The latest wave of interest rate rises have come in for criticism, with banks accused of being "up to their old tricks".

The comments come from a banker turned mortgage broker, David Cunningham. They follow mortgage rate rises announced by ANZ, though other banks have made similar moves.

Cunningham says the rises are allowing banks to increase their profit margins.

Cunningham once headed the Co-operative Bank and now runs the mortgage brokerage Squirrel. He stresses his comments are his own opinion, not those of his employer.

"The banks are up to their old tricks this week, once again lifting mortgage interest rates," he says.

"The announcements come hot on the heels of news, just last week, that inflationary pressures are easing – a clear sign that all the rate hikes we’ve had to date are working exactly as they need to."

"They also come at a time when the Reserve Bank has seen fit to hold off on any further Official Cash Rate (OCR) hikes for several months, and with New Zealand already in the thick of a cost-of-living crisis."

Cunningham queries whether recent increases in wholesale swap rates and other underlying costs of funds are sufficient to explain the rises in retail rates.

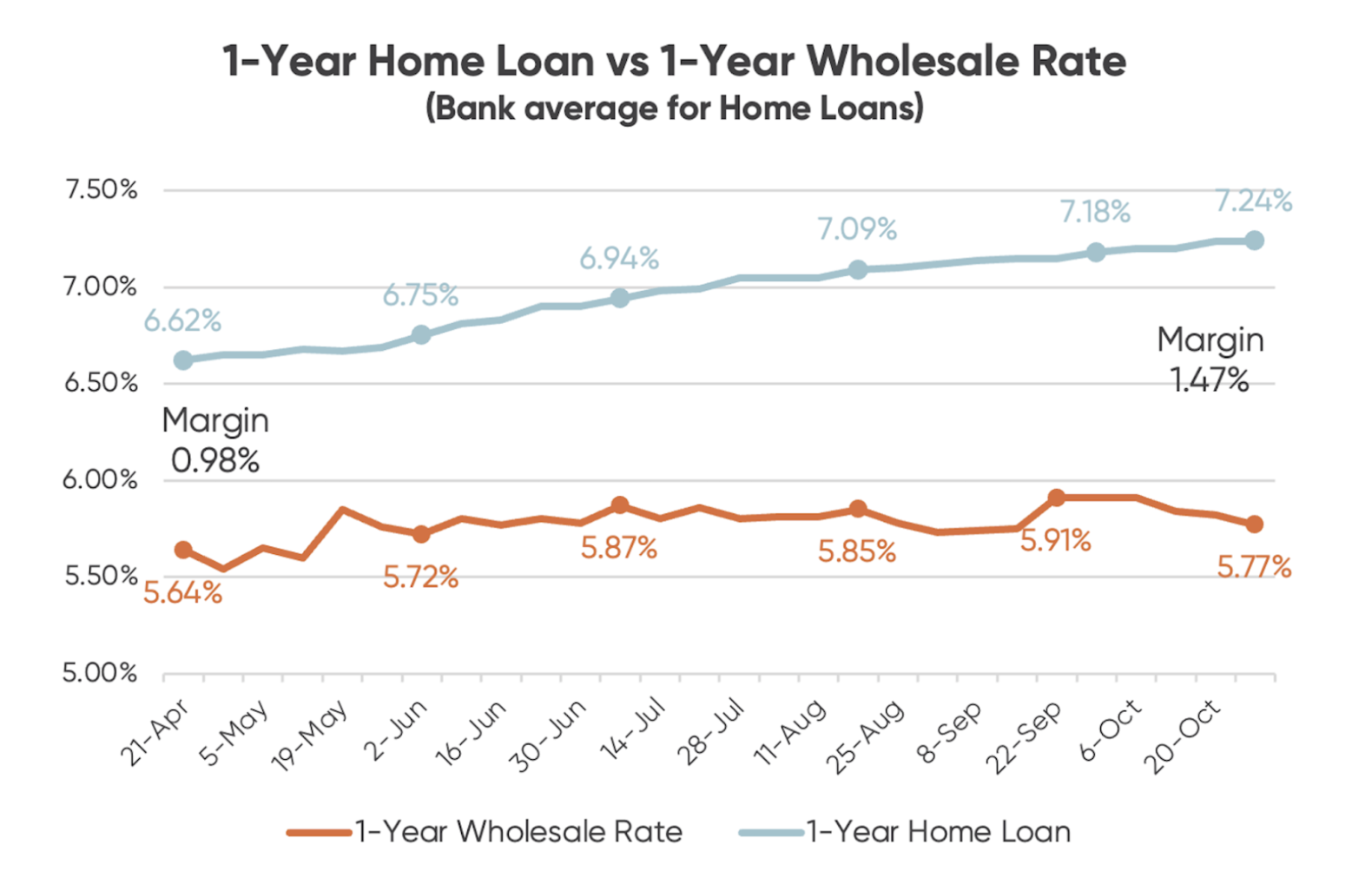

So he produces a chart which he says shows this argument doesn't quite work.

The chart uses a popular one-year home loan product and tracks it against one-year wholesale interest rates.

"As you can see, the one-year wholesale interest rate has barely moved since 24th May, when we had our last OCR hike," Cunningham says.

"And yet, since then, banks have lifted their one-year fixed home loan rates by about 0.5%. That’s equivalent to a 50-point OCR hike!"

