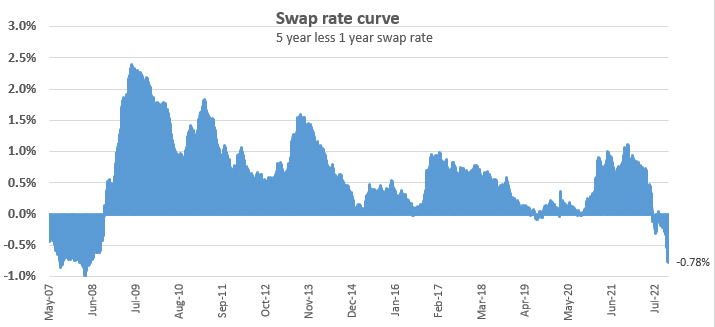

In July, 5 year wholesale swap rates slipped below the one year rate. And they stayed below for the next three months. Not by much, but the inversion was recorded.

However in the past week or so, that inversion has grown, and quickly.

It is now its largest since before the GFC. Back then it ballooned out to a full -1%.

No one knows what it will do this time, but it is entirely possible it could sink to a new record.

That is because the global influences are strong. The local influences are at the short end and are tending to hold rates high. But globally, markets are suddenly pushing rates sharply lower. And that is powering the current wholesale inversion.

An inverted interest rate curve shows that long-term interest rates are less than short-term interest rates. With an inverted yield curve, the yield decreases the further away the maturity date is. Sometimes referred to as a negative yield curve, the inverted curve has proven in the past to be a reliable indicator of a recession.

Hindsight showed that this was certainly true in 2008. A recession lingered for five years or so for most of the world, even if New Zealand got off relatively lightly.

Back in April 2007 well before the collapse of Lehman Brothers and the start of the sharp GFC reactions, the average one year bank fixed rates were 8.80% and the five year rates were 8.55%, so rates were inverted -30 bps. A year later, also also before Lehman Brothers but after some American mortgage banks started to waver and roll over, local one year rates were 9.85% and five year rates were 9.45%, and a -40 bps inversion at retail.

For reference, the OCR in April 2007 was 7.75%, and in April 2008 it was 8.25%. Allan Bollard was the RBNZ Governor at the time.

Of course there is no way of knowing what will actually happen this time. But it would not be surprising to see the inversion deepen on wholesale markets, and well beyond -100 bps. If that did happen, an equivalent shift in retail mortgage rates is a possibility too. One and two year rates might move up a little as the OCR rises. But 3, 4 and 5 year fixed rates might well fall from here, creating a real retail inversion. We are not predicting that, but it is more possible now that at any time over the past 12 years.

But will that also mean we are facing a recession? (Yes, I know, DGMs think we are already in one.) This is a less certain outcome and a lot depends on the labour markets. Unlike 2008-2014, our present labour markets are strong. Participation rates are unusually high. Jobless rates are unusually low. And pay rates are rising quite quickly now. Vacancies are widespread. This is a very different situation now than previously. Of course, we all know that the RBNZ is working to take these pressures out of the economy to quell demand and therefore the inflationary impulse and inflationary expectations. They know inflation won't be beaten without these things happening.

Inflation makes debt easier to repay. It also 'helps' Government finances with higher tax collections and bracket-creep.

If the RBNZ succeeds, then a downshifting economy may bring economic conditions like we saw in 2008-2014, which weren't great.

But it is not all up to the RBNZ. There is an election in 2023, and promises and policy levers will be working overtime to avoid an economic downturn.

Overseas, economies will have a large part to play in the general economic direction too. A healthy US and a healthy Australia will insulate us from too much pain and make the RBNZ's task harder. A reoriented China may spark a global upturn, building on the US, Japan and Australian situations.

But the reverse is just as likely. It has been almost a decade since the last 'real' recession (not counting the pandemic slowdown). The world is due.

And a recession will then likely bring sharply lower interest rates - and more normal rate curves.

There's more to life than interest rate curves. For a fuller discussion about what 2023 will bring, David Hargreaves has a savvy review here. And here.

23 Comments

Upside Down World, or the New World, which is I guess what you're writing.

Bonds rise whenever stocks hit a rough stretch. Worked like a charm every time... until now. So far this

year bonds dropped even more than stocks....the breakdown of such a once-reliable relationship points to something bigger....I don’t expect to see 2019 nominal prices again for almost anything.

https://images.mauldineconomics.com/uploads/pdf/TFTF_Dec_02_2022-2.pdf

But will that also mean we are facing a recession? (Yes, I know, DGMs think we are already in one.) This is a less certain outcome and a lot depends on the labour markets.

Following my labor market thread yesterday, Washington DC literally reached out to see if I can help to fix the data quality and statistical issues with the NFP data they have been releasing. Very humbled, and will do my best. Please reach out if you've been doing work on this. Link

All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident - Arthur Schopenhauer

Good quote :) De-Nile

The debt fueled economy is going fast and fast everyday. It's like a rocket which has gone out of control but has a lot of fuel left in it to go around in circles.

We just need to wait and see what will be the result whether it runs out of fuel and crashes without a major explosion or it crashes and take a whole lot of financial system down with it.

One thing i am sure about it is that it cannot go like this forever. We have created a monster which is eating us slowly like cancer and we do not know.

Oh, we are going to know fairly soon! Once this stuff hits the towns and cities, look out!

Never fear the great Controlorr will soon push the destruct button.

