The Reserve Bank’s well-telegraphed 50 basis point hike in its Official Cash Rate to 2.5% this week was promoted clearly as another 'resolute' move to take inflationary heat out of the economy.

So why is the central bank still lending retail banks $12.7 billion of subsidised cash that is helping to keep asset prices inflated, keep term deposit rates low and further increase bank profits, which are already running at $20 million per day?

The Reserve Bank set up its Funding for Lending Programme during the first year of the Covid crisis to lend banks billions at the same rate as the Official Cash Rate in order to encourage lending and help boost home-owner wealth so as to support the economy. That worked, pushing up house prices 45%, but by mid-2021 it was clear it had worked too well and was generating too much inflation. So the central bank stopped money printing in mid-2021 and started hiking the OCR in October last year because it wanted to slow inflation.

So why is it still shovelling out discounted loans to banks at a rate that means more than a quarter of all new bank lending since December 2020 has been backed by these subsidised loans – and nearly 40% of all new lending since it started tightening monetary policy?

It seemed like a good idea at the time and may well have encouraged lending and supported a fragile economy in the first half of 2021, but the Reserve Bank’s still-open Funding for Lending Programme (FLP) of cheap loans for banks is not only still going strong, it has doubled in size since the RBNZ began outwardly tightening monetary policy from October last year.

Reserve Bank data shows it has lent unspecified banks $12.6b through the programme since it was launched in December 2020, including $6.6b since it started formally tightening policy in late October of last year. A further $350m was lent just last week.

That means 26% of all new housing and business lending since December 2020 was backed by the central bank through these loans, and 36% has been backed since the Reserve Bank started hiking the OCR in October last year.

The banks have slowed their lending growth since late 2021, in part because the Reserve Bank tightened its low-deposit lending restrictions, but the cheap loans also have the effect of boosting banks’ already healthy profit margins. That’s because they usually have to pay retail savers in Aotearoa-NZ and a few wholesale lenders overseas higher rates for term deposits and wholesale bonds.

