Two weeks ago, New Zealand’s Deputy Prime Minister, Carmel Sepuloni, confirmed that the age of entitlement for NZ Super would remain at 65 under a Labour government. This contrasts with the National Party’s commitment to raise the age to 67 if it wins in October.

Narrow self-interest being a major driver of voting behaviour, this could well be a significant issue in the coming election.

It’s interesting to consider this issue in the context of what happens in Australia.

Fourteen years ago, the age of eligibility for the Australian state pension was 65. However, in 2009 a Labor government introduced a transitional process to gradually raise the age over the period from 2017 to 2023. That process will be complete at the end of this month, and from 1 July the age of eligibility will be 67.

The rationale for the increase was fiscal responsibility. The demographics were compelling and rendered a pension age of 65 financially unsustainable.

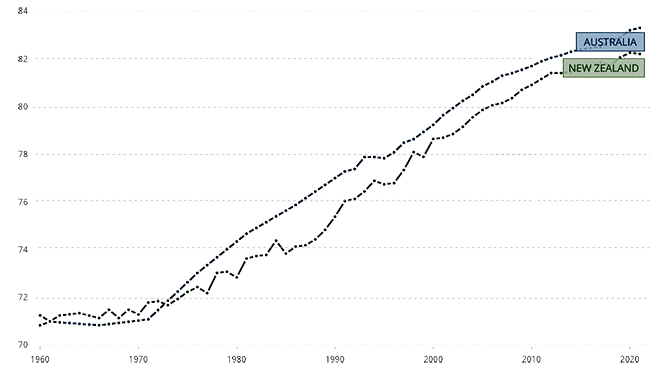

The threshold of 65 was set way back in 1908 when most people weren’t expected to live that long. Today it’s a completely different story. Life expectancy has increased dramatically in Australia and is now closing in on the mid-80s. Someone who reaches 67 today is likely to live for another two decades.

No wonder they say 60 is the new 40. And on that basis, 65 is probably too young for a state pension.

Life expectancy at birth, total (years) – Australia, New Zealand

Source: World Bank

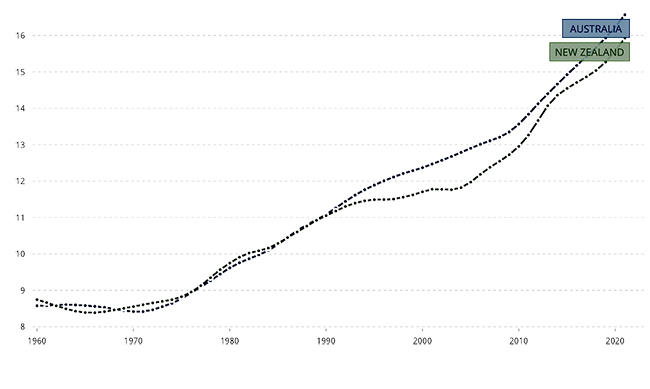

Climbing life expectancy in Australia, combined with various factors such as women having fewer children, has had, and continues to have, another important consequence – a dramatic rise in the percentage of the population aged 65 and above.

% of total population aged 65 and above – Australia, New ZealanD

Source: World Bank

Such a rapid increase in the proportion of the population who meet the qualifying age for the pension can have a major impact on the fiscal sustainability of any taxpayer-funded pension scheme – fewer taxpayers for every pensioner.

In its 2014 budget, the Coalition government proposed increasing the qualifying age for the pension even further than the previous Labor government had done – from 67 to 70 by 2035. According to the Treasurer at the time, demographics and economics meant there was no alternative.

However, as is often the case, political necessity trumped fiscal responsibility. The Australian Senate would not agree to the proposed second pension age increase. In 2018, the Coalition government abandoned the policy altogether.

Therefore, the qualifying age will be 67 from 1 July with no further increase currently advocated by either side of politics.

Nevertheless, the pension funding issue is not going away. Just last month, the Macquarie Business School (MBS) published a statistical analysis of the issue and recommended that the age of pension eligibility be raised to 68 by 2030, 69 by 2036, and 70 by 2050. According to the MBS analysis, these increases are required if the pension system is to remain sustainable without increasing the burden on taxpayers.