What kind of world are we living in where we anticipate lower interest rates as a result of a recession?

Interest rates are a risk premium. The higher the risk of lending, the higher interest rates should be.

Lending in the middle of a recession is a very risky proposition. Interest rates should be higher than normal during a recession, not lower.

People not borrowing and spending due to high interest rates will obviously deepen - and probably lengthen - any recession. But this is the negative feedback loop which is supposed to prevent us from ending up in situations of excess in the first place. Perhaps if we learned to tolerate periods of low growth and and productivity more often, rather than blindly chasing the unobtainable goal of permanent exponential growth, we wouldn't end up in situations where the economy is at risk of either overheating or grinding to a complete halt.

I read the article and thought the same thing - and glad you see the world from this perspective as well.

Each time the chance of default against the NZ housing market increased (think 2008 and 2020), our central bankers dropped the risk premium for that asset class. Which is completely counter intuitive.

All it has done is incentivized bad lending and poor investment decision making with the assumption that the central bank will always bail out your bad debt.

i.e. the central banks are trying to break the rules of finance in order to delay the inevitable. It is a sign of a society living in denial/delusion.

Yes. Upside down world indeed.

It's important to remember too that when the Reserve Bank acts to push rates down even though risk is high, they're not making that risk disappear. They're assuming it on behalf of the taxpayer.

Take the LSAP for example . Paying way too much for Government bonds is one way to drive rates down, but you assume a heap of risk in doing so. That risk is now manifesting itself as billions of dollars in loss, all courtesy of your kids and mine, while those on the other end of the transaction made off like bandits.

It all ends up looking like a bit of a rort, really.

"they're not making that risk disappear. They're assuming it on behalf of the taxpayer"

Not always.

Anybody who bought a house at or near the peak with a mortgage has (had to) assume(d) a high level of risk too.

Maybe.

But all that Risk, in every Asset price below where prices are today? It hasn't gone a way, it's still there, just waiting to reveal itself.

That's what we've done. We've shifted Risk from the Price of Money to the Asset itself.

Lending Risk is supposed to be based around 'the capacity to repay from future income/profits', but we've made it all about the Collateral - "If you don't repay, we'll take your (whatever asset it is that's been lent against)". The business case for Debt has been dislocated. And now, it's about to be returned.

Where to? The Cost of Debt - Interest Rates - past and present and future.

The only thing that has pushed rates up the last year is the Fed. Not inflation. Not "too many Treasuries." And that's why as soon as it looked like the rate hikes are done there's been a staggering amount of buying. Rates going back to fundamentals again. https://youtube.com/watch?v=v_Mq-O Link

This is what Milton Friedman called the interest rate fallacy, and it indeed refuses to die. We can tell what monetary conditions are in the real economy, as opposed to financial liquidity, though the two can be linked, by the general level of interest rates. When money is plentiful, interest rates will be high not low; and when money is restricted, interest rates will be low not high. The reason is as Wicksell described more than a century ago:

[The natural rate] is never high or low in itself, but only in relation to the profit which people can make with the money in their hands, and this, of course, varies. In good times, when trade is brisk, the rate of profit is high, and, what is of great consequence, is generally expected to remain high; in periods of depression it is low, and expected to remain low.

When nominal profits are expected to be robust, holders of money must be compensated for lending it out by higher interest rates. Thus, the same holds for inflationary circumstances, where nominal profits follow the rate of consumer prices. During the Great Inflation, interest rates weren’t low at all, they were through the roof well into double digits and higher by 1980. At the opposite end in the Great Depression, interest rates were low and stayed there because, as Wicksell wrote, the rate of profit was low and was expected to be low well into the future. High quality borrowers were given as much money as they could want while the rest of the economy was deprived of funds; liquidity and safety being the only preferences in what sounds entirely familiar. Link

Interest rates are a risk premium. The higher the risk of lending, the higher interest rates should be.

If the money isn't real, is the risk real? It's all divorced from reality now.

Any headline posed as a question has the answer “no”

Yes all eyes now on the quarterly CPI in NZ. The march quarter released in April will be the next big driver. NZ was one of the most over heated, so we may stay above US and AU for longer. But yes, the long end swaps are easing.

I fear that some borrowers will be tempted to lock in a long 5 year rate when their mortgage comes for renewal in 2023, it seems logical with the interest rate lower than for shorter terms and they get certainty for 5 years. I do think this will be a BIG mistake. To me, an interest rate inversion is a very clear sign that there is trouble ahead, and that due to that trouble interest rates will reduce again, not immediately but I certainly see interest rates dropping in 2024.

I reckon you're probably right.

even if it isnt the ultimate best choice in terms of pure $$ payments --- if you can make those payments - its 5 years of security in a very insecure time - and not the worst choice that borrowers could make --- especially those with minimal equity after price decreases -- or who are close to their ability to meet payment limits

There ae after all 100.000's of mortgage holders with ONE property who live in it -- and only a tiny number of investors with 5+ properties - fixing long at the moment for the vast majority is a very safe peace of mind, good for your mental health strategy!

If you fix long term and then have a change in circumstances that require you to break out of the fixed rate with a large break fee, its not great for your mental health. Alot can change in this time including divorce, job relocation, need to upsize due to kids etc etc. It's also not pleasant if you get stuck on a higher rate/repayments if rates drop.

Great comment

I fear this degree of speculation has entered the realm of particle physics. Perhaps it should be named the Schrodinger interest rate theory. For God's sake, don't open the box, the cat may be infected.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.