Last week the Organisation for Economic Co-operation and Development (OECD) released its latest Economic Survey of Australia. It’s an informative and useful document.

It’s easy to criticise international organisations like the OECD but the OECD frequently provides sensible advice to the governments of its member countries. Particularly on appropriate taxation and expenditure measures.

Too often that advice is largely ignored. That will almost certainly be the case with the latest recommendations for Australia.

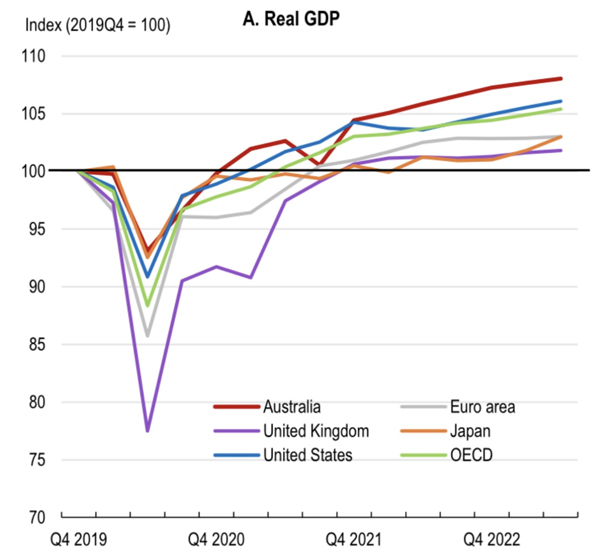

The OECD’s survey paints a reasonably positive picture of Australia’s post-Covid (if there is such a thing) economic recovery.

Source: OECD

Of course, much of the growth has been attributable to debt-funded government spending and a massive increase in immigration over the last 18 months.

The position looking forward is less encouraging. The OECD predicts GDP growth will be an anemic 1.3% and 1.8% over the next two years and unemployment will rise from the current 3.7% to 4.4% by 2025.

Part of the problem is that inflation is not dropping as quickly as hoped. And that means interest rates aren’t dropping either. The current expectation is that the Reserve Bank of Australia will raise the cash rate again next week, putting further pressure on borrowers and household spending.

The OECD survey identifies a number of economic risks to Australia including its exposure to a slowdown in China, the challenges of transitioning to a low carbon economy, and the budgets of state and federal governments.

Accordingly, the OECD advises ‘a prudent approach to fiscal policy’. That includes using ‘windfall government revenues from elevated commodity prices’ to pay down debt rather than fund increased government spending. Australian governments have a history of using temporary windfalls from mining to fund permanent budget items.

Some of the fiscal measures recommended in the OECD survey make a lot of sense.

One that is also relevant to New Zealand is the recommendation that Australia consider ‘linking increases in the pension age to some fraction of the increase of life expectancy of older Australians’. The survey models the benefit of raising the statutory pension age by six months every two years from 2025 to reach 70 by 2037.

Australia already has a pension entitlement age of 67, the age Luxon’s National Party proposes moving to (but not until 2044). Even that modest change looks likely to be scuppered by Winston Peters.

The OECD also criticises Australia for its overreliance on personal income tax as a source of government revenue. It recommends that Australia recalibrate its tax mix by increasing the rate of GST (currently 10%) and increasing its scope by the removal of a raft of exemptions including education, healthcare, and food. This would be accompanied by compensation for low-income households.

Of course, the recommendation to impose GST on food is contrary to proposals from some political parties in NZ that GST be removed from food. Such proposals would be a poorly targeted way of providing cost of living assistance to low-income kiwis. The wealthy, who spend more on expensive food items, would be the biggest beneficiaries. Exemptions also make for a more complex tax system with higher compliance costs.

Increasing the pension age and removing exemptions from GST are two OECD recommendations that will probably be ignored by Australian politicians. The reason is obvious. They would be electorally dangerous.

This highlights one of the major flaws in a liberal democracy. Politicians won’t do something that might lose them votes, even if they know it makes good economic sense. For many years, most Australian economists and financial experts have recognised the benefits of increasing the rate and scope of GST (while compensating low-income households). And yet, at recent elections both major parties have insisted upfront that they will not increase GST.

The same electoral pragmatism may apply in New Zealand. How else to explain the failure of John Key to increase the pension entitlement age and Jacinda Ardern to introduce a capital gains tax. Winning votes appears to trump political ideology and good policy on both sides of the Tasman.

Other OECD recommendations for Australia include replacing state real-estate stamp duties with land taxes and reducing tax concessions in the superannuation system.

