that property rights lack a justifiable moral claim in situations where the value is unearned i.e. not the result of someone’s labour. George advocated for democracy and human rights to counter the natural tendency of capitalism to become entrapped by vested interests and inequality. He is most well-known for promoting land value tax.

Georgism describes the political-economic divide as not between labour and capital or between big government/high taxation versus small government/low taxation, but the divide is best described as supporting both labour and capital and opposing the unearned increment gained by landowners and monopolists.

Stephen Hoskins, a New Zealand Georgist advocate was recently interviewed on an Irish economic podcast discussing YIMBYism and land value tax (LVT) in a show titled — Reframing the housing crisis. This podcast expands on the importance of Georgism to the problems that New Zealand, Ireland, and elsewhere currently face.

It is hard to see another policy-area more needed in New Zealand than land-use reform. Failure or success will affect our safety in a volatile warming world, it will affect our social fabric, and our future shared prosperity.

The government’s Resource Management Act (RMA) reform process has eased some planning related land-use restrictions — minimum car parking requirements were eliminated, taller and bulkier buildings around high frequency public transport was upzoned, and in the largest towns and cities building three stories and three dwellings on most sites was allowed. But the reform process did not consider alternative infrastructure funding options, incentives for local government to create better district plans, or how taxation affects land-use. Because the full range of relevant factors have not been considered it is debatable how effective the RMA reforms will be. Especially as New Zealand’s underlying culture remains unchanged. Land bankers, NIMBYs and similar vested interest groups seem as powerful as ever. It is quite possible the recent good intentions to reform land-use will face a cultural backlash causing them to be rolled back like previous land-use reforms.

Hopefully the cultural backlash is not effective. There are signs that New Zealand could go further with land-use policy reform. Some of New Zealand’s smaller political parties have interesting reforms in the land-use and property wealth space.

The ACT party proposes central government shares some of the construction related sales tax with local government as an incentive for local government to implement better land-use policies.

The Green Party proposes a 1% wealth tax on those with a net worth of greater than $1million.

The TOP party have the most insightful and comprehensive land-use and housing affordability reform package — especially with its tax switch proposal of a $6.35bn income tax cut that is funded by implementing a nationwide land value tax. This proposal would significantly reduce land speculation and help speed up changes to land-use that are needed for environmental, equity, and productivity reasons. See here for the full economic analysis of how this tax switch would affect individuals and groups — notably someone with the median combination of income and land wealth would enjoy an annual net tax cut of $1,300. Those groups like Māori with less than average wealth will of course receive a larger tax cut.

This is a repost of an article here. It is here with permission.

63 Comments

Love TOPs proposal. Bring on the LVT!

NZ already has LVT, it's called Council Rates.

True, but to local councils running costs only and very light and low compared to the other 1st world contemporary countries.......

? Is NZ still 1st world? Probably just.

The Central Govt will need 10s of Billions......so LVTs of 1 - 3% required?

It’s not land value it’s property value. The worse you use your land the less you pay.

.. and that is the crucial point : council rates discourage land & property improvement ... the more your rateable value goes up , the more you pay ...

Whereas an LVT has the opposite effect ... it punishes landbanking , and encourages the most efficient use of land ...

Agree.

Yep. Brendon's first graphic is a perfect illustration of this.

Rates can, but are not always, levied on just the land value (which doesn't include house/improvement value).

You highlight that Councils already have the mechanism in place so they could implement the Land Value tax half of TOP's tax switch proposal with minimal cost. IRD could likewise add a 15k threshold with a 0% rate in their system easily enough for the other half of TOP's policy and we'd be seeing the benefits flow almost immediately if not before (based on expectation of the legislation being passed).

TOP's tax switch has to the easiest policy to implement around and yet it comes with the largest society wide benefits.

Agree.

We can write endless articles about how we need a land tax and change our relationship to land. The results will push us towards productivity, which is all that matters in the end. Unfortunately, the conservative land speculators appear to always win the argument, so keep meaningful change out, so they can continue to enrich themselves at everyone elses expense.

I don't think land speculators win the argument, they have held power though and kept change out as you say.

I think voters have to take more responsibility (yes, they have been lied to by red and blue alike) but there have been alternative parties on the ballot sheet for some time and the same illogical excuses come out such as my family always votes red, or, I don't want to 'waste' my vote (so I'll vote for an equally poor red/blue policy instead of a good policy). I cannot think of a more fair and just policy on offer than TOP's taxation reform policy.

