Lending to businesses gets little visibility in the coverage of overall borrowing levels.

But according to RBNZ data (C5), businesses are borrowing from banks again. At the end of November, businesses owed $115.5 bln to banks and another $7.6 bln to non-bank lenders. That is +$6.8 bln more than a year earlier, or a rise of 5.6%.

But other RBNZ data gives a more nuanced picture (S35).

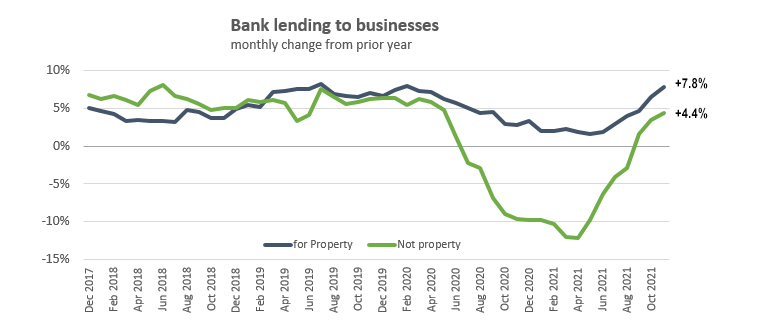

The rise is a lot to do with banks fondness for property lending which is up to almost 38% of all business lending and is growing much faster (+7.8%) than lending for non property purposes (+4.4%).

Bank lending for investment property purchases rose +8.4% to small and medium-sized business in the year. For property development, bank loans rose +4.7% in the year. Similar data isn't available for loans to large corporates, but overall lending for commercial property activities to large businesses was up +7.1%.

All this means that bank lending for non-property-related activities lagged.

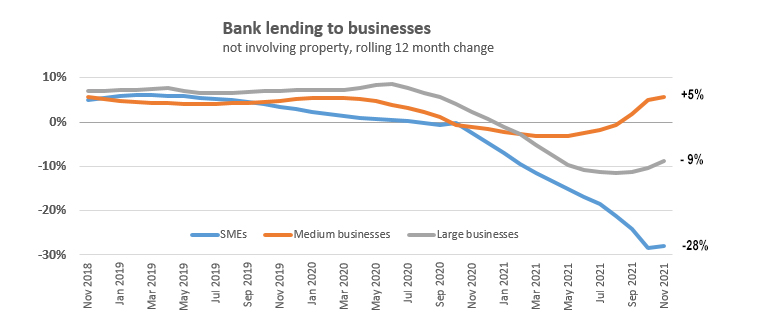

In fact, for SMEs, November lending is now lower by -16% than a year ago. For medium sized business, or large businesses, there wasn't the fall off. Much of the this data is roiled by the Government stepping in to SME business lending during the pandemic with pseudo-loans issued by the IRD where repayment requirements are fuzzy and interest rates charged are unusually low. Of course SMEs switched out of normal risk priced lending to this 'hand-out to zombie SME' type lending because it was easy and came with little or no credit checks. If any bank tried that approach, they would have been deemed irresponsible. Not so the IRD or the Government who aren't held to responsible lending standards.

The result is that the 2020/2021 business lending activity to SMEs is twisted away from banks. Looking at a longer, full year basis (to smooth out the COVID twists), the shift becomes clear.

Banks kept lending to medium and large businesses, but their market to SME's vanished on them.

Bank lending to large corporates has also suffered, probably because of the availability of very cheap funding sources in the corporate bond market. Banks probably facilitated much of this, but when investors were prepared to buy corporate paper at interest yields far below the risks a banker was prepared to accept for the purposes of the loan, why take a bank loan? It was a market where bond investors were eager to satisfy as bond prices rose when the yields fell to tiny levels. Much of this capability relied on fund managers prepared to push the funds available in their mandates (like from KiwiSaver flows, but not only those of course).

When rates rise and bond prices fall, the resulting losses can be explained to investors as 'just one of those things', 'a normal market risk', and 'who knew?'.

The RBNZ also has a useful review of lending to businesses, here through to October, 2021.

4 Comments

What's interesting is that bank loans to residential property development had fallen over 2019 - 2020. Provided this fall isn't sufficiently compensated by other sources of funding and it continues in that trajectory, it is an excellent piece of news for house prices- will have to wait to see if the trend continues.

Coupled with an increase in residential investment lending which does not capture private or other funding sources, the rising gap could be a solid indicator of another prosperous year for every housing investor.

The interaction between housing and business activity is an interesting one. If you want SME to invest and grow their businesses, you'll need an upward valuation of residential properties.

All in all, I think 2022 may just turn out to be another fantastic year.

Where can you ascertain that loans for 'residential property development' fell between 2019-2020?

I can see data that loans for 'construction' fell relatively moderately over than period, about 12%. I would assume that 'construction' includes commercial, industrial and rural building, as well as residential.

Perhaps you can point out evidence for residential construction.

..... "it is an excellent piece of news for house prices- will have to wait to see if the trend continues."

Excellent news? Really? From an investment POV, it would be much better investing at the start of a global debt bubble than at the peak of that bubble when inflation is off the hook and incomes are going nowhere.

Prices could go up for sure. But what does that really mean? It just means that more credit will need to be created to keep the charade moving and also throwing more marginal buyers into situations that they don't fully understand.

He seems to be ignoring my question, conveniently...?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.