By Mike Blackburn*

Recession isn’t specifically a word that is used in relation to the construction sector, we more commonly talk about “boom then bust” cycles.

However, as New Zealand (and many other parts of the world) struggle with the reality of the post COVID blues (a reality check for Governments who spent more money than they had on things that they really didn’t need), this has inevitability flowed through to the residential construction sector which is now in the grips of a recession of its own.

Just to clarify, a recession (economically) is generally acknowledged as a fall in a country’s Gross Domestic Product (GDP) for a period of two consecutive quarters.

New Zealand entered an economic recession in March 2023.

According to Statistics New Zealand:

Economic activity fell 0.1 percent in the March 2023 quarter as measured by gross domestic product. This follows a fall of 0.7 percent in the December 2022 quarter.

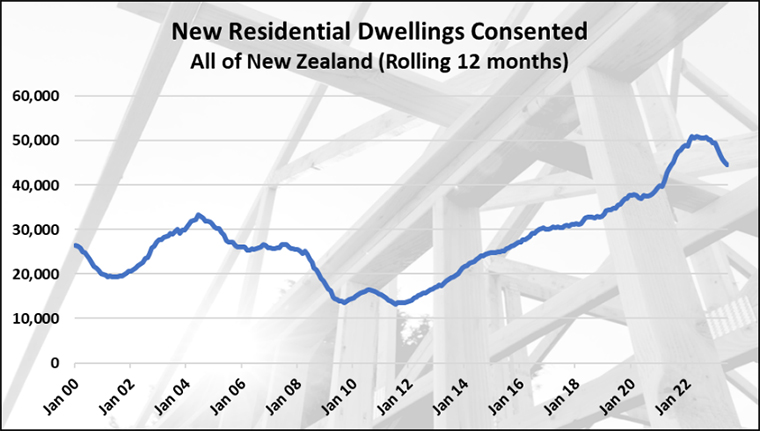

In the 12 months to June 2023 there were 44,524 new residential dwellings consented across all of New Zealand. This is a decline of 12.2% on the 50,736 new residential dwellings consented in the 12 months to June 2022.

I don’t think that this was a surprise for anyone in the residential construction space. All the signs were there to see and the feeling among many builders and developers was that the market had slowly but surely been getting tougher and this announcement of a “technical economic recession” was just a formal confirmation of what was to become an inevitable downturn in building activity.

In actual fact, if you look at the graph below, the downturn officially started in May last year, where building consent numbers peaked at 51,015 (on a rolling 12 month basis). Between May and September, numbers were relatively flat, not really falling away, but certainly not increasing.

However, September 2022 was the beginning of what has now become a nine month slide, which (technically) put the New Zealand construction into a recession in March 2023 (coincidence…I think not).

I’m going to make a bold prediction here; I can see this trend continuing (to a greater or lesser extent) for the next 6 to 12 months.

It would be easy to continue the commentary that the residential construction sector in New Zealand is crashing, however lets back-track a bit here and look at the bigger picture.

July 2011 saw the lowest number of new residential dwellings ever consented (for a rolling 12 month period) since StatsNZ began keeping records in 1965, with only 13,236 dwellings consented. Just for reference, there were 25,932 dwellings consented in the 12 months to March 1966 (which is almost double the July 2011 number).

However, since this time, there has been virtually exponential growth in the construction sector with consent numbers peaking in May 2022 (an 11 year run) with 51,015.

In December 2021 I wrote in my annual market commentary that I thought that this was surely the peak of the market (49,007 for the 12 months to Dec 21).

I could see the beginning signs of a change in market conditions: Increasing interest rates, rising inflation, the supply chain crisis was pushing up the cost of building materials, negative net migration and a number of other factors that would negatively impact residential construction numbers.

And yet, 2022 saw another record year of building consent numbers, but only just with 49,538 for the 12 months to December.

However, the writing was on the wall.

Of course, one other factor that needs to be considered is that (generally) activity in the residential construction sector runs around 12 to 18 months behind economic changes.

So, while in fact the economy had started to turn in early 2021, it wasn’t until mid 2022 that we started to see this starting to impact construction numbers.

I suspect that if you were to talk to most builders (and if they told you the truth), it was probably January or February of 2022 when the phones stopped ringing. The demand for new housing effectively dried up. It didn’t stop completely but compared to the market frenzy of the previous couple of years, the tap was well and truly turned off and new sales enquiries slowed to a trickle.

So then why were building consent numbers continuing to increase during 2022?

Simple, it’s the 12 to 18 month delay I explained earlier. All of the new building consents issued during 2022, were for sales that took place in 2021.

Fast forward 12 months to the beginning of this year 2023 and the red ink of declining building consent numbers is becoming a regular occurrence for most of the Regions and Territorial Authorities across New Zealand.

In a recent article I wrote, I suggested that it wasn’t all Doom and Gloom, and despite what I have said above, I stand by that statement.