However, the issue of fiscal sustainability was analysed by Treasury as part of its Retirement Income Review (RIR), a comprehensive review of the Australian retirement system in 2020/2021. The final report of the RIR concluded that ‘government expenditure on the age pension as a proportion of GDP is projected to fall slightly over the next 40 years to around 2.3 per cent’. That figure assumed no further lift in the pension eligibility age.

How is that possible given the ageing population? The answer lies in the second major difference between the Australian and NZ pension systems. In Australia, the pension is means tested.

Entitlement to the pension phases out at different asset and income levels. Broadly speaking, a single person is not entitled to any age pension if their income exceeds A$60,000. The threshold for the assets tests depends on whether a person owns their own home. If they do, a single person is not entitled to any age pension if their assets (excluding their home) exceed A$634,000. If a person isn’t a homeowner, the threshold is A$859,000.

These means tests disqualify many Australians from receiving the age pension. According to Treasury, in 2019 only 71% of Australians over the pension eligibility age received the age pension or other pension payments. Significantly, that proportion is forecast to fall to just 62% by 2060.

And how is that possible? As the means test thresholds are appropriately indexed, it’s not a result of inflation. Instead, it primarily reflects increasing numbers of Australians failing the assets test because of the value of their superannuation investments.

This is the third key difference between Australia and NZ. Australia has a compulsory superannuation system that has been in place since 1992. Broadly speaking, an employer must pay 10.5% (rising to 11% next month) of an employee’s ordinary earnings into a superannuation fund. Voluntary contributions can also be made.

A crucial aspect of the system is that it is very difficult for a person to access their super until they are in their 60s. The system is intended to force people to save money for their retirement.

The result is that in 2023 Australians collectively hold over A$3.5 trillion in their super accounts. That constitutes the fifth largest pension market in the world. That has many advantages including the provision of vast amounts of capital available to fund infrastructure assets onshore and an exposure to international assets as large Australian super funds inevitably go offshore to find suitable investments.

Importantly, it also reduces the cost of the pension system to the taxpayer as more and more Australians fail the assets means test due to their superannuation savings. As Treasury concluded in the RIR, ‘this is expected to reduce the cost of the Age Pension borne by the next generation’.

There’s only one problem. The superannuation system includes numerous tax concessions both to compensate Australians for the compulsory nature of the system and to incentivise them to make additional contributions. The rising cost of those concessions to the budget undermines much of the fiscal benefit of reducing reliance on the age pension.

In the last budget, the Labor government wound back some of those super-based tax concessions. More work is required. Unfortunately for the government, it’s politically unpopular and therefore electorally dangerous. A bit like increasing the pension eligibility age.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

80 Comments

What’s the ‘right’ age for eligibility for a state pension?

We shouldn't be offering additional financial incentives to people to exit the workforce. Already we have a declining workforce, the labor market is getting tighter every year and we are leaving a legacy of intergenerational debt.

What we shouldnt be doing is encouraging those ay the start of their working lives exiting the workforce ror 4 plus years while they gain 'paper qualifications;...unfortunately thats exactly what we have done for the past decades....time to revert to on the job training for the majority of occupations.

Like Switzerland. They are far richer than NZ.

A university education and training to do a job are two quite different things. If we confuse these as a society ( as many do ) we will all be far worse off.

Tertiary education ....not only university. The confusion about the purpose of university education was one of the issues that has helped create the problem.

The email from Hipkins promising no change has resulted in me changing my vote at the next election. I'm long retired so no self interest but this does affect my four working children. It is an issue is about being responsible with money. I have made minor donations to the Labour party in the past; I will not do so this year and they will not get my vote. Not sure who is the best alternative since I've never cared much for the National party.

Half the problem well illustrated, most people are concerned only about themselves and their own children. Tragedy of the commons.

To be fair to them though most just think of self interest purely and don't consider even their own children's future.

Wow you only just decided not to vote Labour??? Either way, welcome to the rest of your life being better off without them

I consider the NZ pension to be a benefit rather than a pension. It’s not paid for by the recipient but by younger taxpayers. Therefore the right age is when you are no longer capable of work, whether that be 65 or 80.

