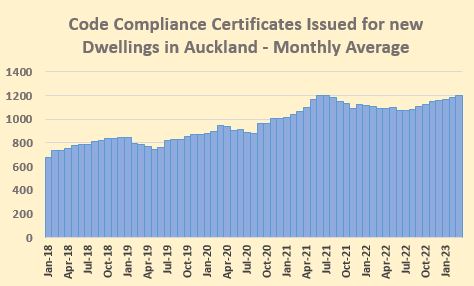

The number of new homes being completed in Auckland remains at record levels, in spite of the fact that the number of residential building consents being issued in the region has taken a dive.

Auckland Council issued 1482 Code Compliance Certificates (CCCs) for new dwellings in March this year, which was the third highest number in any month since the Council began collating the figures in their current format in January 2013.

CCCs are issued when a building is completed, so are the most accurate indicator of new housing supply, unlike building consents which are usually issued before construction commences.

Although the number of new homes completed in Auckland in March has been exceeded twice before, in November 2020 and June 2021, the total number of new homes completed in Auckland in the 12 months to March (14,321) and the rolling 12 month average (1292 - see graph below) both matched the previous record high set in June 2021.

The new dwelling completion figures are in stark contrast to the building consent figures for Auckland, with the number of new dwellings consented in the region in the first quarter of this year down 19.2% compared to the first quarter of last year, suggesting a looming downturn in residential construction.

The high CCC numbers suggest building companies and their suppliers will have been kept busy with residential work already in the pipeline, but may find it more difficult to find new projects to take on as existing ones are completed.

However some of the slack created by the downturn in consents is likely to have been taken up by post cyclone recovery work, which could make the economic effects of the pending downturn slower to show up in areas such as employment.

In the meantime though, the supply of new homes in Auckland continues to roll out at pace.

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

45 Comments

Thanks to Megan woods late run at the housing crisis.

How many sold?

Immigration won't save this expensive cluster.

I wouldn't call it a late run. How would you describe the Key governments efforts? A dismissal or if you were honest you might admit they caused the problem.

No stats on how many of these new builds presold, how many to hit the market??

New build town houses seem to be in the majority if you look at new trademe listings. Hopefully the days of buy, quick renovate and sell are over for ever.

According to this article Australia's homeless rate is about four times that of New Zealand's.

https://independentaustralia.net/politics/politics-display/urgent-need-…

From what I can see driving around Auckland, a lot of townhouses are near complete, few are in the early stages of construction.

Gonna be a lot of idle hands in the sector soon.

Yeah I tend to agree. Although potentially development stacks up more now than 12 months ago as developable properties are selling for way less and the demand for construction labour and materials will be much lower so less delays. Of course the lending will be much harder to get and pay.

Yep, the lending will be an issue. The other things going in a favourable direction as you say.

The key issue in the next 18 months is how many companies will survive, and how many workers will leave the industry. Because we could easily be back to square one again with capacity and costs as companies fold and workers leave.

Boom bust boom bust boom....

Its so hard for political parties to understand and stop our economy repeating the mistakes of the past hey.

And not a few sitting there with plastic wrapping blowing in the wind too.

Like a runaway freight train. The front end has come to a stop buried in the embankment, but the rear end is still closing in with a lot of pent up energy..

Amazing to think we are at record completions and not keeping up. The issue underlying this is something like 11% I believe of adults dont work but our unemployment is 3.4 ish?

Perfect for new bus drivers, teachers and police, except they cannot afford them....

There's always renting off those that can afford them...

Step up and buy a couple Nifty, there is no Queue.... You will have to top it up quite a bit... Would thing you and HW2 would be maxed out but anyway now I guess you are even more bullish... I have looked and I cannot see how to make a profit with all the tax... do you have to have capital gains to make money?

I have looked and I cannot see how to make a profit with all the tax

That's because you need a mortgage at current high interest rates. Although you deny it. For those with a cash pile interest rates and tax deductions don't affect them. They still get the other write offs allowing them to pay less tax. They will be looking for properties with a twist like big land, so that if the brightline gets removed, they can sell next year.

Lets say I buy one at 900k it rents for say 900pw

rent 46.8

less rates at 2.8k

Insureance about 1k

thats 43k (assum full year rented)

so thats a 4.77% yield , I can get 6% as the bank... so the different is 1.23%, I need to CLEAR 11k cap gain a year to be equal to a term deposit

I sell I will be out 2-3% ie 2-3 YEARS of cap gain real eastate fees

whats your magic sauce HW2 how do you make a profit here

Such a short term thinker IT GUY... also, can you tell me how much tax you pay of that 6% term deposit, what will term deposit rates be in 1 year... what's inflation % at currently too?

The same ammount of tax I will pay on the rent from the house IE i pay top rate on the 6% TD or top rate on the 43k income from the house. Inflation is running 6% ish on the TD, house price deflation running about 16%pa

When do we see the double , when does my townhouse get to 1.8mil? who would buy it off me at that price once DTIs come in at 4.5.... assume a 300k deposit thats 1.5m / 4.5 = 333k income... not sure someone on a 333k income will want to buy the overpriced shitbox on 230sq m in the back of milldale..... can you even get milldale at 900k, maybe flatbush, yeah executives LOVE FLATBUSH

Nothing adds up HW except your magical long term future thinking..... I call bullshite.

Yip and so if wages have to approx triple to get to this 333K income point (say from current average joint household income of 120K ish), it means that we've had extremely high inflation in the economy - the result being interest rates will have been going higher, not lower over that time period.

