A burst of springtime activity was on show at the latest residential property auctions with a sharp jump in the number of properties on offer.

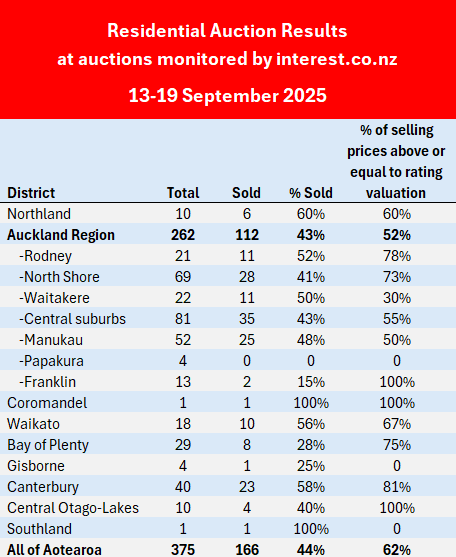

Interest.co.nz monitored the auctions for 375 properties around the country over the week of 13-19 September, up from 286 the previous week.

The last time that many properties were offered at the monitored auctions was mid-May, meaning last week was the busiest in the last four months.

That suggests the spring selling season is now underway.

However, while more properties went under the hammer, there appeared to be no meaningful movement in the sales rate or prices.

Of the 375 properties on offer at the latest auctions, 166 sold under the hammer, giving an overall sales rate of 44%.

The sales rate has bounced around between 39% and 49% over the last five weeks. The latest result was bang in the middle of that range, so no real movement there.

Similarly, 62% of the properties that sold achieved prices equal to or above their rating valuations, compared to a range of 56% to 67% over the last seven weeks. So the latest result was also bang in the middle of that range.

While the latest results show a significant increase in auction activity, there doesn't appear to have been any noticeable change in market sentiment.

Details of the individual properties offered at all the auctions monitored by interest.co.nz, including the prices achieved for those that sold, are available on our Residential Auction Results page.

The comment stream on this article is now closed.

37 Comments

I'm pretty sure we are at or past the bottom. Vibe is better, job ads up. There will be more closures as it is the bottom of a parabola and not a 'V', but more and more business owners I chat with are feeling optimistic.

Now is the the to announce some projects, Government peoples, ride the wave up and claim some credit.

Hard to know, people were optimistic last summer too. All I’m seeing is gloom, although some stats are looking better.

I agree it’s probably the bottom for property, it’s actually reasonably affordable now particularly if you project forward to mortgage rates <4.5%. While we consider NZ to be expensive, have a look at prices elsewhere and you might be surprised. Even Houston average is $550k NZD these days

A friend was selling his home via auction, so I watch ray white auctions during Thursday.

Observations

- Specs offering 15-20% below new RV to start bidding.

- Hardly anything sold under hammer with negotiation required, makes sense no one wants to bid against themselves, then start negotiation as in most cases competitive bidding stopped short of reserve.

- Auctioneer would often only accept another 20 or 50k, indicating they where still a long way off reserve and not interested in 2s or 5s. Auctioneer refused 5k bid and then heated argument with bidder over his right to do so, that did not look great.

- Many had bids over RV ( I though good bids) but moved into negotiation, I guess to try and extract another 20k etc, always best to offer no more if you where the top bidder, if you do add 10k, do not do it as a bid at auction, let it pass in then PILE on the conditions via a conditional offer to swing power back to you.

- A few wanted nuts money for old cheapies. ie bidding got to 800k and wanted 1.1mil

- There are lots of real bidders, but they are not meeting vendors expectation, so there is a bit of a stalemate going on.

- I saw no obvious forced "urgent" sales on Thursday, seems like there are more down South Auckland, most of these where not obvious ex rentals.

- Strong bidding on 2bdrm brick and tile units, as always.

- Older stock of entry level are achieving bids at there last sale price of 2019.

- Its hardly enthusiastic bidding, more like a trip to the dental nurse, but sales possible

- I sense that no vendor is testing the market, these are vendors that want to sell, but they need 'x" for there next house and bidders offering 0.9 x.

