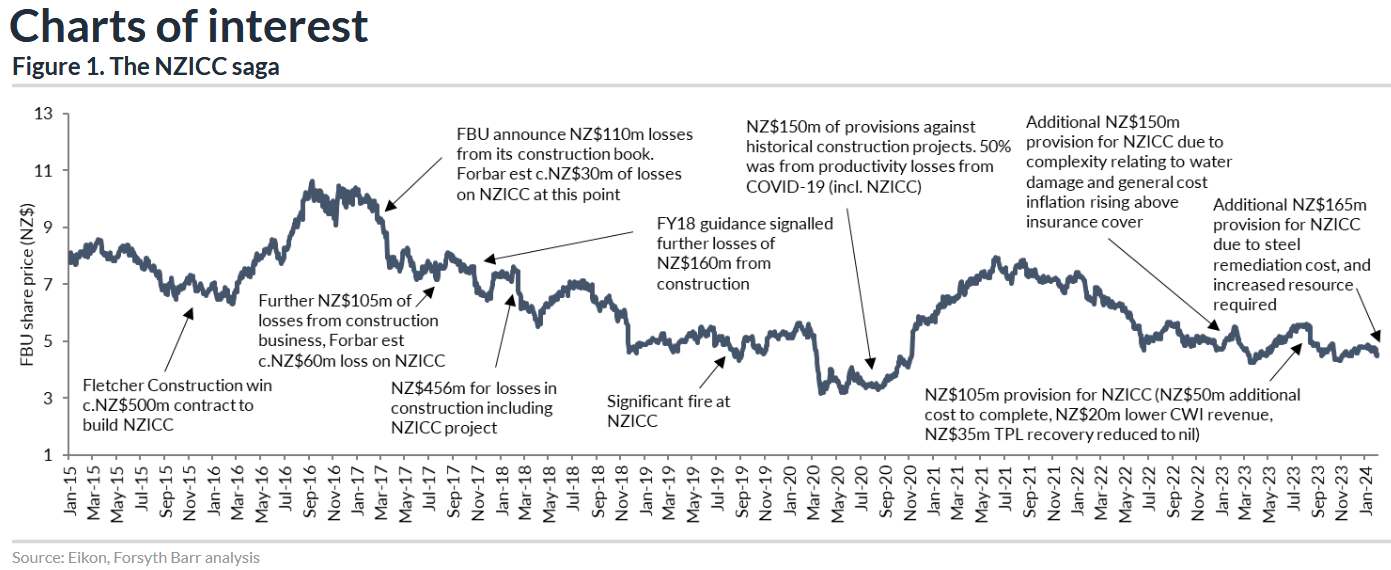

News from construction giant Fletcher Building (FBU) that it's making a further $165 million worth of provisions for work on Auckland's NZ international Convention Centre (NZICC) is "particularly disappointing", according to analysts with investment services firm Forsyth Barr.

In a research report headed: 'NZICC Steels More Cash', Forsyth Barr analysts Rohan Koreman-Smit and Paul Koraua say the provisions are particularly disappointing "given it has been just six months since the last one and continues to bring into question management controls and board oversight".

"This takes [Fletcher Building's] total NZICC-related provisions to $420 million over the last 12 months," the analysts say.

They say the ultimate cash cost will see Fletcher Building's debt to equity levels reach "the top end" of the company's target range "and we expect a reduction in dividends and cuts to the growth capex pipeline" at the company's upcoming half-year result announcement on February 14 in order to "provide some headroom".

"While covenants are likely not at risk we still expect FBU to take action on its balance sheet and expect a reduction in near-term distributions and/or growth capex with the 1H24 result."

The analysts say they are retaining their 'outperform' rating for the company on valuation grounds, with Fletcher Building shares "trading at a discount to its own history and peers, but acknowledge to re-rate the stock the market will likely want more certainty" around NZICC completion costs and also the 'Pro-fit' pipe issues in Australia.

The analysts say their underlying earnings forecasts are unchanged but they have reduced their full-year 2024 and 2025 dividends per share by 26%.

Additionally, they have lowered their 12 month 'target price' for the Fletcher Building stock by 20c to NZ$5.30 "due to additional legacy project cash costs".

Fletcher Building shares are down over 23.5% in the past 12 months, most recently trading at $4.17.

Koreman-Smit and Koraua question whether the market should have known about the latest provisions earlier.