Completely correct. Closed-minded thinking and lazyness is the downfall of NZ when it comes to voting for the reasons you have explained. Educate everyone around you and get them thinking for themselves instead of relying on what their parents thought or what benefits only them most. Let;s build a better NZ

Good article!

As ever , Brendon , you nail it perfectly .... the concept of pre-distribution will be so alien to Kiwis who've been encouraged by equally useless successive short term " what's in it for me " Labour & National governments ...

... we need TOP and ACT to gain more traction on Ocrober 14 ....

We need to care deeply about future generations , and to lay down a framework which empowers the greatest number of our citizens .

Here I was thinking mass immigration, banks chucking free money at anyone that can hold a pen and deliberate policy to trash the value of currency was to blame for the property bubble?

Also speculators' entitlement mentality

Ok, question/s.

You own unused land that is taxed at the new land tax rate to encourage you to develop it, or sell it to someone who will.

But the reason you have not developed it, is there is no market for anything that would be built on it, given the cost of construction etc.

Plus if you are forced to go through the monopoly consenting, and infrastructure providers, you can't develop at the market rate of demand even if you wanted to.

Yes the value of the land can be discounted back to try to make it more affordable, but since everyone with this type of land is doing this, then the market could/would be flooded making the cost of development higher than the value, so there would be no point to build, ie a greater loss on top of what you would also be taxed by. This fact doesn't change whoever the owner is.

This of course impacts the value of all existing buildings, which with everyone having a lower value would also lower the rate of tax collected. Or is it envisaged the tax has a rachet clause?

How are these issues addressed?

In mature markets that have a land value tax, this is not an issue, but how do you change horses mid-stream without everyone taking a bath?

But the reason you have not developed it, is there is no market for anything that would be built on it, given the cost of construction etc.

Then you sell / give it away (not unlike some leasehold properties where the ground rent has become too much). I'm guessing there would need to be an option to be able to return it to local/central government. With time I would expect the Land Value of such land to trend close to zero anyway so the tax due would be small.

This of course impacts the value of all existing buildings, which with everyone having a lower value would also lower the rate of tax collected. Or is it envisaged the tax has a rachet clause?

I would expect the overall total value of Land in NZ to decrease, as you say this would decrease total tax take and therefore the rates would need increased to continue funding the 15k tax free income. This overall decrease is desirable to my mind because future land (and home) owners will have to borrow less in total = less interest and repayments to banks = less bank profits should be going overseas (loosely speaking).

So what what you are saying is this is a Govt. Land grab by stealth.

And the whole point of the land tax was to trade off personal tax for an increase in land tax so land gets developed.

The consequence could be nothing more gets developed and land values fall but Govt. Revenue increases just by them having a rachet clause.

So what what you are saying is this is a Govt. Land grab by stealth.

No. The gifting option was only a suggested solution to your question about land that was uneconomic to do anything with.

the whole point of the land tax was to trade off personal tax for an increase in land tax so land gets developed.

Agree with this being the point. If you accept a government will rase x tax dollars, I want it to be raised via a land tax so that people don't seek / hold more land than they need to encourage home/land ownership being affordable.

The consequence could be nothing more gets developed and land values fall but Govt. Revenue increases just by them having a rachet clause.

It could mean nothing more gets developed but I don't think this is a logical outcome. As the land price falls, the same section + house cost also falls, this means people currently locked out of buying at the margin can now afford to buy because developers that buy cheaper land can afford to build at a lower total price point. Existing land holders will take a loss in capital value, they can decide the best exit (sell or build and sell or just subsidise income tax reductions by stumping up the annual land tax).

A rachet clause implies it only goes up - I don't understand why you would assume that. I do see the land tax rate needing to be changed based on how much revenue is desired to be raised relative to the land vales. But that is no different to any other tax rate that changes (eg GST, income tax thresholds and rates). If the government wishes to raise more total tax dollars, then it will still have to explain why and/or face the consequence. Current TOP is proposing a neutral tax switch so overall no more tax taken.

It can't be tax neutral if they don't collect what they want through the land tax.

And it doesn't work by making people develop land with no market or infrastructure available.

