This is a re-post of an article originally published on pundit.co.nz. It is here with permission.

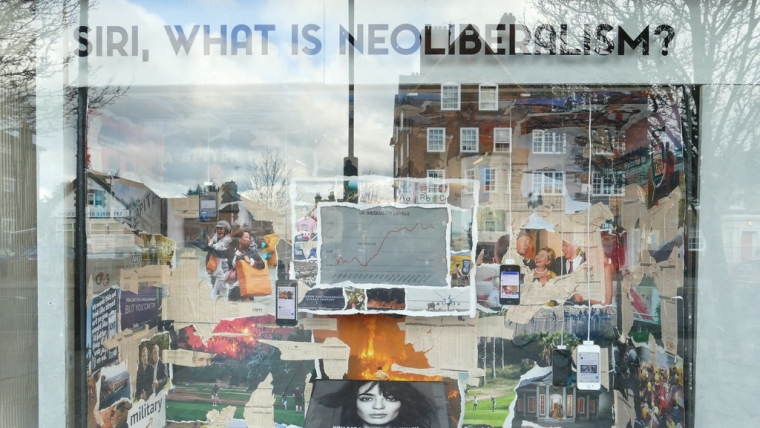

Gary Gerstle’s The Rise and Fall of the Neoliberal Order: America and the World in the Free Market Era is a frustrating book. It is an impressive sweeping history of American politics and economic policy from the New Deal in the 1930s to today, predicting that we are coming to the end of the ‘neoliberal’ era. However, Gerstle never defines what he means by ‘neoliberal’ other than with examples through the narrative, so it is difficult to be able to identify what is coming to an end and when.

A Professor of History at the University of Cambridge, Gerstle’s central notion is ‘political orders’, in which ways of thinking and policy frameworks dominate what is done and how it is talked about. (Sonia Mazey and Jeremy Richardson of the University of Canterbury talk about ‘policy styles’, which is much the same thing. Their recently published Policy-making Under Pressure: Rethinking the Policy Process in Aotearoa New Zealand applies their approach locally.)

Gerstle argues, reasonably convincingly, that there have been two broad political orders in the US in the last ninety years. New Zealand parallels the pattern, which is why we need to think about whether the second one is coming to an end. The ‘New Deal’ first was triggered by the election of Roosevelt in 1932. New Zealand’s trigger was the first Labour Government, although there are precursors in Coates’ initiatives in the preceding Coalition Government. The ‘neoliberalism’ second began with Reagan in 1980, with the New Zealand equivalent precipitated by Roger Douglas during the Third Labour Government.

The difficulty with this narrative is that both paradigms evolved, as Gerstle describes but does not reflect upon. He says Obama pursued neoliberal policies, but surely he does not include Obamacare. Again, one could accuse the Ardern-Robertson Labour Government of being neoliberal, but this ignores that there has been a considerable retreat from the policies introduced by Douglas and Richardson throughout the thirty-odd years since. (Many would argue the retreat has been insufficient; the point is that there has been one.)

What I find uncomfortable about the Gerstle approach is that whatever the historian’s narrative power – he certainly writes well – it lacks analytic power. It is easy enough to say neoliberalism rose, but why then? And that it is failing, but why now? Trying to answer these questions shifts one from history to political economy – to use the phrase in its nineteenth century meaning.

You can get a sense of the difference from my Not in Narrow Seas. Certainly it has a historical narrative but I tried to explain what were the underlying drivers of the political economy and hence the political order/style. For instance, I do not see ‘neoliberalism’ in New Zealand simply as a consequence of the arrival of ideologists who seized power.

Rather, the old policy paradigm was breaking down in the face of increased affluence, diversity, urbanisation, and opportunities from globalisation plus a host of new technological innovations. The centralised control of the economy was too clumsy and inflexible.

This does not mean the neoliberalism revolution was inevitable. (It did not happeen to the same extent on the European Continent). However a handful of extremists grabbed power and imposed it, while repressing dissent. That is why there has been a steady roll back of the more excessive changes. But Gerstle would argue that New Zealand was still in a neoliberal political order. Is it a dying order?

The analytics says that something has to change for the death. A Marxist could argue that it is collapsing under its contradictions and excesses. But any order which has survived four decades requires a little more than inherent contradictions to collapse. In any case, the approach does not tell us what will replace it.

