Corporate Tax

The Green Party would provide a guaranteed income of $385 a week, paid for with a wealth tax on assets over $2m and 45% tax on income over $180,000

11th Jun 23, 11:13am

258

The Green Party would provide a guaranteed income of $385 a week, paid for with a wealth tax on assets over $2m and 45% tax on income over $180,000

Falling tax revenue causes the Government accounts to dip further into the red for the first 10 months of the financial year

8th Jun 23, 1:18pm

15

Falling tax revenue causes the Government accounts to dip further into the red for the first 10 months of the financial year

US$1 trillion in the shade – the annual profits multinational corporations shift to tax havens continues to climb and climb

7th Mar 23, 9:24am

8

US$1 trillion in the shade – the annual profits multinational corporations shift to tax havens continues to climb and climb

Workers are the low-hanging fruit of the tax world. NZ should broaden our diet

7th Sep 22, 10:36am

93

Workers are the low-hanging fruit of the tax world. NZ should broaden our diet

Revenue Minister David Parker says demands for tax cuts aren't as 'realistic or responsible' as they might've been pre-COVID

11th Jun 21, 1:40pm

43

Revenue Minister David Parker says demands for tax cuts aren't as 'realistic or responsible' as they might've been pre-COVID

David Parker 'broadly supportive' of Janet Yellen's push for a global minimum corporate tax rate; Grant Robertson to virtually meet with Yellen next week

7th Apr 21, 5:36pm

25

David Parker 'broadly supportive' of Janet Yellen's push for a global minimum corporate tax rate; Grant Robertson to virtually meet with Yellen next week

Simon Bridges isn't planning to follow in John Key's footsteps by hiking GST and cutting the corporate tax rate, but remains open-minded as circumstances change

11th Mar 20, 1:24pm

87

Simon Bridges isn't planning to follow in John Key's footsteps by hiking GST and cutting the corporate tax rate, but remains open-minded as circumstances change

Revenue Minister Stuart Nash says Tax Working Group to be established with terms of reference released and members named by Christmas

16th Nov 17, 3:57pm

15

Revenue Minister Stuart Nash says Tax Working Group to be established with terms of reference released and members named by Christmas

Grant Robertson makes his case for the Finance Minister job: Alex Tarrant asks about Monetary Policy and not spooking the market with an unemployment target, productivity, free trade, tax settings and spending priorities

12th Sep 17, 9:23am

158

Grant Robertson makes his case for the Finance Minister job: Alex Tarrant asks about Monetary Policy and not spooking the market with an unemployment target, productivity, free trade, tax settings and spending priorities

PM English pours cold water on calls for tax treatment of 'other' forms of savings to be the same as for property; Also says case for corporate tax rate cut faces high hurdles

30th May 17, 5:02am

31

PM English pours cold water on calls for tax treatment of 'other' forms of savings to be the same as for property; Also says case for corporate tax rate cut faces high hurdles

The Taxpayers' Union suggests five ways the government can provide $3bn of tax relief to New Zealanders in its May Budget; Attacks bracket creep

30th Mar 17, 11:01am

6

The Taxpayers' Union suggests five ways the government can provide $3bn of tax relief to New Zealanders in its May Budget; Attacks bracket creep

'Measured' approach proposed for closing multinationals' tax loopholes seen as too tough by big business consultant and too weak by retail lobby group

5th Mar 17, 8:12pm

1

'Measured' approach proposed for closing multinationals' tax loopholes seen as too tough by big business consultant and too weak by retail lobby group

The latest tax transparency report by the Australian Tax Office shows few large companies actually pay tax at the official rate. Just eight of them pay 43% of all tax actually paid by this group

11th Dec 16, 6:02am

7

The latest tax transparency report by the Australian Tax Office shows few large companies actually pay tax at the official rate. Just eight of them pay 43% of all tax actually paid by this group

IRD sets sights on multinationals shifting profits overseas to reduce tax

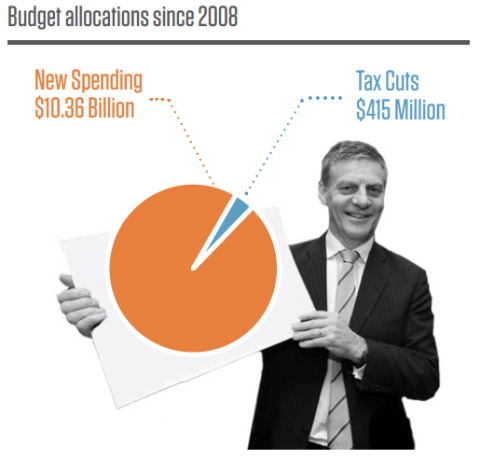

Govt would have to balance calls for cut in company tax rate against quest for surplus, English says, as Australian business tax review eyes cut to 25%, below NZ's 28%

14th Aug 12, 1:04pm

5

Govt would have to balance calls for cut in company tax rate against quest for surplus, English says, as Australian business tax review eyes cut to 25%, below NZ's 28%