The 22nd of May provided two startlingly different approaches to fiscal management.

In New Zealand, the government delivered its so-called ‘growth’ budget – another deficit, no realistic path to surplus, and rising government debt. The major growth item, and the biggest contributor to Crown expenses, was NZ Super, the non-means tested pension paid from the age of 65.

On the same day, the Danish government, led by the center-left Social Democrats, passed legislation to gradually increase its pension age from 67 in 2025 to 70 by 2040.

Since 2006 Denmark, a country with a similar population to NZ, has linked the pension age to life expectancy. That goes a long way to explaining why Denmark has had budget surpluses for the last decade.

By contrast, New Zealand has maintained the pension age at 65 for the last quarter century. That’s despite life expectancy increasing during that time from 78 to 83. NZ Super is now forecast to cost $29bn in 2029, up from $21.6bn in 2024.

That goes a long way to explaining why the NZ budget is a mess of red ink.

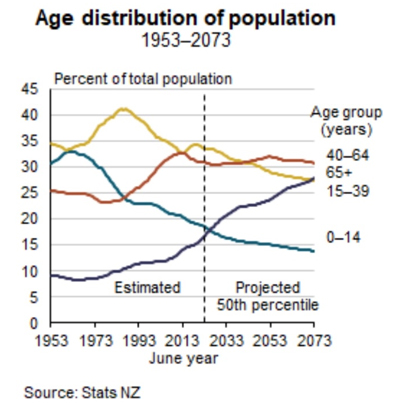

And it’s only going to get worse if nothing is done. Around 16% of New Zealanders are now aged 65 or over. By 2050, this will rise to almost 25%. The figure will still be rising fifty years from now.

Without reform, NZ Super will constitute an ever-greater burden on the budget, to the detriment of other government activities.

This is not a new issue. The fiscal implications of rising life expectancy and an ageing population have been apparent for decades.

Back in 2010, a review by the NZ Retirement Commissioner Diana Crossan recognised that a pension age of 65 was unsustainable. She concluded that ‘something will have to change to keep NZ Super affordable for the long term’. Her recommendation was a transition from 65 to 67 phased in from 2020 to 2033.

Crossan warned that ‘we can’t keep ignoring this issue until it’s too late’. Sadly, it’s now 15 years later and the issue is still being ignored. If the Retirement Commissioner’s recommendation had been followed, NZ would already be five years into the transition period and enjoying significant budgetary gains.

NZ’s folly is highlighted by the action taken in other comparable countries.

Between 2017 and 2023 Australia raised its pension entitlement age from 65 to 67. The figure in the United Kingdom is currently 66 as part of a transition to 67 by 2028. Ireland is at 66 with a plan to reach 68 by 2039.

Entitlement to full Social Security in the US kicks in at 67. Sweden, Spain, Italy, Germany, and the Netherlands are all at or on the way to 67 by 2027.

Why is NZ not transitioning to a higher pension entitlement age? It’s certainly not because the country is in a stronger financial position than all those other places.

There are several possible explanations. One is the New Zealand Superannuation Fund, a sovereign wealth fund intended to partially fund future NZ Super payments. However, while the fund has proven a successful endeavour to date, it’s not a contributory pension scheme and it’s subject to investment risk.

Australia has increased its pension entitlement age to 67 despite having a similar fund. That fund, is called the Future Fund and currently has assets exceeding A$240 bln.

The Australian budget is also protected by the fact that the age pension is means tested and there is a compulsory superannuation system. The latter ensures that a significant part of the population will retire with sufficient assets to be disqualified from a pension under the means test. Australians currently have more than A$4 trillion of super assets.

Increasing the pension age to 67, applying a means test for that pension, and having a compulsory superannuation system all make fiscal sense for Australia. The NZ budget looks exposed by comparison.

Another explanation for NZ Super remaining at 65 is the impact of various ‘fairness’ arguments. Some people contend that the pension age must stay at that level because it’s unreasonable to expect manual workers to work beyond 65. However, such workers are a declining proportion of the workforce, and their position is better addressed by providing specific targeted support rather than by continuing to pay a full pension to all people 65 and over.

