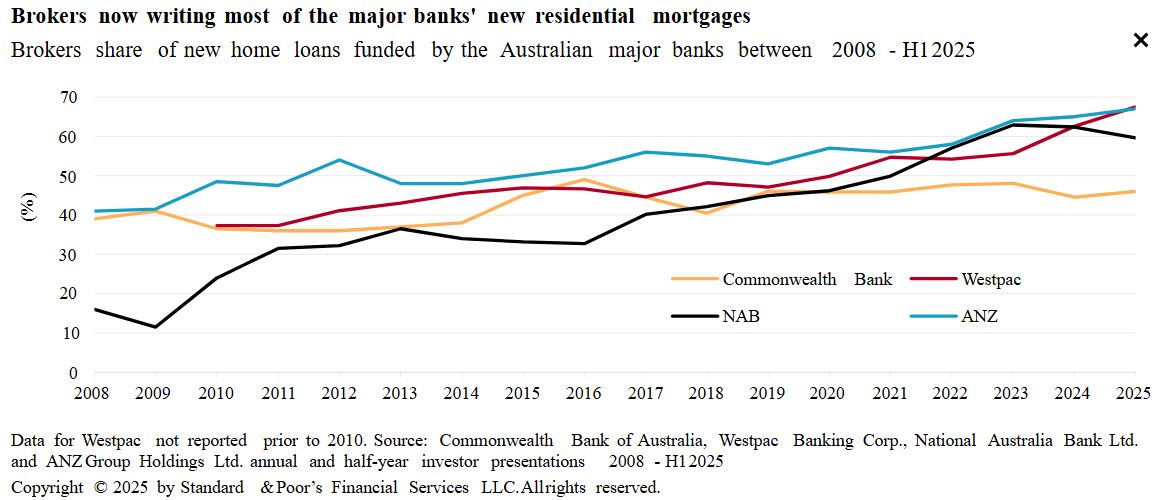

S&P Global is saying Australian banks are eyeing a margin improvement strategy of downgrading their relationships with mortgage brokers by trying to win more business direct from borrowers.

Banks there have a love-hate relationship with brokers who can redirect business at scale, an important enticement for banks who struggle to win new market share. But the costs are high.

And by allowing brokers to capture the introductory channels - essentially become rentiers - they will now be hard to dislodge.

But as a new generation of tech-savvy borrowers continues to embrace digital solutions, these digital-direct channels open new avenues to go direct without broker involvement. "We believe banks will capitalise on this", says S&P.

Digital solutions now mean it is cheaper for banks to generate new business through in-house proprietary channels.

As S&P points out, brokers typically operate on a two-stage commission structure. Banks pay an upfront fee on the drawn loan amount (typically about 0.65%) and a trailing fee over the life of the loan (typically about 0.15% a year). This dramatically reduces the margin of broker-originated loans and makes direct channels more attractive, especially when the profitability of business arriving through broker channels is declining.

Price transparency is key

S&P says: The Australian mortgage-lending business is heavily commoditized. Borrowers see little difference between a mortgage from one bank to another and it's increasingly easy for borrowers to switch lenders. This stems from a combination of better technology, ongoing competition and brokers' incentive to have borrowers refinance their mortgages. Price consequently becomes the determining factor in winning new business.

Brokers can improve price transparency, but they add to the mortgage origination cost. They slash the profit margin on mortgage products; sometimes by as much as 40 basis points (bps). In its half-year results presentation for fiscal 2025 (ended Dec. 31, 2024), Commonwealth Bank of Australia estimated that broker-originated home loans in Australia are typically 20%-30% less profitable than proprietary business.

In many cases - especially over the past three years - even the largest Australian banks have struggled at times to write new mortgage business with sufficient returns to cover their cost of capital.

"We don't think easing monetary settings will help either. As the Reserve Bank of Australia continues to ease interest rates over the next 12-24 months, we believe the government will pressure banks to pass on rate cuts to borrowers in full. For this reason, it's unlikely banks will risk skimming any extra margin on mortgage products by withholding some of the rate cut benefit from customers. Those that dare, risk a political and consumer backlash, which could dent their reputation and customer loyalty," S&P says.

Banks have the option to pass some of the broker upfront and trail commission costs directly to borrowers if they go direct. That would wean more customers off brokers quicker and build the direct channel communication, enabling them to defend the direct relationship better. Digital loan generation tools will greatly help banks.

Headline mortgage rates offered on bank websites are seldom those that borrowers actually pay. Most banks are willing to negotiate discounts with borrowers to win their business. But this takes time and can compel a borrower to seek a broker to facilitate the process.

The use of discretionary discounts creates confusion between lenders and borrowers about how prices are determined. The central bank says that banks may discount to reflect a lower risk on a given loan, to capture a loan of a large size, or simply to head off a competing offer from another lender.

In November 2020, the Australian Competition and Consumer Commission found a lack of easily accessible, transparent pricing information prevented borrowers from switching lenders or home loans, and thereby a chance to minimize their costs.

The intricacy and opacity of banks' pricing structures also makes it difficult for borrowers to compare lenders. Banks offer a mix of fixed, variable, and packaged loan products. These can have different features, fees, discount tiers, and potential cashback offers. This further obscures the true cost of borrowing and increases the appeal of brokers.

See the S&P Global report here.

An original version of this story was originally here on June 11, 2025.

1 Comments

This will be detrimental to your typical borrower, by simply saying that the banks can offer lower rates via their channels signals that they don't really care about the outcomes for their clients. Advisers will talk more about the loan structures and show clients the best way to save on total borrowing costs, banks/lenders don't/won't do that (they aren't allowed to compare themselves with other lenders).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.