By Mike Blackburn*

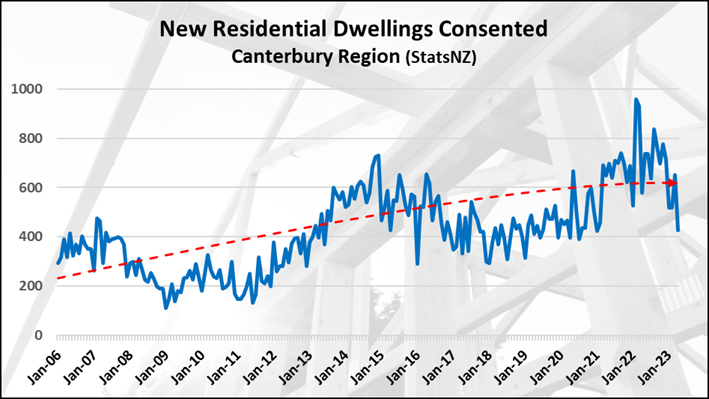

For the last seven months, I have been reporting on the ongoing decline of residential building consent activity across the Christchurch region (and the whole of New Zealand, for that matter).

Unfortunately, June 2023 is no exception in greater Christchurch. 480 new dwellings consented for the month is a 23% decline on the 621 dwellings consented in June 2022.

Having said this, it’s not like we have stopped building new houses…480 new residential dwellings (across all three Councils) is still a huge level of construction activity.

The truth is that for most of 2021 and 2022, we were seeing extraordinarily high numbers of new dwellings being consented, and it’s more likely that (despite the apparent current economic recession) we have come back to a more sustainable level of construction.

Of course, it’s hard to accurately determine what “business as usual” really is here in Canterbury. For the past 16 years (since the initial impacts of the GFC in late 2007) the market has been down, then up, then down, then up…and now we are experiencing another downturn.

It’s important to remember, that even at the lowest point in 2011, there were still almost 2,000 new homes consented across Christchurch, Selwyn and Waimakariri council areas, and then in 2018 (which was lowest point following the peak of the earthquake rebuild in 2014) there were around 4,000 new dwellings consented.

Although 2023 is likely to produce noticeably fewer new homes than were consented in 2022, we are still looking at a target of in excess of 5,000 new dwellings consented for the year.

This doesn’t mean that there aren’t builders, developers and buyers going through some pain. Any downturn in the market comes with an impact and casualties.

I expect that this current downturn still has some legs to run yet. But even in a declining market, there is still work to be had, you just have to work a little harder to find it.

Mike Blackburn is the principal of Blackburn Management. You can contact him here.

34 Comments

There is a significant difference between building a house and making money. There is no longer sufficient development margin so things are going to slow down pretty quickly.

People can only keep their teams busy for so long when there is no risk/reward payoff.

Christchurch will slow but the one that gets me is Wanaka, all those houses with few non-Construction related job. Could get interesting.

Nice to be optimistic, but the reality is its pretty dire in certain sectors. I'm aware of one builder reducing staff from 65, to 20 as work dries up.

Is the builder in ChCh?

The values are going down.

The houses are getting sold for a lot less than CV now. Still got to go down to be in affordable range. So don't rush it.

Plenty of options in spring guys.

Don't fall for the lies of lying agents and greedy spruikers. Their destiny of facing the truth has come.. Don't need to wait for afterlife.

Yes, I am seeing townhouses selling not just less than CV but for almost the same price as what they were bought for off the plan in 2018. The new build prices are artificially high as the value of interest tax deductibility has been built into the price and passed on to investors (and also FHB which is why they shouldnt be buying new builds at the moment if they were smart). If National win and restore interest tax deductibility to all rentals its likely that the prices of new builds will have to rapidly catch down to the prices of older existing homes - rather than the other way around.

This place sold in 2018 for $720k, and was resold last month for $750k (was a Williams Corp build) https://homes.co.nz/address/christchurch/papanui/7-16-grants-road/EO7OQ

KW and that's the point. Something like Williams Corp, Wolf Brook you will see a big drop off because they are all similar in design there are literally thousands of them so if one professional couple have to sell and sell at a lower cost then that sets the benchmark for all the rest. Your bog standard 3/4 brm brand new build ain't going to drop much in price as the cost to build it is going up. Example built a 4brm 18mth ago the joinery cost 15k the same house/Floorplan windows etc I am building again in a different suburb cost 24k so a 9k increase all brought on by this govt. What you will see is builders developers just shut up shop as the risk reward won't be there which in turn will level the prices of homes or increase

The build cost goes up regardless.

The land is also going down. In the past a developer needed to pay ~$1.5 mil for a section in South Auckland, now prob 1/2 of that.

Two-thirds

Probably?

Got any examples

Have you been out to Auctions lately?

That was 3 months ago, properties with development potential are being snapped up again

Interesting ...is this FOMO again

https://www.interest.co.nz/property/123599/more-auction-room-activity-l…

Tim will be here soon to tell everyone that THIS IS THE TIME TO BUY..!

Buy this year, prices are about to rise!

If there is no longer a margin to be made in new houses, that tells me the house price floor is not far away. I expect that in the months ahead following:

- Minimal moves in the unemployment rate. Those in the construction industry will shift from residential builds to renovations or commercial work.

- House prices wont fall any more than a further 5% in nominal terms in most areas.

- House prices will then be static for the next two years, falling in real terms.

- rents will go up until landlords are making between 5-10% gross again.

- Because of council consent costs and development contributions, it will always be better to buy existing than new.

A price floor will be determined by the consumer, not by the "costs". Going from 2.5% to over 6% interest rates on mortgages is not inconsequential, an extra $70 per week on every $100k borrowed.