"The flow and quality of internal information, as well as management controls and oversight, remain in question given a number of these issues should have been recognised earlier (i.e. lower than expected remediation productivity, sub-contractor availability and solvency, degradation of stored materials etc.)."

The analysts are forecasting that Fletcher Building will have made an 'underlying' after-tax profit of $138 million for the first six months of the financial year to June 30, 2024, down 32% on the same period a year ago.

18 Comments

Given Fletcher's immensely strong position in a building market that provides a huge part of our economic activity, and that their share price is around NZD415 (about what it was 20 years ago), just what are the management doing?

Their shareprice was $4.90 in 1997, 25 years with a virtual monopoly on building supplies to a nation with a rapidly expanding population.

25 years of retained earnings as well, and their share price is still lower. The manifest incomptence to achieve that takes your breath away.

Fletchers were not doing well before the Christchurch EQ, and then they got a massive handout in the form of clipping the ticket, not actually doing any of the work. that same work is now being re worked all over the city, houses where re levelling meant leaving a jack sitting on a brick under a floor joist, and closing the manhole.

Guess who is paying for Fletchers incompetence in christchurch , you and me the tax payer, they should have been taken to the cleaners by the government for the mess they left behind

I remember that well DIYman ... it was called being 'Fletchered'.

I have had a lot of overseas construction experience (now retired), which make their Auck project look tiny. I never had a project behind time or over budget. Who are these clowns? Where are their cost controls & PM systems?

They should have never got the work in christchurch, they didnt have the staff with experience to do the job.

I had a call from Fletchers about a month after the EQ asking if I needed them to come and do temporary repairs, like chimneys demolished, I explained that I didn't have insurance, and they said it doesn't matter, it would be covered by EQC, I said really and hung up the phone, they had no idea. I saw houses that had three chimneys fall down , two of which were never used anyway, in a house that ultimately was demolished, and fletchers went in and put three new heat pumps in, a house that was never occupied again, and what was in it for fletchers a 20% handling fee on three new heat pumps installed by a subcontractor. Thats clipping the ticket and wasting the world's resources. Neither are things to be proud of.

crooked and depressing

Who owns Fletchers hence why the govt gave them the job and why the govt never chased them for the f...kup they did.

They’re publicly listed - so thousands of people, organisations and funds own them. The Govt is not one of them as far as I’m aware.

They were busy patting each other on the back and paying themselves obscene bonuses. Fletchers is a perfect example of executives with their snouts in the trough.

Trying to distance themselves from the workface.

Construction is an industry where you need to have done a few seasons of physical labour to understand what its all about.

The board and senior management linkedin profiles show the opposite of that; they've been running from honest hard work all their lives.

And who ponys up for this debacle?

The shareholders to a small degree however every single one of us pays for this via higher building costs as Fletchers will use their dominant position in the building supplies sector to recoup the loss over coming years.

As a shareholder it is pretty galling that this has been going on for nearly 10 years while Board and management keep making excuses

Good to see that some analysts are now finally calling for action

and provisioning $450 million for a $500 million contract reveals appalling incompetence despite the fire and covid. These guys are big enough and should be well enough resourced to manage much better than they have

I have heard that there has been/is a culture of underquoting for the larger commercial tenders. The money is then clawed back through variations etc.

We are not alone in having major budget blowouts on large projects, it's just that if you are a publicly listed company there is a much higher standard of governance and disclosure.

Haha I remember as a teenager buying FBU as my first stock because my uncle taught me how they had a dominance in the sector, moats, barriers to entry etc. While I sold them before the current slump my return over a decade was dismal.

I hope they get dismantled. This is such a rort. For you and all us tax payers. NZ has been royally screwed by this monopoly.

I really wish that FBU would go broke. It does not deserve to be in business. The only thing that keeps it going is the very unhealthy monopoly positions that it occupies in many building products and materials markets. The government refuses to address these glaringly obvious monopoly abuses and goes on to support them with building regulations designed to support them. They are holding back a large chunk of our economy and the best thing would be to break up the company, change the protectionist regulations and force the fragments to compete more nimbly with strong overseas suppliers.

Basketcase

very good example of the dangers of monopoly

I'm sure I read correctly that there was an article in interest a day or three ago about increasing a provision because an insurance payout would be insufficient on one of their projects, fire at Sky City Construction. My take is someone in a senior position forgot to read the insurance small print as to what was and was not covered. Relied on a broker and probably chose the cheapest.

Not untypical of other companies and individuals. You only get to find out once you put in a claim then there'll be back pedaling and rear end covering.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.