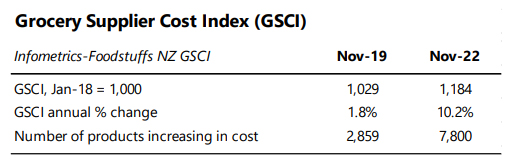

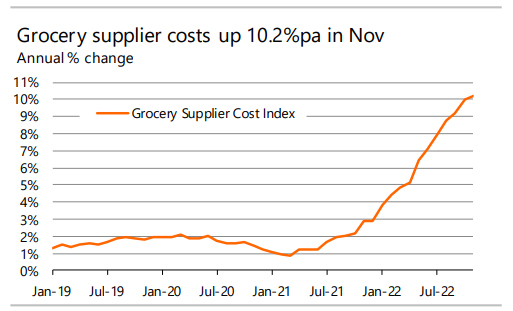

The Grocery Supplier Cost Index rose +10.2% pa in November 2022, as cost increases continue to remain at highly elevated levels across a broader range of items.

Supplier cost increases remain high, at over 10% pa, with substantially higher numbers of supplier cost changes occurring with larger cost increases. These trends underscore the sustained broadness of cost increases, with suppliers passing on higher input costs. Recent acceleration in the costs of less volatile items like general grocery goods reinforces pervasive cost pressures.

Continued large increases in on-farm costs and imported food costs demonstrate the upstream effects of higher input costs being felt further down the supply chain and risks greater cost pressure persistence. Data for November 2022

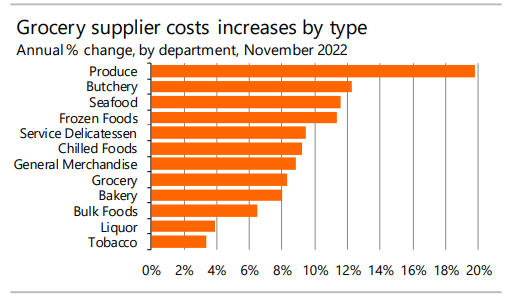

Increases across all departments

Supplier costs to supermarkets continued to rise across all departments. Produce, butchery, and seafood supplier costs rose further, and were joined by frozen foods in the group of departments experiencing a more than 10%pa rise in Supplier costs over the last year.

Supplier cost increases remain broad-based, with grocery and general merchandise department supplier costs up over 8%pa in November 2022.

More large cost increases

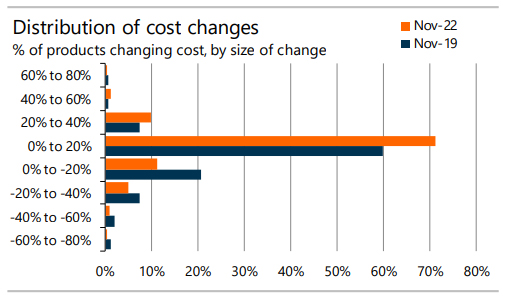

In November 2022 7,800 items increased in cost, nearly three times as many items as in November 2019 (pre-pandemic).

Around 83% supplier cost changes in November 2022 increased in cost, substantially higher than the 69% recorded in November 2019. More of these increases are of a larger magnitude, with just over 11% of cost changes being for increases of more than 20% in cost (compared to just under 9% in 2019).

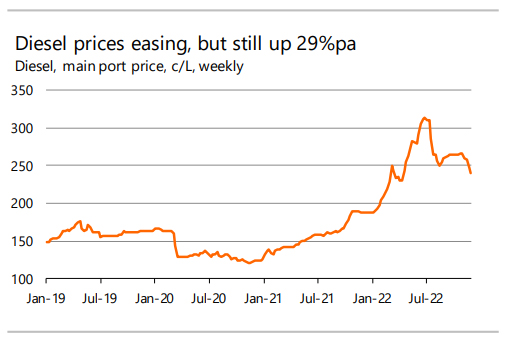

Fuel prices ease, but remain high

The price of diesel has fallen back to $2.41/L at the end of November 2022, its lowest since midApril. Fuel prices declined throughout November, as fears of a global slowdown and possible recession started to widen, with expectations of future fuel oil demand waning, compounded by a weak Chinese economy.

However, diesel prices remain 29% higher than a year ago, and earlier higher fuel costs are still filtering through into goods costs across the supply chain.

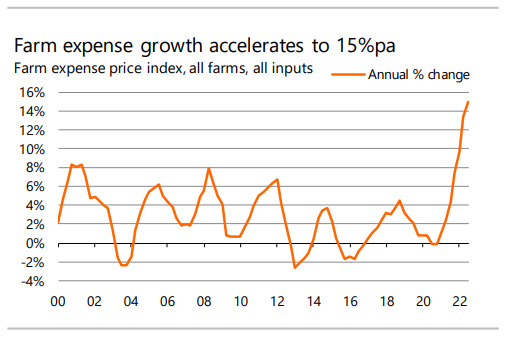

On-farm costs up 15%pa

Cost increases on-farm have accelerated again, with the Stats NZ Farm Expense Price Index increasing 15%pa in the September 2022 quarter.