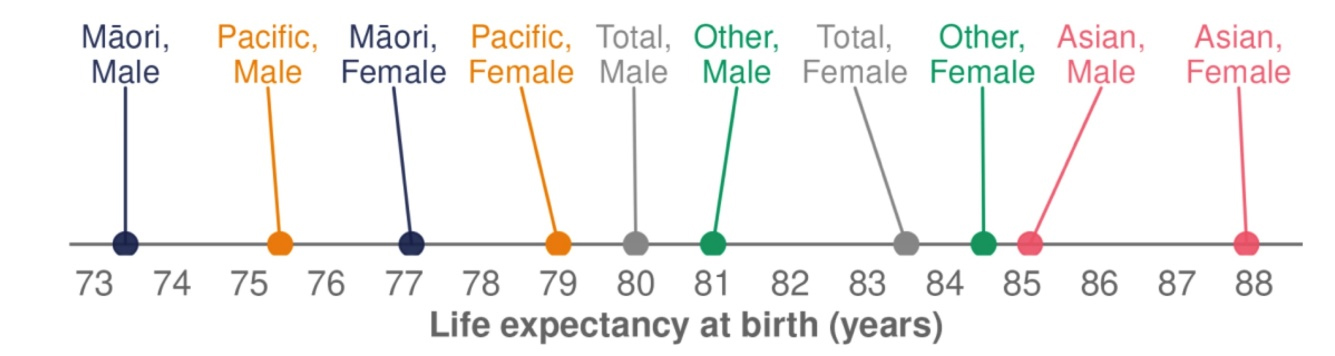

Others contend that the different life expectancies for different ethnicities in NZ should be reflected in different pension entitlement ages. Figures produced by the Ministry of Health certainly reveal some remarkable differences based on ethnicity (and gender).

Aotearoa New Zealand life expectancy at birth, by ethnic group and gender, 2017–2019

Source: Health and Independence Report 2023

Fearing the potential for division and discord in addressing the ethnicity argument, many would rather just ignore the pension age issue altogether.

Interestingly, the manual labour and ethnicity arguments have not stopped other countries raising their pension age.

Of course, the primary reason for inertia on NZ Super is unquestionably the cynicism of the country’s politicians. Reform would take political courage, an attribute in short supply.

Why advocate for long term fiscal discipline if it carries short term risk at the ballot box. Why waste political capital on measures that won’t pay dividends at the next election.

Denmark’s policy to raise the pension age will help protect that nation’s economic viability over the decades to come. That in turn will enhance its prospects of remaining a successful, high-income liberal democracy well into the future.

It’s a shame New Zealand hasn’t adopted the same approach.

*Ross Stitt is a freelance writer with a PhD in political science. He is a New Zealander based in Sydney. His articles are part of our 'Understanding Australia' series.

30 Comments

No fiddling can save it. Phase out National Super completely.

Phase in a muscular Kiwisaver.

That is effectively what Aussie has done, the Australian Age Pension, is heavily means tested, if you have private superannuation (massive in Aussie as employers put 12% in on top of your wages). Its a Backstop if you have nothing, and its definitely not designed to give a decent retirement.

Super gives everyone the same amount. Just as children get the same amount paid by the govt for education. Kiwisaver leaves the well paid still wealthy when retired but the low paid workers end up with a kick in the teeth. Kiwisaver is not a fair go.

What are you talking about singautum? National Super is likely to break, go, wooosh. Then rich and poor alike won't get anything.

What's your plan then?

When the people can't support themselves, there comes a time when the government can't support them either.

Not good for the poor then.

I’m entitled to my entitlements

I have paid for my super all my life

Common cries from many. We need to somehow means test NZ super and start being serious about investing for future retirees, KiwiSaver etc, if we want to have any hope of being like the countries that do. I have family in Denmark and the retirement savings plans are spectacular, as per others as well.

Im not holding my breath as we seem intent on getting our “entitlements”

I agree. Some form of income-and-asset testing would be rational for NZ Superannuation, which is simply a social welfare benefit for oldies. It is surprising that Ross Stint does not mention this: means testing is fundamental to the Australian pension.

Susan St John has revised her proposal this year to turn NZ Super into a universally available tax-free grant, with those who sign up for it going on to a claw-back tax regime to trim their other income to keep NZ Superannuation affordable.

https://www.auckland.ac.nz/assets/business/PIE%20WP%20%202025%20NZS%20a…

Even if that Super regime change were implemented, it might still make fiscal sense to gradually raise the qualifying age to 70. But that would have to be matched by introducing a strictly means-tested social welfare invalid benefit equal to the NZ Super grant for people under 70 unable to support themselves.

"We need to somehow means test NZ super and start being serious about investing for future retirees, KiwiSaver etc"

That seems contradictory to me. You're saying that those who plan for their future investment get punished by not getting Super, and those who don't plan get rewarded by getting Super. It looks like a perfect incentive NOT to plan for the future.

You do not need to actively plan in Aussie, below is from the ATO

As an employer, it's compulsory to pay your eligible employees super guarantee (SG) at least 4 times a year. The minimum SG rate you must pay for each eligible employee from 1 July 2024 is 11.5% of their ordinary time earnings (OTE). This is scheduled to progressively increase to 12% on 1 July 2025.

Its impossible to not plan for your future under such a system.