The NZ government does account for the pension as a social welfare benefit. And, like other benefits, it's administered by the MSD.

Yours is an interesting idea but 'no longer capable' is a subjective thing.

Perhaps you are saying that anyone still working past 65, who is earning in excess of what the pension is, should not qualify. And that's basically a means-test. So is your argument for means-testing - and then of course, like the Aussies, do you means-test on income-only or on income + assets or on assets-only?

How about getting some actuary on the case?

For every year you defer applying for superannuation past the age of 65, you then get a modest uptick from when you do?

So for those who are still able to and enjoy working, then they can look after themselves for maybe another 5-10 year. Then at age 70 or 75, when they do apply for super, they get the base super rate + x% as an acknowledgement for the 5-10 years they haven't been claiming it.

The offset would be that for the expected remaining life of such people, the extra x% payment will be less than the amount which they declined claiming for between age 65 and whatever.

Peter Dunne worked this out a decade ago. His proposal was to allow NZSuper to be accessible between 60 to 70 with an actuarial adjusted +/- payment rate. This then provides support for people who can't do manual jobs anymore, women who had spent their lives supporting families & those who wished/had to keep working beyond 65.

It was far too sensible for the major parties to support.

Yes, I recall that - you're quite right that an actuarial approach proved far too logical/rational for the voting public. A bit like a Land Value Tax.

Kate - we already have a land value tax its called rates on property so if for fairness you think property owners having paid out of taxed income for their home should be further taxed then you will happy for females who statistically live 3 + years longer than males have their pension age raised accordingly

Only a portion (and it's not a great portion) of rates are a land value tax - and in most local authority jurisdictions they use capital value (land value + value of improvements) to calculate that General Rate. But the General Rate is only a portion of what you pay in your overall rates bill. Most services provided are charged on a user-pay basis (either a Fixed Charge or a Targeted Rate). And then there is the Uniform Annual General Charge (UAGC) - another component of your rates bill.

Most local authorities break down how these various rating tools are applied on your rates bill.

I'm all for the pension (super) being converted to a Universal Basic Income (UBI). That's the most equitable to my mind as it doesn't discriminate based on age - everyone 18+ qualifies..

Except Peter Dunne's approach was to give you less each year if you retired at 60 and give you more each year if you retired at 70.

If you're stopping work when you're 60 because you physically cannot work any longer, why should you get paid less than someone who is retiring at 65?

Similarly if you're choosing to delay retiring until you're 70 because you're in a cushy office job and get paid lots of money anyway, why is then fair that you get paid more compared to someone who retired at 65?

It basically just didn't make sense.

It makes perfect sense as a policy change. Unless you think net taxpayers/other peoples money grows on trees.

If you are only and solely concerned about money, yes.

You seem to not have engaged in my point at all - how is it fair that someone who cannot physically work any more (they've been a labourer their whole life) who has to retire at age 60 gets paid less each year FOR THE REST OF THEIR LIFE than someone who is in an easy office job that retires at 65.

It wasn't that the 60 year old gets paid less for 5 years until they turn 65 and then get paid the same. They would get paid less, forever, until they died. So now you could have a room of 10 pensioners but they'd all be getting paid different amounts, meaning some pensioners would be much more affected by future policy changes than others by virtue of getting paid less on the pension.

That's why his policy didn't make sense. On the face of it, sensible, but if you dug through the first layer that focussed only on the money, then it was pretty perverse.

But then there's genetics involved and sheer luck of the draw there, so is it fair that someone in their 40's gets osteoarthritic hips even though they worked a desk job their whole life? What then do you do for people in non-physical roles who happen to have degrading joints in their 50's? Far too many variables to be looking at 'if you did ____ job your whole life you can retire earlier'. Many work in physical jobs their whole life and have no issues until their 70's.

It's no less fair than the current situation though is it where your example of someone would has to retire at 60 then they have to wait until 65 to get a pension. At least providing an ability to retire earlier if you choose helps to get around that and to be able to provide that without perverse incentives it has to be at a lower rate permanently.

Ultimately any pension should be means tested so you don't get highly paid people claiming a pension that makes a fairly immaterial difference to their livelihood

It would be an incentive to reduce the total burden on all tax payers.

