Embattled building industry giant Fletcher Building [FBU] has now officially put the 'for sale' signs on its problematic construction division after broadly hinting for months that the division is on the block.

In the full financial year to June 30, 2024 the construction division made revenues of about $1.6 billion, which was just under a fifth of Fletcher Building's total revenues.

However, the problems the division has caused for Fletcher Building over the years dwarf its revenue contribution.

Probably the most well known difficulty for the construction division has been the agonising building of Auckland's New Zealand International Convention Centre, where the problems have included, but haven't been limited to, a substantial fire that extensively damaged the building and caused years-long delays. It's due to be finished in the second half of this year. Convention centre operator SkyCity Entertainment Group has instigated legal action action against Fletcher Building, though analysts doubt its chances of success.

Fletcher Building told the NZX on Tuesday that "given the inbound interest received and following completion of its strategic review", the company has commenced exploring potential divestment options in relation to its Construction Division and its Higgins, Brian Perry Civil and Fletcher Construction Major Projects business units.

This includes appointment of financial advisers.

Managing Director and CEO Andrew Reding said given the "quality and strong recent performance" of the construction businesses, and the role they will play in New Zealand’s growing infrastructure pipeline, "we were not surprised to receive inbound interest for them, which has motivated us to test whether there are attractive divestment options".

"No decision has been made to sell at this time, and we will carefully consider the value of any options presented from this process before deciding whether to move ahead."

Fletcher Building's due to announce annual results for the full 2025 financial year next month.

In an investor day update in June the company said that on top of writedowns of $251 million previously indicated at the half-year result announcement, the company is forecasting further provisions in the second half that will see total 'significant items' for the full year of between $573 million and $781 million.

Whatever the final provisions figure, it will overwhelm the expected operating earnings (before interest and tax) of between $370 million to $375 million and suggests the final loss could be larger than the $227 million loss reported last year.

The company's not currently paying dividends and won't be in future till it gets its net debt levels lower, with the target level being between $400 to $900 million. At the half-year mark the net debt figure was $1.1 billion and the Investor Day presentation indicated the nebt debt will be at about the same level on the June 30 end of the 2025 financial year.

After that update, analysts indicated that Fletcher Building would not pay dividends until the company's net debt nears the midpoint of the target, which, assuming no asset sales could take as long as till the 2028 financial year.