- Most houses had conditional offers waiting to be presented, which seems to be the strategy here, use auction to get conditional offers. Probably a gd startegy actually if you want to sell and know the market value

https://www.rw-theevent.com/ was a big event over the day

So given all that, I do not see the bidders suddenly upping bids 10% but if vendors willing to drop say 5% and bidders come up a touch then we will see bigger sales numbers, hence I think we maybe 5-10% off the bottom, I think the 10% higher band as there are a lot of totally blind to market value vendors still out there, who will work there way through a few agents then finally sell. Right now if you happy with 2019 prices I think you can sell there.

Who conceded in the heated argument?

The auctioneer insisted he had the right to not accept any bid, as he does from the contract , the bidder asked why he accepted a 1k bid in previous auction... it was sort of a stalemate, but everyone knew what was happening , I think that property was a couple of hundred away from reserve and he did not want to muck around with 5k bids......

Small bids mid auction make it harder to raise the bidding steps later on, if it had been on the market he would have had to accept it or the vendor would have puked on him.

Auctions are a game to either sell if you have bidders or create time pressure if you do not for fear of missing out. hence so many going to conditional bids after passing in.

But they get twice the house in Houston for that money.

With much higher property taxes.

The US are good at bigger but not so great at better. Many of those big houses are dated and expensive to modernise.

You get a pretty crappy house in LA for the median which is almost $2 mil NZ. It’s really hard to compare house prices around the world.

Their property taxes also cover police, fire, schools and rates for subdivision maintenance.

And it is easy to make comparisons if you understand the comparables.

For starters you don't treat the US as one market.

California has more in common with NZ land use policy, whereas Texas land use policies are completely different, hence Texas is much more affordable

Anything you mentioned about LA housing re being dated and expensive to modernize, for those that are like that, is similar to NZ.

And you don't look at the dollar conversion, you look at the median house price to income multiple.

That is why the median multiple is such as good measure, because the multiple points to whether the housing jurisdiction has poor land and house policy, or not. High median multiple jurisdictions have high restrictive land use policies, and low median multiples have low restrictive land use policies.

Lots of property withdrawn from sale from lack of greed expectations. Are we just starting to see them listed again as interest rates plummet?

They're doing it on purpose just to see people comment 5x a day about greedy specuponzivestors online. Good hobby.

If you go onto reddit or face book there are hundreds if not thousands of "tell them there dreamin" type comments, comments here are pretty balanced, but in the wider community there is still a feeling that prices are too high.

Does anyone know the 2 storey brick homestead at 337 Massey Road, Mangere East? Built in 1853 which later became home to William Massey—New Zealands 2nd longest-serving prime minister (1912–1925). Massey could have been the longest had he not died in office "with his boots on"

What I found most interesting was that Massey bought the property for £600 in 1890 using a £500 mortgage. That’s a classic low-equity loan by today’s standards—low equity loans are not such a new thing but who'd have thought they go back that far

A century after his passing in 1925, the house still stands as a tangible link, and as a heritage. Quality stands the test of time a

unlike this one or the shitboxes of flatbush

https://www.trademe.co.nz/a/property/residential/sale/listing/5533030657

A lick of paint and she'll be right...

I guess decluttering does help , imagine what it looked like before the cleanup, vendor throwing in 11 old cars and a couple of boats

unlike this one or the shitboxes of flatbush

https://www.trademe.co.nz/a/property/residential/sale/listing/5533030657

The novice sees the "shitboxes", the clever man sees the over 4,000 m2 of land underneath.

RV is 1k per sq m, in Waverly, hell you can buy in AKL for that...

lead from the front Yvil

Re Massey Road

I recall playing casual tennis there 45 years ago. At the time I think that the property was owned by Manukau City Council and was used for community purposes.

Of interest; when David Lange was Prime Minister in 1984 he lived a few hundred metres up the road on the opposite side in a very basic simple bungalow. The only notable feature of that home was that it was painted a horrible yellow. Quite a contrast in grandeur.

I really respected David Lange, he could represent all of NZ and was a reasonable man with a super sharp intellect. together with (Mr Lamb Burger) Mike Moore, and Roger D they where much more like Aussie Labour. These where people that wanted productive kiwi enterprises to grow,

And then there is Hippy and his non cis non white male hangers on, what a clown show Labour has become, so so so far from there roots of a fair days pay for a fair days work, Sundays and Saturdays off.