I think it's worth exploring again in some form.

At the moment, the alternative is that everyone, regardless of their physical/mental capacity to work is being lumped in together and all will at some point be either seeing the age of entitlement go up, or the allowance reduce (in relative terms), or both.

I've not come across many in their 70's sitting in a cushy office job. The odd one that gets pulled in for a short consulting gig.

First I said '70' not '70s', there's a difference. As for 'cushy office job', I was using that as an example of a type of work that is not physically demanding but well paid, for which people could easily choose to delay retirement because doing so gets them paid more money for when they do actually retire. Teaching can fit that bill for example - teachers who have been in the profession for decades are likely to be getting paid at least $80-90k per year

You're being pedantic, still haven't seen many in 70 year olds either in 'cushy office jobs'. You clearly come from a background of a hard labouring type job and so your view point seems to be completed tainted by that and you can't seem to take an objective view of it. The perfect example of this is you think teachers earning $80k is a 'cushy office job' that is well paid, I wouldn't really call well paid anything less than $120k and even that isn't that well paid in the grand scheme

Which is not enough, hence they're striking. If you think teachers should work to 70 because they have an easy job then you're deluded Lanthanide.

It made sense to give people choice. If you are 60 now and can’t work, how does that policy make you worse off?

Why would anyone defer in that case? The increased amount would mean more taxed at a higher rate and if the deferred % was smdesigned to be lower than what would otherwise be collected then why not take the early amount and put the whole thing into kiwisaver to earn a return for the period where you would otherwise have deferred it so that you 1. Get more and 2. The higher amount is earning you a return 3. In the event that you need the money urgently you may draw it as a lump sum from your investment account ?

It’s not paid for by the recipient but by younger taxpayers

Were not today's recipients younger taxpayers once? Paying the older people's superannuation all those years?

Also, people who look after themselves shouldn't be punished. Just because you have looked after yourself and are still healthy shouldn't bring a penalty and deny one their rightful annuity.

Super used to be a separate tax & govt account for many years until around 1970 when Muldoon rolled it into general taxation to fiddle the national accounts.

The net taxpayers who "dont need it" are also the ones funding super for those who do. Half of nz households pay no net income tax.

The social contract is that we fund our parents pensions as they funded our grandparents. Hopefully our kids feel the same way about us.

You sure like to trot out that "half of nz households pay no net income tax" line a lot. Do you know why that is?

Because it takes 2/3rds of a full time wage to pay the rent in this country, so you have us non-rentseeking net taxpayers subsidizing property investment. Maybe we could unwind all the tax credits, but we'd have to introduce rent price caps because you'd have mass evictions.

Maybe under 65 net taxpayers should be entitled to the unemployment benefit too, because we're funding that as well?

Because it takes 2/3rds of a full time wage to pay the rent in this country, so you have us non-rentseeking net taxpayers subsidizing property investment.

Yes, I spoke to Parliament's Petitions Committee yesterday on this proposal;

No interest in solving the problem whatsoever from what I gathered (still I could be proven wrong - so await their report) - Nat and ACT MPs both asked, "but, but" what about the landlords costs? I just don't 'get' their logic. What other industry expects a 100% return on the cost of a capital asset from day one? And thereafter for all time as the asset gets revalued upwards and the capital gains are tax free?

We are killing the future prospects of our children in this unregulated housing market - while also subsidising the property ponzi (via the Accommodation Supplement) to the tune of $2 billion taxpayer dollars per annum at the same time.

Kate - I have long lobbied various MPs/parties for the introduction of a rent cap. The reality is, most of the current crop of MPs have their snouts in the trough, and are not going to do anything about it at all.

What I have been proposing is a cap of 2% RV per annum - on the basis that for a 25-year mortgage, this would've had the tenant paying 1/2 the landlords principal payments, and none of the interest costs - as the landlords are gaining the asset for it.

If the maths then doesn't stack up for the landlord, well, they can sell up and allow their tenant who is currently paying for the mortgage to pay for their own mortgage.

It's not too hard - it's conflict of interest.

Yes. I gave the example of our son who purchased his home in 2015 for $260,000. I pointed out he can afford the mortgage, but wouldn't be able to afford to rent it based on today's rental market prices. How hard is that to understand!

