The United States Federal Bureau of Investigation's (FBI) latest annual Internet Crime Report shows losses due to crypto currency fraud spiked 53% in 2023.

Crypto currency fraud is listed in the investment complaints category in the FBI's Internet Complaints Centre (IC3) which accepts reports from economies worldwide.

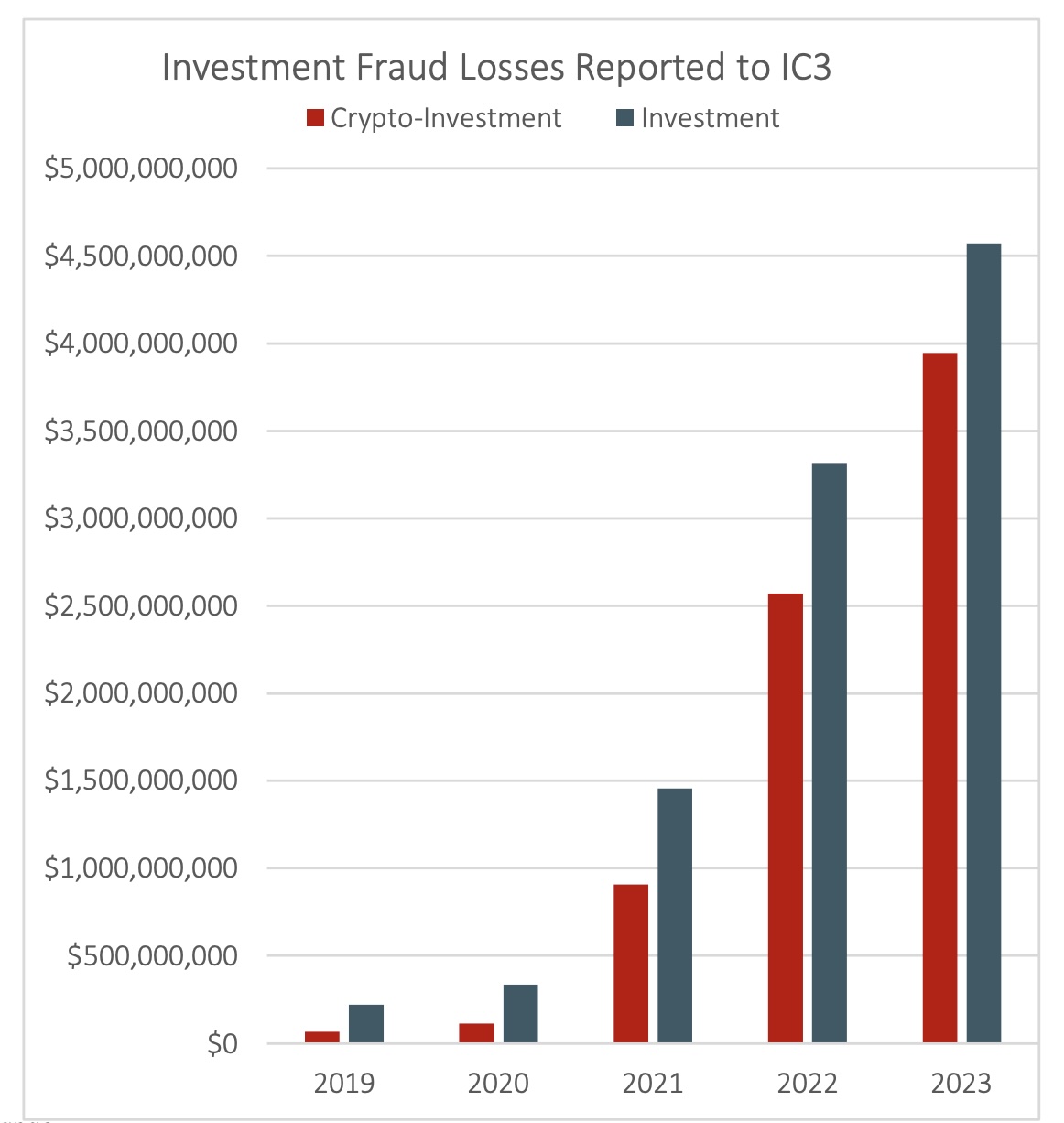

For 2023, the reported losses in the Investment category reached US$4.57 billion, up 28% from 2022. Of that number, US$3.94 billion was attributed to crypto fraud. This is up from $2.57 billion in 2022,

It makes it the leading crime category in the IC3 report, ahead for the first time of Business Email Compromise (BEC) under which users reported US$2.9 billion in losses.

IC3 said of the crypto scams that they are "designed to entice those targeted with the promise of lucrative returns on investment."

In terms of complaints numbers, the IC3 received 39,570 complaints for the Investment fraud category in 2023. The top category last year was Phishing and Spoofing, with nearly 300,000 complaints, followed by Personal Data Breach (55,851), Non-payment/Non-delivery (50,523), and Extortion (48,223).

