By Shane Martin & David Norman*

• We would expect that properties in Auckland’s rapid transit network catchments (the train and northern busway stations) would sell for more money given the additional amenity that comes from access to frequent, faster public transport.

• Our analysis shows that the maximum walk-up distance to the rapid transit network (RTN) that adds value to a property is shorter than we had anticipated although there are several likely reasons for this we have not been able to model.

• Nevertheless, homes that are well-served by trains or express buses command a significant premium over those that are not.

• The work suggests that the completion of the City Rail Link (CRL) and the proposed light rail project would provide a significant windfall gain to nearby properties that has not yet been fully realised. This has policy implications in terms of the case for recouping some of the costs of construction from those who benefit from the windfall gains of new RTN infrastructure.

Widespread public transport (PT) in Auckland has existed since the early 1900s, when the original Auckland tramway system opened. Over time, the trams gave way to buses, trolley buses, and trains. Historically, ridership peaked during World War II, then fell dramatically through to the 1980s. Since the mid-1990s, ridership has increased rapidly, but is still well below WWII levels, despite a population that is six times higher today.

According to Auckland Transport, rail ridership has nearly tripled in the past 10 years and the northern busway has grown from nothing to 5.5 million trips a year. Overall, ridership on Auckland’s RTN has increased eight-fold in 10 years whilst population has grown a little under 20%. All of this tells us that, while Auckland’s PT system is not currently optimised (a fact we delve into below), people are still switching to PT from other modes.

What we would expect

It stands to reason that when PT options become more frequent and accessible, the properties within easy walking distance to these amenities will increase in value.

It is important to note that it is irrelevant whether the people living in these places use the RTN themselves – the properties gain value because someone would pay more to live near the RTN1 . The question is then: how much is the premium and how far out from the station does it extend?

