By Gary Blick & James Stewart

Auckland Council has been issuing record numbers of consents as housing supply responds to demand shifts.

Auckland Council, as a Building Consent Authority, issues building consents and inspects construction to ensure compliance with the Building Act 2004. The Chief Economist Unit monitors new homes from consent to completion to inform rates revenue forecasts. This paper looks at that pipeline over the recent cycle.

New homes in the pipeline

Building consent and inspection activity offer insight into two stages of Auckland’s housing pipeline.

- Consented, not under construction – a consent has been issued but no inspection has occurred.

- Under construction – a first inspection has been completed but no final inspection has occurred.

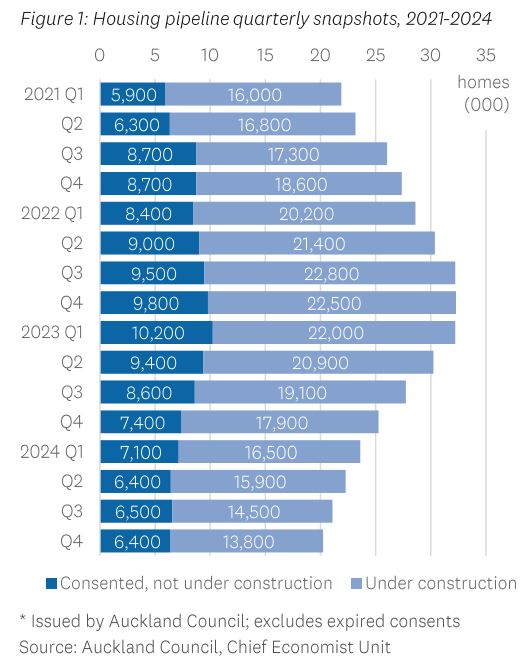

Figure 1 estimates homes in the pipeline at the end of each quarter from 2021 to 2024. The data covers consents issued by Auckland Council, which account for 93% of new homes over that period, with the rest being independently consented public housing.

As of December 2024, 20,200 homes were in the pipeline, with 13,800 under construction and 6,400 consented but not yet started construction.

Market conditions have led to fewer homes in the pipeline since the December 2022 peak of 32,300, when 22,500 were under construction and 9,800 were yet to start. That peak followed a surge in building consents, driven by strong demand for housing, in particular after the interest rate cut in March 2020. The housing supply response was supported by the Auckland Unitary Plan, which created development opportunities by allowing more flexible land use.

Increases in the Official Cash Rate from October 2021 began to dampen demand, observable in a decrease in new building consents from late 2022. Homes under construction remained above 22,000 from mid-2022 to early 2023, before decreasing as projects were completed and fewer new starts occurred. Overall, the number of homes in the pipeline began to fall as more homes were completed than consented.

Construction starts and completion rates

Most housing projects begin construction within six months of receiving a building consent. Table 1 shows the proportion of projects consented in each year that received a first inspection within a given period. These construction start rates have fallen over time, likely due, initially, to the surge in consented projects relative to construction industry capacity, and later to the impact of rising interest rates on buyer demand.

Building consents are a good measure of new homes, as almost all consented projects are completed, as indicated by a final inspection. Figure 2 shows that cumulative completion rates for projects consented each year range from 66% to 80% after two years and 90% to 92% after four years.

Completion curves for consents issued in 2021 and 2022 lag compared to earlier years, likely due to larger quantities, industry capacity constraints and rising interest rates. The 1-year completion rate for consents issued in 2023 is higher than for the two preceding years, suggesting a return towards the earlier trend.

Time to completion

Project completion times have fluctuated, with the median in the December 2024 quarter being 400 days (13 months), down from 470 days (16 months) in 2023 but above 280 days (9 months) in 2019. Construction times, which make up most of the overall completion time, have followed a similar trend, as Figure 3 shows. The trend is influenced by shifts in composition, with complex, long-duration projects being more sensitive to interest rate changes. Pandemic restrictions and supply chain disruptions have also been a factor.

Number of completed homes

The number of homes completed each year has risen over the recent cycle. Code Compliance Certificates issued by Auckland Council confirm completed work complies with the building consent. These increased from 10,200 in 2018 to a peak of 18,100 in 2023, before easing back to 17,200 in 2024 as Figure 4 shows. The trend reflects the increase in consents and the time lag between issue and completion of construction.

Some existing homes are demolished to enable more productive use of a site. Data on these demolitions is incomplete as consent is only required in some cases. However, research estimates an average demolition rate of one-in-nine homes (11%) between 2018 and 2022. This suggests that around 89% of recent new homes have added to the housing stock.

Key takeaways

This Insights Paper uses quarterly pipeline snapshots, project start rates, completion rates, and time-to-completion data to assess how market conditions and land use policy changes have influenced Auckland’s housing supply between 2021 and 2024.

- Building consents are a reliable indicator of new homes, with nearly all consented projects reaching completion.

- The number of homes in the pipeline is sensitive to changes in interest rates, which affect demand for housing and project viability.

- The housing supply has responded to shifts in demand over the recent cycle, supported by the opportunities enabled by the Unitary Plan and the construction industry’s ability to scale up.

- Auckland Council has stepped up as a Building Consent Authority, issuing record numbers of consents and conducting more site inspections.

Ongoing monitoring of Auckland’s housing pipeline will help inform future policy decisions — to ensure there is sufficient development capacity to enable the housing supply to respond effectively to demand.

* Gary Blick is the Chief Economist at Auckland Council. This article is here with permission. The original is here.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.