40 years of falling interest rates and rising house prices gives way to a fixed way of thinking that is going to be very hard to adjust going forward. i.e. prices can't fall because they never really have meaningfully. Well it is possible we are at that crossroads now.

They will be looking for properties with a twist like big land, so that if the brightline gets removed, they can sell next year.

This takes them completely out of ther new build market. Thus investors will not ride to the rescue, we will need FHBers and they cannot afford them... Re the rentals, nah investors chasing free cap gain via sub division, still this is speculative gain, not yield based....

So you aren't paying tax on that income then? Or is it 0?

you will have to pay tax on the term dep or rental... assume same marginal rate...

what's your magic sauce HW2

having already stated above what others are doing, can you please learn to read properly as well as learn to spell loser

So buy land to speculate - are you saying its impossible to come out positive without speculating on future capital gains?

Sounds like gambling not investment... if you cannot see a for sure profit on a spreadsheet

I suggest you remain Abscent from the Market.

Oh I heard someone crowing about using that secret sauce in one of the eastern suburbs like Glendowie to make millions. I didn't think at the time that they were speculating and carrying on a taxable activity, perhaps you are right

Small point that doesn't really alter your conclusion, but the rates and insurance (as well as repairs and maintenance) are tax deductible.

I know what I would be doing now .....

https://www.youtube.com/watch?v=6MneA9pgLVw

...and at 6% why wouldn't ya ....or are you waiting for that magical "capital gain" beanstalk to grow in your back garden again ???

keewees still believing in the tooth fairy ...

If an immigrant could afford to buy a property in the AKL, you can be sure NZ will NOT be first on their list for migration ....it's always the good 'ol USA , then maybe the UKaay, Canadia or aussie .....THEN that little place to the east of aussie.....

ya can only put those rents up so far peeps !

anyway way more important things to be concerned with ....anyone heard of a debt ceiling or inverted yield curves ...my fave is the 3 month 10 year ...that baby is a dozee !

The S will HTF when everyone thinks those yield curves revert back to normal ....... but dat is when the fun starts !!!

Yee Haaaah say the "Crazy Horse" !!!

somebody has to buy them to then rent them!

Why subsidize there rent.... and lose about 1k a day last month as well.... seems crazy loss making in every way, can someone post a quick analysis on what price would be required to just break even... though who risks such a purchase without a clear plan to make money?

The numbers are out of whack EVEN after 25% falls, oh well take another 25% off....

All the people getting lending from the banks at present to buy rentals?

Or are people who actually have money (not debt) going to take their cash out of 6% term deposits (with a guarantee to the return of their capital in 12 months time) and gambling on it by receiving a 3% yield on a house that's capital value is current falling 15% p.a. with further downside risk?

Buts it’s guaranteed to double in value in 10 years remember.

Thats true I forgot about the double smirk smirk...

Had an interesting conversation with our bank last week re: potential borrowing (in the future when we find something that's not a leaky home on special...)

Their numbers lined up with ours, but - they're not doing pre-approvals because 'interest rates are too volatile. Pay your deposit to the vendor, then come see us for finance.' Weirdly, we don't feel like putting down the deposit without finance sorted - that seems just a little risky. Nothings catching our eye, we can wait.

Tells me the bank is being cautious against further rate rises pushing pre-approvals into unaffordable territory.

We had a chat with ours last week too, but for commercial/light industrial construction. We already own the land but wanted to build a ~350sqm workshop to lease out as another source of income. We had leasing estimates and a very keen prospective long term tenant, and the bank thought it all sounded like a fantastic idea...but would only lend the equivalent of about 3.5x the annual projected income.

It would have been enough to build a shed, but not one likely to attract the lease estimate. A lower lease would have meant less lending available, and so the downward spiral into "forget it" begins.

I don't know if this is normal for commercial lending, but it's certainly been an interesting exercise.

We asked to borrow on a building that was quake prone and the bank refused to give even one cent. Not interested in land value either.

If your build cost was 1000 per sq metre and the bank lent you 200k perhaps. Go see one of the second tier lenders, through a broker or there is a list on interest.co you could approach them

The things an article like this triggers. "I wonder how Gary and Steve are doing?" I thought.

Their firm did some renovation work for me, some time back; did high end, high budget stuff regularly, and looks like they came a cropper not that long ago.

If firms like this; hard-working; inscrutably honest and knowledgeable, struggle from time to time, then hard times indeed are on the way.

"Three Rilean Construction companies have been placed in liquidation. Rilean Construction South Island started in Queenstown in 1994. It has been reported that the original Rilean Construction was started in 1979 by McLean’s parents.

https://www.stuff.co.nz/business/123212122/three-rilean-construction-co…

The EA Data which shows new ICP connections (less those that are removed) shows 2181 new connections for greater Auckland 1/3/23 to 30/4/23.

Nationally the EA figures for new net ICP connections show a net growth of 127370,Auckland 50456 ( a 9.62% increase) since 1/1/18 to 30/4/23

More fuel on the fire of the housing market crash.

frank hopes this will bring things back to more sensible levels for the common man to get themselves a decent home

Still a long way back for that. We used to consider 2018 prices extremely unaffordable.

Very true. They’ve been largely unaffordable for decades

Its all been printed money since the GFC, but its over now.

All bank lending involves creating new bank deposits as credit as they never lend out existing money.

-

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.