By David Skilling*

The reduced frequency of these notes over the past few weeks has been due to my being on the road in New Zealand and Singapore, my first trip back since the pandemic. The long flights provided ample opportunity to reflect on my conversations and observations. So this note provides my take on some observed similarities and differences between Europe and Asia.

Airports, Covid, & the recovery

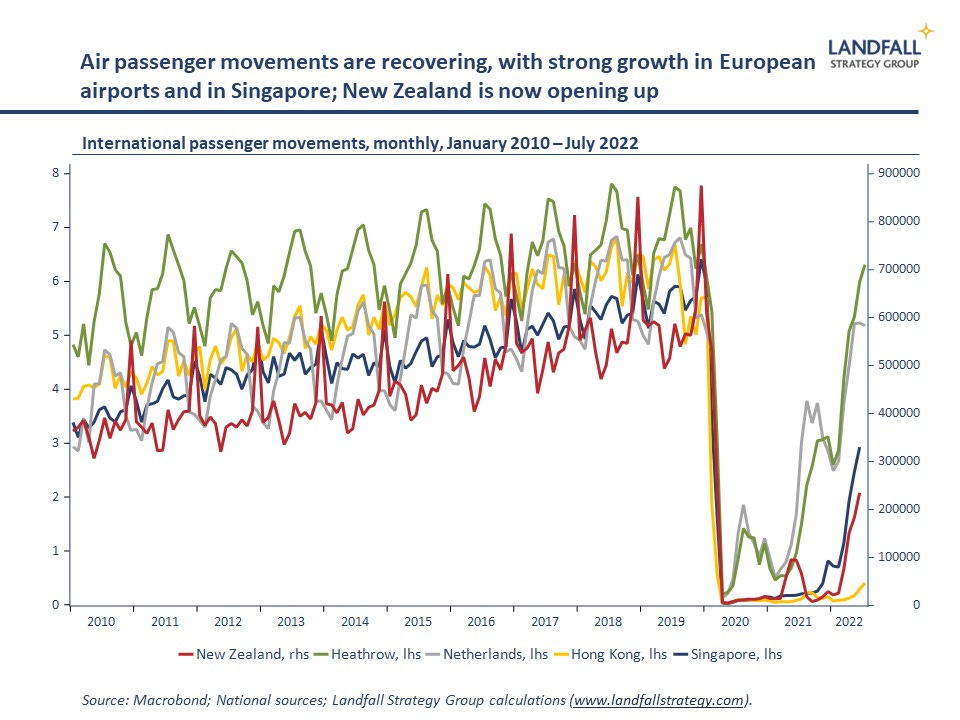

One clear difference, evident before departure, was the functioning of airports! Arriving at Schiphol well before 7am, I encountered snaking queues already forming outside the short-haul terminal. I was fortunate: it only took a couple of hours to get through. But the labour market stresses in a strongly rebounding European economy were clear.

In contrast, Singapore’s Changi Airport was its usual paragon of efficiency. And New Zealand airports were quiet, partly because borders hadn’t yet fully reopened.

The second obvious difference was policy approaches to Covid. Although infection rates in Singapore and New Zealand remain relatively low, mask-wearing is ubiquitous – including outdoors in tropical Singapore. Not having seen a mask in the Netherlands for a long time, it was jolting to see the ongoing reality of Covid precautions in Asia.

The tough approach in Asia to initial Covid management casts a long shadow – while Europe has continued its relatively liberal approach. There are clear differences in national risk tolerance with respect to Covid, which will have impacts on economic behaviour.

