Kiwibank kept up a healthy growth rate in the March year, the latest update of the Reserve Bank's Bank Financial Strength Dashboard shows.

Total assets rose by 10.7% compared with low single-digit growth by the big four banks, ANZ ASB, BNZ and Westpac.

Kiwibank's loan book expanded by $3.36 billion, to $34.93 billion. The extra lending went mostly to housing, $2.54 billion, and business, $722 million.

Following a recommendation from the Commerce Commission's market study into personal banking services, Finance Minister Nicola Willis in December instructed Kiwibank to raise $500 million from private investors to bolster its ability to compete with the big four Australian-owned banks.

An initial public offering may be considered if the National Party-led Government wins a second term at next year's election.

Kiwibank's return on assets edged down over the March quarter from 0.6% to 0.5%. Its return on equity was 6.7%, down from 8.4% in the December quarter.

Its quarterly net interest margin was 2.2%, down from 2.3% in the December quarter, and below the big four banks' 2.3% to 2.5%.

Kiwibank will release its June-year financial results on August 21.

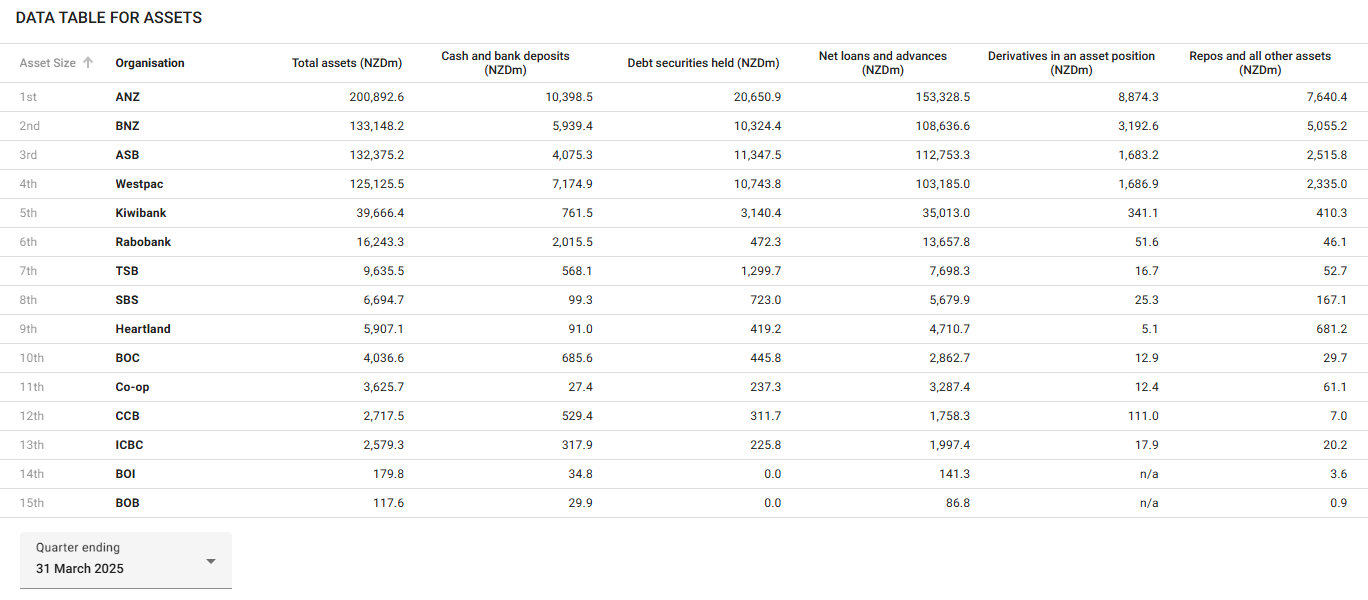

The table below comes from the Reserve Bank dashboard.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.