Westpac economists have cut their forecast for 2025 house price growth from 6.2% to 4%, but still expect 6% growth in 2026.

The earlier forecast had been predicated on sharply lower interest rates, more favourable tax treatment for investors, and an improvement in the labour market later this year.

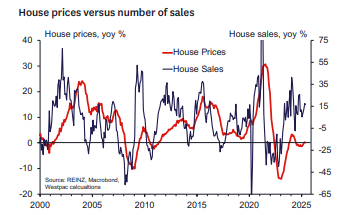

However, they said, only parts of this had come true; while house sales year-to-date are up 17% on a year ago, prices have risen by only 1%.

And while demand had improved, so had supply. Despite significant slowing from the peak, a pipeline of new housing projects was working through.

The labour market remained weak, rents were trending weaker, and global economic uncertainty "may be contributing to more caution amongst house purchasers."

"The RBNZ has leaned heavily in recent forecasts on the idea that elevated uncertainty might pin back household demand for a while," said Chief Economist Kelly Eckhold.

Eckhold said Westpac Economics' view was that the OCR was currently "neutral" at 3.75%, so 3.25% looked "mildly stimulatory."

Mortgage interest rates under 5% would underpin demand.

"And we still have a fair way to go before past mortgage rate reductions flow through to household budgets - which could be important in supporting demand form existing owner occupiers."

Westpac is picking muted house price growth over the winter, picking up to 1.75% for the December quarter.

1 Comments

I would be interested to see a regional distribution of their forecasts. I think the regions will continue to increase, because the median price is below replacement cost and therefore any new supply will be at a higher price. However, Auckland I think will drop another 1-2% by the end of the year, because of the stock of housing still coming to the market, and the number of investors looking to dispose of holdings when the summer comes.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.