Either land prices fall, council fees fall, Labour charge out rates fall, manufacturer margins fall to meet the market or eventually work dries up and people go bust. The scary thing is, the 2 biggest inputs (land/council fees) are probably the 2 least incentivized to fall in a tanking market.

Fully agree. The one thing that has been reasonably consistent in the whole house price journey has been the difference between yield and interest rates (i.e. you could make a little more by renting out a house than putting the money in the bank). Until now when very few houses would yield more than a TD rate. Rents must go up (but who can afford it), or house prices go down.

Actually supply/demand will set the rates, it's just a question of how long it takes to equalise...

Demand can come in the form of 2.5% interest rates that allow people to borrow more, thus pushing up prices, thus pushing up equity, and allowing cash poor people to become eligible to buy additional property surplus to their needs by leveraging off that equity.

It all comes back to ability and means to pay. Demand does not settle a transaction, money and debt is the settling factor.

Rents can only go up if wages increase too. I thought your points were pretty good until I read that part. The only credit you get for that statement... is that you didn't put a time frame on it.

Maybe there is a correlation between rents and wages in the very long term but not in the short term. Look at Australia. Rents are going up far faster than wages - rent is up 11.7% nationwide in 12 months, while wage growth is up only 3.7%.

All that happens is that people are forced to alter their living standards to accommodate the higher rent - by not spending on other things, by living with flatmates instead of living alone, by renting a room on AirBnB, by renting a smaller house and making children share bedrooms, by moving to a cheaper area, by putting in bunkbeds or single beds and sharing bedrooms, by getting a second job or sending a partner or child out to work ....etc. The ones at the bottom of the heap who cant do any of the above end up homeless and in emergency housing while waiting for Govt public housing to be provided.

Agree with some of these points but think that the cost of building a new house won’t stop the market falling further than another 5% nominal. Unemployment will increase and be a factor in this. When the floor is found I agree there will be 2 years of flat prices - when OCR reductions do come there will be a significant lag in their effect on house prices, just as there was on the way up.

The actual cost of building a new house will soften as building work gets more competitive.

There is a big difference in the quality of a new house built to current codes compared to an older cold, inefficient and possibly leaky old house that the market may start to value.

Would you rather have an old 4 bedroom villa in Ponsonby or a new 2 bedroom townhouse in Drury? The market will continue to value character and location over ticky tacky boxes out in woop woop. And insulating an older home is not that expensive, as the Government keeps telling landlords.

Alot of builders heading to Aus remeber interest had an article about that a little while ago if to dire here gone what does that do to labour costs. Also strange how everyone else wants builders wages to go down yet if there wages were to hell to pay. Yet don't see them out in the cold wet or heat working

Alot of builders heading to Aus remeber interest had an article about that a little while ago if to dire here gone what does that do to labour costs. Also strange how everyone else wants builders wages to go down yet if there wages were to hell to pay. Yet don't see them out in the cold wet or heat working

I agree with everything there apart from your first point.

We've had a of block of medium density units being built in our street. They started probably 18 months ago. Judging by the speed that people are moving I expect them to be ready to move into by about 2025.

There must be a more efficient way to create houses than this. Horribly inefficient.

Edit:

1: I'm in Christchurch.

2: Hey, where's my green tick?

The ones on my street took just over 2 years to build, from the time they were sold off the plan. And they were built by one of the largest home builders in Christchurch (Mike Greer). It was like they were on a go slow, make work, timetable. Maybe they were?

I haven't been tracking what price they are trying to sell them for. I'd be peeved if I found out that I paid $100K more than my neighbour who has an identical house.

Supply issues are a big factor

There are a lot of costs in building, and some of these need to be eliminated, by some smart thinking.

Rework, we have a friend whose kitchen was the wrong sizes, and had to be rebuilt.

Waste, builders always order extra nails, extra building paper, extra plywood, extra flashings, extra gib. almost extra everything

What's more is most of this extra stuff gets thrown in the skip, except for the nails, and is sent to landfill.

Lack of recycling, I went to the dump last week and a contractor had dumped a truck of AP20 in the waste end of the pit. I asked the loader driver politely if he could load it on my trailer, if only I had a truck, and he was only too happy. he weighed it before he loaded my trailer, and I thought he was going to charge me, but he said he didn't want to overload my trailer, fair enough. At the other dump, there is a place for dumping clean gib board, and the rate is about half general rubbish, and most builders dont sort their rubbish and the clean gib board ends up in landfill.

I have built a house using as much recycled materials as I can, all gets approved by the inspector, they did ask why I had several different brands of building wrap on the house, and didnt say boo when I said I was using up stuff. The reinforcing in the foundations came from a site where they had over ordered, and it was going to the metal recyclers, and I paid the price the metal merchant would have paid the builder.

A family member is building a house and they only pay for what is used. Anything left over the builder will take as it hasn't been paid for. Maybe it helps with supply issues, if they over order, then they know they have product to continue on with their next build?

Tricky?

Bet you they are charging your family member a margin on materials (fixed).

Return the left-overs but keep the margin?

The problem is, consents issued doesn't necessarily mean they'll convert into breaking ground. Building starts is what matters and I think more and more consent holders will sit on their hands as they see declining demand and general economic uncertainty as sound reasons to hold back.

I will get through this.

The biggest reward will be the big clean out.

Council gouging.

Traffic gouging.

Bad workmanship.

Purge it all and get the pricing and costing system streamlined.

The pain will be worth it [I say painfully].

Kick this b l o -- d y government to touch - nuture the unproductive and slaughter the productive,

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.