By Ludvig Wier & Gabriel Zucman*

About a decade ago, the world’s biggest economies agreed to crack down on multinational corporations’ abusive use of tax havens. This resulted in a 15-point action plan that aimed to curb practices that shielded a large chunk of corporate profits from tax authorities.

But, according to our estimates, it hasn’t worked. Instead of reining in the use of tax havens – countries such as the Bahamas and Cayman Islands with very low or no effective tax rates – the problem has only gotten worse.

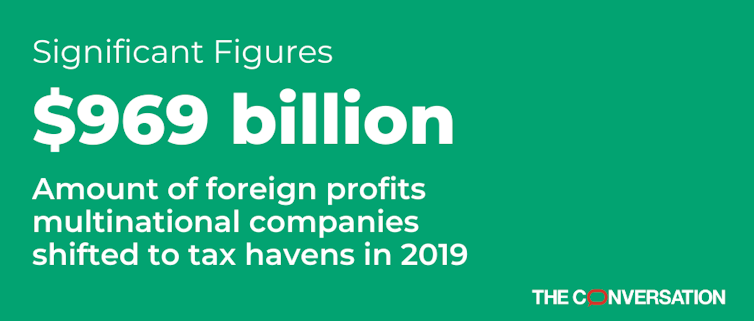

By our reckoning, corporations shifted nearly US$1 trillion in profits earned outside of their home countries to tax havens in 2019, up from $616 billion in 2015, the year before the global tax haven plan was implemented by the group of 20 leading economies, also known as the G-20.

In a new study, we measured the excessive profits reported in tax havens that cannot be explained by ordinary economic activity such as employees, factories and research in that country. Our findings – which you can explore in more detail along with the data and an interactive map in our public database – show a striking pattern of artificial shifting of paper profits to tax havens by corporations, which has been relentless since the 1980s.

Global crackdown

The current effort to curb the legal corporate practice of using tax havens to avoid paying taxes began in June 2012, when world leaders at the G-20 meeting in Los Cabos, Mexico, agreed on the need to do something.

The Organization for Economic Cooperation and Development, a group of 37 democracies with market-based economies, developed a plan that consisted of 15 tangible actions it believed would significantly limit abusive corporate tax practices. These included creating a single set of international tax rules and cracking down on harmful tax practices.

In 2015, the G-20 adopted the plan officially, and implementation began across the world the following year.

In addition, following leaks like the Panama Papers and Paradise Papers – which shed light on dodgy corporate tax practices – public outrage led governments in the U.S. and Europe to initiate their own efforts to lower the incentive to shift profits to tax havens.

Profit-shifting soars

Our research shows all these efforts appear to have had little impact.

We found that the world’s biggest multinational businesses shifted 37% of the profits – or $969 billion – they earned in other countries (outside the headquarter country) to tax havens in 2019, up from about 20% in 2012 when G-20 leaders met in Los Cabos and agreed to crack down. The figure was less than 2% back in the 1970s. The main reasons for the large increase were the growth of the tax avoidance industry in the 1980s and U.S. policies that made it easier to shift profits from high-tax countries to tax havens.

We also estimate that the amount of corporate taxes lost as a result reached 10% of total corporate revenue in 2019, up from less than 0.1% in the 1970s.

In 2019, the total government tax loss globally was $250 billion. U.S. multinational corporations alone accounted for about half of that, followed by the U.K. and Germany.

Global minimum tax

How do policymakers fix this?

So far, the world as a whole has been trying to solve this problem by cutting or scrapping corporate taxes, albeit in a very gradual way. In the past 40 years, the global effective corporate tax rate has fallen from 23% to 17%. At the same time, governments have relied more heavily on consumption taxes, which are regressive and tend to increase income inequality.

But the root cause of profit-shifting is the incentives involved, such as generous or lenient corporate tax rates in other countries. If countries could agree on a global minimum corporate tax rate of, say, 20%, the problem of profit-shifting would, in our estimation, largely disappear, as tax havens would simply cease to exist.

This type of mechanism is exactly what more than 130 countries signed onto in 2021, with implementation of a 15% minimum tax set to begin in 2024 in the EU, U.K., Japan, Indonesia and many other countries. While the Biden administration has helped spearhead the global effort to implement the tax, the U.S. has notably not been able to get legislation through Congress.

Our research suggests implementing this type of tax reform is necessary to reverse the shift of ever-greater amounts of corporate profits going to tax havens – instead of being taxed by the governments where they operate and create value.![]()

*Ludvig Wier, External Lecturer of Economics, University of Copenhagen and Gabriel Zucman, Associate Professor of Economics, University of California, Berkeley. This article is republished from The Conversation under a Creative Commons license. Read the original article.

8 Comments

Where do generous corporate handouts sit within this conversation. When accounted for total subsidies received by certain corporations from different regimes around the world, I wouldn't be surprised if certain global players actually came out as a net negative to taxpayers on a yearly basis.

O&G corporations alone received an eyewatering ~US$470b in government support in 2021. So much for the neolibs/libertarians arguing that governments should keep their hands off the sector's windfall gains in 2022.

"If countries could agree..."

There's the problem in 4 words. That's never going to happen. Someone is always going to undercut everyone else in one way or another

This is not new.

40 years ago (in all innocence back then!) multinational corporations were shifting profit, and losses (and employee remuneration at the top end) from one subsidiary to another come tax-time. (Tax minimisation happens onshore as well). It's part of the bargain that came along with Financialisation of Global Markets. And from there, there is no way back.

(NB: New Zealand plays its part in this game with things like the 2% tax payable via the Approved Issuer Levy =" If you are a non-resident of New Zealand for tax purposes and elect to have AIL applied to your interest, then a levy of 2% will apply")

Just drop company tax and have GST only?

Higher GST would lead to mass cash transactions, and tax avoiding bartering. Just drop income tax and have a universal land tax to compensate, but include everyone like farmers, commercial land and Iwi. Increase the rate for foreign nationals.

Or an FFT on all transactions, payable by the recipient, and paid by BOTH parties on a barter (which is effectively two transactions). Payable on all cross-border transfers (both ways).

[Note the post about land tax doesn't really apply to the context of the article, the following is just my response to the proposal]

Then convert all non-treaty land to leasehold, paying out all owners a non-transferable credit (linked to IRD number) for the value of the land, usable towards future lease payments (for current and future land leases). Ameliorated out over 50 years.

Add a UBI, get rid of all benefits (super, JS, AS, WFF).

Then give RNBZ three additional tools to manage the economy: UBI rate, lease rate, and FFT rate. Make Kiwibank an arm of the RBNZ, giving the people direct access to loans/deposits at the OCR.

For treaty purposes, Maori control the lease rate for their own land, and don't pay lease to the people of NZ, for 100 years.

Tax based on total gross rather than net profit.

Businesses do not pay GST.

As a business owner. If they make money you pay GST. As I have to this month.

Only because your business got paid that gst in the first place. (Or you or your accountant screwed up).

Businesses are GST neutral.

If CST was increased to 30% the resultant amount paid to the government by businesses would be exactly the same. Zero.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.