By Eric Frykberg

More evidence has emerged about the dire state of the gas industry in the publication, Energy in New Zealand 2025, by the Ministry of Business Innovation and Employment (MBIE).

The evidence shows the supply of natural gas for 2024 was 115.70 petajoules (PJ), a decrease of 20.9% on the previous year.

This was mainly due to existing wells producing far less gas than they planned to.

Natural gas in New Zealand is used for manufacturing chemicals such as fertiliser and methanol, for electricity generation, for producing industrial heat, for operating boilers and heaters in hospitals or schools, and for residential cooking and heating.

Its decline over many years has been repeatedly blamed on the previous Government’s ban on new offshore oil and gas wells, though the Labour Party denies that it is responsible.

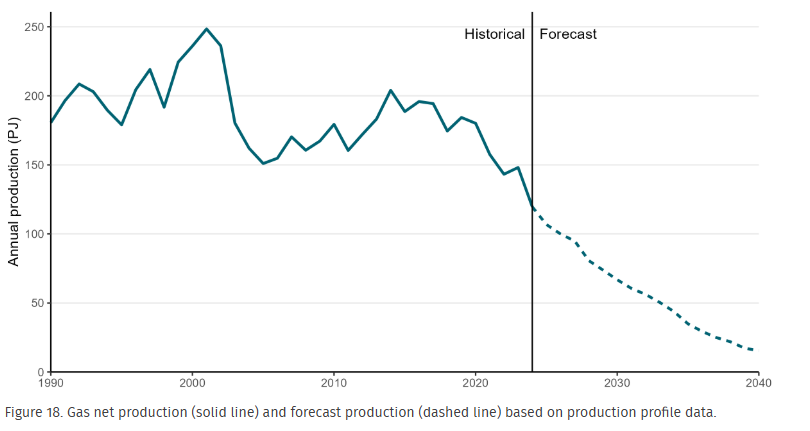

But the new report from MBIE shows not just a steady decline in the past, but a serious decline forecast for the future.

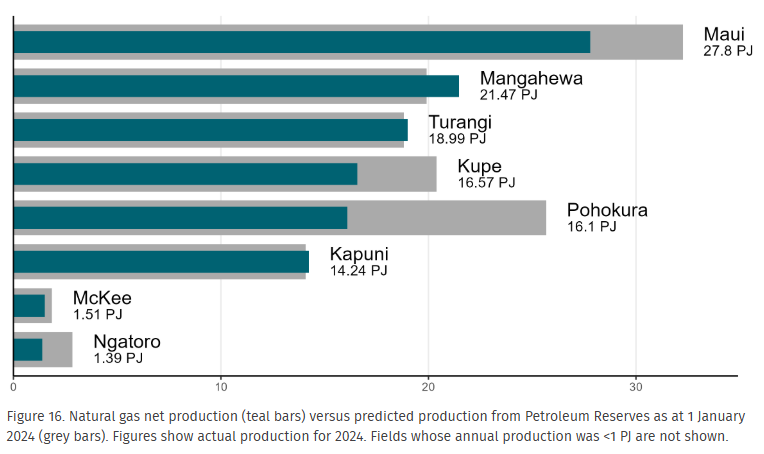

Production at several wells slipped badly. These included the Maui and Pohokura fields.

In addition, there was less-than-expected production from the Kupe KS-9 well, which began production in January 2023. A graph from MBIE shows New Zealand’s main gas fields generally falling short of expectations, with just three doing better than they thought they would.

New Zealand's deteriorating gas supply has had knock-on effects for several years.

For example, Taranaki’s Methanex plants, which transform natural gas into the liquid fuel, Methanol, have reduced or even stopped production, so that gas can be freed up for electricity generation at Huntly or at some other thermal power plant.

The consequent tight supply of electricity has led to reduced production at the aluminium smelter in Southland. Critics have alleged that New Zealand is de-industrialising to keep the lights on.

The MBIE report supports this argument, saying a 22% decrease in gas use was caused mainly by production cuts at Methanex.

MBIE reported on gas reserves as well as gas usage. The report says reserves at January 1, 2025 were estimated to be 948 PJ, a drop of 27% on January 1, 2024 figures.

“While some of this drop was due to natural gas extracted for use over the course of 2024, around 66% of the drop is due to gas field operators revising their estimates of field reserves,” the report says.

“Production will continue to decrease year-on-year, with annual production likely dropping below 100 PJ in the next two years.”

New Zealand’s gas predicament morphed into major changes in the coal industry.

Although overall coal production declined, due in part to failures in the rail system used for transportation, coal for electricity generation rose.

Part way through the year, the electricity company, Genesis, resumed the importation of coal, mainly from Indonesia. Then, a few weeks ago, four electricity companies agreed to stockpile coal for ten years for emergency generation.