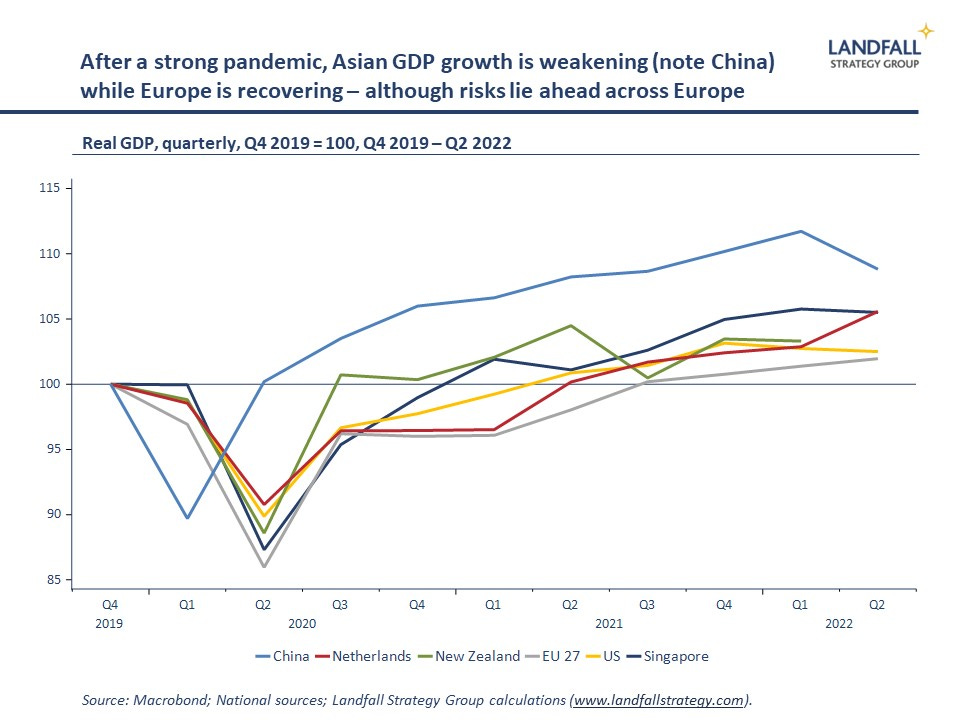

Indeed, a third striking difference between Asia and Europe is the state of the economic recovery from Covid. Asian economies performed strongly through the pandemic – partly because strong initial Covid control measures allowed them to reopen relatively quickly. Many (larger) European economies did not do as well.

But now there is some faltering in Asian economies. Singapore reported negative qoq GDP growth in Q2, and the Reserve Bank forecasts weak GDP growth in New Zealand from late 2022. A weakening Chinese economy weighs on the outlook across Asia. In contrast, European GDP numbers for Q2 were surprisingly robust – although the economic outlook in Europe is clearly clouded by high energy prices.

Geopolitics & inflation

But beyond these differences, the conversations with policy-makers, investors, and business leaders were strikingly similar in focus to those I have in Europe. Two topics that headlined almost every conversation were growing geopolitical tensions; and the economics and politics of surging inflation.

Geopolitics

The debate in Europe is dominated by the direct and indirect impact of Russia’s invasion of Ukraine. Previous notes have described the altered geopolitical landscape and different national decision-making: the expansion of NATO, commitments to increase military spending, and tough sanctions on Russia. Economic and energy relations with Russia have structurally changed – leading to substantial near-term cost in terms of higher energy prices.

It is possible that public opinion will weaken over the next several months, as high energy prices persist into the Northern winter months. But my sense is that support for Ukraine (and sanctions on Russia) across European countries will be sustained – and certainly by the US, the dominant provider of financial and military support to Ukraine.

The complacency that many European countries had with respect to geopolitics has been diminished. Indeed, there is much greater caution by European governments and firms with respect to China: it is seen as a strategic competitor not just a large market. The tone of the European debate is converging to that in Asia, where it is broadly recognised that geopolitical realities shape the ability to pursue economic engagement.

The geopolitical preoccupation in Asia over the past fortnight has been Taiwan, on the back of Ms Pelosi’s visit. Once the news of her proposed visit had leaked, it became politically difficult to back down. But the level of tension around Taiwan has been structurally increased as a consequence of her visit, even beyond that due to China’s increasingly aggressive behaviours.

China’s prolonged live fire exercises around Taiwan are likely to be seen more often, and the US is also likely to become more assertive in various ways. It is likely that there will be more frequent episodes of elevated tension around Taiwan, with associated economic costs.

