Banks play an essential role in funding the business community and its activities.

While large businesses can avoid borrowing from banks, by issuing listed corporate debt or raising equity on public or private markets, these are not options for most businesses.

To thrive, grow, or even just to survive, most businesses need to supplement their capital with bank debt facilities, whether to smooth the funding of working capital, or invest in long term assets.

But after the adoption of the Basel III standards that came into effect just after the GFC, banks took an opportunity then to use the more flexible capital rules to their advantage. That essentially meant lending for housing became a much more profitable way to deploy their capital. Far less capital support was required for housing than other lending.

Up until 2013 when Basel III became effective, bank lending to businesses grew at a compound annual growth rate of +6%. In the years to January 2023 that expansion slowed to a bit over +4.5%. But since 2023, it has slowed sharply to just +1.5%.

Business debt

Select chart tabs

The overall data is available from the long-running RBNZ series C5, a dataset that starts in 1998.

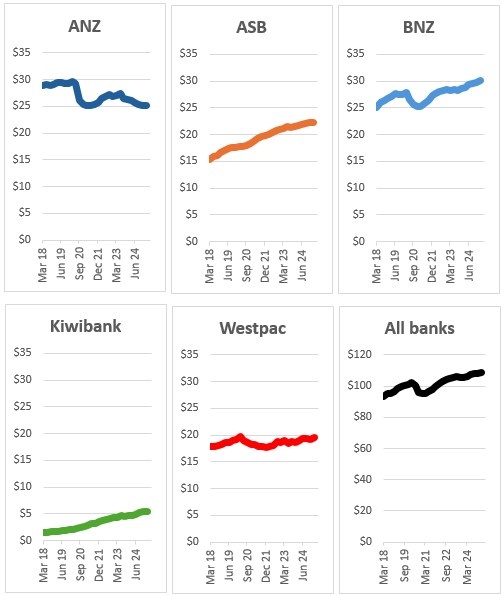

But the RBNZ Dashboard allows us to see which banks are pulling back in their support of businesses, and those still committed. (This Dashboard data starts in 2018.)

And that shows there has been a variety of responses.

Total business lending, by major bank, $ bln

Despite the pandemic, ASB and Kiwibank have pushed on by lending increased amounts to business. Westpac has clearly decided not to grow its business lending book. BNZ, which hesitated on risk-aversion when the pandemic hit, has got its lending mojo back and pushed on to reclaim its status as the largest business lender among our banks and with more momentum recently.

But the behaviour of our largest bank (and largest home loan lender) toward its lending to business has been far more restrained. It has not shown any more appetite after the pandemic shock and in fact seems to be letting its business lending loan book atrophy slowly.

And because of this changed attitude and their dominant size, this is largely the reason (with Westpac) that the overall bank lending in support of business activity has tailed off.

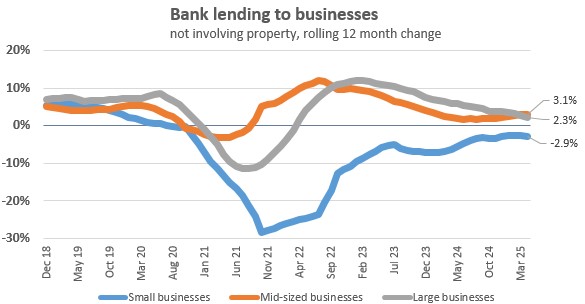

A lot of bank lending in this sector is for property-related activity.

But if we exclude that, pure business lending for the non-farming productive sector is revealed in another overall RBNZ series (S35) like this.

That confirms that the overall banking sector has cooled on business lending since the pandemic to a notable degree, but most because of policy decisions taken at Westpac, and more importantly, ANZ.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.