When the data is released for June 2025, we will find that two thirds of all bank lending is for housing.

While that may not be 'news' for regular readers, it will be an important milestone.

The core data is revealed in the RBNZ's Dashboard. When that series started, it was 58%, so that share has risen since 2018 by eight percentage points. And in a industry loan book of $556 bln (total bank lending), every 1% is $5.5 bln of additional mortgage lending. As at March 2025 it totaled $368 bln. And given that on June 19, Stats NZ will release Q1-2025 GDP data, that probably means it is equivalent to more than 85% of nominal GDP.

Housing and housing lending dominates our economy - still, even after capital gains have evaporated in the sector.

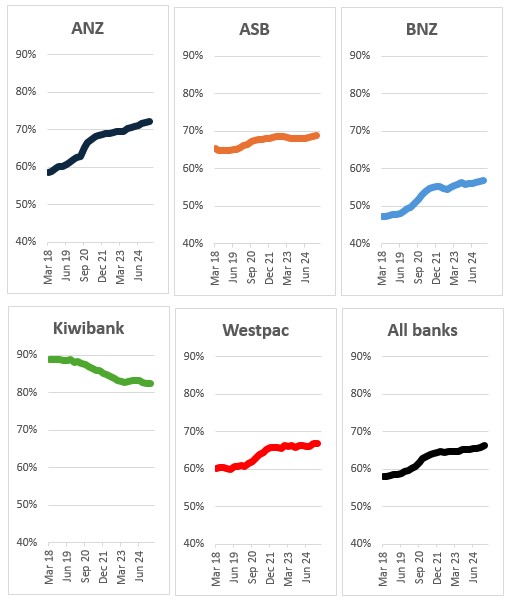

In the seven plus years that the Dashboard data has been available, it is the largest banks who have driven this shift.

Share of each bank's mortgage lending of all its lending

ANZ has led the way, twisting its lending share into housing from 59% of all its loans to 72%, a 13 percentage point shift.

ASB, which started out higher, has been more restrained, but going from a high 65% to an even higher 69%.

BNZ, which saw itself underweight in housing loan exposures at just 47% in 2018, has added ten percentage points to 57%. It is still the smallest concentration of any retail bank.

Westpac has gone from 60% to 67% over that same period.

Kiwibank, which started life exclusively lending for mortgages still has an outsized twist to housing but has managed to reduce its concentration from a sky-high 89% to 83%, still far more than the mortgage market leader ANZ's 72%.

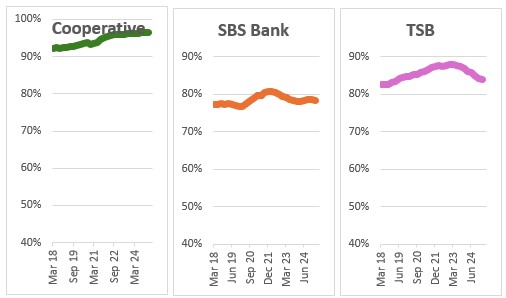

Among the key retail challenger banks, the Cooperative Bank is all in on mortgage lending, SBS Bank has been stable and high, and TSB has a higher level but has managed to wean itself off the March 2021 giddy heights.

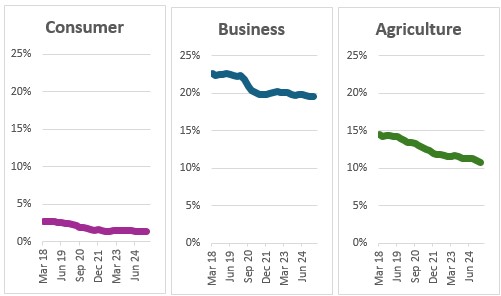

Of course, the inverse is true too, the other side of lending for personal loans, business loans and rural lending are all at record low shares.

Share of all bank non-mortgage lending of all its lending

That may not be a bad thing, per se. But the consumer loan business has a heavy influence of non-bank lenders and the bank share doesn't really reflect that sector's activities - except to show banks aren't that interested mainly because it can never move their profit needle.

Bank lending for business and corporates is also only a part of company borrowing. Big licks of debt funding is raised in the corporate bond market. The NZX lists $25.6 bln in corporate debt (excluding central and local government debt and bank det issues, but including SOEs). There is also unlisted debt.

Lending to the rural sector has a number of non-bank institutions active as well, and recent strong cashflows in the dairy sector encourages paydown of loans. Rabobank's active specialist engagement has tended to limit the main banks, as do the widely shifting risk profiles of borrowers.

26 Comments

So what is the future, financial stability and viability of these banks? - with their only plan is to "Bet it all on the NZ Property Ponzi" - total gambling.

The need to have "constant capital gains going on" gamble, to stay viable and promote such continuance, at every turn, with their external "talking head" narratives, at every bank. How prudent is this plan?

Such as is evidence by the constant barracking by banksters so called: "Economists", who are really are, just "Complicit in the Housing Ponzi agents" bought and paid for, mouthpieces, of the Industrial Banking Complex.

The Ponzi has now been plough sheared to bits and is mid collapse. What could possibly go wrong?

How many underwater loans and non-mortgage payments are the Banks, in total, "managing/hiding"??? Only time and future liquidity tests by the RBNZ will tell. Some I fear are swimming totally naked and with the outgoing negative equity tide/water, is just covering the belly buttons for some.....

Be careful at your banking choices.

Rabo seem solid/the best, with Rural doing very well.