TOP need to explain how this all works.

It can't be tax neutral if they don't collect what they want through the land tax.

True - of course it would be near impossible to exactly match the land tax collected to reduction in income taxes payable on an annual basis - the difference could be borrowed/repaid as required from year to year.

And it doesn't work by making people develop land with no market or infrastructure available.

No one will be forced to develop anything under TOP policy (encouraged yes - due to larger holding cost). They may hold it or sell it as is the case now. However, they will pay for the privilege of ownership should they choose to keep it. If no market or infrastructure then the Land Value will be low, therefore the tax will be low. They may challenge the land valuation if they think it is too high as is currently possible.

TOP need to explain how this all works.

Council adds an extra line on the rates bill for LVT, passed onto government. IRD changes income tax system to have a rate of 0% for the first 15k. Government borrows/repays the difference as impossible to be 100% accurate in the offset as you point out. Land Values will move and as such the rates will likely change due to this but it's not like we have 100% accurate GST or PAYE tax takes today so don't see why LVT needs to be. What else is there you'd like explained?

'TOP needs to explain how this all works'

So you are the official TOP spokesperson on this?

Besides missing what I was asking about, especially the likes of land where infrastructure and consenting are not readily available? And it has nothing to do with rates.

'TOP needs to explain how this all works'

I've explained the practical implementation of how the tax could be levied (via Councils) and returned (via IRD). Perhaps you could define what you mean by 'all' as obviously you had something else in mind. TOP needs to explain how it would implement it (I have), why it would be better than the status quo (I have), what the consequences might reasonably be (I have). If you think NZ would be worse with the TOP taxation reform, would you care to explain why?

So you are the official TOP spokesperson on this?

No, I've met Raf at the AGM and a couple of meetups but not anyone else that makes the policy. Other than telling Raf what I think (TOP should only have a few policies and they should be simpler) I've had no input. I am however a longtime advocate for a land tax and think it would greatly help quality of life in NZ by making housing more affordable amongst other downstream benefits.

Besides missing what I was asking about, especially the likes of land where infrastructure and consenting are not readily available? And it has nothing to do with rates.

Yes, I've been reading your posts with interest for years and generally find myself nodding along, so I think we are talking across ourselves.

TOP's tax switch policy, which I have been advocating for, is not intended to magic up infrastructure and consenting. Where it isn't available it will still not be available, but the price of the land should be low in such places because of it. Where it is available the price of land should be high(er). As such, the land tax would be higher too and hopefully a material annual reminder to the owner to consider doing something with it. Specifically, developing it or selling to someone else that might be keen on developing it. I think you're probably looking answers to questions a land tax never holds itself out as providing.

I know how it would be implemented, my concern, see my reply to Brendon below, is that good intent is not enough. We have had spectacular policy failures in recent years/decades because every Govt. seems to be blinded by its ideology, rather than a bipartisan look at the evidence.

I emailed ACT twice now (National, Labour, Greens etc. are a lost cause), to follow up on some questions I had about the implementation of their housing and land use policies, but have heard nothing.

All I can imagine is them sitting there, scratching their heads, going, 'shit we had thought of that.'

A LVT is a good idea, but as I said, because we are in the situation we are in, it is the equivalent of changing horses midstream. I am asking, how do we make that change without the economy falling into and going underwater?

The answer might be to just let that happen as it is just a case of when not if. But it is usually said by people standing on the bank hoping to get ownership of the horse.

But note, I don't know of any country in the world that has unwound a dysfunctional housing market without causing a lot of pain.

It's not just about trading one badly implemented plan with another.

Thanks for that Dale, I appreciate and I'm slightly honored to have engaged with you in this thread being a long-time reader but more recent poster.

It seems we may agree on the potential of the LVT after all. I don't see it as changing horse midstream, more like we've gone down the wrong fork in the river over 2 decades ago and yes it will cause pain to reform the taxation system to those leveraged into multiple properties, but it has to be done at some point.

Delaying the pain for some (leveraged existing land holders) has been inflicting pain bit by bit on the younger/next generation. Then we wonder why they leave in droves or give up on society in other ways like not working, commit crime or substance abuse.

