If you’re reading this on an Apple iPhone, a Samsung Galaxy or a competing Google Android based phone like Oppo, the chip that does the processing in the device was licensed from Britain’s Arm Holdings.

Majority owned by Japan’s Softbank since 2016, Arm went public on the NASDAQ exchange in the United States in August last year.

This week, Arm released its financials for the March quarter, reporting US$824 million revenue, which is far higher than the average of analysts’ estimates of US$761 million.

Projected revenue of US$850 million to US$900 million was well above the US$778 million that analysts expected. With the company now touting a strategy for riding the artificial intelligence boom, shares in Arm shot up over 50% in a trading frenzy this week.

Arm’s story is one of taking a different route than that of other chip makers like Intel and AMD. The company is relatively young, having been founded in 1990 with Apple putting US$3 million on the table to fund a business started by employees formerly of Britain’s Acorn Computers, and with chip maker VLSI Technologies supplying tools.

Acorn Computers built educational computers like the famous BBC Micro and Archimedes.

Arm started developing processors based on the reduced instruction set computer (RISC) principle. At the time they competed against complex instruction set computers (CISC), and while the first bit of time was bumpy for Arm - which originally stood for Advanced RISC Machines - the design path the UK company followed has turned out to be hugely successful.

In a recent corporate presentation, Arm estimated that around 280 billion chips featuring the company’s design have been shipped to date.

The secret sauce for Arm has been its ability to provide great performance per watt. This is what makers of mobile devices desire, as long battery life is all important for them.

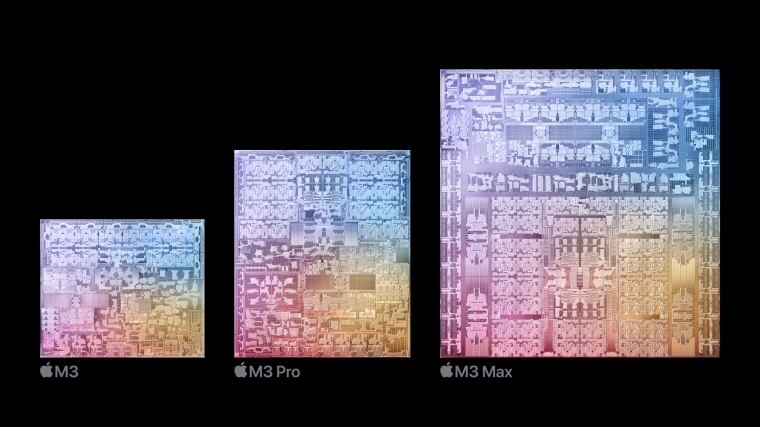

Original Arm investor Apple customised the British company’s chip designs to build processors for its revolutionary iPhone smartphone, and also its iPad tablets. In 2020, Apple went fully Arm across its entire range of computing products, including Macs, following quality problems with its existing chip supplier Intel.

Smartphone and tablet makers using Google’s Android mobile operating system also use Arm-designed chips, mostly produced by US vendor Qualcomm, but with Samsung also making its own range of Exynos processors that are integrated into devices destined for certain markets around the world.

However, Arm designs are now making inroads into servers for cloud computing as well. Their energy efficiency allows for denser server designs in data centres, with lower power usage and less need for chip cooling. It means lower cost than when using traditional processor technologies, and it adds up for tech giants like Amazon Web Services building massive hyperscale data centres.

Now Arm is positioning itself to ride the artificial intelligence wave. “You can’t run AI without Arm” the company has said. AI requires vast computing resources, and questions are being raised as to how sustainable the technology is, given the enormous amount of power it consumes; Arm is pitching its energy-efficient designs as a way to dampen the electricity appetite.

Arm is working with graphics card vendor Nvidia, which is itself buoyed by the AI boom as with its powerful parallel processing chips, to build the Grace Hopper Superchip that offers excellent per-watt performance.

Microsoft and AWS are also developing Arm-design based AI processors, and generative technology is moving to handheld devices as well.

Cars look set to be equipped with advanced driver assistance systems (ADAS) with AI features, like obstacle detection and avoidance, autonomous driving and sensor monitoring, using Arm processors.

Arm has a dominant market position currently, but it’s not the only game in town with the partly open source RISC-V architecture gaining interest, ditto the existing MIPS design that originated in the late 1980s. Bigger rivals that have taken a beating in the market from Arm include Intel and AMD, both of which missed out on the smartphone opportunity.

For now though, Arm has a strong lead with established partnerships and a roadmap that the computing industry backs. Any potential competitor will face an uphill struggle, but Arm will need to stay sharp as the technology market flips fast.

3 Comments

Good overview, thanks. It will be interesting to see where to from here.

RISC was always about performance per watt. The AI hype will run its course. As did self-driving cars. And the dot-com boom. And before that client-server. Anyone remember what happened after these events? Nice for a short visit but I don't want to live there.

Arm designs are now making inroads into servers for cloud computing as well. Their energy efficiency allows for denser server designs in data centres, with lower power usage and less need for chip cooling. Hello Neighbor

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.