They do not get 'punished' Yvil, nor are they getting anything 'taken away' from them as many seems to think, and take offence by. Those that plan will have more comfortable retirement than those that rely on super alone, period. We need to remove this old mentality that super is a piggy bank system and instead is meant to allow a minimum standard of living for retirees as a backstop. Super was set up as such, with life expectancy considered and allowing that pensioners would draw it of an average number of years. The years have grown and grown with life expectancy, and the pension has not changed to adapt, to a point it is due to implode if not addressed. Over the lifespan of the silent and baby boomer generations, NZ Super has seemed to have morphed into what is seen as an entitlement that cannot be touched, with all facts reality willfully ignored for the betterment of them.

I’m entitled to my entitlements

Copy Denmark and trigger Super by average lifespan. Then the future cost is easily calculated. It is fair from one generation to another.

"That goes a long way to explaining why the NZ budget is a mess of red ink."

Not really. A more recent Retirement Commissioner had a different perspective that the one quoted above. "Wrightson added that NZ has the eighth lowest pension cost in the OECD (which has 38 countries as members) and NZ was in the lowest quartile for expenditure." (%of GDP)

A fact never mentioned by the multitudes of NZSuper naysayers reneging on the social contract committed to by those who spent their lives paying taxes to support their own parents super entitlement.

Interest seems to have realised that property and super articles catch the most debate in NZ..

NZ Super sounds 100% like a Ponzi scheme, there is no pot of growing investments like a normal annuity type product managed by an Actuary.

A Ponzi scheme is a fraudulent investment scheme where existing investors are paid with money collected from new investors, rather than from legitimate profits generated by the scheme's business. It relies on attracting a steady stream of new investors to keep the scheme running, as the returns are not derived from actual investments.

We seem to like building our economy on such things, witness Property etc, where boomers hope to sell their surplus houses to new entrants for far more then they paid.

Things could really go pear shaped here, there and everywhere.

"...there is no pot of growing investments..."

The NZ Super (Cullen) Fund was setup to support the pension entitlements. You probably recall that National (Key) stopped contributing to it a decade or 2 ago. Not sure that any Govt ever recommenced payments as Orr "outperformed" the Fund on the back of the post GFC money printing sharemarket boom. IIRC Robertson/Ardern then decided to make their accounts balance better by also including the Fund asset without including the associated pension liability.

In theory I'd suppose a growing GDP would provide support however succesive Govts have increased NZ GDP only by massive immigration, reducing GDP/capita & the public sector continues to disproportionately increase it's share of GDP = the NZ economy

the multitudes of NZSuper naysayers reneging on the social contract committed to by those who spent their lives paying taxes to support their own parents super entitlement.

It was ideal when there were 7.1 working age people for every pensioner in the 60's. It has only gotten worse since, and projected to continue doing so. Is it fair to say we must tax the workers more to keep it at current setting? This will require quite a hike in taxation, or do we realise the fundamental flaw in the system and address that the world is not having bigger and bigger generation numbers, and hence effect change for sustainability. What good s the social contract you say when the current workers will not get the same treatment by necessity than the prior generations? We require a new contract, one that addresses the core issue, acknowledges that current settings are unsustainable and prove the lesser overall financial impact on those working across their lifetime so they may still be able to claim super if/when they need it.

Really? How is it that the doomsayers on a universal pension are able to predict population demographics, productivity and the type of economy we will have in 2050? There's a prevalence in NZ for penny pinching and a stifling obsession with any one getting something they shouldn't.

There are big advantages to universal benefits - they are easy to administer and they ensure no-one misses out. What's more they provide social and economic stability something that the author does not consider.

If we can do it we can afford it - the economy is not a static monolith stuck in one time period for 50 years.

Many of the doomsters are Actuaries, we should heed their warnings

An actuary is a professional who uses mathematical and statistical methods to assess and manage financial risks. They work in various sectors, including insurance, investment, and pension management, providing businesses and individuals with valuable insights into future financial outcomes. Actuaries help organizations make sound decisions by quantifying and managing risks associated with uncertain events.

"There are big advantages to universal benefits"

There's also a fundamental disadvantage of getting something for doing nothing, namely a lazy society going backwards over time.

Something for nothing. That applies to means testing - the fit but elderly will stop working when Super kicks in. Our universal system lets those who can work continue to do so and pay increased income tax. So current system has Kiwis working past retirement age to a greater extent than other countries.

We live in the stupidest of times.

Compare the Danish and NZ economies. The pink bars are the Govt surplus or deficit. What do you see? The NZ Govt is having to run deficits because we are running large current account surpluses.

NZ exports cheap primary goods (and billions in dividends / rent to offshore investors) and we import expensive fossil fuels, machinery, and technology. Denmark are the polar opposite, which is why they have 10% of GDP flowing into the country rather than the 5% of GDP that we have flowing out. It is that 10% of GDP inflow that enables the Danish Govt to run budget surpluses, We can't - unless our blessed banks are pumping tens of billions of dollars a month into the economy through the housing ponzi.. Our economic imbalance is at the macro level - the age of Super is borderline irrelevant.