The former is another no-brainer that is widely accepted by experts because stamp duties limit labour mobility and the transfer of assets to more productive uses. However, once again, implementation has been disappointing. Like so much tax reform, it falls into the ‘too hard’ basket.

Reducing superannuation tax concessions is particularly controversial. The reality is that the tax concessions provided to encourage people to save via super, and thereby become less reliant on the means-tested state pension, have become far too generous. However, addressing this problem is a political minefield.

A minefield full of retired, or soon-to-be retired, baby boomers protective of their nest eggs.

The prize for the most unlikely OECD policy idea to be implemented in Australia goes to ‘introducing an inheritance and estate tax’. The survey points out that such taxes ‘are levied in most other OECD countries’, … ‘are less distortive to growth than labour taxes and can help address intergenerational inequality’.

That may all be true, but a ‘death tax’ would be electoral suicide in Australia, even if it was accompanied by significant cuts to personal income tax. It would be almost impossible to sell at the best of times. And these are not the best of times – an era of negative political campaigning and widespread fearmongering via social media.

A death tax aside, the OECD survey contains some great policy ideas that Australia would do well to embrace. The fact it won’t is an indictment of the country’s politics. Major reform is required to improve productivity, ensure fiscal sustainability, and address the ageing population. There’s something wrong with a political system that makes such reform so difficult.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

14 Comments

Propose a land tax and end up like TOP, politically destitute and irrelevant. We are a liberal free market democracy, people will not agree to having their assets taxed.

Did you miss that this is about Australia? They have CGT and stamp duties currently... so assets are taxed on sale.

The sad part is though, in NZ context you are right for the same reasons Ross suggests the OECD will be ignored. Because winning votes trumps good policy. The scary part is when this rears its head in the form of a wealth tax on the left in our recent election (the lowest efficiency, and least justifiable way of taxing capital), rather than CGT or preferably LVT/Inheritance taxes.

Yes, they have land tax and capital gains tax on investment property. However they also have negative gearing so what they pay on their property they take off their personal tax. All this does is encourage leverage and further inequity.

people will not agree to having their assets taxed.

Only because those with major assets control the media narrative and have convinced the ignorant that an asset tax is an evil. When in fact it will benefit all of NZ by shifting the burden .

Which group do you belong to?

Asset wealthy or..... the other?

"Which group do you belong to?

Asset wealthy or..... the envious?"

.

Asset and income..on my standards, perhaps not some. Properties, cash, investments, great family, successful kids. Overseas trips when I feel like it, multiday tramping/hunting trips, excellent health, want for nothing.

Life s is very good for me.

Has that bust your bubble?

This is a dumb argument you could use for any sort of tax.

Alcohol tax is an envy tax, cos some people can afford alcohol.

Petrol tax is an envy tax, cos some people can buy cars.

GST is an envy tax, cos some people can buy more things.

Income tax is an envy tax against high incomes.

Ridiculous assertion that a CGT would be an "envy tax".

Income Tax is merely an envy tax.

It is levied by those old enough to have received assets affordably from previous generations' taxes and efforts, who demand to be carried but who lack the skills and knowledge to compete in today's economy. We have clowns who expect a universal welfare benefit handout paid for by the taxes of the young and hard-working but also expect to be net-negatives in society.

Calling diversification of the tax base envy tax is intellectually lazy, and whinging about being required to contribute like everyone else is just deeply entrenched entitlement mentality.

If you have any assets that are worth a lot of money you will have them off shore in a trust, death taxes therefore have directly the opposite affect from their intention. In the UK a 40% tax is applied after a person dies to estates that are worth over £325,000. The average sold price for a property in London in the last 12 months is £725,149 and therefore the average property owner in London will pay £160,059 in death taxes. ($330,000) If that sounds fair or a good idea then viva the revolution commrade.

an offshore trust can be dealt with. You need to ask yourself why they are not.

Try the Cook Islands in our own back yard as a start point.

Cook Islands Tax Haven | Is the Islands an Offshore Jurisdiction? (offshore-protection.com)

One of the main purposes of taxation is to control the quantity of the governments currency which it has issued through its spending and so maintain its value and so If the government only spent its currency but didn't then tax it back and cancel it again then we would soon have a currency with zero value and also rampant inflation. Taxation then has nothing to do with theft, envy or communism.

Understanding Modern Money: How a sovereign currency works. https://www.levyinstitute.org/pubs/Wray_Understanding_Modern.pdf

You may very well think that.

Incorrect. There is a relatively new ‘Passing on a home’ additional threshold plus available unused credits from the first to die. See HRMC website https://www.gov.uk/inheritance-tax/passing-on-home

very rough calculation - in the uk 2 parents can pass nzd 2m to their children inheritance tax free if the family home is included

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.