I don't see LVT as being a catalyst for the economy for falling into and going underwater as you do though. I see it as improving society fairness (penalty for accumulating houses past the one you live in) and promoting desirable outcomes such as working (you keep more of what you earn, higher home ownership rates, lower financial stress due to lower home prices). The economy should be better off as overseas owners now have to contribute to general taxation by paying for their empty houses in NZ and then of course those houses that are rented but 'outside' the IRD tax system will now have no way to avoid the LVT. As we expect the land price to decrease, new FHB's will by definition have to borrow less = less interest paid = less profit heading to overseas banks = more money to spend locally. So, I see the introduction of LVT as a good thing for the wider economy.

I honestly don't have the experience to comment on the details that yourself and Brendon do at the local government level. I absolutely agree there are things there to be improved from reading posts here over the years - I just don't see a problem implementing the LVT and tax switch in the meantime.

In terms of TOP the political party, I think they should be focused on high level directional questions, eg tax land or labour (I say land or at the very least both). Why is NZ increasing population at all, let alone if we cannot free up enough land to house them? Should we be undertaking the more difficult task of pulling people off the human scrap heap of beneficiaries as opposed to attempting to 'strip' other countries of their best and brightest that raises housing demand in the first place? I think it's a mistake for TOP the political party to go into detail like they have done on many policies - they should sell a vision of what they want for NZ and that is a fair and caring society when the average person isn't going to be still paying off the mortgage at retirement age.

Regards,

Murray

Selling a vision and getting the big directional messaging right is excellent advice for TOP. Good stuff Murray

Thanks Brendon.

Excellent to see rationale thought and intellectual debate focusing on the future :-) Great job guys. Housing speculation: Not Our Future

Geez man, you set up a rare case strawman, then said it would be applied everywhere?

Dale if there is no market for land to be developed then it's land value and its land value tax will not be high.

Brendon, it doesn't work like that, otherwise given there was a market for housing etc, then it would have been met, but it wasn't. And now that there is less of a market, they are still building to oversupply. The reason is that the demand and supply cycles are countercyclical because of all the restrictions in the system.

I'm all for an LVT, but it won't work just by itself, as all you are doing is forcing a release of a STILL restricted supply without removing the rest of the restrictions that encouraged them not to develop in the first place.

It would be easier to have far fewer restrictions, so the market had more choices and which in turn would bring pricing down.

It's a red flag when Govts. reach to the tax stick, rather than other encouraging forms of behaviour.

Dale I think you are cherry picking/ straw manning my article. I never said LVT is the only factor inhibiting land supply and in fact I detail a number of different factors - infrastructure, planning permission, YIMBYism vs NIMBYism etc. But mainly this piece is about how the culture of NZ developed and is maintained so win/win solutions that would help resolve these land supply issues are not understood or implemented.

I was just replying to your comment about no market no build.

And my question is to TOPS proposal, not your article per se.

I think TOP still needs to work on its policies for incentivising local government having more permissive district plans. They have ACTs policy of giving some construction related GST to LG which is a good incentive.

I think LG also needs to take rates off capital value as another incentive to build. TOP (or another political party) could have a policy of providing better LG infrastructure and financing tools in exchange for LG removing capital value rates (so only having rates on land value).

And that's the point.

All policies make the assumption that if they implement something 90% of the way(nothing is perfect is the argument), then they will get 90% of the target. Sort of like Labours Zero road death policy as a target, assuming as they do, it will get them closer to fewer road deaths. Or are they really aiming for a zero policy like Covid?

Their logic also follows that if a car goes 100 km/hr on four wheels, it will do 75 km/hr on three wheels.

LVR works in countries that use it, because they either started using it as general policy from the start with what else they did, or when they did make the change, it was not by itself and any pain they went through, is a distant memory.

But the general attitude with many of the comments here is that just implement one particular change and nothing happens with the rest of the economy or their lifestyle.

What some are calling strawman arguments, are the same people that come back later and talk about unintended consequences.

No policy is ever going to be perfect, expecting it to be so from the start is kind of laughable. It's how policy works, you implement something to target 90% of the problem and over time modify it as people poke holes in it. For reference, see almost any law ever written in this country and their subsequent amendments.

When it came time to actually write the law around LVT, you could have your input to ensure it doesn't have some of the small problems you are taking issue with. That's why they go out for consultation and have review committees and cabinet etc to review a written law prior to its implementation and take valid feedback into account.