However there are changes which are undermining neoliberalism. But, hey Brian, you are as bad as Gerstle, you haven’t defined what you mean by ‘neoliberalism’. My neoliberalism is not everything I disagree with, which is often the way Gerstle presents his case. Rather, I define it as an approach which minimises the role of the state in the economy.

(I found Gerstle’s discussion on the neoliberal approach to social relations especially valuable. He details how they generally support a neo-Victorian moral code, including a punitive criminal regime. Trump, of course, has not such a code; Pence is at the other end of the spectrum. The US Supreme Court has shifted in the neo-Victorian direction.)

Insofar as this anti-government frame is what Gerstle has in mind, we are seeing the return of the stronger state. We cannot go back to the New Deal because of those changes I outlined. Market decentralisation will have to be largely retained. You are welcome to nostalgia towards the pre-1984 regime, but don’t let it block hardheaded analysis.

The most obvious example of the need for a greater role for the state is the response to climate change. It is not an accident that there were neoliberals among the strongest deniers. While the market may be a part of the solution, as the New Zealand experience shows it is one in which there is a high level of government regulation. One of the reasons the world is failing to achieve its goals is there is there not a world government.

Another example is that there was once the belief that macroeconomic policy only involved the central bank regulating the stock of money (the monetarist approach). Practically, the belief quickly broke down; today central banks set interest rates, a far more Keynesian prescription. But only in the last decade or so, there has been a real acceptance that in many circumstances fiscal policy – the government’s responsibility – has to play a coordinating role.

I could give many other illustrations of where the government is being sucked into being more involved with the economy, but in the remaining space I want to list some of the major constraints upon government involvement.

First, both the government and the public are heavily in debt, which puts them in thrall to the finance sector terrorised by bond markets, as I described last week.

Second, there is a reluctance to acknowledge that great government intervention requires a change in the public-to-private spending balance and hence higher taxation. Those that have headlocked us into this position range from the Taxpayers’ Union through to the National Party and even the Prime Minister herself.

Third, while the rate of globalisation may be slowing down, and perhaps even retreating in some areas, especially for the trading of goods (not services), all countries remain locked into international trade. The deleterious impact of Brexit on the British economic performance well illustrates the consequence of denying this truism.

Fourth – I am not so clear about this – is that the US is finding it increasingly difficult to respond to new circumstances. Political management of the most powerful economy in the world may be seizing up. Given the ease with which we uncritically adopted the neoliberalism of the US and Britain (whose politics may also be seizing up), New Zealand may well find this as another headlock on our thinking.

Fifth, if we really are in secular stagnation, or even just a lower growth phase that the period of neoliberalism experienced, then a number of mechanisms which resolved the inherent conflicts no longer work.

Each of these constraints is a column – nay a book – in itself. They limit our ability to adapt to the new circumstances. But adapt we will. Gerstle’s book describes to the nuanced reader how political orders evolve internally, even if they pretend otherwise. But it provides no guarantee that the evolution will lead to a better world.

*Brian Easton, an independent scholar, is an economist, social statistician, public policy analyst and historian. He was the Listener economic columnist from 1978 to 2014. This is a re-post of an article originally published on pundit.co.nz. It is here with permission.

15 Comments

Adern, Robertson and Orr will probably be remembered for a short failed initiative to return state dominance to the economy. It's reminded a new generation how ineffective and prone to overreach government is, at achieving stated objectives, and how effective the market is in improving wellbeing. The EU amd China are prime examples of that overreach.

The US voted for Biden and centrist Democrats to protect democracy, not to pivot left, and the neoliberal US will lead the world out of recession.

Can't happen. Growth was exponential, predicated on exponentially-increased extraction of the highest-quality energy we will ever see; fossilised sunlight, geologically compacted over eons at no expense to ourselves (indeed, before we even evolved).

We have burned our way through the best half of that resource, and already can't keep all out balls in the air. And everything we've made is getting older - thus ever-more maintenance-requiring, thus ever-more energy-demanding.

The last half will support a lessened total of activity, reducing with time. That reduction will be compounded by said older-ness (entropy, to name it correctly).

So global growth is all in the rearview mirror. No social construct can usurp physics - Canute pointed that out. And the 'market' was all about short-term advantage; it was long-term blind (due in no small part by the fervent belief demonstrated by the likes of your good self). It assumed no inputs, no outputs, but was linear; the only way to describe that is: 'Ignorant'.