What we found: Go the distance

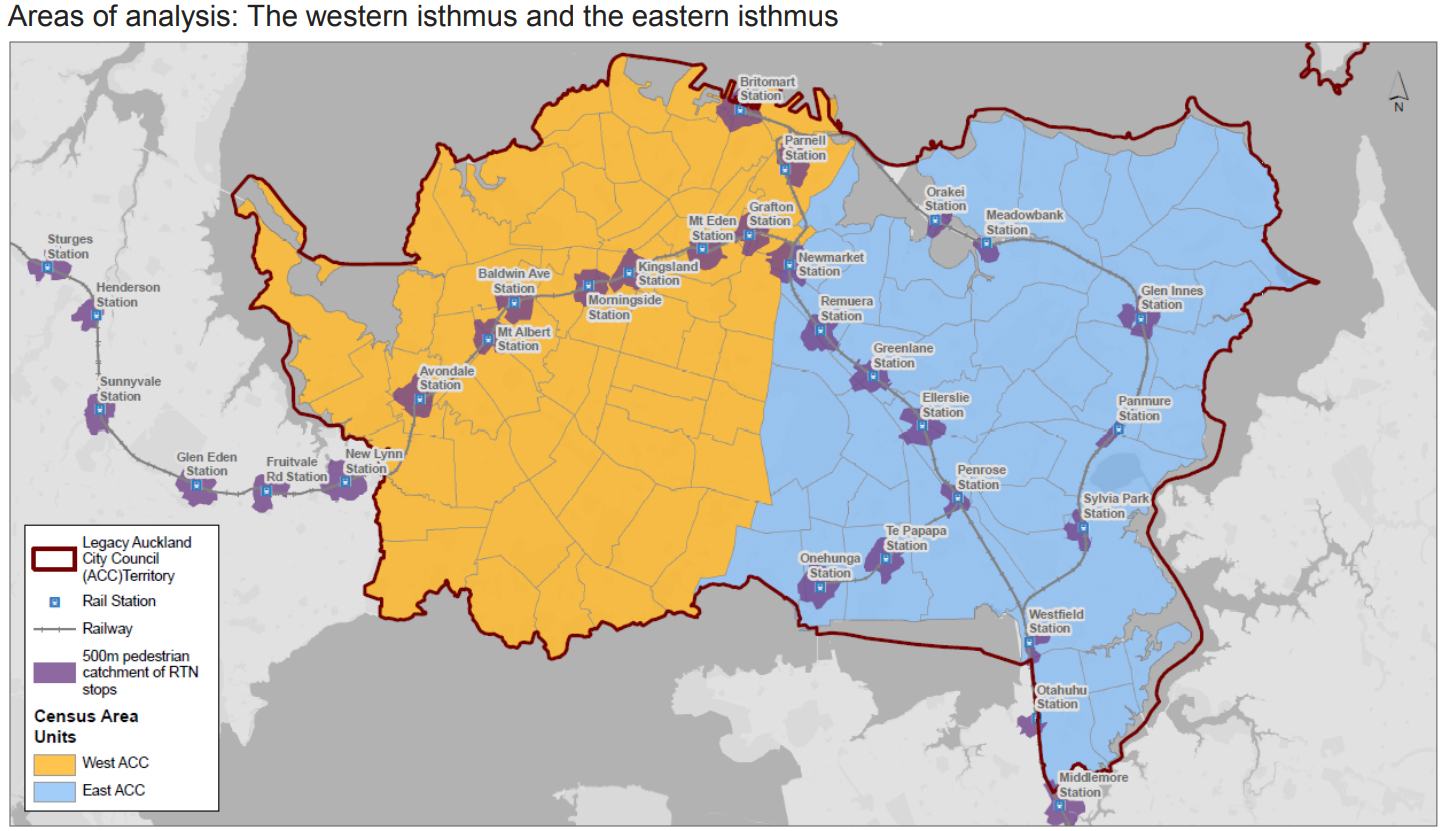

We found that on the Auckland isthmus2, properties within a 500-metre walk-up distance receive a value premium from being close to the train network. At further distances, there was no detectable value uplift from access to the RTN. This was a smaller value catchment than we thought we would discover given the distances people are willing to travel to get to train stations3. However, there are some very good reasons why Auckland’s value catchments may be smaller than in other, more transit-oriented cities.

First, as currently configured, Auckland’s train system is sub-optimal for moving people to the two main job centres in the city – the airport precinct and the CBD. The only station with CBD access is Britomart, and the upper CBD is an almost 2km long uphill walk from there. Even Auckland Town Hall is more than 1km from Britomart Transport Centre. The closest station to the airport is more than 6km away, from which a person can catch a bus that runs only three to four times per hour at peak times. This is clearly suboptimal for job access via PT.

Second, a bus network that can move people to the CBD faster than the current train alignment is available. For instance, a bus from Avondale to the central CBD takes less time than walking to the train, riding to Britomart, and then walking up Queen Street. For many people on the isthmus, unless you live very close to a train station, it just does not make sense to use the train instead of the bus. The CRL (and proposed light rail project) aim to overcome this sub-optimal idiosyncrasy of the Auckland train network.

The CRL will cut 10 or more minutes off travel times across the train network to the CBD and double frequency on much of the network. Part of the value of this increased access will already be incorporated into land values along the rail corridor and around the new stations, but as we move closer to the CRL becoming operative, we would expect homes near train stations to increase further in value. The new stations and removal of the Newmarket dog-leg will make the train a much more attractive option to people currently reliant on the bus, and we would expect to see an increase in the walk-up distance within which proximity to a train station adds value.

The train station premium

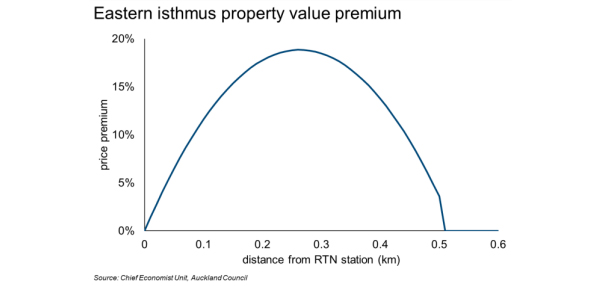

Using the 500-metre train walk-up catchments, we find a statistically significant, positive impact on property values on the Auckland isthmus. We find that the maximum premium occurs at around 260 metres. This makes sense as despite the huge accessibility benefits of living right next to the train station, these are offset by the accompanying noise and congestion. But living a three-minute walk away from frequent train services is ideal.