There is a lot of 'unintended consequences' and ' we didn't see that coming,' hiding behind the excuse of not doing the right thing, and that close is close enough.

For those in the industry, it's plain to see where the issues are that prevent success.

For somethings you either do it right or go home.

The chasm they stand before from where we are and where we need to get to can only be made in one leap.

Not two steps or more as they are trying to do.

An LVT is only half the answer.

Show me where anyone said that LVT is the golden panacea , the answer to all that ails us ...

... as a nation where precious little tax is taken from asset owners , LVT is just one step to redress the tax balance between income earners & asset holders ...

Why is this simple concept so hard for you to grasp ?

No one has used the words 'golden panacea, so not sure why you are asking.

BUT most have only mentioned LVT in their replies without giving any qualifier to that being only part of the answer.

Because many do think it is that simple.

And without the rest of the 'package' it is no answer.

And you will see that I said I agree with a LVT, as part of a complete package.

... you seem confused ... we're all mentioning LVT because that is the premise underpinning Brendon's article ... did you read it completely ?

LVT is a very efficient tool to redress the shocking imbalance in NZ between taxes collected off income tax workers & businesses , and passive asset holders ...

What further " package " do you need ?

Dp

Although I like that TOP has taken the first step toward a LVT - I think as the idea matrues we can improve on it.

A very clever urban LVT would set a dollar value per square meter on central city land (with lower per square meter the further away from the CBD one goes), and then reduce that per square meter land value tax, the more intensified the building on the land is.

For example, if folks in the leafy green single dwelling suburbs want to keep their low density neighbourhood, they pay the highest per square meter LVT rate (an empty section would of course be marginally higher) - whereas - should an owner choose to build a multi-story development on that same land, the land taxes per square meter reduces with each additional story added to the build.

It would encourage intensification from the CBD out.

High LVT percentages per square meter at the centre and lower per square meter out from the centre. Reducing LVT percentages as intensification on a particular parcel of land increases.

Huh? The tax they are proposing is a Land VALUE Tax. In general land closer to city centres is more valuable, so what you propose is already built into their LVT and is exactly why its a good solution because it does exactly what you propose it should do: "It would encourage intensification from the CBD out."

No changes required.

Agree - no changes required. I think Kate is looking to supercharge the LVT according to desired outcomes, my only concern with that is desired by whom? I like the idea that the market sets the price of land according to amenity and the LVT is kept simple so the majority can understand it. Either that or I'm just too lazy to think about it.

That said, I'm sure what she suggests would be possible like her excellent method of how rent controls could be introduced to remove the accommodation supplement.

.... yes , the beauty of a LVT is how simple it is to apply ... and it goes across the board ... no one is exempt ... no one can avoid it ...

And all those $ billions from the wealthy can be directly applied to drastically reduce PAYE income tax & company tax rates ...

.... in time , WFF could be completely scrapped too ...

I would love that in the long term NZ did not need the Accomadation Supplement and WFF. That these were replaced by tax cuts at the bottom of the income spectrum and a UBI. And it was LVT and housing/rental reforms that allowed this transition.

I would love that in the long term NZ did not need the Accomadation Supplement and WFF.

Both are band aides to a fundamentally broken system, and that's before we consider PDK's road.

LVT and housing/rental reforms that allowed this transition.

To me sorting out housing affordability (biggest cost of living, lack of security and feeling part of society item) is the key to then being in a position to take on other issues (crime, environment, health). I know they aren't mutually exclusive, but so much money is going into unnecessary land costs (rent/interest on loans to buy land often sent overseas as bank profits). This is where I think TOP are failing, they aren't focusing enough on the benefits of sorting out housing affordability (also security of tenure which is MIA now) and therefore the message is being blurred. And housing is so easy to make affordable with strokes of a pen, climate change etc. are not but if they won't be sorted while half the population struggles from payday to payday relying on AS and WFF.

Beautifully put GBH.

Might as well prepare to have me up for plagiarism of your poetry in the future - I simply cannot put it any better than you have here.

I find it a bit strange that Labour is not advancing a LVT given their position on many matters. Maybe they will, although I wouldn’t bet the house on it.

... they're permanently fixated on trying to slide a CGT through ... regardless of overseas evidence that it's pretty pathetic at equalizing the tax balance between jobs/businesses & assets ...