Although a military conflict seems unlikely in the near term (Russia’s problems in Ukraine are cautionary for China), the chance of a mistake or a miscalculation has increased: Singapore’s Deputy PM Wong talked during the week of the dangers of ‘sleepwalking into conflict’. A military/economic conflict involving China and the West would be a much more serious matter than Russia’s invasion of Ukraine, with catastrophic economic and political consequences. Geopolitical risks topped PM Lee’s National Day Message last week.

Although the specific focus of geopolitical concern varies across regions, there is a shared sense that countries and firms need to grapple with a more geopolitically challenging context. And that choices will need to be made as the global system fragments.

Indeed, there has been some recent toughening of rhetoric in New Zealand on geopolitical issues: sanctions on Russia, tougher on China (Pacific, Taiwan), and a more Western-aligned stance. There are even rumours about New Zealand joining AUKUS, although this seems distinctly unlikely in the near-term.

Inflation

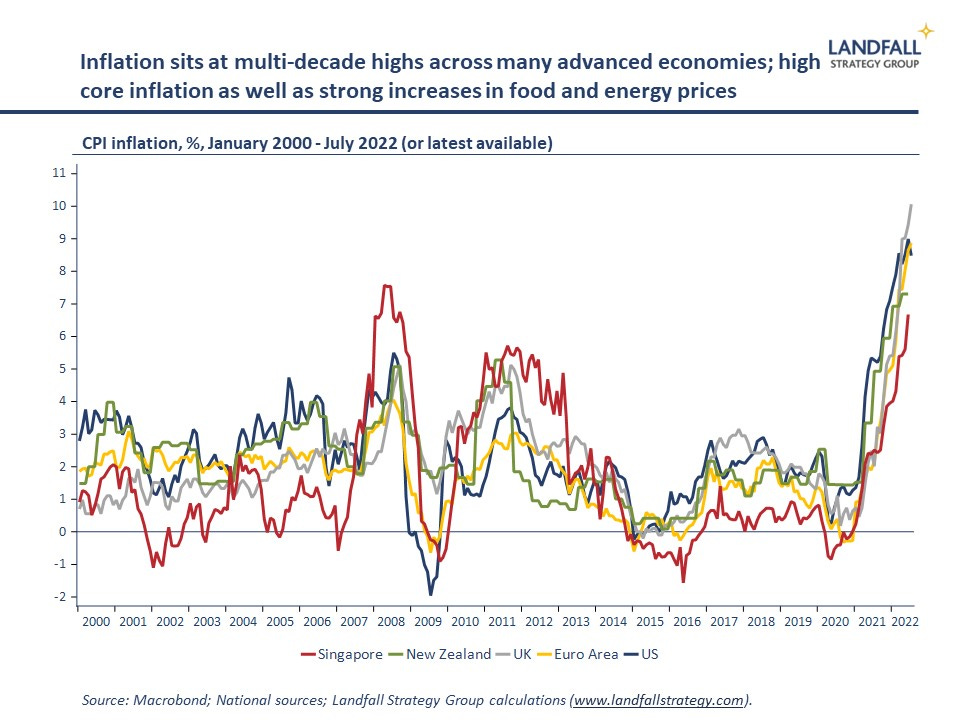

Inflation has surged to multi-decade highs across advanced economies for a variety of reasons: excess demand, supply-side constraints, high energy and food prices, and so on. This is true in Asia as in Europe, even if inflation rates are slightly more muted in Asia (partly because Asian economies are less exposed to higher energy prices, particularly gas).

‘Happy families are all alike; every unhappy family is unhappy in its own way’, Leo Tolstoy (Anna Karenina)

Central banks in Singapore and New Zealand have tightened monetary policy in response. Indeed, on Wednesday, the RBNZ lifted policy rates by 50bp with more expected. The ECB has started to lift the policy rate but this will be a much more gradual process (partly constrained by high public debt levels in countries like Italy and Greece).

Inflation matters not simply because it can be economically damaging (demand destruction, the need for higher interest rates) but also because high inflation can impose political costs. After decades of relatively modest (and sub-target) inflation, households have rapidly acquired a distaste for resurgent inflation. Even when some of the inflation is due to external forces (such as higher energy prices), this is seen as a marker of the competence of the government’s economic management.