Two books in my shelf are The Rise and Fall of American Growth, and The Collapse of Globalism. The question - too often unasked, especially by journalists - is: Why? The answer (to why global growth is dead) is: a reduction of energy and resource-input.

So many confused narratives - so few anywhere near the truth...

Walking through a mall on the weekend (yes, sad use of an hour or two), I was reminded just how pointless and unnecessary much of our supply-side search for growth is. So many overly specialised small appliances trying to attract my dollar - but why do I need them, and will I need more room to store them all? New fashion clothes in very slightly different styles to last year...okay, but I have more clothes than I need. Jewelry, retro-style watches, fast-fashion stationery (Typo), often trying to evoke feelings to get slightly more unnecessary sales.

Meanwhile, an older relative spoke of life growing up in the 1950s without much stuff at all, and how he never felt they were lacking. "There's just so much stuff today", he said.

Brian you appear to support the position that the state needs higher taxes to deliver

Surely the state already holds the cards as it makes the rules and regulations - so we need better rules and regulations not higher taxes per se

and if we put the "tragedy of the commons" at the forefront of our thinking and rule book then you could argue that the state would be doing its job properly and neoliberalism is a good model for delivering. Currently the "tragedy of the commons" argument is being abused to wrest control for favoured groups (think three waters structure) instead of rules being made for the good of all - and higher taxes doesnt solve this problem just enriches different groups

Orthodox economists like Brian Easton are one of the reasons that neo-liberalism persists as they have no perception of how money works and how governments with sovereign currencies finance themselves.

A government with its own sovereign currency can never be terrorised by the bond markets as it it never dependent upon them and it is in fact the bond market which depends upon the governments money and not the other way around.

Government debt is in no way similar to private debt as the government is simply holding its own issued currency in the form of bonds rather than as central bank reserves. Nor does the government ever spend bank deposits which have been taxed from us. The government spends by issuing its own currency.

These simple facts are all beyond the understanding of economists like Brian Easton though it seems and who have designed their own imaginary world of monetary make believe.

I don’t know whether to laugh or cry.

If you are referring to Brian Easton's ramblings then I would do both.

Economist L. Randall Wray explains here how our monetary system operates. https://www.levyinstitute.org/pubs/Wray_Understanding_Modern.pdf

The Levy Economics Institute states here that taxes and bonds don't finance spending. https://www.levyinstitute.org/publications/can-taxes-and-bonds-finance-….

Just a couple of examples.

treadlightly,

"A government with its own sovereign currency can never be terrorised by the bond markets"- total nonsense, as the UK government has just found out.

Brian I think you make a succinct point when you say ‘what will we replace the current system with’. No one anywhere seems to have an answer that us simple hobbits can understand and support. Any system that addresses inequality in NZ and everyone paying their fair share of taxes would do me. Whilst living within our means as a nation of course.

We don't need a new system,we only need to understand the one that we have and how to make it work for our benefit. Economists like Brian Easton are a part of the problem rather than a solution.

There you are 100% wrong.

The one we have, is past its use-by date (it was constructed to facilitate growth - see my post above).

Neither of you are actually onto it; economics itself is deficient in that it fails to measure stocks, only flows (and then, only the ones it chooses to monitor).

The problem is that we - fairly quickly - are headed for an orders-of-magnitude reduction in energy (watch Europe this winter - it's physics, not politics, at the bottom of their predicament) availability. Thus we are headed for physical triage (are already there, if we were accounting correctly - seen SH1 recently?). We are also headed for irreconcilable debt (and if Governments issue debt they have no intention of honouring, what is a dollar worth?).

There is nothing in MMT that says that we have to have growth. MMT recognises that resources are the constraint rather than money itself and that we also are facing ecological limits. MMT does believe in full employment though and that everybody who wishes to work should have a job and if the private sector cannot provide one then the government should, This could be in environmental repair and green jobs for instance.

Earning 'money' to be spent on?

Something other than processed parts of the planet?

Virtual stuff, then?

Don't get me wrong, I think everyone will be working - and very hard. Human labour displacing fossil energy in food production, is something we have not trained for....

The modern world is very wasteful of its resources, much of our food never gets eaten and we make things that cannot be repaired but must be replaced. We drive large SUVs and utes instead of more economical vehicles. Perhaps our world population will decline to a level that is sustainable at some point in the future.

But Wrong John says we're run by communists! (McCarthyism isn't dead...)

How can they be neoliberal AND communists?

Someone must be wrong...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.