However, the pattern varies significantly across the isthmus. When the isthmus is split into east and west roughly along Manuaku Road/Pah Road (see the map at the end of this paper), the results vary drastically. On the west side of the isthmus, there is no detectible premium for RTN access.

However, on the east side, the premium is large and statistically significant. On the eastern isthmus, a home with a 260-metre walking distance to an RTN station has a premium of about 19% over a home more than 500 metres away from a station. Some explanations for this premium include that:

• The eastern isthmus has much more train access than the west. The Southern, Eastern, and Onehunga lines provide reasonably dense coverage of that half of the city.

• Options on the eastern, southern and Onehunga lines are higher due to the many stations that are covered by more than one line.

• Trains on these lines enjoy a direct trip into the CBD, unlike the Western line which requires a dog-leg through Newmarket until the CRL opens.

This is a surprisingly large premium, though not unprecedented in the international literature.4 While this result is positive and statistically significant, a relatively small share of sales in the eastern isthmus were within the 500 metre catchments. Further, we would highlight that our analysis is limited to properties with a land component; it excludes apartments and townhouses without a specific land component, and the premium, if any, to these typologies is unknown. Nevertheless, the results do give us a guide to the existence and scale of premiums that could occur in the west as the opening of CRL approaches.

Outside the isthmus, there is no detectible premium for living near a train station. This could be due to several factors beyond the ones already mentioned. In particular, many of these stations are “Park and Ride” stations, where walking access is less crucial for using the train. It stands to reason that people are not willing to pay much extra to be able to walk, when they can take a short drive and park their car for free or at low cost.

What about the northern busway?

The northern busway was officially opened in February of 2008, with dedicated bus lanes from Constellation Drive to the Harbour Bridge. After just two years of operation, Auckland Transport estimated that the busway was removing more than 5,000 cars from the morning peak rush hour, improving the commute for everyone. Today, ridership has reached 5.5 million trips a year.

But how much is the busway valued? Using the same methodology, we find that homes located within 500 metres’ walk-up distance have a flat premium of approximately 6.5%.

Part of the issue for walking access to busway stations is that there are few homes near them, as the busway is along the motorway. However, for those homes where walking is possible, there is a real, measurable premium.

What does it all mean?

Auckland’s RTN adds value to the city and as it improves and expands, we would expect this value to roll out to a number of additional households, most notably across the western line, the light rail route, and to greater walk-up distances around existing train stations.

These major infrastructure projects will result in a windfall gain to many thousands of properties within the walk-up catchments, and we now have a sense of the likely scale. This has policy implications for thinking about how infrastructure like light rail may be funded. A model that gets those who reap a significant windfall gain from proximity to the RTN to contribute some share toward its development is more than reasonable and is good economics – those who benefit should contribute in a commensurate way.

How we did it

To analyse the premium (if any) that the RTN adds to properties in its catchment, we compared properties inside and out a defined catchment.

Naturally, there are likely to be other differences between these properties, beyond the presence of PT nearby, so we controlled for these factors as thoroughly as possible. A statistical method called “hedonic pricing” allows us to estimate the price of a property based upon the characteristics of the dwelling (e.g. size, quality, construction type, age, decks, garages) and the characteristics of the land itself (e.g. views, proximity to CBD, school zone, proximity to the coast, proximity to green space). By doing this, we could see the effect of proximity to an RTN station separately from other things that add value to a property.

As with our previous studies on upzoning and special character areas, we used a log-linear hedonic pricing model with time and location fixed effects, and robust clustered standard errors at the Census Area Unit level.

Data on house sales from 2013-2016 was used. To be included, the sale must have been of a freehold property including land and a dwelling of at least 30 square metres.

Several model specifications were tested, and the results were reported for the model with the best fit.

*Shane Martin is an economist in the chief economist unit & David Norman is chief economist at the Auckland Council. This article was first published here.

47 Comments

Sounds like we should be paying for our infrastructure through property rates rather than petrol taxes because the landholders are rewarded by that infrastructure.

Rates is the long standing mechanism we have in NZ for recouping the unearned increment from city infrastructure delivery, agglomeration and other processes which leads to localised capital gains. NB in a functioning property market these benefits would lead to more house and business building. Price increases would not be excessive i.e in proportion to income gains.