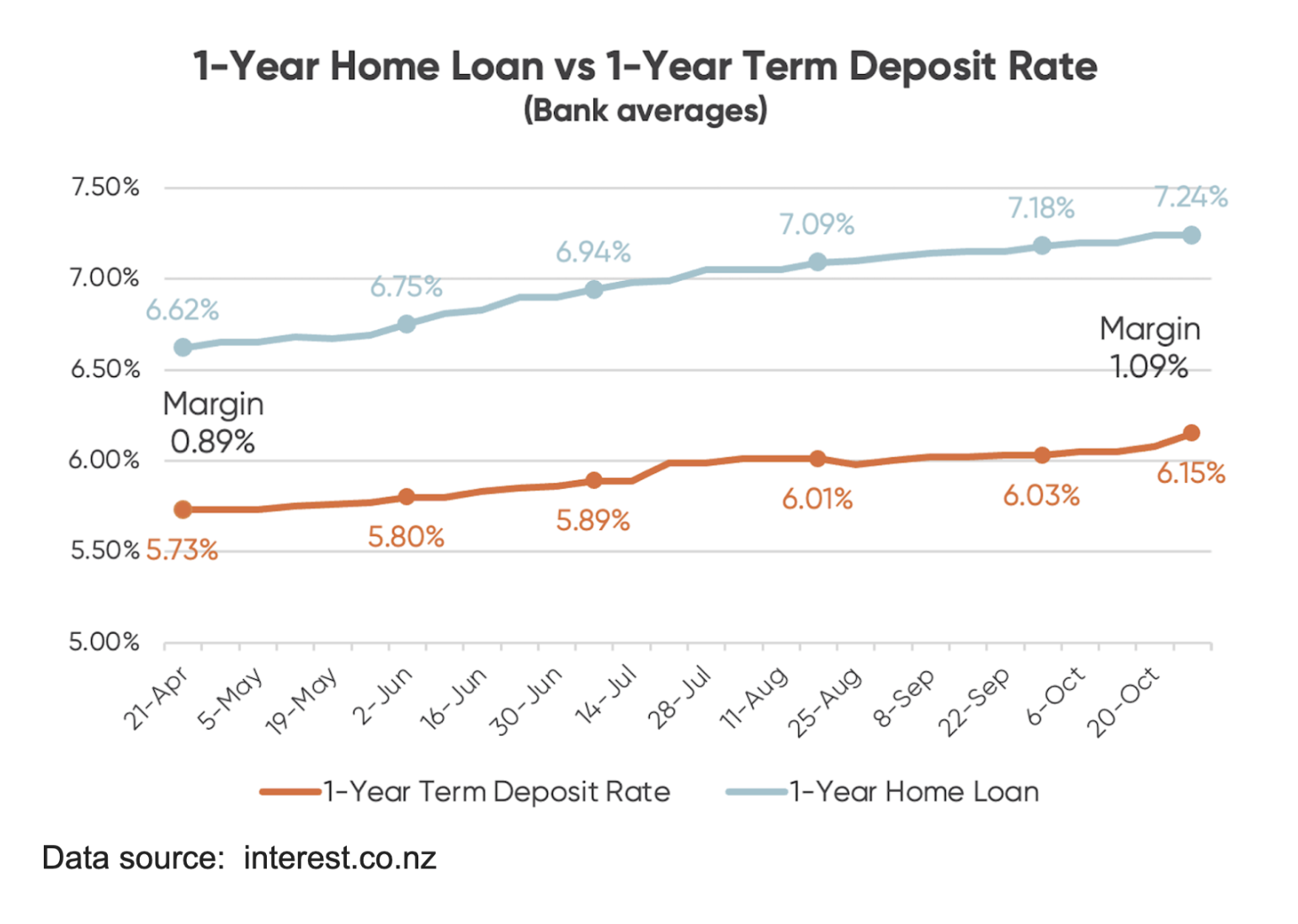

Cunningham concedes that unlike the wholesale rate, term deposit rates have risen in that time, but they did so at a lesser rate than the one-year home loan rate.

And he says there has been a similar process with term deposit rates, which have lifted over the same period, but again, by a lower rate.

"For ANZ in particular, the reality is richer still, given their one-year home loan rate has just risen to 7.39%, while its one-year term deposit rate sits below the market average, at 6.1%."

"While the rest of us suffer a cost-of-living crisis, ANZ (and the other banks) continue to celebrate a profitability bonanza. Fair? You be the judge," Cunningham says.

In a statement, ANZ says it constantly reviews its deposit rates to ensure it provides a balanced approach to managing interest margins and product pricing.

It adds the timeframe chosen for interest rate comparisons can give differing impressions.

Since October 2021, ANZ had increased its one-year term deposit by 4.7% buts its one-year home loan by a lower amount, 4.6%.

"Rates are influenced by many factors, and therefore looking at shorter time frames does not always paint the most accurate picture," ANZ says.

"When reviewing interest rates, we consider a range of factors, including the impact on customers, the underlying cost of funds and competitor activity."

27 Comments

what do you expect with the 4 main banks having an oligopoly 85% of the market.

If only we had a Commerce Commission that could do something about competition within the banking industry...

ANZ buying National Bank... all good says the CC

Z buying Caltex,, all good!