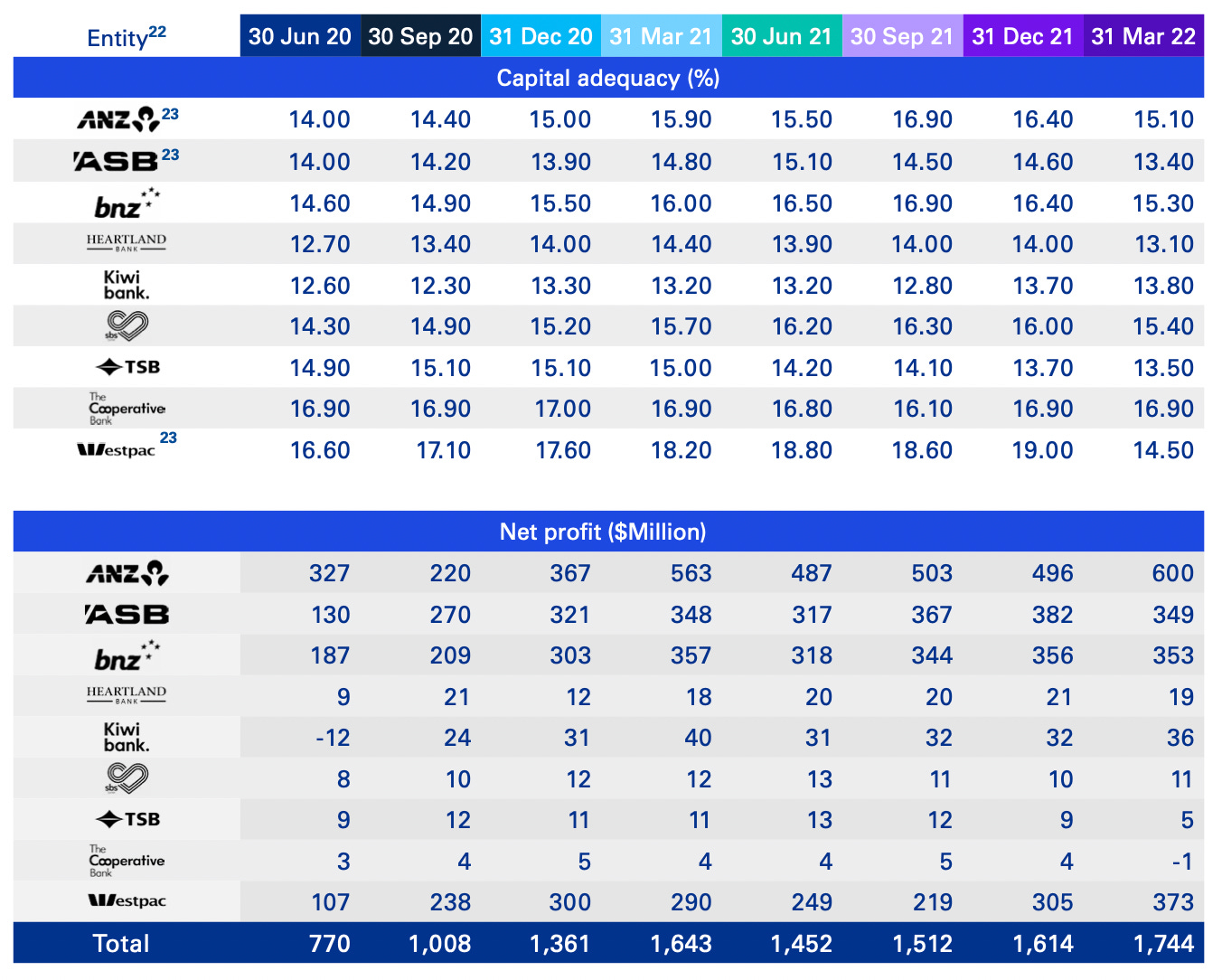

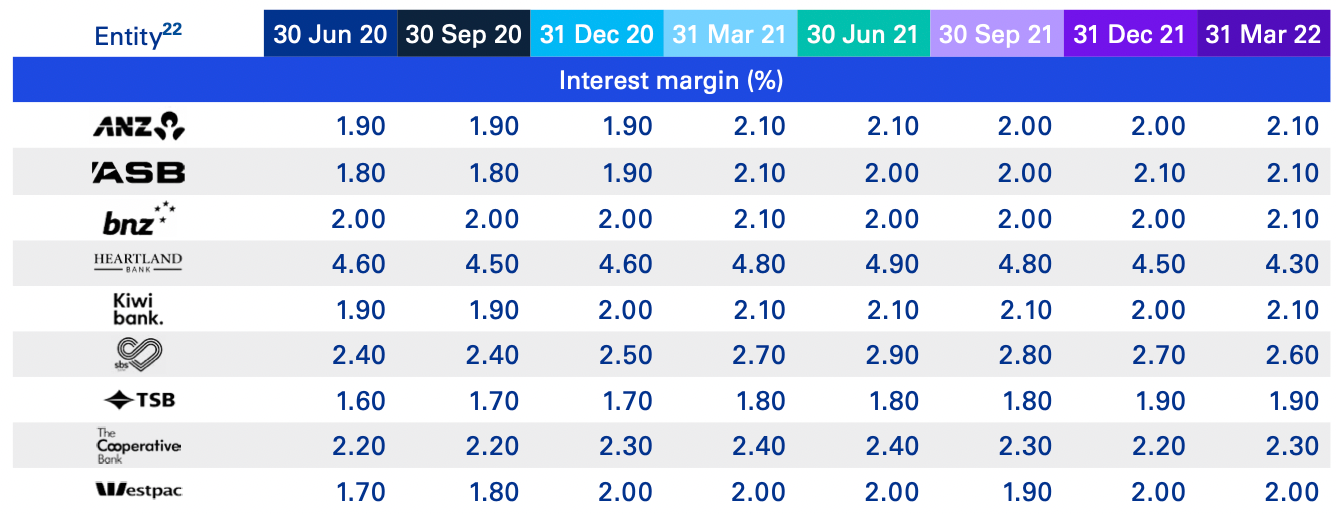

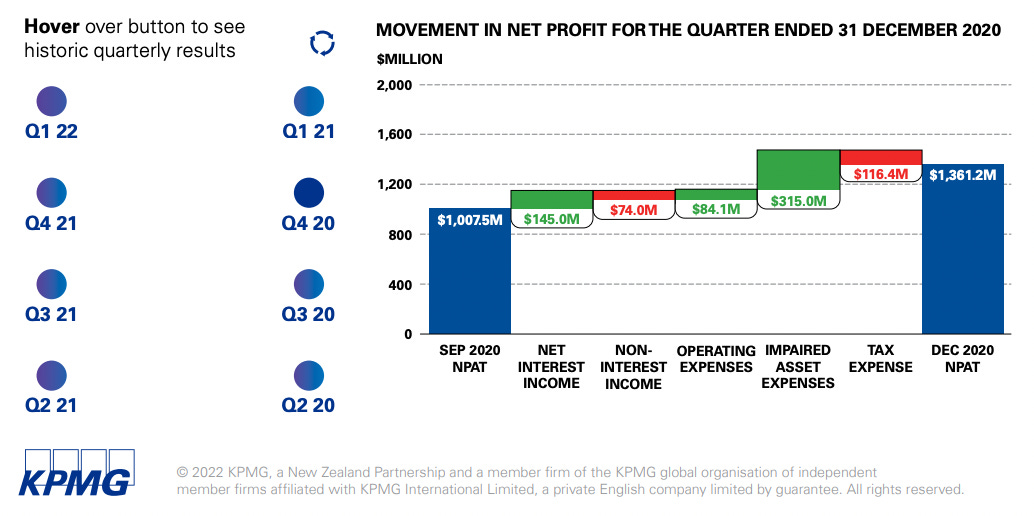

Banks made profits of $1.75b in the March quarter of 2022 alone, equivalent to almost $20m a day, and up from $1.36b in the December quarter of 2020 when FLP was started. That was partly due to higher net interest margins since December 2020, as these tables and charts from KPMG’s quarterly banking sector report show.

The big four banks’ profit margins are up around 20 basis points since FLP began, equivalent to least $25m per year on the $12.6b currently being lent at the OCR. Overall profit from net interest margins on lending versus deposits were up by $145m overall in the six months FLP began operating at full tilt.

So what? - Why is a taxpayer-owned body subsidising already-profitable (mostly private and mostly Australian) banks to the tune of tens of millions of dollars and in a way that makes it easier for them to lend cheaply to inflate house values? And all at the same time as ostensibly trying to slow down activity in the economy and reduce inflation?

The Reserve Bank has said it promised the banks when it set up the FLP that it would run for two years from December 2020, but within six months it was pulling back its stimulus through its LSAP (Large Scale Asset Programme) or Quatitative Easing programme of money printing to buy bonds, and within 10 months was actually increasing the OCR.

The Reserve Bank has said it didn’t want to go back on its word of leaving the programme open for two years, but that doesn’t explain why it accepted the requests that kept rolling in, especially in the last year when it should have been tightening policy.

In my view, the Reserve Bank should have shut down the FLP at the same time it stopped buying more Government bonds in mid-2021, when only $3.6b had been lent. A further $9b has been lent since then, backing just over a third of new bank lending and adding tens of millions to bank profits.

37 Comments

Yes, of course they should have shut it down. RBNZ should have also stopped paying OCR on settlement institutions' balances, which are currently $45 billion. That is over $1bn a year in interest payments ($3m per day)... because... we're friends.

Your comment on settlement institutions' balances is quite embarassing, and really demonstrates a lack of understanding of how the central bank works within the context of the wider banking system. I suggest you read up on it.