DP

You think new public transport infrastructure should be funded through rates because landlords benefit from value uplift? The majority of houses are not owned by landlords and are not within a public transport “value catchment”. And even for rental properties that are in a value catchment, Council found that the additional value is lower than expected. Not to mention the fact that landlords would simply pass on the rates increase to tenants through higher rent.

Petrol taxes charge those that are causing the congestion problems in order to fund the solution (new public transport infrastructure). There is also the benefit of disincentivising private vehicle use. Rates would unfairly charge homeowners that may not travel by car at all.

People will happily pay a premium for convenience - and Aucklanders are no exception. Modern lifestyles are busy, so cutting back on time spent travelling is an attractive proposition.

Thus, no surprise that properties with good access to buses/trains fetch higher prices. Better still if a property is walk-to-work.

TTP

All I could see was how minute the areas affected are. Try the next article on how the South fits into your demographic. Oh that is right - there is nothing for them.

This article is the work of some very distracted minds. Why aren't Auckland Council economists working out how to build more affordable housing in response to the rapid transit network. That is what survey after survey shows the public want.

The starting point of any proposal must be building more houses. If Auckland built more houses around its new rapid transit network many of the infrastructure costs would be solved. Fare revenue would increase. Rate revenue would rise (More houses).

I am not seeing any evidence that these so called economic experts understand the need to build more affordable houses .

It is bizarre that it can be so obvious to some but not others that if we stopped rationing the 'permissions' to house building then Auckland might be a more liveable place.

How is it that a London lawyer (John Myers founder of LondonYIMBY) can understand the economics (and politics) of housing better than two trained economists?

Read this article by John https://capx.co/strangely-building-more-homes-does-reduce-a-housing-sho… and compare it to the dribble above.

One is much clearer than the other.

But surely understanding amenity premiums is essential in planning for housing development, no?

I mean. What's the point in building, as you say, around infrastructure hubs if there is no amenity value associated? Or, why we can't build 'affordable' housing around transport hubs because there is a huge amenity premium.

I don't know what you want the Chief Economist's Dept. to do, Brendon?

Their mandate isn't planning; it's impartial economic advice.

I have sat through many a presentation where the three economists from AC have reiterated the need for affordable housing. Their scope of influence extends only to their reports. The real decisions are made by the idiots at AC who disregard much of said advice.

The amenity *premium* can be either 1. capitalised into existing property prices or 2. it can induce demand i.e. some new houses or businesses are built at lower prices than would occur in option 1.

In both scenarios those properties affected positively by the amenity *premium* will pay more rates (because either their GVs go up relative to others or because their is more ratepayers) so there is no free ride.

But clearly the most benefit for the city and the country is more of the second outcome and less of the first.

The whole purpose of providing the infrastructure is to provide benefits, such as more housing, more businesses, more customers, more employment.

Why are Auckland economists being distracted by the first option rather than studying how Auckland can get more of the second option?

Between local and central govt there will be $28 billion invested on Auckland's transport system in the next decade. The purpose of this investment is not to boost a few property values it is provide a range of economic opportunities.

I find this report narrowminded and in danger of missing the point. Given the sums of public money involved I think Auckland Council could do better.

I'm not saying there is a free ride.

My point was that if you don't know the amenity premium component, you can't optimise planning.

Thus I fail to see how you can extricate the locational amenity from the land price without subsidy. Unless you are proposing a full recovery of the infrastructure / amenity development costs from a targeted rates structure. Given the rates structure of AC, all locational amenity value is subsidised by improvement value, relatively speaking.

I don't disagree about the purpose of infrastructure planning. But this is exactly what this report is about - the effect of infrastructure on land value which is how causality flows to your other mentioned purposes; more housing, more business, more employment.

Comparing land values of existing properties over time is not a valid measure of amenity premium. At best it is a partial measure. Using a research method that only measures price increases for existing property to measure amenity premium is flawed thinking.

There is plenty of spatial economic research that shows specific planning restrictions have distorted land values and/or limit economic opportunities.

Economic research demonstrates the cost of some specific planning restrictions is way in excess of any conceivable benefit to the community.