What's the point of comparing the price of a house in 2015 to today's rent? If he cant afford to rent the house at today's rent, he most certainly will not be able to afford to buy the house at today's house price. What he paid for it in 2015 is completely immaterial. So capping his rent is not going to help him meet a 9% mortgage servicing test or come up with a 20% deposit.

And if you are suggesting that had a rent cap been in place everyone would still be paying 2015 rents, then all that would happen is that there would be no landlords left in the country. Who in their right mind would put up with a rent cap on property that you can now sell and put your money in the bank for 5.5% return with no outgoings and no tenant hassle? What most people have failed to comprehend is that high interest rates are making landlording very unappealing, as the income for doing nothing now far outweighs the income from housing low income New Zealanders. The world has already changed, most are yet to realise that.

My proposal is not a cap - as market rent prices are already unaffordable for most - hence our burgeoning spend on the accommodation supplement. If actually interested in the formula approach - here's the article I did for interest.co a while back.

Yes, if there is political will to regulate the market - I imagine many current property investors will go for the bank deposit instead as their preferred investment vehicle; others will invest in company shares and/or businesses.

And yes, I talked to one of the property investor NGOs - and they did point out that interest rates are their main cost driver at the moment. Hence, I've recommended to Parliament that the previous tax incentives be restored alongside the formula's implementation. It won't keep everyone profitable, depending on the percentage of the mortgage still outstanding on the property, but it might just be enough for others.

FYI chaosinflesh - here's the recording of my appearance yesterday - starts at 11minutes, 40 seconds in -

Petition on Weekly Rent Maximum Formula

Just because you can pay rent doesn’t mean you can buy. There is the small matter of the deposit and credit checks etc.

Once upon a time a deposit was the equivalent of around 6 months wages. Then it ballooned to around 2 years wages. An extra 18 months give or take of paying rent, just to reach the same milestone.

Capping rents would enable people to accumulate their deposit faster. *Scoff* no the Landlord needs that because they've borrowed too much. How about "Just because you can pay the rent, doesn't mean the Landlord should borrow".

With the publication of the article, one of the commentators said why should the wider taxpayer base pay for the speculative investments of other taxpayers. I thought that quite a good way to look at the question - no investment is without risk - that's why many prefer term deposits (and that's why their returns are so low).

Very true - hence I've recommended to Parliament that a beefed-up shared equity scheme be introduced at the same time as the formula approach. In many cases where low-income families are concerned, their largest debts are to the government (eg., emergency grants). So, yes there needs to be government assistance in order to allow them to change-over from renter to purchaser/owner.

What was the ratio of young taxpayers to pensioners back then?

Also, It's a benefit, not a loyalty scheme.

NZ Super is financed by the government as it is the currency issuer and taxpayers are not currency issuers, they are currency users.

https://www.levyinstitute.org/publications/can-taxes-and-bonds-finance-…

https://www.levyinstitute.org/pubs/Wray_Understanding_Modern.pdf

Gees you're hung up on that. It's well and good - but if the government aren't balancing the books, they are introducing a deficit that needs to be paid further down the line, by future tax payers. And as long as it's not paid back, government spending is inflationary.

Why does it need to be paid further down the line? Who is this person that we need to pay this money back to?

Any spending can be inflationary even if the money comes from a superannuation fund. Retirement is not a financial issue, it is one of productivity when retirees become purely consumers and not also producers and we still need to be producing the goods and services to support them and their spending.

Alan Greenspan explains here, https://www.youtube.com/watch?v=DNCZHAQnfGU

The no longer capable of work thing is critical. NZ super shouldn't be thought of as some sort of reward for all your hard work put in. In fact many on it have done little paid employment at all. It is a guarantee of a minimum standard of living for older NZers.

I would propose aligning the rates of the supported living payment (formerly sickness/invalid's benefit) with NZ super, and bumping up the age of eligibility to NZ super to something like 70. If you are unable to work when you're 65-70, you get on the supported living payment just like any younger person that cannot work, and it would be the same as those on super now. For those that are in good health in their late 60s, they can either keep working or live off their life savings.