Arguably the least racist/sexist/genderist leader currently in politics is the evangelical Christian Chris Luxon.

Before politics David Lange worked in mangere/mangere east as a lawyer and assisted people of low means including my grandmother. He obviously walked the talk

It's about 17% equity so hardly a low equity loan.

I meant because it is higher than 80 percent LVR which is the benchmark

Should I stand corrected Dale

Banks had to be reined in to stop giving people lower equity loans.

Banks were ok with taking less when speculative capital gains growth is rapidly happening as within months the property had increased enough to give that 20% margin.

In the present market low equity loans are only possible by other equity being secured by cross collateralization, or with a Kainga Ora insurance underwrite to the banks for the difference, which the homeowner has to pay the insurance on.

But about a 20% deposit was the minimum and standard historically in a stable market, without the banks having to be told anything. And still is in jurisdictions that have stable property markets, which are also very affordable.

Auctions came to prominence when policy restrictions were imposed in the supply of property from about 1995 onwards.

Auctions are made for either:

1. Unique properties, where it is hard to put a price on them, or unique enough that someone with more money than sense will buy it regardless.

2. Mortgagee sales so that the Mortgagor can legally say it was open to all the market, even though it may result in a lower price than if sold by other means.

3. Restrictive markets where there is always at least one more bidder, so the price is bid up to the max the purchaser has to pay to stop any further bids by the underbidder.

99% of properties do not fit that description in this market.

REINZ say that auctions as a percent of all sales is increasing again. From memory it's gone from 11 to 13 percent

It used to be more way more, but unless it is achieving 90% closing success it is just more a branding exercise for the real estate companies, which they get the vendor to pay for.

So about 44% of 13% is selling at auction = 5.7% of property gets a sale via auction?

Hard to know as some of the property selling by negotiation, is priced so high its not actually for sale.

I have used it to get great price and used it and got no bid after GFC, but the property sold on 21st Dec to an expat via offer.

Auctions do work but you need enough bidders hence the lower 1/3rd of market is probably a good place to pitch via this method, IMHO around 2mil plus maybe not so much.

What was that a long winded way of saying IT?

224 Beverley Tce in Whangamata sold this week for 8.5. To be clear that's 8.5M not 8.5B :) 2 bidders

Yawn. Easily developed into three properties, one waterfront in central Whangamata beach (bluewater chipper). Just about the last undeveloped property in this location.

166 sold this week vs 120 sold last week is a 38% increase in the number sold. I thought that would warrant a mention.

It doesn't fit the prevailing doom & gloom narrative that features in this comments section.

Doom and gloom is subjective, the changing paradigm of house price appreciation objective.

Interest.co.nz monitored the auctions for 375 properties around the country over the week of 13-19 September, up from 286 the previous week.

The last time that many properties were offered at the monitored auctions was mid-May, meaning last week was the busiest in the last four months. Of the 375 properties on offer at the latest auctions, 166 sold under the hammer, giving an overall sales rate of 44%. The sales rate has bounced around between 39% and 49% over the last five weeks. The latest result was bang in the middle of that range, so no real movement there.

Spring does not indicate a bounce in sentiment, every year more list in spring because mud is hard to sell, and rain keeps people away from open homes, tree's turn green and everyone has a better mood. In stats its called seasonally adjusting the data. Are your green shots indoor or last season outdoor?

Last September the OCR was at 5.25% with retail rates north of 7%. This September is quite a different story, so forgive me if I take your negative interpretation with a grain of salt.

A lot has happened in last 12 months ( interest rates) yet nothing has happened (pricing). Overhang of stock for sale in auckland, other regions have tightened. If you go through the list it's the second tier that are looking stronger, the micro areas not so well

There is always a 12 month lag before seeing the full results of the OCR changes. A sub-5% rate has only been available since May and most people are yet to come off their 6.5/7% rates meaning the net weighting is still restrictive.

https://www.nzherald.co.nz/nz/auckland/resident-encounters-22-speed-hum…

Please remind me what is the cost of a speed hump. Oh well, its worth it as the new residents will love them /sarc

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.