For instance the $billion viewshaft restrictions that prevents the construction of houses and businesses in the most productive location in NZ's economy -inner city Auckland. Research done by a previous Auckland economist.

https://www.newshub.co.nz/home/new-zealand/2018/10/the-view-of-mt-eden-…

Okay. Now you are changing the direction to suit your narrative.

The sample period didn't straddle any changes in planning regulations. It fell between the announcement and the finalisation of the AUP, limiting the expectations in the market wrt endogenous planning changes.

Secondly, although the methodology is maybe a bit flawed, it addresses time variation in it's specification - it is controlling for time fixed effects.

The question you are asking is whether the marginal effect of amenity on price is best represented this way (assumed to be constant over time wrt to time fixed effects). To which I answer, not necessarily, but it should be well approximated given that we know that the marginal effects of many amenity values are relatively consistent over time when we estimate them in a cross sectional context.

I am not disagreeing that there is plenty of literature noting the relationship between planning restrictions and land values. Exactly which way causality flows though is the question.

I appreciate your work Brendon, but it's one thing to have an understanding of the economic theory and another to be able to design an appropriate econometric model.

Econometric models create narratives. They hide assumptions. All models do that. They are simplifications of the real world. So the question is this model a reasonable depiction of the real world or does it create a narrative that in non-expert hands will mislead?

I think there is a danger of the second.

The narrative this research creates is that land value increases by a certain amount as a result of amenity provision. But the research is only telling you that under certain conditions -for a particular set of planning restrictions. Change the conditions and the results will vary. Land values might increase by a much lesser amount and there might be much more building instead.

Rapid transit of the nature that the government and Auckland Council is proposing has the potential to open up a huge supply of residential land within Auckland's metropolitan area/labour market. Residential blocks around rapid transit stations could easily have five times the amount of housing.

The expansion of rapid transit in Auckland could be like the expansion of the underground in London in the 1930s that John Myers discussed in the link in my first comment. This provided affordable housing for hundreds of thousands middle and working class households. But of course it occured under a much more permissive planning regime according to Prof Craft.

https://www.theguardian.com/housing-network/2013/apr/19/1930s-house-bui…

The problem the UK had is after the war they became obsessed about capturing the planning gain for public use (rather than competing away excessive land price inflation). This led to the UK Town and Country Act and Betterment Taxes. These didn't work -they are a rabbit hole that never delivered what it promised.

I would welcome it if Auckland Council decides to impose an additional small targeted rate on areas close to rapid transit as result of this research. That could be a welcome source of funding for rapid transit -I doubt it would be enough -but it could help. But so would some regional hypothecated income taxes, sales tax or fuel taxes -as they also capture economic activity and are successfully used in various places overseas to fund infrastructure provision. Transport demand management by congestion charging and parking fees would also help for slightly different reasons.

In Tokyo because of their permissive planning rules and the way that private vehicles are not subsidised wrt spatial economics this allows rapid transit to be provided by for profit rail companies.

Ultimately I believe one way or another rapid transit will be provided for Auckland and then the proper question for public officials -both central and local -is how to maximise the best return from the public's investment? $28billion is a lot money -I hope we get the best bang for our buck!

P.S re the causation flow for planning restrictions and land values -I suggest you read Glaeser et al

I don't disagree that models can assumptions. They are pretty much always laid apparent, as they are here (well, largely). And yes, in this case they assume a static, ceterus paribus, position in those assumptions.

I just think your ridicule is misguided in that you forget that this still has a purpose.

Would we love to see some endogenous structural modelling of planning rules and prices? Of course. But these aren't necessarily feasible, hence the reliance on the simpler models such as this. As I say your mind is familiar with the theory, but it gets ahead of itself in how it can be robustly proven in observational data.

Exactly which Glaeser paper?

Because the ones I remember (like pretty much all of the urban economics literature) explicitly states the temporal endogenous nature of land use restrictions and prices. It is the biggest issue tackled in the urban science literature. Hence why a substantial amount of effort goes into finding ways to instrument for this issue in every case they conduct econometric analysis involving land use regulation and prices and they wish to establish causality.

Try this Glaeser paper -The Economic Implications of Housing Supply

https://pubs.aeaweb.org/doi/pdf/10.1257/jep.32.1.3

Thanks.