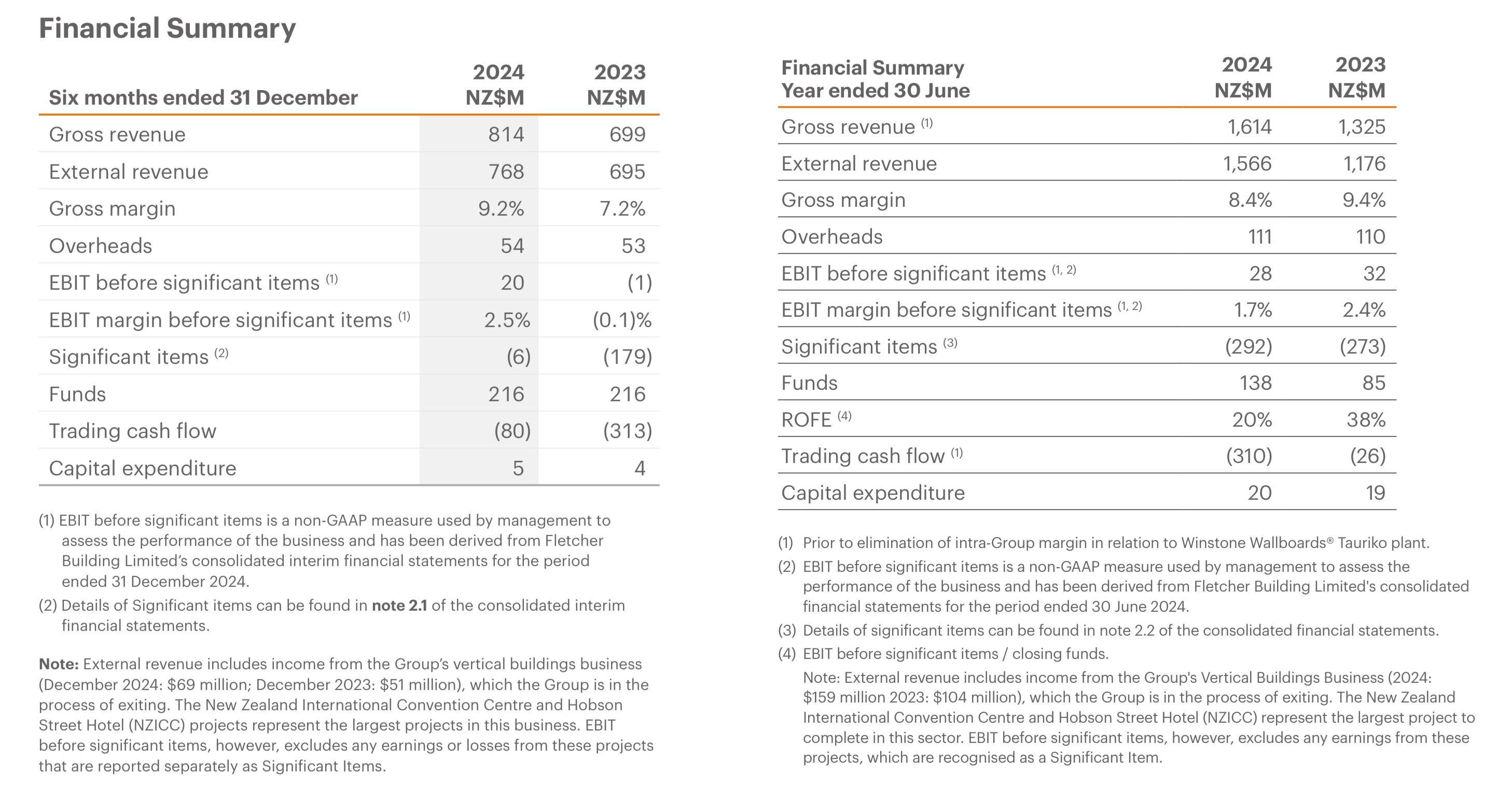

For the full 2024 financial year the company's construction division produced operating earnings (before interest and tax) of $28 million, but this was swamped by $292 million of writedowns. The half-year operating earnings in the 2025 financial year were $20 million, with $6 million of writedowns.

Below are the financial details of the division for the first half of the 2025 financial year (left side) and the full 2024 year (right hand table).

In early trading on the NZX on Tuesday the Fletcher Building shares were up 5c at $3.10.

Last year the company had indicated it was seeking partners for its residential development business, but there's been no recent updates on this.

7 Comments

I don't know what completed housing stock Fletcher building has on its books and what they value the stock at but the few adverts I've seen have been around for a while, > three months. Desperately hanging on hoping for reduced interest rates and an increase in housing prices. Perhaps the executive staff have been in their own echo chamber convincing themselves to hang on.

None. Fletcher Living is their division for the housing.

Believe Living do contract Building for most of the housing builds. Valuing Fletcher Building very difficult since so much of business is as a subbie to other divisions of Fletchers.

Is there anything left of the original Fletcher company? They were into forests, paper, energy, construction, you name it, at one point.

Generations of Fletcher's are rolling in their grave. Just a sad day to see the foundation stone of this company that once generated 10% of NZ GDP put up on the block. An indictment on the leadership of this company.

Old men who used spreadsheets for risk management

The right risk team, risk tools and risk culture could have saved them from this.

The sad thing is people see this in other industries on a daily basis, but the demands to pay your mortgage means people shut up, to cause trouble will lose your job, income, house and families economic security.

Would go back further in my opinion. The cronyism that took root under Muldoon’s prime ministership, CEO Trotter et al, created a culture of arrogance and self entitlement. The outfit didn’t become known as the hungry lion for no reason. The dismal and dreadful intervention in the Canterbury earthquake repairs, the resultant shonky and unacceptable work, is due testament to all the failings in the company at large.

Buy this division of the company, take on a lot of debt, and then face the task of a ground-up rebuild of the culture that got them in to this position in the first place.

Hardly an inviting investment prospect, is it?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.