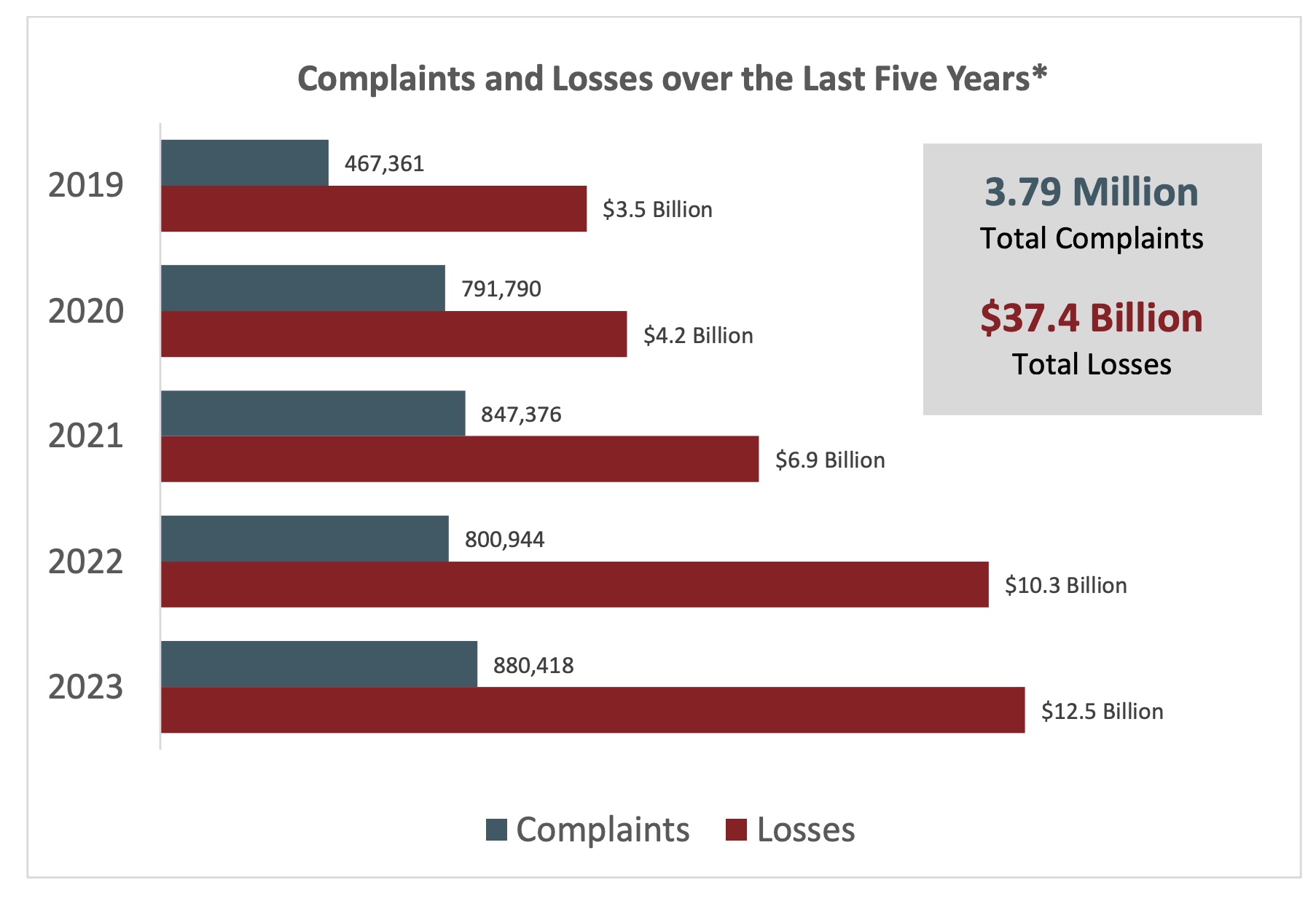

For 2023, the IC3 recorded US$12.5 billion in losses, a number that shows an upward trend over the past five years along with crime complaints to the FBI.

Illicit crypto use down in 2023

The FBI's numbers contrast with blockchain tracing firm Chainalysis which published its 2024 Crypto Crime report in February, saying that 2023 saw "a significant drop in value received by illicit crypto currency addresses, to a total of US$24.2 billion."

On top of crypto scams, Chainalysis looked at transactions involving several other types of crimes such as ransomware, money laundering, theft, market manipulation, child abuse material, government actions, terrorism financing and dark net markets.

That number is down from US$39.6 billion in 2022, which includes US$8.7 billion in creditor claims against failed crypto exchange FTX.

The US$24.2 billion represents 0.34% of total on-chain transaction volume, Chainalysis said.

Chainalysis said its on-chain metrics suggest crypto scamming revenues were down significantly, by 29.2%, along with hacking earnings (down 54.3%) last year.

"We believe that this aligns with the long-standing trend that scamming is most successful when markets are up, exuberance is high, and people feel like they are missing out on an opportunity to get rich quickly," Chainalysis said.

Of the illicit transactions, the majority were with sanctioned entities and jurisdictions. These accounted for US$14.9 billion in transaction volume, or 61.5%.

Ransomware payments crypto currency payments for 2023 rose sharply, exceeding US$1 billion after declining in 2022.

Chainalysis gave several caveats for its data, saying the figures are lower bound estimates based on inflows to the illicit addresses they've identified today. As more addresses are identified, the totals are almost certainly going to be higher, the company said.

For 2023, so-called stablecoins which are pegged against fiat currencies or commodities, account for the majority of all illicit transaction volume.

Chainalysis believes 2023 was a year of recovery for crypto currency, with the industry rebounding from scandals, blowups and price declines the year before.

1 Comments

Just need to add the customers of a few crypto exchanges to the books because the operating & governance model is direct fraud & scam. Sadly in NZ many customers coming from a realm of simple laws and even minimal customer regulations into the world where there are none were less than prepared. You really cannot trust anyone in crypto (it being distributed leads to a low trust model where ownership & retrieval of funds is a grey area). They should have been more prepared to never trust wallets, exchanges, apps, hardware & software key storage, advisors, businesses that transact with crypto, other users that trade in crypto and anyone advertising the blockchain as a software solution.

Actually successful crypto traders start with a low trust model and don't buy into the many many common attack vectors and things like exchanges (which claim to have cold storage but never actually do have basic cold storage security). Also being familiar with bot trading, pump schemes and services that can hide the source and end points of transactions help the most successful crypto traders... can't remember why that was so important... oh yeah.

I think XKCD said it best:

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.