After a 1 min skim read, I pretty much find what I was saying...

My comment: "Exactly which way causality flows though is the question."

Glaeser's note on exactly the same thing:

"However, it has been a challenge in this literature to find convincing instruments or some form of experimental variation. Because empirical work in this area is cross sectional in nature, it is subject to standard potential biases associated with omitted variables and reverse causality."

Hence why it is very difficult to put prices and LURs in the same econometric model and come out with something meaningful if you have any scientific integrity. But if you have any ideas for instruments, lets the AC guys know. Auckland Uni econ dept. seem to be doing a lot on this recently also so let them know too.

Haven't you also just proved that econometric modeling land prices with amenity, such as Auckland's economists attempt here, cannot be accurately measured i.e. there is no econometric model that accurately measures factors such as amenity or land use restrictions against price.

There is evidence that supply restrictions do have an significant effect in raising prices but exactly quantifying them is difficult. Also demand effects, such as, improving amenities will also have an effect, especially dependent on the elasticity of supply, but again quantifying the exact amount is difficult.

Is this a problem? Not really. What we should do is go through a democratic rather than a 'expert' led process. Democracy can determine what infrastructure to provide and how to reduce unreasonable land use restrictions.

Restrictions where the benefit are low -viewshafts that are only visible briefly from motorways for instance, or the nuisance/externality costs are marginal -e.g. building height limits being much lower than tree height or street width. Or where the cost can be mitigated in another way -such as, congestion pricing or car parking metering managing the demand effects from traffic.

There is a difficulty in how to remove restrictions when the nuisance or externality is reasonable, such as shade and privacy protections. But if the externality can be contained within a small group of neighbours without spilling over then a Hyperlocal process could be the answer.

https://medium.com/land-buildings-identity-and-values/hyperlocalism-how…

Well, no. Because they aren't talking at all about zoning - They are talking about infrastructure. The effect of infrastructure controlling for all other factors (which I assume includes expected zoning - they don't mention this, though).

The covariance between price and zoning in the hedonic specification doesn't change dependent on the flow of causality. So all the other results remain consistent and efficient.

Of course there is lots of evidence on supply elasticity and price. However, it is all done under the assumption that prices and LURs are endogenous - which is what I have been pointing out.

I 100% agree that development should be done democratically and not 'expertly' - one only needs to look as far as AC to see why that is so. And yes, local solutions are a solution. Whether feasible, I'm not so sure.

Really! I am no econometric expert. But it seems you are saying it is possible the measure the effect of a change in infrastructure provision has on land values. But it is not possible to measure whether a change in zoning -up or down has an effect on land values. That can't be right -surely it is both then?

In fact I think from memory there was some research done about this when the Unitary Plan was changed.

Econometrics is about causality.

Well. All economics is about causality.

My point is that you need to establish this to make sense of covariance relationships. It is this that is hotly debated in the urban economics literature - whether LURs have causal effect on price or whether prices have causal effect on LURs. Both are plausible.

Can you explain what you mean by it is plausible that prices have causal effect on land use restrictions?

Because a change in planning regulation is not necessarily exogenous.

Take Auckland for example - coincidentally in the AUP there is a band around the central city which is all low density zoned. Surely if planners didn't care about residents, that would all be high density housing. Thus, it is the effect of people trying to maintain the value of their property.

Hence, prices are influencing LURs.

What? If that is the rationale for why the causal relationship between zoning restrictions and price can't be determined but infrastructure can be quantified then truly this approach has gone down a rabbit hole.

It just depends on what you assume to be the exogenous factor.

Unless we are in the great midwest era of railway construction in the 19th century, property prices are a function of railway infrastructure. Not the other way around.

Given that the AUP opted to declare huge tracts of prime intensification locations as single house zones, I would argue that LURs are not exogenous to price.

This is the standard approach in the literature wrt LURs, given that there are no papers that don't instrument for LURs in their econometric specifications.

The Auckland economists research does not show big the amenity premium is. Where was there research on how much new housing is being built close to rapid transit versus further away? Where is there research on the effect on business, employment, shopping etc close to transit versus further away?