Countdown buying Progressives (Foodtown and Woolworths), a real win for the consumer says the CC!

IAG buyig Lumley and AMI, 50% market share for a single market participant will allow the consumer to benefit from scale says the CC

yeah right

But Telecom owning copper networks and telephone exchange buildings throughout New Zealand was seen as anti-competitive and were forced to open up their assets to their competitors. Would be similar to the CC forcing Caltex to let Domo Gasoline install pumps on their forecourt.

Well to be fair , petrol station forecourts are not a natural monopoly in the way a copper and now fibre network that goes to almost every single household in NZ is.

can I fix that for you?

If only we had a a generation of GOVERNMENTS that could do something about competition within the banking industry...

Did you mean the Comedy Commission ?

Far be it from me to be seen as an apologist for the banks, though I do wonder whether Mr Cunningham has left out the data on the longer end of the rate curve through oversight or by omission?

A cursory look tells that 2 & 3 year US treasury yields have lifted from 4.1% & 3.6% in April, to 4.08% & 4.98% currently, while bank fixed rates have gone from 6.49% and 6.4%, to 6.99% and 6.76%. The closing of the respective margins from 0.98% & 1.11%, to 0.5 & .36%, mean that less profit is being taken at the middle of the curve. Granted that this yield curve is not determinate on the cost of lending for the Big 4, it's still fairly informative.

The real story here is either "banks adjust pricing strategy to take more profit at the short end, at the expense of the mid term", or "Mortgage Broker seeks to drum up business by inciting anger towards old bogeyman". Take your pick.