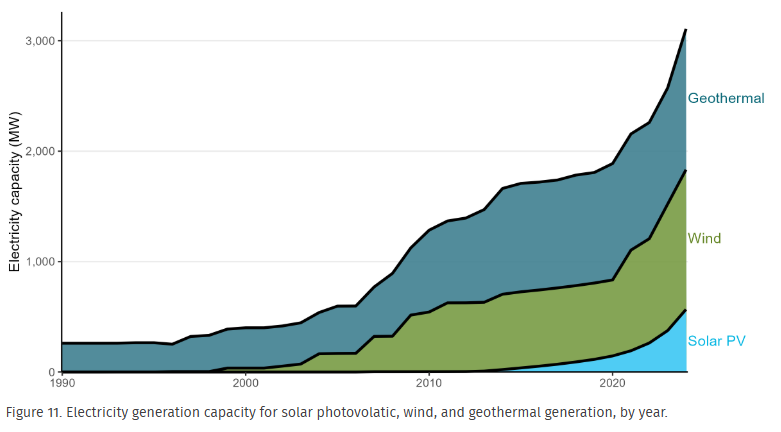

Overall, 85.5% of electricity in 2024 came from renewable sources, down from 88.1% in 2023. Hydro generation was down to its lowest level since 2013. However solar, wind and geothermal electricity rose to record levels.

Overall renewable energy production increased 4% on 2023 levels.

The MBIE report stops at the end of last year. "But the trends have continued this year,” BNZ economists said in their latest Manufacturing Snapshot.

“In Q1, commercial gas prices were 20.7% above year earlier levels as demand bumps up against limited domestic supply. In response, some industrial gas users have been forced to cut staff, increase prices or reduce production.”

Meanwhile, the impact of tight gas supplies will be limited for residential gas users, since they account for only about 2% of total consumption. However, the problem will definitely cause the prices they pay to rise, and any consequent decline in gas usage could compromise the economic viability of gas pipelines.

The lobby group Energy Resources Aotearoa also says the whole industry is maintaining a laser-like focus on ensuring it remains a critical part of our energy system for decades to come.

"Sadly, we’re witnessing the consequences of a shrinking domestic gas supply: higher prices, the doubled use of imported coal for electricity generation, and uncertainty for industrial users," says CEO John Carnegie.

"New Zealand households aren’t yet facing gas rationing, but they can expect steadily rising bills as supplies shrink and costs are spread over fewer users. Unfortunately, the 2024 drop in reserves and production continues to persist into 2025 – this is only getting worse."

Carnegie says the latest data underlines why the Government’s focus on measures that can rebuild our reserves, like reopening exploration and committing $200m in co-investment, is vital to avoid further instability.

29 Comments

Multi-generational government failures of failing to have a long term energy plan that results in affordable energy for consumers.

Or refusing to invest beyond an election cycle. Bring back the ministry of works

Irrespective of government and affordability, if the resource is depleting, it is depleting. It does however seem farcical to say that there needs to be a level of usage to make it viable maintaining gas lined to suburbs, yet there is an imminent increase in gas prices over time that will lower, and dissuade demand.

Break up the wholesale generation of the gentailers for the free market to deliver more generation incentive I say. Why are we paying out to shareholders for holding the country to ransom for an essential service such as electricity.

From one side we get an exploration ban, and no noticeable planning about how to make the necessary transition away from fossil fuels. From the other we get a return to business as usual, also without a transition plan.

Why are our governments allergic to the nuts and bolts of planning the execution of their ideas? Is that it involves concrete measure that entail accountability? It certainly looks that way.

Because if they do they're only really appealing to ~5% of the voter base. Just pump out substance less headlines and you'll keep the majority happy...

"At current levels of gas use, remaining natural gas reserves would be exhausted in 11 years"

https://www.mbie.govt.nz/assets/bc14c2778b/energy-in-nz-2017.pdf

Makes for very sober reading. I have a solar panel sales rep turning up on Monday to advise me on solar.

I see no light at the end of the tunnel for NZ's energy sector and things are going to get very very expensive.

Fine choice. If you can find a way to get an old EV battery wired in as your battery bank you will save a LOT on battery storage. For example on trademe just now: Used 24KWh nissan leaf battery at 73.65% health (17.676kWh capacity) for $2290. For comparison an 11kWh BYD battery bank will set you back $11-15k from solar outfits. The key is finding someone who can wire it correctly, which sadly I couldn't myself, but if so the savings would be worthwhile.

This. I bought a 30KWh Leaf as our second/runaround car and when it no longer has useful range it will become the house battery.