All this research showed is the effect rapid transit has on land values. But land values can be distorted by non-amenity factors such planning restrictions -another form of windfall gains which the Auckland economists seem less worried about -why is that?. Really how valid is land values for measuring amenity gains when it can be so easily distorted?

Finally the Auckland economists claim it is fair to measure the value uplift so a mechanism can be created to tax existing land owners for the 'windfall' gain. Yet they do not discuss that if property government values rise relative to other parts of the city then those properties will pay higher rates -so they are not getting 'free' windfall gains.

Good thoughts, Brendon. Plus, to add to the variables inherent in such analysis, there are wildly different time leads and lags involved with plan and regs changes. Leading, if there is room for quick-thinking developers to get in before a plan change becomes operative. Lagging - often by a decade or more - when significant changes are made and the risk of misinterpreting untested regulations, policies, and staff comprehension is very high for early adopters. So looking at prices is essentially a lottery when timing is ignored.

Re: "But surely understanding amenity premiums is essential in planning for housing development, no?"

Nymad who builds houses, who chooses where to live, who chooses what type of houses to live in? Planners or people? I saw after Christchurch earthquakes the biggest building boom per capita in NZ in the last 50 years. People decided what amenities were important to them. They do not need any research. Planners were useless -the areas they thought would be popular -many are still empty.

I think NZ should be offering more choices -so planners have a place esp transport planners -but ultimately it is people not planners who decide.

But that just reiterates my point, right?

The price of amenity is still capitalised into land value, regardless of planning or not. Hence, why understanding that is important.

I would say one reason the planned areas didn't succeed could be exactly this - due to the lack of understanding of the amenity premiums associated with the land location.

I suspect you are both talking past each other re the definition of 'amenity'. Quite apart from anything else, 'amenity' for a given household has a very definite life cycle. Early on, it is access to the bright lights and the social action. After a family is started, it is access to schools, recreation, and malls. Empty nest time, often 'amenity' is either on the road, overseas, or somewhere else perfectly inaccessible to local planners. Much later, the Rymans and Summersets of the world do all the planning needed. So, just as 'sustainability' cannot be quoted alone but must be accompanied by 'at what level of civilization and comfort', so must 'amenity' be accompanied by 'at what stage of a life-cycle'......Timing, as always, is key....

Do amenities always capitalise into land prices?

I think sofas are really comfortable. I love the amenity they provide. But does that mean the price I pay for a sofa should be above its cost of production? If sofa prices did inflate above the cost of production wouldn't another firm enter the market and undercut the price?

What about a tiny home built on a trailer that doesn't need permission to locate it on a city plot of land? Should tiny homes have amenity prices greater than the cost of production? What about the same tiny home without the trailer that does need permission?

Why do 'permits' capitalise into land prices?

What effect does 'permit' prices have on labour mobility? Would this be the same effect as a Chinese hukou-style system requiring workers to get permits to move to cities with high wages?

What if the 'permit' price inflated faster than wages? Would that be worse than China?

You quoted Glaeser earlier - do you not agree with his views on what locational amenity does to Intensive price of land?

Which is also a great segue to the permit question also covered by Glaeser in the same paper - No. They don't capitalise into land value at the margin; they are part of the extensive cost of land.

I dunno where you are going with the sofa analogy but an understanding of the intensive and extensive cost components of 'land' should highlight what is wrong with what you are saying.

Why is there a difference between how sofas, tiny homes on wheels and tiny homes without wheels are priced? Could it be something to do with how 'permits' are rationed.

I do not recall Glaeser's locational amenity impact of intensive price of land. But I would not deny that locational amenity does influence price. But is the whole amenity value accruing to price or is there some consumer surplus? Much like I might value my sofa more than it costs.

I do recall his intensive versus extensive margin analysis but that relates to one of his proofs that land has different values depending on whether it is land with a permit to build or not.

Intensive capitalises the amenity value as it is the raw value of the land undeveloped. Extensive captures the cost of regulation above the cost of undeveloped land at the margin.

You are confusing the point with the sofa analogy. That's not really amenity value, but utility.

But, to use your analogy - the intensive cost would be the cost of production at the margin. The extensive cost would be the price you pay, so the difference is some producer surplus or an implied tax - exactly what Glaeser means by the wedge between the intensive and extensive price of land.