I won't repeat my rant from last year on this issue. It's my 3:20pm comment here. But, I will add that when the economy is getting too hot for RBNZ, job growth amongst the over 65s shoots up - hitting 8% annual growth rate in 2023 compared to a 2% increase in the 65+ population. If we want more old people working and paying taxes etc, give a job to any oldie that wants one. Do the same for Under 25s to make it fair, and we're onto a winner.

Why is the no "caucasian male and female" group on the chart ?

""Others contend that the different life expectancies for different ethnicities in NZ should be reflected in different pension entitlement ages.""

What about smoking? Isn't that a matter of choice that shortens life expectancy? Give them the pension earlier.

Left handed males die a decade before Right handed - can I ask for my Super ten years earlier?

'Total Female' life expectancy is almost 3 years more than 'Total Male' so surely men should qualify three years earlier.

The reality is class differences matter but ethnicity doesn't. Except when PIs (eg my wife) are more likely in NZ to be working class.

Had to look that one up! https://www.bbc.com/news/magazine-23988352

Not sure about lefties, but yes, why not show male and female Europeans?

Danes have average annual income about double Kiwis. Many reasons for that but surely the fact that they can debate retirement age and immigration and NZ politicians can't is significant.

and they pay a lot of tax but get great services. They also highly value education(and it’s free all the way through) and hence a highly skilled workforce, 6 months fully paid parental leave for both partners, control property speculation very hard, have strict rental rules and generally follow the rules.

The direct opposite of NZ.

Denmark actually have generous public pensions with a total cost of 8% of their GDP. NZ Super costs just under 5% of our much lower GDP. I guess the article could have pointed these basic facts out, but that wouldn't have suited the narrative.

I love my Super. The kids pay for it.

It's a pity the kids won't be getting Super themselves.

The Budget is that time of year when the usual voices loudly tell us that our universal pension scheme, NZ Superannuation, is rapidly becoming unaffordable. So, they tell us, we must all put our savings into KiwiSaver to look after our own retirement.

These people look enviously across The Ditch, wring their hands, and say 'If only we had a compulsory superannuation savings system like Australia's. Then we'd all be rich. Let's make KiwiSaver compulsory!'

Remark, if you will, that all these voices are those of wealthy politicians, rich KiwiSaver fund managers, and comfortably secure journalists and agony-aunt columnists.

Why is that? Because it's bullshit.

NZ Superannuation provides a universal basic income in retirement. It will continue to do so as long as society is willing to be taxed enough to fund it. Yes, that tax could be going into private KiwiSaver savings instead, ensuring that the gulf between haves and have-nots throughout life becomes even more extreme in old age.

Or we can pay the tax, boost NZ Super to provide a more liveable bottom line for everyone who gets it ... and those who have been able to save extra through life will enjoy spending their savings anyway.

The reason NZ Super is yearly becoming uncomfortably more expensive is because the surtax on recipients' other income was abolished in 1998, so NZ Super goes in full to those who don't need it, and costs the country a fortune.

Bring back some form of the surtax to restore NZ Super to being a universal basic income.

Okay, back to Australia. Is their compulsory universal superannuation savings scheme as good as we are so often told? Here's Geoff Carmody, writing a decade ago in the Australian Financial Review (not a socialist newspaper). He looks enviously at New Zealand's universal super, and reckons what we have is better, and fairer.

https://archive.ph/4FXUL

And a follow-up:

https://www.afr.com/policy/geoff-carmody-is-right--scrap-super-20160313…

https://archive.ph/GLHwf

And:

'Scrap [Australia's compulsory] superannuation.

'It fails to meet the standards of a retirement income system. It is costly and inefficient, unnecessary, and incredibly unfair.

'The age pension system is by far the most economically efficient retirement income system.

Scrap superannuation. Expand the age pension. Boost the economy.'

https://treasury.gov.au/sites/default/files/2020-02/murray290120_0.pdf

And:

https://www.macrobusiness.com.au/2021/01/scrap-superannuation-for-a-uni…

I agree with most of that. Defined contribution super schemes are a neoliberal wet dream attempt to avoid state (=taxpayer) responsibility for aged care & to pump up / overvalue sharemarkets. And Ozs employer / employee scheme has a lot more carveout rorts embedded than NZs KS.

Most commentators will know that I'm generally all in favour of personal responsibility however I acknowledge that there's a line to be drawn in old age to maintain & support a civil society.

"Reform would take political courage, an attribute in short supply.

Why advocate for long term fiscal discipline if it carries short term risk at the ballot box. Why waste political capital on measures that won’t pay dividends at the next election."

And there it is: The heart of the problem. Successive governments of all flavours avoiding unpopular, but necessary, structural reforms that would MNZGA. Indeed we get short term pandering to various focus groups to try and win the next election.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.