^^ yep, it’s where the money goes. The FLP is actually positively yielding, but that’s not a good thing as it has other effects being that way.

Don’t berate though, central banking is hard to learn externally.

Took me ages.

Could you elaborate or maybe ELI5? If they pay more interest this is a cost to a central bank, no?

It's a cost to the Crown really. Net govt spending ends up as settlement balances earning OCR or bonds earning yield. It's a dumb system - free money for wealthy people.

Ok cool but the reserve bank can surely say to the banks we'll pay you 0.5% not OCR on your settlement account balances and that money is saved on NZs behalf? In theory the banks may try lending it out instead obviously.

Really? I understand how it works, thanks. I just fundamentally disagree with the corridor system and the central banks propping up the overnight rate. The natural rate of interest is zero.

there's the juice of the lemon right there.

The primary form of collateral being pledged against FLP loans is residential mortgage-backed securities.

Presumably, there's incentive here for banks to get bad debt off their books by palming these off onto the RBNZ in return for cheap cash.

The RBNZ has recently deferred a review of mortgage bond collateral standards until after the FLP ends, so it's not like they're checking:

https://www.rbnz.govt.nz/financial-markets/domestic-markets/review-of-m…

I wouldn't be surprised to see FLP drawdowns increase this year even as lending decreases.

Right on the money Bernard. The FLP still operating is a disgrace but like politics the little thinking people can do little about the situation.

Arbroath,

Arbroath smokies, the best!

A disgrace really, the only reason this is still here is they committed a timeframe at the outset. This is emblematic of leaders at RBNZ being unwilling to review their position when they receive new information, much like declaring "OCR won't go up for a year" to May-2021. It was clear by Christmas 2020 this was the wrong move, but they stuck by it.

Contrarily, the RBA said the OCR wouldn't move till 2024, a foolish comment, but soon after they ate their hat and changed rates. Kudos to them for chewing the hat and doing the right thing.

C'mon Adrian, it's about NZ, not you.

In related news:

NZ Prime Minister declares "Climate change is the Nuclear free moment of our generation", and then reduces petrol tax (aka subsidizes fossil fuel use) in the face of a NZHerald beat up.

Is it that difficult to declare a purpose/vision, and make every decision with that front of mind?

People going without, just trying to get to fill the tank to get to work and back while the government rakes in more and more exise that it wills into existence is a beat-up? It's OK dude, I hate poor people too.

Respectfully, petrol prices going up is the POINT of the tax.

The tax was put in place to encourage people to use less fuel by raising the price of fuel (I don't want to debate whether that's morally right or not, just stating why it was put in place). Consequently, the price of fuel went up. Because the price of fuel went up, people started complaining they had to use less fuel. And now because of those complaints the tax has been scrapped.

Excuse the French, but what is the f*cking point? Do it or don't do it, but have the balls to stick with your decision until the end - otherwise you achieve nothing.

On this point, I am dismayed by the ETS. The ETS exists to encourage businesses that are high emitters to change their behaviours - if businesses don't change, and continue to emit lots, they will have to pay lots to the ETS. Makes sense - businesses can choose for themselves whether they want to change their behaviour (i.e. invest in equipment that is less emissions intensive) or keep the same behaviour but pay more through the ETS (which offsets the higher emissions). But now that the ETS is put in place, businesses are complaining that they might have to change their behaviour, so the government is doling out huge pardons and carve-outs to exempt certain businesses from the ETS. Again - what is the f*cking point? The ETS was put in place to make companies change their behaviours, but now that companies are changing their behaviours we're going to exempt them because they have to change their behaviour??/?? It's completely incoherent.

(Sorry, got a bit carried away there. Made myself mad just typing it. Off to have a coffee to cool down.)

Exactly, FLP should have stopped 6 months ago. Some banks still drinking from the fountain, look at their savings rates. ASB raised their call savings rate to 0.55% today, laughable.

maybe they can see what's coming and are leaving the lights on just in case but I doubt it - lights are no thing to a blind man.

Corruption in plain sight.