Governments across Asia and Europe are scrambling to deploy policy measures that will offset or control inflation: from household energy subsidies to various price controls. And countries like Singapore are also acting to strengthen the functioning of labour markets, in order to ease skills shortages – as I noted recently, labour market disruptions in the post-Covid global economy are one underlying cause for high inflation.

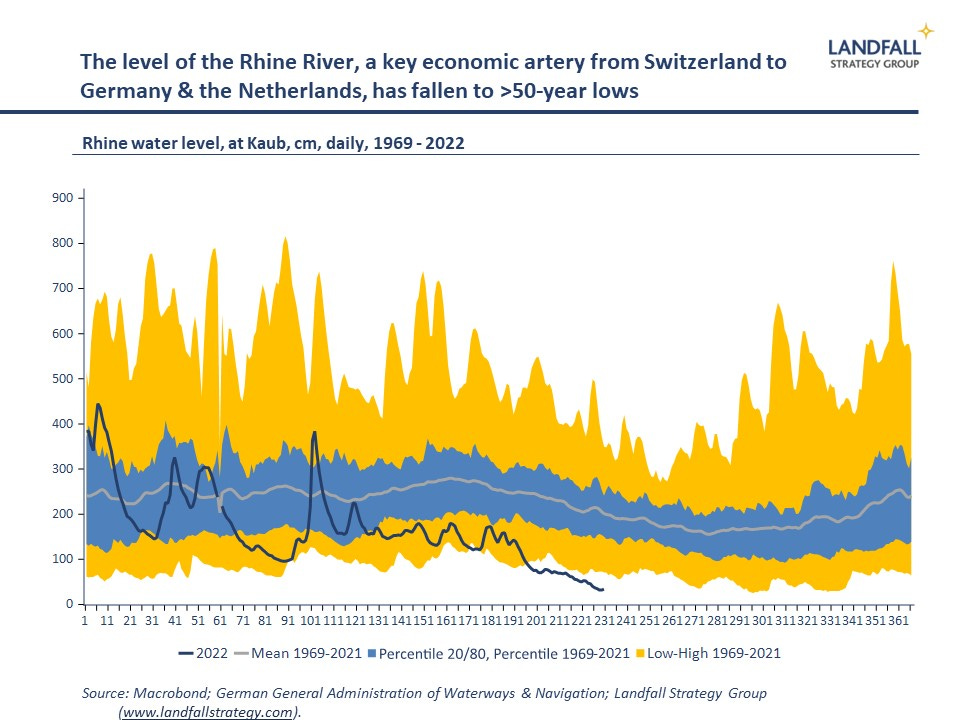

Climate records

As a final observation, while Europe experienced one of its hottest and driest summers on record (with the Rhine at historic lows), much of New Zealand experienced its wettest July on record. Although I dodged the worst of the torrential New Zealand rain, a return to a parched, brown Netherlands provided a reminder of the changing climate across the globe.

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. The original is here. You can subscribe to receive David Skilling’s notes by email here.

19 Comments

Travel is always an eye opener. Speaking to locals through Asia.

There was very little helicopter money. There was no cheap debt.

Things for many were pretty rough. Half of the commercial spaces on average are closed.

Plus they have most of our current problems, and more.

This shows us how connected the system is. Is it even possible to be prosperous without having to be part of the global order?

This sounds familiar.

“Alarmingly, it was the German jurist and one-time Nazi Carl Schmitt, who wrote the playbook for the authoritarian takeover of democracy. Schmitt set it out in one sentence: “Sovereign is he who declares the exception.”

Simply: construct an emergency, claim extraordinary powers, and put yourself above the rules.”

What is with this retarded thing of anyone who was associated with the NSDAP is always describing how they do bad guy things as the baddies?

It is retarded, the context on that, which is from a book (The Crisis of Parliamentary Democracy) he wrote in the early 20s on how the German government responded to the Communist revolution which was launched by Rosa Luxembourg and her lot of conspirators. It is about why democracy is a dysfunctional form of government.

kiwikidsnz,

Sounds like Scott Morrison.