I have been watching videos on how to convert a leaf to a house battery suggest an outside hut for the battery, there are people who will sell you controllers for battery management etc and ethernet/wifi comms etc

even the 70% battery has value. I have a BE Elect and electronic, it does not look too hard but there are some residual risks hence distance from house

I thought along the lines of burying it in a ventilated, coated metal box with airflow control to regulate temp (fans, sensors, and a pipe up above ground on each end) then run the cabling underground to the house. Less temp fluctuation underground and if thermal runaway hit, no danger to the house and limited oxygen to work with.

It is concerning, I think many will be thinking this way, solar panels are cheap at the moment

They have been getting cheaper and better over the years. Hopefully this trend will continue but the tipping point happened last year apparently.

Me and Mrs Other hit the go button late last year with 21 x 455kw Aiko panels and a Tesla PowerWall 3. Yes, I know how awful a person Elon is.

I'm hoping to never pay another power bill again, but at $37k for the installation it's going to be a few years for us to get our money back.

Economic vandalism by virtue signally do gooder politicians. It is not bad news for the gas industry, it is a big globe out there, it is bad news for all of New Zealand. Proven reserves of natural gas have never been higher globally, the world is awash with natural gas and NZ is too vain to get it's act together.

The capacity chart is a joke. As much use the maximum speed number on my car dash dial. Wind capacity was 4 MW out of 1039MW two days ago and with zero process heat - and eye wateringly high transmission costs that just got added to all kiwis power bill in April.

It's not just us, look at Germany. Their heavy industry is getting decimated by high energy costs and China - they are having to tariff China so heavily that a Tesla Y is nearly 2x Australia. (But Trumps the bad guy on tarrif's lol). So what do they do? Flood the country with cheap labour to try and keep costs low, stimulate demand and service the debt mountain.

The richest countries consume the most electricity.... bodes badly for NZ if we need to ration it via high prices.

Perhaps NAct could provide an incentive for investment in solar, make interest tax deductible?

they did it for landlords.

If you want it tax deductible set up a bitcoin miner - though if solar actually provided cheap, reliable electricity we would all be sitting at home mining bitcoin.

About nine years ago I wanted total disconnection of gas from my house. The cost then was about $800 and could only be done by one contractor. I emailed Megan Woods and James Shaw quoting a number of statements JA and MW had made concerning gas and coal. I requested financial assistance to disconnect completely. I hoped Labour would put their money where their mouth was and pay for it, or at least most of it. The Minister's Office sent it to file 13.

We're gas for hot water and cooking - but not reticulated gas, rather we have two LPG bottles.

That said we've only been here a year and have already had two price rises.

It will get more expensive once we have to import LPG

unfun conversations around the xmas BBQ, or charcoal pit

If only we had the worlds largest coal exporter on our doorstep.....

Are you renting your bottles or do you own them outright?

If renting them, note that the indicator device commonly used shows "red" when the bottle still has plenty of gas in it (one guy in the industry told me they would change while still 33% full). So try to make sure one is properly empty before ringing for a replacement.

Renting, so thanks - will take note!

I'm piped gas for the hob, very low usage for two people and piped gas space heating. Many years ago, at least 15, I did an energy comparison. Household electricity in c/kWh and bottled gas in c/kWh having used the gas energy in MJ/kg and the gas weight in a bottle converted to c/kWh. They were within 2 % or so of each other. Now comes the tricky part in estimating efficiencies. I came to the conclusion then that piped gas was very much cheaper than bottled gas or electricity. Now not so sure. Piped gas energy in NP for me now is about 70% price of electricity in c/Kwh.

Piped gas for us became unacceptable when it hit $1 per day for the line charge alone. We first switched to rented bottles then purchased our own. This does of course require the ability to take them to a gas supplier to get them refilled.

Switch from piped to bottles requires changing the jet sizes on the hob too.

I'll have to number crunch again to see what the cost per kWh is including line charge. I have been contemplating switching to a heat pump but capital cost is quite high, around $4k. Then there's the cost of an external bottle supply into the kitchen. Not too much of a problem for our arrangement. I think I actually bought larger jets a few years ago in anticipation of doing a switch at some stage. The oven is electric.

"The Climate Change Commission floated the idea in 2021 of banning new connections to the gas pipeline network after 2025, in a draft advice document, prompting an outcry from gasfitters and pipeline owners.

Gas bottles like the ones that fuel barbecues would not have been touched, and households with existing gas pipes would have been able to keep them connected.

A modified version of the draft recommendation made it into the commission's final advice to the government, but without any deadline to take effect.

Gas NZ told other gas companies the government's subsequent Emissions Reduction Plan excluded any ban after its successful campaigning."

https://www.rnz.co.nz/news/national/528952/gas-industry-boasts-about-ki…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.