I think you are completely over-egging it. The total mortgage liability is less than $370 bln. The current valuation of all housing is over $1.6 tln, for an overall LVR of only 23% nationally. That is not excessive. Suggesting anecdotal stress at the margins (of which there is some) is what the whole banking and housing market is like, just isn't supported by the data.

Fair call, on the surface, of readily available information.

How much are the banks not displaying, not reporting, on the stressed customers being Debt and Stress managed?

- this will only surface when the SHTF and the "itsy bitsy gully" exposes the full scope of the naked swimming.

"on the stressed customers being Debt and Stress managed? " A key statement. Are RBNZ asleep at the wheel on this? Perhaps dozing and not wanting to alarm anyone are keeping it under the wraps. Time to increase bank capital ratios but those beholden to the Banks or those wanting a nice cushy bank job after their political career unlikely to take any action. No names of course, but the National party sticks out on this. Labour wouldn't know any better and Act would loosen bank regulation even more than the Nats.

Has no one asked themselves "Why are banks increasingly lending for housing…?" It is quite simply because housing is less risky to lend against, than businesses, period.

No its simply that the RBNZ allows them to hold less capital against this space, so that increases their profits.

Yes the bank is in business to help themselves, not their customers. If it isn't profitable they wouldn't do it.

...and if the borrowing is for a business the bank will still seek to secure it against a house

Yes, because of that, but not because house prices will never go down, like the comment would suggest

Housing is considered safer in the industry in terms of repayments -> the regulatory provisions for housing are lower than business -> for the same capital, the bank can create more credit for mortgages than it can for business lending -> more profit

It's pure greed in the end, backed by industry's observations of borrower behaviour. It has nothing to do with the stability of the prices in the future, as the comment might suggest

To clarify, my comment did not suggest that house prices never go down, that's your interpretation.

Self fulfilling prophecy surely.

The total mortgage liability is less than $370 bln. The current valuation of all housing is over $1.6 tln, for an overall LVR of only 23% nationally. That is not excessive.

Little disingenuous if you ask me.

1. The denominator is the product of money supply generated for the 'valuation'. It's definitely not the 'market value.' If a substantial number of properties were 'on the market', the market value could drop precipitously.

2. The numerator is also a product of money supply.

Suggesting anecdotal stress at the margins (of which there is some) is what the whole banking and housing market is like, just isn't supported by the data.

Regardless, there are people who are out there who believe that the total market value depends on the marginal buyer, not just the target property of the market buyer. I would go as far to say it even affects the properties 3 x SD to the right, but that may not be so obvious.

Is there another country in the OECD where the major banks in their economies focus mainly on Mortgage debt? maybe Aussie?

Not quite the same data, but, housing loans as % of GDP is probably not a bad proxy. We're up there obviously, Australia and Canada too.

Housing basket. Lazy lending and as long as capital gains were happening it was risk free profit. That ever increasing prices were destructive to society and inflation fueling mattered not.

Now some of us saw the capital gains Rocketships propellant, was burning through its last payload in 2021...... now falling like an unguided, flailing, spent husk.

The banks sitting on thousands of well underwater loans (spent husk properties) may soon see the Big risks, that they took.

One Roof is pre-coping

Don't worry! The CVs aren't even gonna be accurate, and some suburbs even went up. Phew

https://www.oneroof.co.nz/news/aucklands-new-cvs-what-the-latest-valuat…

Oh good Rodney has gone up

The Onespoof toads are the major dispensers of Crashing House Price copium drugs, all the while smoking the House Hopium Highs.....

They are sooooo transparent as their sole goal......jacking up house prices, loading up poor foolish FHBs with as much Deadly Debt as humanly possible and getting the REA industry the required, profit maximizing, turnover. The place the likes of the ole rat: TTP, would hang out smoking durries, in the shadows.

Is it that retail banks are too highly focused on mortgage lending or is it demonstration of our lack of a robust capital raising industry?

I find NZ as a country is profoundly ignorant in generating and allocating capital for entrepreneurship and business in general.

Agreed. But our company laws are weak and don't put people in Jail who deserve it. That Mr Bluechip avoided jail is astounding.

...it took a while for the Aussies to catchup as well

Disgraced NZ businessman Mark Bryers sentenced to 8.5 years in Australian prison | RNZ News

A couple of decades ago I took Bryers to NZ court on a relatively minor amount (<$10k) & when he ignored the judgement (he never attended the hearing) I sent debt collectors after him & collected all outstanding including costs within a week.

Well done Straya.

It won't happen, but there is a solution. we could force the banks to split their operations with all home lending in one basket-a return to boring but secure building societies-and all other activity in another basket.

The home lenders would be mutual societies and would have government backing making them 100% risk-free. All other banking activities-loans, deposits would have no government backing and all risk would be with the shareholders.

I can but dream.

What a turnaround for the banks

When I Started work with a bank back in the late 60s housing loans were only granted to our very top customers and then they were via a bank subsidiary such as National Bank of NZ Savings Bank

Most of the housing lending was via Government State Advances ,Building Societies,Insurance Companies and then a large amount by the Trustee Saving Banks

All our lending was to farmers and businesses, however the banks were highly regulated, interest rates were set which encouraged lending to farmers and to productive businesses

Our percentage of lending to each sector was also government prescribed

I am not saying we should go back to those days but the banks need to be encouraged to lend to businesses and less tick the box housing lending.

Most of the banks are Australian in NZ, and the flow of infomration is instant and constant now. We aren;t as insulated as we used ot be

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.