Singapore is an international financial center that benefitted immensely from Covid-- asset price inflation (increase in assets under management) and an exodus of capital from China all landed in Singapore as Hong Kong is no longer favored.

Having virtually a monopoly in finance as an export service in the region does them a lot of good and provides their economy with a lot of resilience.

Such a sector is largely immune from the effect of climate change, unlike agriculture. Also Covid, unlike tourism. New Zealand needs to develop export industries that is resilient as well, whatever that may be, we cannot entirely rely on farming, tourism, and international education as our three exports--all decimated and vulnerable to climate and outbreaks

As well as becoming more self sufficient. But then you are up against the Greenies all theory and Politics

It will be an interesting watch as Europe goes into their autumn & winter this year, with traditional energy supplies now under threat. We can only hope that Putin can see sense in all of this somehow - a big ask for a 20th century dictator/dinosaur.

Back here on the ranch we desperately need more water storage for energy, drinking & productive purposes. It's a bit like social houses, we didn't do anything to them for 50 years & now there's a social housing crisis. The same applies to the water. We've done FA for the last 50 years & we plainly do not have enough storage. Yeah, okay, it rains a lot, but as we know, we can't always rely on mother nature.

The future of this nation lies in getting these fundamental infrastructures right & then keeping them right. We had a similar issues with roading until John Key decided to do something & then along came Jane & promptly stopped it.

I know both sides are as bad as each other, especially these days, but at least Luxon will govern over one nation, not splitting it into two like Jacinda is proposing.

I’m not sure NZ has a lack of roads! A significant excess of roads is one of our biggest problems at the moment, had John invested in public transport instead we could use our clean electricity to power it and significantly reduce our oil imports, emissions and trade deficit.

I do agree it is very important that the government invests in the right assets now, it’s quite obvious that renewable energy and public transport are essential, still hard to see how National and so many NZers can be so stupid to not get it. Investing in things that cause emissions is at best very bad business these days, it makes you wonder how much business acumen they actually possess. I guess Luxon ran an airline so he certainly doesn’t get it.

If we invest in assets that create CO2 then the next generation will just have to rip it all out. Might be hard for them to pay for new infrastructure and your pension.

Most public transport uses roads. Intercity travel uses roads, almost without exception. Roads are important for most forms of transport. By the way, have you driven on SH2 lately? Any of it? Most of it is a goat track masquerading as a 1st world road. And guess what? Train replacements and intercity buses run on said road.

Too much sarcasim

"Singapore’s Deputy PM Wong talked during the week of the dangers of ‘sleepwalking into conflict’"

EU/Europe certainly did.

"Even when some of the inflation is due to external forces (such as higher energy prices), this is seen as a marker of the competence of the government’s economic management"

More like political mis-management.

I wonder how many European citizens see inflation as their contribution to the Russo-Ukraine war.

I just can't understand the EU. I've tried, I really have. I love the place. The places. But all they've done is create another ultra-expensive layer of bureaucracy - in return for peace. Well, how's that looking now?

Some of the German decision-making, around their energy requirements, over the past 15-20 years has been abysmal. And I love the Germans, so it hurts me even more.

... yes ... been there , supped ales with the locals , wandered the Struggle Streets ... fricking awesome... BUT ... but , OMG , the unelected leaders of the EU are completely bereft of an ounce of empathy or commonsense ...

We have been traveling around America for a while now, city hopping and there’s hardly a mask in site and no ones talking about Covid. It’s really refreshing. Plus we get plastic bags with our shopping and gas seems cheap. Hard to describe but the US feels a lot more positive than home, NZ.

structural engineer,

Wonderful country but if you consider that getting plastic bags with your shopping is 'more positive', you might want to raise your sights a little. Sure, the petrol is much cheaper, but again, is that really a good thing today?

Yes but we would like to be able to live a little now

"Plus we get plastic bags with our shopping" is that a good thing?

Bugger the next generations, we will flood their oceans with plastic bags! we are living the dream now.

Oh for the freedom of plastic shopping bags...... LOL.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.