It's a permanent mental road blockage to Labour being able to free think about wealth tax alternatives ...

Best thing they could do is quietly stand aside in Ilam - with a nod and a wink.

LVT via MMP.

TOPs package on tax and housing is a much better policy than the Green's wealth tax.

.

... agree 100 % , that'd be a nice act to assist TOP

As if anyone would miss Jumbo Gerry anyway ....

Indeed, the Greens wealth tax is mired in redistribution ideology, it doesn't really work the way they think it will. Most of their economic/tax policies will make us less productive but support low/no income households more.

For anyone wishing more information on Cathedral Thinking, take a look at www.cathedralthinking.com for context, perspective and a host of other uses.

Nice article Brendon - I read your stuff on twitter too, always on point.

Firstly, LVT is by a distance the obvious next move for the NZ tax system.

My challenge is on the 'LVT to pay for flood repairs' argument. I would make the same challenge on the Green Party 'tax the fossil fuel companies profits' proposal.

The argument against financing the flood repairs via increased Govt debt is based on the premise that any additional Govt spending in the current environment will inevitably be inflationary. Now, I don't buy this, but let's roll with it for a minute.

Why would Govt spending be inflationary? The idea is that Govt would be bidding against the private sector for a limited supply of goods and services (e.g. civil engineers, tradies, building materials etc). This would lead to price rises as demand exceeded supply.

So, would financing the recovery from an LVT reduce this risk? No. In fact it could make things worse. LVT incentivises land bankers to get on with development - i.e. to go out and secure the engineers, tradies, building materials they need - the very things Govt needs for the recovery. Would a windfall tax on fossil fuel companies or banks be any better? Not really, taking money off rich shareholders might impact their savings, or slow the flow of Teslas into the country, but will it free up the real resources (people and materials) we need for the recovery? Nope.

So, should we go for a LVT? Yes. But, should we penalise landbanking if we need all the tradies, engineers, etc on the East Coast? I'm not so sure - sounds like it might create exactly the kind of bidding war we need to avoid. As ever, we need a coherent strategy, and, as ever, we will muddle through instead.

If LVT was used to pay for the Cyclone Gabriel then it can't be used for the tax cut. So for instance the $6bn tax revenue from TOP's LVT proposal could come first and the tax cuts could come 2 years later. That would mean there is an extra $12bn available for recovery spending. Funding this spending from tax would be less inflationary than borrowing $12bn for the recovery.

Funding this spending from tax would be less inflationary than borrowing $12bn for the recovery.

That depends on the tax. We need to 'make space' in the economy for the necessary construction and infrastructure projects - that means using taxes or other policy / regulatory tools that reduce demand for the skills, people and materials we need for those projects. If your choice of tax mainly reduces the net worth of people who can afford to carry on spending the same amount into the economy, what does it achieve in terms of reducing aggregate demand? If your choice of tax actually incentivises building work (net) then it is potentially inflationary in the current environment (at least in the short-term).

As per my comment below, I am not saying 'don't do it'. I am saying we need a more coherent strategy.

A LVT is paid by land owners as soon as it is implemented which reduces their spending capacity. Borrowing reduces future spending when it is paid back. So borrowing for civil works construction is more inflationary to the whole economy than using LVT to fund that construction.

But I get your point that LVT may make construction bottlenecks and inflation in the sector even worse in the short term. Over time the sector would adjust to the new tax conditions.

There will never be a good time to make change for <insert any reason here>.

Maybe I wasn't clear enough. I would absolutely introduce LVT today - but it needs to be done alongside supporting policies to prevent extra demand for limited civil engineering and construction capacity driving up the cost of essential public infrastructure works (like the flood recovery). My personal preference, which may be unpopular, would be to take control of the building materials supply chain for the next few years and secure our construction resources in the same way that the US and UK secured manufacturing capacity in the second world war. If we have an infrastructure crisis, let's declare war on it.

I would like NZ to have something like the Ministry of Works again. Contracting everything out is not working. We need some in-house expertise at the hands-on construction level IMO.

... exactly , Mr b ... let's just carry on as we are , because it's working so fantastically well for us ... not !

There was a time when pollies had some guts , and came up with transformational policies which benefitted us ...

... now they're content to twiddle with the dials ... or , they're foisting some ideologically driven BS on us that none of us asked for nor wanted ...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.