Yes, in the 12 months to June 2023, building consent numbers across all of New Zealand are down by an average of 12%. Some of the worst affected areas are Bay of Plenty, down by 25.5% (somewhat understandably following Cyclone Gabriel in February). Taranaki, down by 25.1%. Wellington, down by 17.2% and Waikato, down by 16.3%

Potentially we could be looking at a collective fall in building consent numbers equivalent to what we saw in 2008 following the Global financial Crisis (GFC).

But on the plus side, these current falls are coming after record highs and (when looking at long term trends) construction number sit well above historical averages.

Having said all of this (much as I suggested in December 2021), I can see the signs of a market change.

Interest rates have largely peaked (although I don’t expect any significant fall in rates any time soon), Inflation looks like it is slowly (very slowly) on its way back down. Despite the recent introduction of the new H1 regulations (adding an estimated $30,000+ to the cost of construction of a new house) the supply chain and price increases appear to have stabilised.

Perhaps the most positive indicator is net international migration, which has done a complete flip and (as of June 2023) is now sitting at a whopping influx of almost 87,000 people…which of course means we need more houses.

Realistically though, it will take the sector another 12 to 18 months to work through its current issues. In that time building companies will continue to go into liquidation, some developers will lose their shirts and some tradies and contractors will get caught in the middle.

There is still plenty of work out there. It will be harder to find. You will be competing against more companies, margins and profits will take a hit. But (if you have been in the construction game for more than 12 years) this is probably something that you have seen before.

Recession, yes, end of the world, no.

Mike Blackburn is the principal of Blackburn Management. You can contact him here.

16 Comments

A steady, moderated approach is completely MIA in NZ since the turn of the century.

Booms and busts, shortage and glut, easing and tightening, lockdowns and ultrahigh migration... makes it easy for the overlords to earn big moolah and control more wealth.

Back in the good old days - when politicians controlled the economy - we'd blame them and the swing voters would effect a change in government, or not.

Now? Well, we have an over-reactionary reserve bank that seems to be accountable to no-one and who believes humans must be sacrificed to ensure a mess they created is fixed.

We call this progress?

Let's get real ... It's crashing.

Kianga Ora is just about the only customer left taking on building work in the whole country, because they don't have to make numbers stack up. This despite KO apparently being over budget already.

The delicious irony is that it was the government's move to not limit interest rate reductions to business at the start of the pandemic, then to remove interest deductibility with new builds as an exemption to a paniced tax policy, that set us down this path... and the lack of any progress towards making building cheaper that will hammer the stake home. We started at let's build 100k homes and within 6 years have absolute decimation of an industry.

I'll take KO going overbudget and generous on building new social homes any day over the colossal waste of taxpayer funds on bureaucrats, consultants and vanity projects from the wider public sector that have nothing to show for other than higher inflation.

The real issue is not the activity in the construction sector, it’s the underlying cost of building. New builds won’t come back until there is margin in it. Even the spec builders have stopped which is pretty telling and highlights the underlying issue.

So, what gives, what will change the economics of building? Land reduction won’t be enough.

As someone who is looking to buy land and move a house on, I can tell you a reduction in land prices will definitely help, or at least if agents stopped pricing them at the 2021 peak they might see some buying movement. It's ridiculous, especially in the cheaper regions where they still want to ask peak prices $250k+ ish, and then add a new build on it $400k ish, in areas selling around $450-500k ish. It's insane.

The only thing that will save the industry is a return to low cost (land and building) single level housing on greenfields land. Luckily this is being promised by National in their housing policy.

Labour seems still stuck back in a draconian urban containment ideology which has proved so disastrous for their traditional supporters - keeping them out of home ownership and hiking up rents.

And unfortunately that approach it’s going to cost Councils a fortune.

The inability to efficiently do vertical builds in this country is one of our biggest failings.

We need a decline. An increase would indicate more immigration. We need a stable population - not endless new suburbs and carved up sections.

What the author is missing here is that the conversion of building consents into actual building also drops precipitously during building downturns.

Many of the current consents in the system will remain just that until the more speculative end of the market is seeing a better prospect of selling off the plans or are confident they can sell a completed project.

Personal anecdote: I know of a developer who had 10 homes in the pipeline to build but canned them all for lack of sales or inquiry. That's ten consents but no building.

I’m going to make a bold prediction here; I can see this trend continuing (to a greater or lesser extent) for the next 6 to 12 months.

My, this guy is pretty brave...

"Positive indicator"... only if you're already wealthy and own a house or two, and dont need to drive anywhere or go to hospital.

Certainly seeing a potential glut over the next 12 month or so in civil infrastructure. Hard to gauge exactly as this time of year normally quietens down as all the consultants squirrel away at the next batch of projects to be released for the current fiscal year. Election year doesn't help, and I suspect 3 waters is putting some projects on the backburner because why fund from council funds when the taxpayer can fund it.

I just had a vision... I foresaw Kianga Ora buying homes from folks who were forced to sell and had lost their deposit, due to the housing market crash. Then let the former owners stay in their home at KO rent prices ($150pw for a 3 bed).

A nightmare or a dream? Who knows. But I only think this would happen if National don't win the election. The vision is fuzzy, so I have no idea on timeframe.

So how about a comparison with Consented v CCC's?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.