Here we go again. The Australian housing market has turned, and prices are on the rise once more.

It appears that reports of the dire state of the market may have been exaggerated.

On Monday property data provider CoreLogic released its latest national Home Value Index. The index was up 0.5% in April, following a similar lift in March.

House prices in Sydney, the bellwether for the Australian market, rose 1.3% in April. That’s the third monthly rise in a row leaving prices in the NSW capital 3% higher than they were in January (but still 11.2% below the post-Covid high).

Significantly, the four largest capital cities in Australia all recorded increasing house prices over the April quarter.

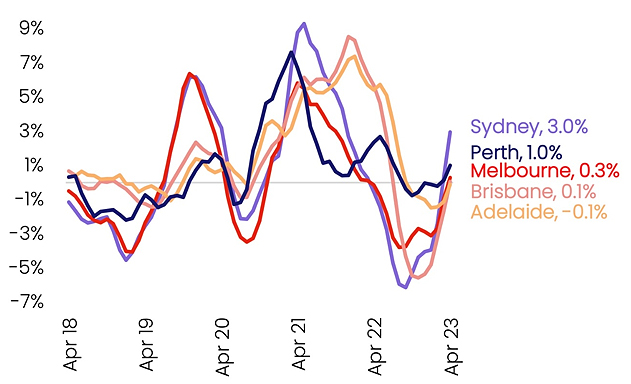

Rolling three-month change in dwelling values

State capitals

Source: CoreLogic

According to CoreLogic’s Research Director, Tim Lawless, the evidence indicates that the market has reached an “inflection point”.

Not only are we seeing housing values stabilising or rising across most areas of the country, a number of other indicators are confirming the positive shift. Auction clearance rates are holding slightly above the long run average, sentiment has lifted and home sales are trending around the previous five-year average.

CoreLogic is not alone in identifying a dramatic shift in the housing market. Many commentators, including the major banks, are now rapidly revising their forecasts upwards. In the face of a national fall of only 9.1% peak to trough, many are abandoning earlier dire predictions of a decline of 15 to 20% or more.

CBA, Australia’s largest bank, is now forecasting that Australian house prices will rise nationally in 2023. As reported in the AFR, the bank’s head of Australian economics, Gareth Aird, acknowledged this week that “the shift in dwelling prices has arrived earlier than we anticipated, and the evidence indicates that home values bottomed in February”.

ANZ has also revised its position. ANZ Research posted that “We now think we’re past the worst for housing prices”. Felicity Emmett and Adelaide Timbrell, senior economists with the bank, admitted that “the recent upturn has come as a surprise to us”.

Westpac now predicts that house prices will be flat in 2023, a significant change from its previous forecast of a 7% fall this year.

What’s going on here? Until very recently the media was dominated by despairing stories of widespread mortgage stress and rising negative equity. It seemed that every second headline referenced the apocalyptic ‘mortgage cliff’.

Ten interest rate hikes in the twelve months to April by the Reserve Bank of Australia (RBA) had supposedly pushed any prospect of a recovery in the housing market well into 2024.

So how to explain the earlier-than-expected turnaround? A combination of soaring immigration, rapidly rising rents, high inflation in construction costs, continuing low unemployment, and an inadequate supply of new housing.

Last October, the federal budget forecast net migration to Australia of 235,000 people in the financial year to 30 June 2023. Last week, just six months later, Treasury updated that forecast to 400,000 immigrants. Inevitably, this sudden influx of people looking for a home has consequences for the housing market, particularly in Sydney and Melbourne.

As Tim Lawless of CoreLogic puts it, “a significant lift in net overseas migration has run headlong into a lack of housing supply”.

The most immediate impact has been on rents. According to CoreLogic, dwelling rents rose 3.9% in Sydney and 4.2% in Melbourne in the April quarter. For units, the figures were a remarkable 5.8% and 5% in the two cities. With vacancy rates at around 1%, Lawless argues that “more people are fast tracking a purchasing decision simply because they can’t find rental accommodation”.

The mix of fast rising rents and house prices well below their recent peak is also making residential property investment a more attractive proposition for many investors.

Westpac views high inflation in construction costs as another major factor making existing dwellings more appealing.

Nationally, the purchase cost of newly built dwellings rose 18% in 2022. With prices for existing dwellings declining, this has significantly shifted the relativity between existing and newly built houses. In effect, the ‘replacement cost’ of the non-land component of a dwelling has increased dramatically.

High construction cost inflation, together with the rapid rise of interest rates over the last year, has also led to a slowdown in the development of new residential projects. That will become more apparent in the next couple of years but no doubt some home buyers and investors are buying existing housing stock now in anticipation of future shortages that will put further upward pressure on house prices.

Psychology plays a not insignificant role in the housing market. We may be seeing a return of FOMO – the fear among would-be buyers, particularly first home buyers, of missing out as prices rise again.

Some commentators had attributed the recent turnaround in Australian house prices to the expectation that the RBA had finished raising interest rates in April. Many predicted that the April ‘pause’ signaled the end of the current round of rate rises, and that the RBA might even start cutting rates later in the year.

However, the RBA had other ideas. On Tuesday it again raised the cash rate, this time by 25 basis points to 3.85%. This hike was not anticipated by most economic experts and will give many potential house buyers, and heavily mortgaged owners, pause for thought.

Of course, house prices and the cash rate are a two-way street. It’s hard to imagine that the CoreLogic data on the house price turnaround wasn’t a consideration for the RBA board in its rate setting exercise.

Will the house price reversal in the April quarter prove to be a dead cat bounce? Will the February low turn out to be a false bottom?

Only time will tell.

The only certainty is that the economic circumstances will keep changing. Next week, the Treasurer, Jim Chalmers, will deliver the federal budget. And next month the RBA will again assess the wisdom of another rate rise.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

6 Comments

comparing building costs, it doesn't make much sense for house prices keep dropping.

Land prices can continue dropping though. Price to build isn't the only input.

When we bought our house the land value on the rates bill was about 15% of the total valuation.

It's at about 50% now I think.

So yes, plenty of scope for land value to fall back.

Can Australians not see that Wall Street is about to sneeze?

....or that they could be sleep walking into military conflict with their largest trading partner.

Suspect this is the Bull Trap. Also know as the suckers rally.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.