New Zealand's major banks should manage to maintain their return on equity at about 11% to 12% over the next couple of years without having to take significant risks, S&P Global Ratings says.

The comment comes in S&P's Global Banks Country-By-Country Outlook for 2026.

S&P Primary Credit Analyst Lisa Barrett says credit losses should remain low over the next two years, with her estimates at about 10 basis points through the 2026 and 2027 June years. That's in line with S&P's expectations for Australia's banks.

Barrett says NZ house prices should return to growth in 2026, forecasting "mid-single digit" growth through 2026 and 2027. Meanwhile, S&P sees NZ Gross Domestic Product growth of 2.2% to 2.3% over the next two June years.

"[Major] New Zealand banks should be able to maintain the return on equity at around 11% to 12% over the next two years without any need to take undue risk. This is off the back of higher credit growth and stable credit costs offset by lower net interest margins. We project private sector credit growth to trend back toward its 5% long-term average over the next two years," Barrett says.

The latest quarterly figures from the Reserve Bank's Bank Financial Strength Dashboard show June quarter return on equity of 13.2% for ANZ NZ, 11% for ASB, 10.4% for BNZ, and 12.1% for Westpac NZ. Kiwibank was at 6.5%, Rabobank NZ at 6.5%, TSB at 5.8%, SBS Bank at 4.9%, Heartland Bank at 3.9%, and The Co-operative Bank at 3.8%.

S&P's Australia outlook notes the institutional framework for the Aussie banking industry is the lowest risk level on its scale, in line with Canada, Hong Kong and Singapore. S&P says, however, technology risks in Australia are rising.

"...inadequate management of third-party risks could result in major operational disruptions or cyber incidents, causing significant financial losses," S&P says.

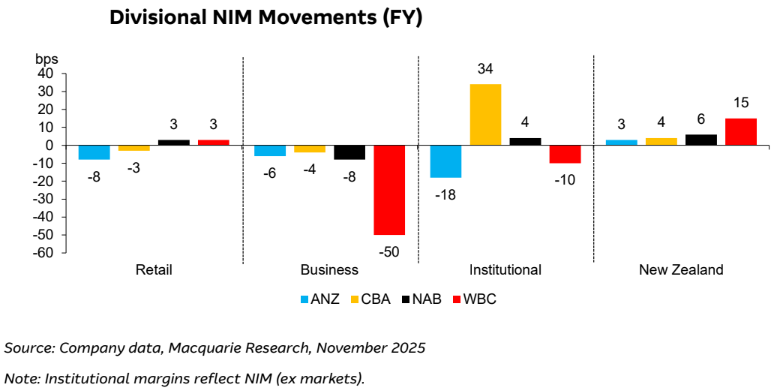

Meanwhile, Macquarie analysts' wrap of the recent round of Australasian bank financial results notes the NZ units of the big Australian banks all recorded net interest margin increases year-on-year, which they attributed to "tailwinds from better mortgage spreads."

S&P has AA- ratings with a stable outlook on all of ANZ NZ, ASB, BNZ and Westpac NZ. See credit ratings explained here.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.