What? That is not what Glaeser states. Here is the quote

"This gap between price and cost seems to reflect the influence of regulation, not the scarcity value arising from a purely physical or geographic limitation on the supply of land. For example, in Glaeser, Gyourko, and Saks (2005), we show that the cost of Manhattan apartments are far higher than marginal construction costs, and more apartments could readily be delivered by building up without using more land. This and other research we have done (Glaeser and Gyourko 2003) also finds that land is worth far more when it sits under a new home than when it extends the lot of an existing home, which is also most compatible with a view that the limitation is related to permits, not acreage per se. " P.14

Sorry, I misread the sofa analogy and conflated it with the permit analogy.

I didn't read it as a scarcity problem, as you intended.

Re: "I don't know what you want the Chief Economist's Dept to do, Brendon?"

I would want them to read Glaeser and explain that to Auckland Council and the wider public. Not some weird Nymad econometric approach that somehow can exactly measure the amenity benefits resulting from infrastructure but cannot measure the costs that restrictive planning rules imposes. Even though a former Auckland Council economist has a published paper on exactly this topic.

If that is not their cup of tea. They could try these new publication from Alain Bertaud. He is an urbanist and, since 2012, a senior research scholar at the NYU Marron Institute of Urban Management. He just completed writing a book about urban planning that is titled “Order Without Design: How Markets Shape Cities“. This book will be published by MIT Press in November 2018. Bertaud previously held the position of principal urban planner at the World Bank.

Fair enough.

I'm not saying you can't estimate the relationship - as I said, the covariance relationship exists.

I'm saying you can't necessarily make inference from it.

When you find a paper that doesn't explicitly note the causality issues between prices and LURs, let us know.

Nymad I am not going to make some weirdo econometric guys the final arbiter on whether land use restrictions are good or not. Why would I do that? The evidence is quite clear on any reasonable reading of it that excessive land use restrictions have harmful effects. If the available evidence doesn't fit into some particular econometric worldview well that is a problem for that worldview.

Our analysis shows that the maximum walk-up distance to the rapid transit network (RTN) that adds value to a property is shorter than we had anticipated although there are several likely reasons for this we have not been able to model.

No, it is because Auckland is planned to be massive sprawl.

Land costs in Auckland City are held insanely high to make urban transport less relatively valuable. Maybe the nice people might like to know in how much smaller an area than expectations the measured effect was detected. In a normal city we can expect the effects to remain statistically significant up to 1000 m to 1500 m away. But in Auckland it is just 500 m.

https://www.fciq.ca/pdf/mot_economiste/me_112016_en.pdf

https://www.tandfonline.com/doi/abs/10.2753/CES1097-1475430203?journalC…

Don't cherry pick research.

How is Auckland at all similar to Shanghai?

Population Density, density of infrastructure, foot/cycle traffic. These are all reasons why the reported spatial effect is lower in Auckland.

It is probably related to the fact that in many parts of Auckland no-one wants to (or their other half to) walk more than a small distance in the dark with wind and rain thrown in. So at 500 metres it almost becomes necessarily a drive, So no better than 3,000 metres. my 5c

Hardly surprising the same applies to all improvements in transport. Take the completion of the Puhoi to Warkworth motorway for example. Property prices started rising in Warkworth even before the work started on the motorway let alone the 2020/21 completion date.

and this whole report is amazingly useless. Summary.

Some people really close to stations will see property values go up so we will end up with a bit more rating income off their owners. Or off the people who buy off their properties because they can't afford rate increase.

Report done! I'll send an invoice for $2

Yip that sums up this report. It shows what areas will pay more rates because their properties went up in price as a result of rapid transit.

"..... the maximum walk-up distance to the rapid transit network (RTN) that adds value to a property is shorter than we had anticipated...."

Unprofessional.

A typical Council stance. Obviously they are looking for a desired outcome. Council surveys are done this way as well.

Huh? Northern busway ridership goes from zero to....

Whaaaat?

Buses have been going over the harbour bridge since it was built!!

Len Brown wanted to force people to catch the train by not construction one km of bus lanes while he was in power.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.