Fuel costs remain high, up more than 53%pa over the last year, alongside fertiliser costs (up 37%pa) and interest rates (up 34%pa).

Cost increases are broadening on-farm too, with feed costs increasing 13%pa, and repairs and maintenance up 12%pa.

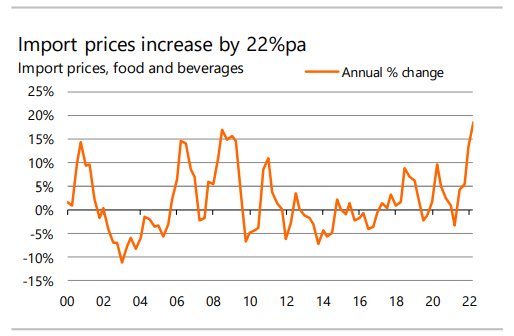

Import prices accelerate further

Import prices for food and beverages increased 22%pa in the September 2022 quarter, as higher global food costs earlier in 2022 continue to filter through supply chains and add imported cost pressures. For example, import prices for cereal and related products increased 26%pa over the last year.

The recent weakness in the NZ dollar against the US dollar will have exacerbated higher import costs for overseas goods.

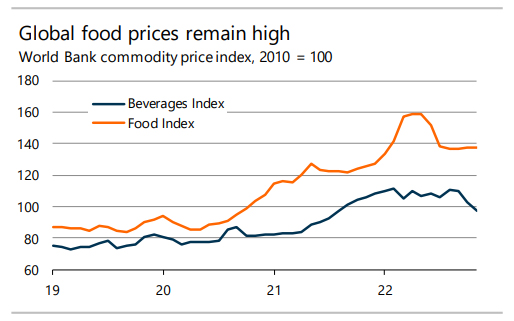

No change in global food prices

Global food prices remain unchanged again in November, with the latest World Bank commodity price index showing effectively flat food prices for the last five months. The stabilisation in global food prices, albeit at a higher price, is welcome, but price increases earlier in 2022 are yet to fully flow through to all parts of the supply chain.

Although food oils have slightly declined in price, grains and other foods prices (including fruits and meats) remain at elevated levels. Beverage prices have fallen, driven by lower coffee prices.

The Infometrics-Foodstuffs New Zealand Grocery Supplier Cost Index (GSCI) measures the change in the cost of grocery goods charged by suppliers to the Foodstuffs North and South Island cooperatives. The Index utilises detailed Foodstuffs NZ data, across over 60,000 products, analysed by independent economics consultancy Infometrics to produce the GSCI and publish it on a monthly basis. For more details see www.infometrics.co.nz/product/grocery-supplier-cost-index.

This article was first published here. It is reposted with permission.

7 Comments

Could the increase in costs have some relationship to new rules for supermarkets? Foodstuffs has been screwing the prices it pays suppliers down really tight for years and with signals from the ComCom maybe the suppliers are finally charging a decent return.

The article lays out the cause of the cost increases. If I were a supplier to supermarkets I'd be trying to claw back some extra margin for sure, but that's very hard to determine.

Com Com have been clear with their investigation that Super Market owners have been receiving twice the normal returns on equity that most businesses expect, hence some ( but not enough) action is happening. This article is more about the rampant costs of getting food to supermarkets, from a very interested industry observer perspective this all very painful for producers who are under very real cost pressure out of their control, as are consumers suffering.

This all happens while the government determined to reduce emissions that puts even more downward pressure on food production.

We need some strong leadership to break this cycle.

Avoid Countdown.

Crooks.

And it’s not just food. Cleaning materials, ranges reducing, specials decreasing, prices the opposite.

Timely article Brad, thank you.

One thing to take into account with supermarkets is the rebate payments based upon volume and sales sold into store - these are significant.

Don't assume that the 10+% supplier increases go back to the supplier, the vast majority remains withing the supermarket.

There was a massive impact of increased shipping costs on the importers due to huge spike in container freight rates 2020 -2021. An importer of canned product from China with a 20' container shipment would have seen their freight cost go from 0.05c a can in 2019 to around 0.25c a can at peak. Rates have since come back considerably. That same can is probably costing around 0.12c in freight now. When you are talking about products that retail 0.80 c - 2.00 per can. Then those shipping costs have a big influence. Especially when it seems the supermarkets insist in retaining their margin per unit. No matter what.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.