I don't understand why we have this weird multi tier benefit system that just because you're old you're entitled to more money than younger people that also cannot work. Do the essentials like rent, food, power, etc. get more expensive as you age?

If you check the 2023 budget, supported living payments are only around 1/9 of the cost of super, so the increase to pay for younger people getting more wouldn't be that much, and would probably get cancelled out by the fewer recipients of super: https://www.interest.co.nz/public-policy/121455/budget-2023-social-deve…

Yes, the discrepancy is nonsensical and amoral to my mind. Those permanently disabled have to wait until they are 65 to be treated equitably.

That is a good idea. Combine that with Peter Dunne’s flexi super and it is a win. If you can’t work before you reach the default age then you can get the super for that age early. 67 is a good age to start with.

100% support this idea. If you are physically incapable of working, that is what the disability benefit is for. Same as for any person of any age. If you are incapable of working your old job, but are still capable of working in another occupation (eg. you might not be able to be a construction labourer, but you could get a job at Bunnings) then you go on the Jobseekers benefit, just like every other unemployed person of any age. My father worked until he was 75, and only stopped because of the Covid border closure, otherwise he would probably still be there. People are still very fit and healthy at age 70, even the retirement villages won't let them in until they are 75.

Wow - $3.5 trillion in their super accounts - we really are the 'poor' cousins, eh!

A UBI really seems to me to be the only solution to our NZ problem, as there is no 'pension' with a UBI - and so, age, becomes irrelevant.

And, a UBI which is fully funded via the broadening of our tax base, would be ideal.

Add to that, taking a lesson from AUS and gradually upping employer contributions to Kiwisaver, so that we might find ourselves not-quite-so-poor cousins going forward would also help.

TOP

Yep!

I like what TOP wants to achieve, I'm just skeptical of their methods to achieve their goals.

If only they had more detailed info on their website

Website has costed out details. Else send them an email.

Even when you break it down per person it's a massive difference. Australia has >100k AUD per person. For Kiwisaver in NZ it's <20k NZD per person. Helps that theirs started much earlier, and contribution rates both from employees and employers are much higher.

"Broadening the tax base" lol. We cant even keep people in the country now, how is taxing them more going to stop them moving to Australia? The other day I heard a radio ad from the Victorian Govt promising huge financial incentives to teachers for moving to Australia. $50k bonuses are up for grabs. Our "tax base" is highly sought after. You know who is not highly sought after? The ever increasing number of benefit bludgers who think they are owed a free ride for life, enabled by people like you.

What happens when the 2% who pay 25% of the tax base, leave?

https://www.theguardian.com/world/2023/apr/10/super-rich-abandoning-nor…

I don’t think you’ve understood what “broadening the tax base” means. It’s not about taxing wage and salary earners more, it’s about taxing other items like they do overseas - a capital gains tax for example on share sales, property sales etc, or a land value tax.

Something which removed the burden of solely workers and broadens the base from which tax is collected. TOP have costed ideas on this on their website and how well it would work

I understand perfectly. But who pays those extra taxes? The exact same people who currently pay tax now. So in other words, everyone gets taxed more. Taxing different things doesnt "broaden the tax base" it just extracts more money from the same tax base. The tax base then gets annoyed and moves overseas. Then the tax base is shrunk. And then to make up for shrinking the tax base, everyone left has to pay even more.

Broadening the tax base would be actually making people and organisations who don't pay tax currently, pay tax. Like charities, and Maori Iwi.

Where LVT is concerned, there is an awful lot of land in NZ that is overseas owned. An awful lot. What tax does NZ collect from a pine forest while it grows, for example? Perverse as it is, we pay the overseas owners for the carbon credits.

The answer is of course - not 65. It need to creep up to 70 over the next decade, 1 year age every 2 years.

Also means tested - both on income and assets. If you’ve gotten rich on paper due to riding the enormous property boom you can sell off a property to live on

It won't happen while the baby boomers are still within that age range as it directly effects them. The mentality of the pension being a god given right to receive, and the level of voter engagement of that generation will prevent it. Should the Millenials and GenZ show greater engagement in politics and the future of this country then we will see change

What's funny is when I (as a Millenial) suggest that the pension is unsustainable in its current form, the immediate response is always to project the self centered mentality back on to me "that'll change when you reach 65" etc. I don't expect to receive a non-means tested pension when I retire, and it wont disincentive my retirement preparations, like many Boomers claim would happen if it were means tested.