Mr Cunningham's job is to sell mortgages. Any spin applied to potentially increase his sales, including pressuring banks to keep borrowing costs lower, will mean more willing debt slaves knocking on his door with associated commission trails.

It doesn't make him wrong though.

Real returns on bank term deposits are still low and have been subsidising the property Ponzi for a decade. Inflation on essentials is still high. Land inflation is returning as official government policy. interest rates need to remain high to give the financial system a hint of credibility. Not to mention gathering global risks.

I suspect the time range is probably carefully chosen as well. Extend that first graph out another year back.

I'm not sure why Kiwibank can't win a lot of market share. They don't need to match any other bank on pricing as they are publicly owned, and they in theory should have nearly unlimited funds. The profits stay in New Zealand.

Having tried to deal with KB, I know at least one reason why they aren't winning a lot of market share, but that's another matter.

I remember when Kiwibank first started, we thought we'd give them a shot. The guy running the local NZ post/ Kiwibank franchise couldn't have been less interested. Customer service rating somewhere between pathetic and and appalling. So we didn't bother. The 100000s in interest we paid over the years went to CBA shareholders instead. Service does count for something above being slapped for wanting to do the right thing.

I'll stand up for them - my mortgage is with KB and I've had no issues other than an incorrect overpayment fee which was reversed after an online message. I haven't had to go into a branch since the mortgage was set up, re-fixing and overpaying were done through online messaging.

I'm sure they've improved their systems and my experience was perhaps catching the guy after the death of a family member, but it was a lost sales opportunity for Kiwibank and since then we've been treated well where we are and don't need the hassle of re establishing a relationship with a new bank.

Ironically, Kiwibank has trouble raising capital as the government won't contribute any more funds. They're quite happy to prop up Air NZ with tax payer funds when they need it. I would have thought Kiwibank would be a much better place put that money.

Just more socialisation of the costs of the tourism industry.

Kiwibank is no different from the other banks.

A potential strategy to gain market share could involve offering a 4% fixed for a 5 years. However, they wouldn’t have the capability to efficiently process the applications.

We've just refinanced a mortgage with KB.

All the Aussie banks we approached (ANZ and ASB) would lend quite a bit more given the same disposable income figure (made up of mainly rents). KB would lend quite a bit less. With regards service, all were okay. KB did everything via email or mobile phone with just one visit to a branch to sign something the lawyers doing the conveyancing on KB's behalf insisted be signed in person and on paper. With regards pricing - KB were just the same (reinforcing my view it's an oligopoly). And the cash back was the same. And it came with very clear claw-back terms.

We went with Kiwibank.

Two reasons.

1) we'd didn't want or need the maximum amount we could borrow. (FHBs take note!)

2) it made us feel good to know the money would stay in NZ and support public services.

Banks will do whatever they can to cut costs cut services increase margins and increase profits.

It is banking 101

With massive societal impacts (not good ones) .

The trend is your friend. And they are also risk adverse. They see the wholesale funding from some sources getting higher. It may come down to how much funding is from overseas vs NZ deposits. They clearly aren't that keen on lending in the current environment. Wonder why?

Yup.

I mentioned this in another post but margins were actually very tight to swap over the last 18 months compared to the last 20 years where from what I saw mortgage rates were roughly 2% over the swap rate. If you look at about 2 months ago BNZ issued a retail 5 year bond at 100 basis points over swap. If they had switched this into funding 2 year mortgages at the time there would have been no margin as 2 year swap was around 1% under carded rates. So I think you will find if that chart were to go further back it wouldn’t be that surprising.

Banks…

NZ’s biggest gang

Just the facts...on ANZ...last raised their rates on 23 Aug 2023 the 1 year IRS rate dropped 5bps since then yet they raised their rates. Why? because they will have one year rollovers happening and customers will be rolling fixed for just one year in the hope interest rates will fall....they say rates are remaining elevated - why not come out and say the truth...we want bigger margins to report bigger profits.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.