Yep. When people in leadership positions make decisions at the expense of taxpayers, in a way that appears to profit foreign banks, you have to ask why. Corruption is often the answer when things don't make sense.

$20m a day profits, and headline news is supermarkets $150k/day???

At last... someone has finally asked the question. The FLP was supposed to end at the beginning of June, and why it was extended is mind blowing. I can understand why you may create this sort of moneygoround in your own economy. But these profits go to foreign banks.

But I guess why is the media not asking the question more widely and sooner than Bernard. I reckon if it got the media attention it deserved then the thing would have been shut down ages ago.

I admit, I don't fully understand all the ins & outs, but it doesn't read well, that's for sure. In fact, it makes us look dumb. Again.

Giving the banks more reserves won't necessarily increase lending, banks are not reserve constrained in their lending anyway and they don't lend out reserves and all lending creates new deposits.

Giving the banks more reserves won't necessarily increase lending, banks are not reserve constrained in their lending anyway and they don't lend out reserves and all lending creates new deposits.

Banks simply buy promissory notes. As I explained y'day, base money more easily becomes broad money in the Anglosphere because of the drunken sailor mentality towards the housing mkt in particular.

You merely seem to be agreeing with me again today. As I said loans create deposits and not the other way around. Banks are capital constrained in their lending and not reserve constrained.

Lending is capital- not reserve-constrained http://bilbo.economicoutlook.net/blog/?p=9075

MMT doesn't solve this.

Maybe, maybe not but it does give an accurate description of how modern banking works unlike mainstream economics which still has its head stuck in the money multiplier, fractional reserve and loanable funds theory of money. It is cringeworthy listening to mainstream economists pontificating about things that they don't even understand.

I think they just ignore it more than anything else. Why would someone like Zollner explain to the public about credit creation? It's not in her interests or her employer's interests. Similarly with Kaumatua Orr and his iwi at the RBNZ. They would prefer the hoi polloi not to understand these things.

I think that we have some common ground there and that we could also include the treasury in this. Its hard to tell just who they are working for sometimes. Most of our economists seem to have come from working in the banking sector I think.

Why isn't the near-term performance of bank equities doing so well? Given all the support they receive, they're arguably being wholly subsidized by the taxpayer. Risk is being removed and moral hazard is abundant.

Zoom out on the bank equity prices and you can see that if you've owned them over the long term, you've made out like a bandit. But this is also part of the problem. Bank stocks are primarily owned by the old farts and are a large component of the ASX, of which the Aussie super industry relies on. As boomers approach retirement, they want those bank stocks to be delivering.

It's like one big centrally planned economy, which is one reason why I think that Kaumatua Orr and his own little iwi at the RBNZ are taking care of different stakeholders.

That the FLP is still going on is indicative of the lack of a coherent policy by the RBNZ, and of the incompetence of the people in charge of it. Not that we need further proof of it, mind you, after the repeated and sustained mistakes of the last two-three years.

How long before Orr is on the board at Westpac?

Yep. I wouldn't hire Robbo.

Driving up bank profits worked for John Key.

by Audaxes | 13th Jul 22, 9:47am

Funding for Lending Programme (FLP) has been declared a repo transaction available to existing RBNZ counterparties.

Outstanding bank funding arrangements for eligible collateral securities are forecast to be replaced by RBNZ OCR priced funding under this arrangement.

Banks will retain an economic interest in the securities posted as loan collateral, unlike the debt securities sold, in QE transactions, to the RBNZ.

A review of this accounting diagram Exhibit 2 (secured borrowing) sets out the reality.

The fact the FLP is still in place - and was put in place in the first instance - should finally put to bed the notion, pushed forward by Bernard H among many others, that banks had "huge amounts of money to lend" as a result "money printing"/QE and the resulting large increase in bank deposits at the RBNZ.

For why would the banks need a FLP program if they had $45 billion sitting on deposit at the RBNZ earning the OCR?

The answer is of course, those deposits are not available to the banks to lend out..........

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.