Claiming a pension when one is capable of looking after themselves is like queuing up at the food banks when you have the means of buying your own groceries. Wouldn't surprise me if Boomers do that too.

Unfortunately boomers are the most selfish, entitled and short sighted generation to have ever existed.

They want low tax and rates but high services. Want people to wipe their bums, be their doctors and nurses, but not pay into the system via capital gains taxes on their property investments. Claim pension is their right and block any reform even though it’s unaffordable and further condemning subsequent generations.

Then moan when their kids and grandkids leave for Australia and blame it on Labour

Looks like Australia is turning their pension system into an old person benefit. You only get $532 a week, just enough to get by. Their system is basically a backstop for elderly that are economically destitute. NZ on the other hand insists on paying out the pension to every 2 million dollar home owning yuppy.

Oz pension means test excludes the family home so plenty of $2M home owners get it there.

Yes this is a silly exemption. Regardless at least Aussie understands the unaffordability problem and is willing to address the issue. NZ has its head in the sand.

Only 61% of over 65’s receive the pension in Australia

After tax it's comparable to NZ's rate though as Australia's lower tax thresholds are much lower than ours.

Considering Maori have a lot shorter life expectancy than pakeha then eligibility should be race based or better still based on race and occupation.

How many 67 year old roofers have you seen.

Some fraction of our population can choose their race. Most can choose their profession. Should smokers qualify earlier?

No you can't any more than you can choose your alcoholic mother.

More policy suited tho their voters from the old stale male party.

correlation is not causation.

How would you define a Maori in today woke pc world then? Would Debbie ngarewa packer or Matthew tukaki with an Irish mother and Maori father qualify?

Would those with a single grandparent or great grandparent?

Would Cullen Grace who never knew he had any Maori ancestry until picked for Nz Maori rugby?

Could we all just self elect like the Maori roll in which case everyone is now on it?

Its better to have it means tested, aligned to disability benefit and raise age - anyone who can’t work due to medical reason can still get the disability benefit as others have suggested.

We could do something just, where people who have done heavy physical work - farming, nursing, building and the like - get an earlier retirement age, where people in less physically demanding jobs (like me) qualify for superannuation later.

I know a lot of people who have worked hard and faithfully at heavy jobs and their bodies suffer from doing that often unglamorous, but very important, work.

Or like other people of any age, if you dont like doing a particular job, you transition into doing another. There is nothing to stop a 65 year old person working in a call centre, a Bunning's store, or any number of non physical jobs. I am on my 4th career change. There is no rule that says the job you chose when you are 18 is the only one you are allowed to do for life. People have plenty of time to change careers before they reach retirement age.

The pension problem is not the worst of it. Its just currently where the bulge of baby boomers are right now in the demographic cycle. Most of them are still very healthy, and their biggest problem is what retirement village are they going to move in to when they turn 75 (the oldest baby boomer is currently 77). But wait until this cohort get into their 80's and start to be a drain on the health system. Not just in hospitals and aged care but in pharmaceuticals. Alzheimer prevention drugs are about to be launched - the next multi-billion dollar pharma money making scheme. How is NZ going to afford to pay for those drugs when every baby boomer is going to want a prescription?

https://edition.cnn.com/2021/07/20/politics/aduhelm-alzheimers-drug-cos…

The aged care who can’t get staff because nobody wants to pay the exorbitant rents in our overinflated housing “market” caused by that same cohort in the rest home?

Both Australia and New Zealand governments are currency issuers. This makes the pensions are fiscally unaffordable statements just nonsense.

Same logic goes for a UBI. But we would need to diversify the tax base.

Great. Let's just print $50 trillion and give each person in the country $10 million. Would solve child hunger overnight, everyone would be able to buy their own homes.

New Zealand had a mandatory savings scheme that was implemented in the 70s. If still around today, estimates put its value at hundreds of billions. Unfortunately Rob Muldoon cancelled it, leading to the mess we're in today

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.